From Worst To First: Here’s How Each State Ranks For Solution Providers In 2020

CRN’s annual best states project ranks all 50 states for operating a solution provider business. We also provide a rank specifically for the business impact of the COVID-19 pandemic for each state.

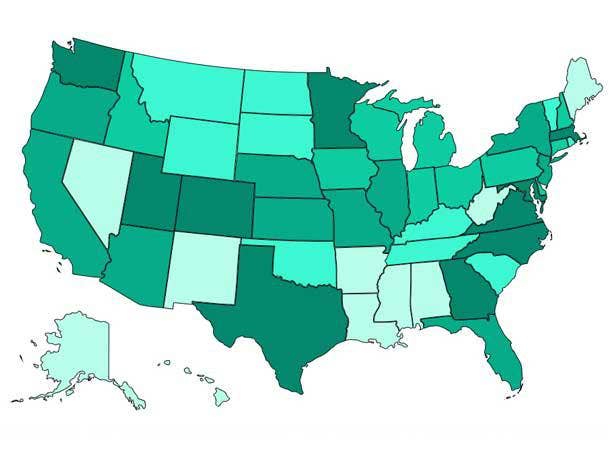

State Of The 50 States

Solution providers have had to navigate through a difficult year that began with the strongest economy in years and then plunged into recession in February and March as the COVID-19 pandemic took hold.

The impact of the pandemic and recession, while hitting all 50 states, has not been even felt throughout the country. Some states went into deeper shutdowns than others in an effort to curb the spread of the disease. And some states fared better or worse economically depending on a range of factors such as their ability to respond to the pandemic and their dependence on specific industries – such as travel and tourism – that were hit especially hard by the pandemic and faltering economy.

Each year, CRN undertakes its Best States project to help IT entrepreneurs identify the best and the worst states in the U.S. to start and operate a solution provider business, examining such criteria as the business and entrepreneurial climate of each state, the availability of talented IT workers, and the tax and regulatory burden.

The goal of the Best States analysis is to provide readers with a comprehensive view of the economic, workforce and channel climate in each state. The conclusions can be used by entrepreneurs who are considering starting a solution provider business or by solution provider owners and executives who might be looking for expansion opportunities – or just to gain a clearer picture of the situation in the states in which they already operate.

This year, solution providers had to quickly pivot their businesses as the IT needs of their clients changed and everyone adjusted to a new work-from-home normal. With the pandemic ongoing and the economy struggling to recover, CRN is itself pivoting with this year’s Best States by going beyond the more long-term criteria used to evaluate each state to include more immediate data such as the pandemic’s impact on each state’s GDP and employment.

The following slides examine each state according to a range of criteria, including data more immediate to the pandemic and recession such as the impact on small businesses, a state’s available resources to deal with the pandemic and economic impact, first-quarter GDP declines and February-to-July job loss.

The overall rankings also include a broad range of more long-range criteria used in previous Best States analyses such as the education and experience level of each state’s workforce, labor and business operating costs, and tax and regulatory burdens. States are also examined for their potential for fostering innovation, spurring growth and generating business opportunities. (A more complete list of criteria and data sources is provided on the final slide.)

The following ranks all 50 states, starting with the worst (No. 50) to the best (No. 1) for operating a solution provider business, considering all criteria. We also provide a rank specifically for the business impact of the COVID-19 pandemic for each state (with those with higher numbers fairing the worst).

And, as in previous years, we’ve crossed referenced the Best States results with this year’s CRN Solution Provider 500 noting how many of the industry’s biggest solution providers call each state home.

A ranking of the 50 states based solely on the business impact of the COVID-19 pandemic is provided in a separate slide series as part of this year’s Best States survey.

No. 50: Mississippi (No. 35 in 2019)

Number of CRN Solution Provider 500 Companies: 2

COVID-19 Business Impact Rank: 22

Mississippi’s net job loss February to July 2020 was 4.1 percent of the workforce with the unemployment rate standing at 8.7 percent in July (No. 24). The state’s GDP declined 5.2 percent in the first quarter of 2020 (No. 32).

Mississippi is ranked No. 50 in the education and experience of its workforce. Tech jobs account for only 3.7 percent of the state’s workforce (No. 49), according to the CompTIA 2020 Cyberstates report. And the state is ranked No. 50 in STEM (science, math, engineering and math) concentration advanced degrees and in the number of science and engineering bachelor’s degree holders, according to the Bloomberg 2020 U.S. State Innovation Index.

The Magnolia State is No. 49 in entrepreneurship and innovation and No. 49 in state infrastructure. But the state has relatively low labor and operating costs (No. 10).

No. 49: Louisiana (No. 39 in 2019)

Number of CRN Solution Provider 500 Companies: 3

COVID-19 Business Impact Rank: 8

Louisiana’s net job loss February to July 2020 was 8.0 percent of the workforce (No. 25) with the unemployment rate standing at 9.7 percent (No. 27) in July. The state’s GDP declined 6.6 percent in the first quarter of 2020 (No. 46).

Louisiana was No. 49 in workforce education and experience: Both U.S. News Best States report and WalletHub’s Most Educated States in America ranked the Pelican State No. 48 for education attainment levels of its available labor force. And tech jobs accounted for 4.2 percent of the total workforce (No. 47).

Louisiana has an 8.0 percent corporate income tax rate.

The state was No. 46 in business climate and competitive environment: The state was ranked No. 49 in economic health by CNBC America’s Top States for Business, No. 49 for economic expansion by U.S. News Best States and No. 50 for opportunity by U.S. News.

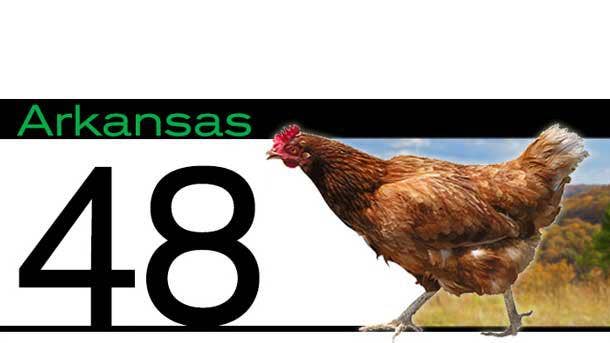

No. 48: Arkansas (No. 50 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 25

Arkansas’ net job loss February to July 2020 was 5.3 percent of the workforce (No. 9) with the unemployment rate standing at 8.0 percent (No. 16) in July. The state’s GDP declined 5.0 percent in the first quarter of 2020 (No. 25).

Arkansas, which was No. 50 in last year’s Best States rankings, moved up two spots this year.

The Natural State is No. 48 in entrepreneurship and innovation: The tech sector accounted for 3.5 percent of total gross state product – No. 45 among all states. And it is No. 47 in workforce education and experience – it was only one of five states that recorded a decline in tech employment (548 jobs) in 2019 over 2018.

Arkansas can boast about its No. 7 ranking in labor and operational costs. But the state is No. 45 in taxes and regulations: The state ranked a poor No. 46 in the Tax Foundation’s 2020 State Business Tax Climate Index, largely due to the state’s high property taxes.

No. 47: West Virginia (No. 49 in 2019)

Number of CRN Solution Provider 500 Companies:0

COVID-19 Business Impact Rank: 2

West Virginia was the last state to report a confirmed COVID-19 case (March 17). But that didn’t prevent the state from feeling the impact of the pandemic and recession. West Virginia’s net job loss February to July 2020 was 6.2 percent of the workforce (No. 16) with the unemployment rate standing at 10.4 percent (No. 32) in July. The state’s GDP declined 5.0 percent in the first quarter of 2020 (No. 25).

West Virginia is No. 50 in entrepreneurship and innovation with the tech sector accounting for only 3.3 percent of total gross state product (No. 48). And the Bloomberg 2020 U.S. State Innovation Index ranked it No. 49 for innovation environment.

The Mountain State is No. 48 for workforce education and experience. Tech jobs make up only 4.2 percent of the total workforce (No. 47). West Virginia is ranked No. 50 for state infrastructure.

No. 46: Nevada (No. 41 in 2019)

Number of CRN Solution Provider 500 Companies: 1

COVID-19 Business Impact Rank: 16

Nevada’s economy, with its heavy dependence on tourism and gambling, took a major hit as the pandemic spread, conventions and events were canceled, and people stopped traveling for business and pleasure.

The state’s net job loss February to July 2020 was 10.2 percent of the workforce (No. 41) with the unemployment rate standing at 15 percent (No. 47) in July. Nevada’s GDP declined 8.2 percent in the first quarter of 2020 (No. 49).

The state benefits from having no individual or corporate income taxes. But the state’s No. 37 rank for business climate and competitive environment suffered from the 8.2 percent decline in GDP in the first quarter of 2020 (No. 49).

Nevada ranks a poor No. 44 for workforce education and experience: The Silver State is No. 49 in STEM concentration advanced degrees and No. 31 in science and engineering bachelor’s degrees, according to the Bloomberg 2020 U.S. State Innovation Index.

No. 45: Hawaii (No. 45 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 1

Hawaii was spared the worst of the COVID-19 pandemic in terms of the number of cases and deaths, although the Aloha State’s tourism-focused economy didn’t escape unscathed. But its high scores for such criteria as low impact on small businesses, workforce support conditions and high availability of resources to deal with the pandemic helped the state weather the crisis better than other states.

Nevertheless, Hawaii’s net job loss February to July 2020 was 16.5 percent of the workforce (No. 50) with the unemployment rate standing at 13.9 percent (No. 43) in July. The state’s GDP declined 8.1 percent in the first quarter of 2020 (No. 48).

Hawaii has traditionally ranked low in the CRN Best States analysis because of its high costs and high taxes. Hawaii is No. 47 for high labor and operating costs: The state is No. 50 with the highest electricity costs in the nation. And it has a high 11 percent individual income tax, but a moderate 6.4 corporate income tax.

The Aloha State is No. 50 in business climate and competitive environment: State GDP tumbled 8.1 percent in the first quarter of 2020 and the large numbers of job losses (16.5 percent of the workforce) pushed the state’s unemployment rate in July to 13.9 percent.

No. 44: Alabama (No. 34 in 2019)

Number of CRN Solution Provider 500 Companies: 2

COVID-19 Business Impact Rank: 45

Alabama’s net job loss February to July 2020 was 5.4 percent of the workforce (No. 12) with the unemployment rate standing at 7.5 percent (No. 10) in July. The state’s GDP declined 4.8 percent in the first quarter of 2020 (No. 22).

Alabama is No. 46 in workforce education and experience: The Yellowhammer State is ranked No. 50 by U.S. News Best States for the education attainment levels of the available workforce. Still, tech jobs account for 7.1 percent of the total workforce (No. 20).

On the plus side Alabama is No. 12 for its relatively low labor and operating costs.

No. 43: New Mexico (No. 27 in 2019)

Number of CRN Solution Provider 500 Companies: 1

COVID-19 Business Impact Rank: 27

New Mexico’s net job loss February to July 2020 was 9.2 percent of the workforce (No. 35) with the unemployment rate standing at 8.3 percent (No. 19) in July. The state’s GDP declined 3.1 percent in the first quarter of 2020 (No. 5).

New Mexico ranks a relatively poor No. 41 in workforce education and experience: WalletHub puts New Mexico at No. 47 for the available workforce with a bachelor’s degree while U.S. News ranks the Land of Enchantment State at No. 49 for the education attainment levels of the available workforce.

While New Mexico is No. 47 for state infrastructure (it has only 66.5 percent terrestrial broadband coverage, for example), the state is ranked a relatively favorable No. 16 for taxes and regulations.

No. 42: Maine (No. 42 in 2019)

Number of CRN Solution Provider 500 Companies: 3

COVID-19 Business Impact Rank: 3

Maine’s net job loss February to July 2020 was 9.5 percent of the workforce (No. 37) with the unemployment rate standing at 6.6 percent (No. 5) in July. The state’s GDP declined 6.3 percent in the first quarter of 2020 (No. 45).

The Pine Tree State is No. 49 in business climate and competitive environment. Maine’s GDP fell 6.3 percent in the first quarter of 2020 (No. 45) and the state receives middling-to-poor scores for economic expansion and development (No. 42 from CNBC America’s Top States for Business) and business environment (No. 46 from U.S. News). And the state ranks No. 44 for entrepreneurship and innovation.

Maine is No. 23 for workforce education and experience and No. 27 for labor and operating costs. And while it ranks a poor No. 45 for state infrastructure, it is No. 21 for individual cost of living and quality of life.

Maine has an 8.93 percent corporate income tax rate – the highest in New England.

No. 41: Alaska (No. 48 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 7

Alaska’s net job loss February to July 2020 was 11.7 percent of the workforce (No. 46) with the unemployment rate standing at 12.4 percent (No. 39) in July. The state’s GDP declined 4.0 percent in the first quarter of 2020 (No. 12).

Alaska is No. 44 for its high labor and operating costs, although that’s somewhat balanced by its favorable No. 15 rank for low taxes and regulatory burden on businesses. Similarly, while housing and other personal expenses are high, its lack of individual income and sales taxes boosts the state’s personal cost of living/quality of life rank to No. 6. (But its 9.4 percent corporate income tax is among the five highest in the nation.)

The Last Frontier State is No. 37 for entrepreneurship and innovation and No. 42 for business climate/competitive environment (Alaska has only 73,298 small businesses, No. 49 among all states).

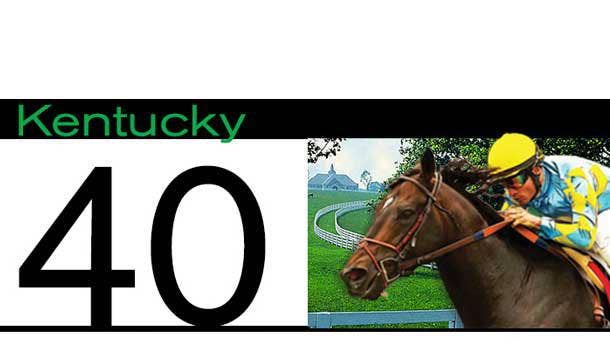

No. 40: Kentucky (No. 47 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 12

While Kentucky’s economy took a hit at the start of the pandemic and recession, with a steep decline in its GDP, it has rebounded to have the lowest unemployment rate in the nation.

Kentucky’s net job loss February to July 2020 was 8.0 percent of the workforce (No. 25) with the unemployment rate standing at 4.3 percent (No. 1) in July. The state’s GDP declined 5.8 percent in the first quarter of 2020 (No. 41).

Kentucky ranks poorly in workforce education and experience (No. 45), entrepreneurship and innovation (No. 40) and business climate/competitive environment (No. 40). The tech sector accounts for only 3.9 percent of total gross state product (No. 43) and tech jobs are only 4.8 percent of the total workforce (No. 41).

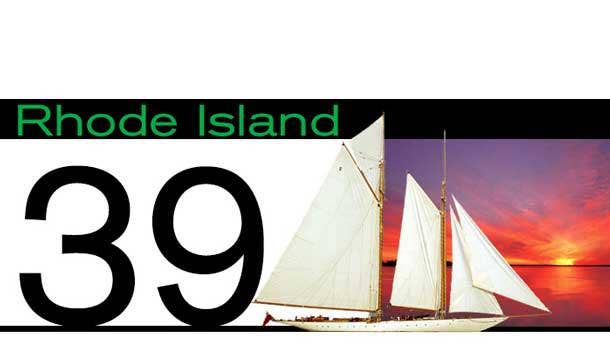

No. 39: Rhode Island (No. 43 in 2019)

Number of CRN Solution Provider 500 Companies: 1

COVID-19 Business Impact Rank: 31

Rhode Island was slammed by the Great Recession of 2007-2009 and it didn’t return to its pre-recession employment levels until 2017. And its economy took a hard hit this year as the COVID-19 pandemic spread. Nevertheless, the Ocean State managed to move up five spots overall this year.

Rhode Island’s net job loss February to July 2020 was 9.6 percent of the workforce (No. 38) with the unemployment rate standing at 12.4 percent (No. 39) in July. The state’s GDP declined 6.2 percent in the first quarter of 2020 (No. 43).

The state ranks No. 47 in business climate/competitive environment: Its relatively small population, small GDP and limited number of small businesses (No. 44 for all three) mean fewer opportunities for solution providers.

No. 38: Vermont (No. 30 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 4

Vermont’s net job loss February to July 2020 was 11.2 percent of the workforce (No. 44) with the unemployment rate standing at 9.4 percent (No. 26) in July. The state’s GDP declined 6.1 percent in the first quarter of 2020 (No. 42).

Vermont has one of the more educated workforces in the country (No. 10). WalletHub’s Most Educated States in America ranks the state No. 14 for workforce education attainment levels.

ranks the Green Mountain State No. 8 for the available labor force with a bachelor’s degree while the Bloomberg 2020 U.S. State Innovation Index rates Vermont No. 9 for science and engineering bachelor’s degree holders.

But the largely rural state is ranked No. 48 for business climate/competitive environment: It has the second smallest population among all states (second only to Wyoming) and the smallest GDP.

No. 37: South Carolina (No. 36 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 17 (Tie)

South Carolina’s net job loss February to July 2020 was 6.6 percent of the workforce (No. 19) with the unemployment rate standing at 8.7 percent (No. 24) in July. The state’s GDP declined 4.8 percent in the first quarter of 2020 (No. 22).

South Carolina’s overall rank is pulled down by its No. 43 rank in workforce education and experience. WalletHub’s Most Educated States in America ranks the Palmetto State No. 49 for the available labor force with a bachelor’s degree.

The state gets mediocre grades for taxation (No. 28), entrepreneurship and innovation (No. 36) and business climate/competitive environment (No. 26). But its poor No. 42 ranking for personal cost of living quality of life takes a hit from its relatively high individual income and sales taxes.

No. 36: South Dakota (No. 46 in 2019)

Number of CRN Solution Provider 500 Companies: 2

COVID-19 Business Impact Rank: 30

South Dakota’s net job loss February to July 2020 was 5.3 percent of the workforce (No. 9) with the unemployment rate standing at 7.2 percent (No. 9) in July. The state’s GDP declined only 2.2 percent in the first quarter of 2020 (No. 2).

South Dakota has low labor and operating costs (No. 5) and a relatively low tax burden (No. 13): There are no individual or corporate income taxes.

But the Mount Rushmore State is No. 38 for workforce education and experience and No. 47 for entrepreneurship and innovation: South Dakota is No. 47 for tech businesses and No. 48 for tech industry employment. The tech sector accounts for 4.3 percent of total gross state product (No. 40).

No. 35: Montana (No. 32 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 10

Montana’s net job loss February to July 2020 was 5.8 percent of the workforce (No. 14) with the unemployment rate standing at 7.1 percent (No. 8) in July. The state’s GDP declined 5.4 percent in the first quarter of 2020 (No. 33).

Montana is an enviable No. 3 in taxes and regulations. The Tax Foundation ranks it No. 5 in its State Business Tax Climate Index: It has no state or local sales taxes and moderate corporate individual and corporate income taxes (6.9 percent and 6.75 percent, respectively).

But being a huge, largely rural state, the Treasure State is No. 46 for entrepreneurship and innovation (No. 45 in tech industry employment) and No. 44 for business climate/competitive environment (its total GDP is No. 48 among all states).

Montana is No. 21 in workforce education and experience with WalletHub’s Most Educated States in America ranking the state No. 14 for workforce education attainment levels.

No. 34: Oklahoma (No. 21 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 50

Oklahoma’s net job loss February to July 2020 was 5.2 percent of the workforce (No. 7) with the unemployment rate standing at 6.6 percent (No. 5) in July. The state’s GDP declined 4.0 percent in the first quarter of 2020 (No. 12).

The Sooner State, however, is ranked No. 43 by the U.S. Bureau of Labor Statistics for “business environment and workforce support conditions” during the pandemic and a poor No. 47 by the University of New Hampshire’s Carsey School of Public Policy for state recovery since the start of the COVID-19 crisis.

Oklahoma ranks an attractive No. 4 in labor and operating costs, helped by its low electricity costs (No. 1) and relatively low unemployment rate. And the Sooner State is No. 17 in taxes and regulations (although its 8.95 percent sales tax is among the nation’s highest).

But Oklahoma is No. 42 in workforce education and experience: Bloomberg ranks the state No. 46 in the number of workers with science and engineering bachelor’s degrees and tech jobs account for only 5.2 percent of the total workforce (No. 38), according to the CompTIA 2020 Cyberstates Report.

No. 33: Wyoming (No. 44 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 33

Wyoming’s net job loss February to July 2020 was 6.4 percent of the workforce (No. 18) with the unemployment rate standing at 7.6 percent (No. 12) in July. The state’s GDP declined 3.6 percent in the first quarter of 2020 (No. 9).

With Wyoming’s sparse population (No. 50) and small GDP (No. 49), the Cowboy State offers limited business opportunities. The state is No. 42 in entrepreneurship and innovation and No. 39 in business climate/competitive. Wyoming’s economy, nevertheless, hasn’t been as hard hit by the pandemic and recession as most other states.

Wyoming ranks a favorable No. 10 in taxes and regulations: It has no individual or corporate income tax. And while the state is No. 48 in state infrastructure, it’s an enviable No. 7 in personal cost of living/quality of life – with the lack of a individual income tax a major factor.

No. 32: Tennessee (No. 19 in 2019)

Number of CRN Solution Provider 500 Companies: 6

COVID-19 Business Impact Rank: 17 (Tie)

Tennessee’s net job loss February to July 2020 was 6.2 percent of the workforce (No. 16) with the unemployment rate standing at 9.7 percent (No. 27) in July. The state’s GDP declined 6.2 percent in the first quarter of 2020 (No. 43).

Tennessee is ranked No. 40 for workforce education and experience. Bloomberg ranks the Volunteer State No. 36 for the percentage of the workforce with science and engineering degrees and No. 39 for available workers with advanced degrees with a STEM (science, technology, engineering and math) concentration.

Tennessee’s rankings are otherwise middling including No. 24 in taxes and regulations (although U.S. News ranks it No. 1 in fiscal stability), No. 30 in entrepreneurship and innovation and No. 25 in business climate/competitive environment.

No. 31: North Dakota (No. 24 in 2019)

Number of CRN Solution Provider 500 Companies: 1

COVID-19 Business Impact Rank: 36

Not many years ago North Dakota ranked high in our Best States survey when the explosion of oil drilling and extraction, which began in 2006 and peaked in 2012, boosted the state’s GDP and created business opportunities of all kinds. But the Peace Garden State has been falling in its rankings since and is now more in line with other states in the northern plains.

North Dakota’s net job loss February to July 2020 was 8.6 percent of the workforce (No. 32) with the unemployment rate standing at 6.1 percent (No. 4) in July. The state’s GDP declined 2.6 percent in the first quarter of 2020 (No. 4).

North Dakota is No. 7 for low individual and corporate income taxes. But the state is only No. 30 for workforce education and experience and No. 43 for entrepreneurship and innovation.

No. 30: Indiana (No. 16 in 2019)

Number of CRN Solution Provider 500 Companies: 5

COVID-19 Business Impact Rank: 39 (Tie)

Indiana’s net job loss February to July 2020 was 5.3 percent of the workforce (No. 9) with the unemployment rate standing at 11.2 percent (No. 36) in July. The state’s GDP declined 5.6 percent in the first quarter of 2020 (No. 37).

Indiana is ranked a favorable No. 6 in taxes with its moderate (5.5 percent) corporate income tax and low (3.23 percent) individual income tax.

The Hoosier State’s rankings in other areas are otherwise in the middle of the pack including No. 26 in entrepreneurship and innovation, No. 30 in business climate/competitive environment and No. 25 in personal cost of living/quality of life.

Indiana ranks No. 37 for workforce education and experience: Tech jobs account for 5.7 percent of the total workforce (No. 34).

No. 29: Delaware (No. 6 in 2019)

Number of Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 26

Delaware’s net job loss February to July 2020 was 10.6 percent of the workforce (No. 43) with the unemployment rate standing at 12.5 percent (No. 41) in July. The state’s GDP declined 5.6 percent in the first quarter of 2020 (No. 37).

Delaware is something of a study in contrasts. The First State is No. 2 for taxes and regulations: It has no sales tax, but the state’s 8.7 percent corporate income tax is among the country’s 10 highest.

The state is No. 17 for workforce education and experience and No. 21 for entrepreneurship and innovation. But it is a poor No. 41 for business climate and competitive environment: The state’s small size (No. 42 for GDP and No. 46 for number of small businesses) are factors here. The tech sector does account for 8.0 percent of total gross state product (No. 18).

No. 28: Ohio (No. 7 in 2019)

Number of CRN Solution Provider 500 Companies: 9

COVID-19 Business Impact Rank: 46

Ohio’s net job loss February to July 2020 was 8.9 percent of the workforce (No. 33) with the unemployment rate standing at 10.9 percent (No. 35) in July. The state’s GDP declined 5.5 percent in the first quarter of 2020 (No. 35).

Ohio is very much in the middle of the pack in most of its rankings. The Buckeye State ranks a respectable No. 19 in business climate/competitive environment, No. 22 in entrepreneurship and innovation, and a not-so-great No. 33 in workforce education and experience.

The tech sector accounts for 5.6 percent of Ohio’s total gross product (No. 34). Nevertheless, the number of tech business establishments is enough to rank Ohio No. 12 and its tech industry employment ranks No. 10.

Ohio is No. 26 for taxes and regulatory environment. The Tax Foundation ranks the state No. 38 on its State Business Tax Climate Index and U.S. News ranks the state No. 41 for fiscal stability.

No. 27: Idaho (No. 37 in 2019)

Number of CRN Solution Provider 500 Companies: 2

COVID-19 Business Impact Rank: 20

Idaho’s net job loss February to July 2020 was 2.7 percent of the workforce (No. 1) with the unemployment rate standing at 5.6 percent (No. 3) in July. The state’s GDP declined 4.1 percent in the first quarter of 2020 (No. 15).

The Gem State is No. 1 in labor and operating costs. During the crucial first six months (February to July) of the pandemic net job loss was only 2.7 percent – the least among all states. But Idaho scores poorly for business environment and workforce support conditions (No. 46) during the pandemic and for affected industries and workforce (No. 42).

While Idaho ranks only No. 36 for workforce education and experience, the state is No. 20 for taxes, No. 27 for entrepreneurship and education and No. 20 for business climate/competitive environment. But it is a poor No. 46 for state infrastructure.

No. 26: Pennsylvania (No. 38 in 2019)

Number of CRN Solution Provider 500 Companies: 18

COVID-19 Business Impact Rank: 34

Pennsylvania’s net job loss February to July 2020 was 9.6 percent of the workforce (No. 38) with the unemployment rate standing at 13.0 percent (No. 42) in July. The state’s GDP declined 5.6 percent in the first quarter of 2020 (No. 37).

As a northern industrial state, Pennsylvania can be an expensive place to run a business: It ranks No. 43 for labor and operating costs and No. 35 for taxes and regulations. (The Keystone State’s 9.99 percent corporate income tax is second only to Iowa’s 12 percent corporate income tax.)

Pennsylvania is No. 28 for workforce education and experience, No. 16 for entrepreneurship and innovation and No. 23 for business climate/competitive environment.

No. 25: Iowa (No. 40 in 2019)

Number of CRN Solution Provider 500 Companies: 5

COVID-19 Business Impact Rank: 35

Iowa’s net job loss February to July 2020 was 5.9 percent of the workforce (No. 15) with the unemployment rate standing at 8.0 percent (No. 16) in July.

The Hawkeye State’s GDP declined 3.5 percent in the first quarter of 2020 (No. 8). But Iowa scores a mediocre No. 23 for business environment and workforce support conditions during the pandemic and a poor No. 43 for affected industries and workforce.

Reflective of its mixed rural/small city profile, Iowa has largely middling rankings across the board including No. 32 for entrepreneurship and innovation, No. 22 for business climate/competitive environment, and No. 26 for workforce education and experience.

Iowa is ranked a poor No. 39 for taxes thanks to its 12.0 percent corporate income tax – the nation’s highest.

No. 24: Michigan (No. 28 in 2019)

Number of CRN Solution Provider 500 Companies: 11

COVID-19 Business Impact Rank: 37

Michigan was especially hard hit by the pandemic and economic shutdown with a big hit to its gross state product and its workforce. Michigan’s net job loss February to July 2020 was 11.7 percent of the workforce (No. 46) with the unemployment rate standing at 14.8 percent (No. 45) in July. The state’s GDP declined 6.8 percent in the first quarter of 2020 (No. 47).

But WalletHub ranked Michigan a relatively favorable No. 9 for the economic impact of the pandemic and the Wolverine State scored well in other COVID-19 response criteria.

Michigan is ranked No. 45 for high labor and operating costs, but that’s balanced somewhat by the attractive No. 8 rank for its relatively moderate taxes.

Michigan is No. 27 in workforce education and experience: Tech jobs account for 8.9 percent of the total workforce (No. 9).

No. 23: New Hampshire (No. 33 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 5

New Hampshire’s net job loss February to July 2020 was 10.0 percent of the workforce (No. 40) with the unemployment rate standing at 11.8 percent (No. 38) in July. The state’s GDP declined 5.7 percent in the first quarter of 2020 (No. 40).

The Granite State is No. 41 for high labor, operating and energy costs. But that’s somewhat balanced by its No. 18 ranking for taxes: It has no individual income tax (although it does tax interest and dividend income) and no sales tax and its 7.7 percent corporate income tax is about in the middle of all states.

New Hampshire is No. 7 with a well-educated and experienced workforce. Tech jobs account for 10.1 percent of the total workforce (No. 6). The state is No. 10 for workers with science and engineering bachelor’s degrees and No. 7 for workers with advanced STEM degrees.

No. 22: Wisconsin (No. 26 in 2019)

Number of CRN Solution Provider 500 Companies: 11

COVID-19 Business Impact Rank: 42

Wisconsin’s net job loss February to July 2020 was 9.1 percent of the workforce (No. 34) with the unemployment rate standing at 8.5 percent (No. 21) in July. The state’s GDP declined 5.0 percent in the first quarter of 2020 (No. 25).

Wisconsin’s other rankings are largely in the middle of the pack or slightly better than other states. The Badger State is No. 16 for workforce education and experience, while it ranks No. 25 for entrepreneurship and innovation and No. 16 for business climate and competitive environment.

While Wisconsin ranks a relatively poor No. 34 for labor and operating costs, the state is No. 22 for taxes thanks to its moderate sales tax.

No. 21: Connecticut (No. 31 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 38

Connecticut’s net job loss February to July 2020 was 9.4 percent of the workforce (No. 36) with the unemployment rate standing at 9.8 percent (No. 29) in July. The state’s GDP declined 4.6 percent in the first quarter of 2020 (No. 18).

The Nutmeg State is No. 8 in workforce education and experience. WalletHub ranks Connecticut No. 4 in labor force education attainment while Bloomberg puts the state at No. 12 for both the number of workers with science and engineering bachelor’s degrees and with STEM advanced degrees.

But Connecticut is No. 47 in taxes, with a 7.50 percent corporate income tax and a 6.35 percent sales tax. The state is No. 37 for its relatively high labor and operating costs. And while Connecticut is No. 12 overall for entrepreneurship and innovation, WalletHub ranks it a dismal No. 48 for states in which to start a business due to its less-than-friendly business environment.

No. 20: New York (No. 23 in 2019)

Number of CRN Solution Provider 500 Companies: 38

COVID-19 Business Impact Rank: 9

New York was among the hardest hit states in the early months of the pandemic – both in terms of the number of cases and deaths in the state as well as economically. New York’s net job loss February to July 2020 was 14.2 percent of the workforce (No. 49) with the unemployment rate standing at 15.7 percent (No. 48) in July. The state’s GDP declined 8.2 percent in the first quarter of 2020 (No. 49).

But the Empire State’s overall COVID-19 ranking is high because of the resources it brought to bear to deal with the crisis, its recovery and its diversified economy.

More long term, the Empire State is No. 50 for high labor and operating costs and No. 40 for high taxes (particularly its 8.52 percent sales tax).

On the plus side, New York ranks No. 12 for workforce education and experience and No. 4 for entrepreneurship and innovation: The tech industry employs 679,083 in New York, No. 3 among the states, according to the CompTIA2020 Cyberstates Report.

No. 19: Kansas (No. 18 in 2019)

Number of CRN Solution Provider 500 Companies: 5

COVID-19 Business Impact Rank: 13

Kansas’ net job loss February to July 2020 was 5.5 percent of the workforce (No. 13) with the unemployment rate standing at 7.5 percent (No. 10) in July. The state’s GDP declined 3.1 percent in the first quarter of 2020 (No. 5).

Kansas experimented with deep tax cuts starting in 2012 in an effort to boost economic growth – a move that played havoc with the state’s finances. Those cuts were repealed in 2017 and today Kansas is ranked No. 31 with a 5.7 percent individual income tax and 7.0 percent corporate income tax.

The Sunflower State is No. 9 for low labor and operational costs. But it otherwise scores in the middle of the pack of states including No. 25 for workforce education, No. 31 for entrepreneurship and innovation, and No. 24 for business climate/competitive environment.

No. 18: Missouri (No. 8 in 2019)

Number of CRN Solution Provider 500 Companies: 8

COVID-19 Business Impact Rank: 44

Missouri’s net job loss February to July 2020 was 5.0 percent of the workforce (No. 5) with the unemployment rate standing at 7.9 percent (No. 15) in July. The state’s GDP declined 4.7 percent in the first quarter of 2020 (No. 19).

Missouri can be a good state in which to run a business from a financial perspective. The Show Me State is No. 6 for low labor and operating costs and it is No. 5 for its low corporate income tax (4.0 percent). And some of that business-friendly approach carries over to business climate/competitive environment where Missouri is No. 14.

But Missouri is a poor No. 34 for workforce education and experience – the state is No. 38 for workers with science and engineering degrees, according to the Bloomberg 2020 U.S. state innovation index.

No. 17: Arizona (No. 9 in 2019)

Number of CRN Solution Provider 500 Companies: 10

COVID-19 Business Impact Rank: 24

Arizona’s net job loss February to July 2020 was 5.2 percent of the workforce (No. 7) with the unemployment rate standing at 10.0 percent (No. 31) in July. The state’s GDP declined 3.6 percent in the first quarter of 2020 (No. 9).

Where Arizona stumbles is in workforce education and experience where it ranks No. 39. WalletHub ranks the state No. 44 for the available workforce with a bachelor’s degree.

Fast growing Arizona has generally been high up on the Best States survey. This year The Grand Canyon State is No. 10 in business climate/competitive environment with its expanding population and growing number of small businesses. And the state is No. 18 in entrepreneurship and innovation: The tech sector accounts for 10.1 percent of total gross state product (No. 10).

Arizona also has a favorable tax and regulatory environment (No. 12) with relatively low individual and corporate income taxes (4.5 percent and 4.9 percent, respectively). The state does have a relatively high sales tax at 8.4 percent.

No. 16: Illinois (No. 29 in 2019)

Number of CRN Solution Provider 500 Companies: 29

COVID-19 Business Impact Rank: 39 (Tie)

Illinois’ net job loss February to July 2020 was 8.2 percent of the workforce (No. 27) with the unemployment rate standing at 14.6 percent (No. 44) in July. The state’s GDP declined 5.4 percent in the first quarter of 2020 (No. 33).

Illinois’ state government has been in fiscal crisis for years – U.S. News ranks Illinois No. 50 for fiscal stability. Combine that with the state’s high tax burden (an 8.80 percent sales tax and a 9.50 percent corporate income tax) and the Prairie State is No. 48 in taxes in this survey.

Illinois is No. 14 in workforce education and experience and the state is No. 7 in tech industry employment – which helps boost the state’s entrepreneurship and innovation rank to No. 13.

No. 15: Oregon (No. 20 in 2019)

Number of CRN Solution Provider 500 Companies: 5

COVID-19 Business Impact Rank: 28

Oregon’s net job loss February to July 2020 was 8.3 percent of the workforce (No. 29) with the unemployment rate standing at 11.2 percent (No. 36) in July. The state’s GDP declined 4.4 percent in the first quarter of 2020 (No. 17).

Long term, Oregon has a lot going for it (the current tragedies surrounding the wildfires notwithstanding) with a No. 7 rank in entrepreneurship and innovation and No. 13 in business climate/competitive environment.

The Beaver State is No. 15 in workforce education and experience: It is No. 6 in the available workforce with science and engineering bachelor’s degrees.

Oregon is an impressive No. 11 in taxes with its lack of a sales tax.

No. 14: New Jersey (No. 25 in 2019)

Number of CRN Solution Provider 500 Companies: 22

COVID-19 Business Impact Rank: 14

New Jersey’s net job loss February to July 2020 was 11.6 percent of the workforce (No. 45) with the unemployment rate standing at 16.6 percent (No. 49) in July. The state’s GDP declined 5.5 percent in the first quarter of 2020 (No. 35). But it was ranked No. 3 among the most recovered states since the COVID-19 crisis began.

Like such states as California, New York and Massachusetts, New Jersey ranks high in such areas as worker education and entrepreneurship but suffers from high costs and tax rates.

The Garden State is No. 50 for taxes and regulatory environment with its 10.05 percent corporate income tax (second only to Iowa) and high labor and operating costs (No. 48 behind only New York and Massachusetts). And the state’s very high individual income tax (10.75 percent, second only to California) knocks its personal cost of living/quality of life rank to No. 27.

New Jersey does have a highly educated and experienced workforce (No. 6) with tech jobs accounting for 8.0 percent of the state’s workforce. The state is No. 9 in entrepreneurship and innovation: The tech sector accounts for 9.6 percent of total gross state product (No. 14).

No. 13: Nebraska (No. 12 in 2019)

Number of CRN Solution Provider 500 Companies: 0

COVID-19 Business Impact Rank: 23

Nebraska’s net job loss February to July 2020 was 4.8 percent of the workforce (No. 4) with the unemployment rate standing at 6.7 percent (No. 7) in July. The state’s GDP declined 1.3 percent in the first quarter of 2020 (No. 1) – the lowest among all 50 states. But the state ranked No. 49 for its highly affected industries and workforces.

The Cornhusker State is No. 3 in labor and operating costs and relatively favorable tax environment (No. 14). Nebraska is also ranked fairly high (No. 17) for business climate/competitive environment – its state GDP suffered the smallest decline in the first six months of the pandemic. But the state is a relatively low No. 38 for entrepreneurship and innovation.

The state’s overall ranking also gets a boost from its No. 4 position in personal cost of living/quality of life with its low living expenses.

No. 12: California (No. 10 in 2019)

Number of CRN Solution Provider 500 Companies: 53

COVID-19 Business Impact Rank: 21

California’s net job loss February to July 2020 was 10.3 percent of the workforce (No. 42) with the unemployment rate standing at 14.9 percent (No. 46) in July. The state’s GDP declined 4.7 percent in the first quarter of 2020 (No. 19).

California is, as every year, a study in contrasts. Not surprisingly the Golden State is No. 1 in entrepreneurship and innovation. The tech sector accounts for 18.1 percent of the state’s total gross state product (No. 2, behind only Washington’s 20.2 percent) and employs 1,866,951 people (No.1), according to the CompTIA 2020 Cyberstates Report.

The state is No. 2 in business climate/competitive environment with its 4,131,508 small businesses that make prospective customers for a solution provider. And California is No. 13 for workforce education and experience.

But California remains an expensive place to do business. It is No. 46 for labor and operating costs and No. 44 for taxes and regulatory environment. The state’s 8.84 percent corporate income tax is among the nation’s 10 highest as is its 8.68 percent sales tax.

And California is last (No. 50) for personal cost of living and quality of life: The state’s 13.3 percent individual income tax is the highest in the country, according to the Tax Foundation.

No. 11: Florida (No. 1 in 2019)

Number of CRN Solution Provider 500 Companies: 12

COVID-19 Business Impact Rank: 41

While Florida wasn’t among the early states hit hard by the pandemic, its economy – heavily dependent on tourists from elsewhere – took a hit nevertheless. Florida’s net job loss February to July 2020 was 6.7 percent of the workforce (No. 20) with the unemployment rate standing at 10.4 percent (No. 32) in July. The state’s GDP declined 4.9 percent in the first quarter of 2020 (No. 24).

The Sunshine State, which has held the overall No. 1 spot in the Best States survey for several years, fell to No. 11 this year with lower rankings in many criteria. Florida declined to No. 29 in labor and operating expenses with its slower rate of job growth, for example, and to No. 18 in workforce education with its low rankings for available workers with engineering, science and advanced STEM degrees.

Florida does remain No. 1 in taxes and regulations for its low tax burden including no individual income tax, a low 4.458 percent corporate income tax and middle-of-the-road sales tax (7.05 percent).

Florida is also No. 5 in business climate/competitive environment with its large state GDP and number of new businesses (No. 2) and number of small businesses (No. 3).

No. 10: Colorado (No. 11 in 2019)

Number of CRN Solution Provider 500 Companies: 11

COVID-19 Business Impact Rank: 48

Colorado, with its booming economy, wealth of business startups and pool of educated workers, often ranks high on the Best States list.

Colorado’s net job loss February to July 2020 was 7.4 percent of the workforce (No. 23) with the unemployment rate standing at 10.5 percent (No. 34) in July. The state’s GDP declined 4.1 percent in the first quarter of 2020 (No. 15).

The Centennial State is No. 5 in entrepreneurship and innovation and No. 4 in business climate/competitive environment – U.S. News ranked Colorado No. 1 for economic stability and potential. The tech sector accounts for 14.3 percent of total gross state product (No. 4) and Colorado is No. 9 in the number of tech business establishments that call the state home.

Colorado is blessed with a highly educated and experienced workforce (No. 5) with tech jobs accounting for 10.5 percent of the workforce (No. 4). The state is No. 7 for the available workforce with science and engineering bachelor’s degrees.

No. 9: North Carolina (No. 2 in 2019)

Number of CRN Solution Provider 500 Companies: 4

COVID-19 Business Impact Rank: 11

North Carolina is another state that has often been high on the annual Best States list. With its normally robust economy the state is No. 11 for entrepreneurship and innovation – the Research Triangle Park area has become of the country’s major technology hubs – and No. 12 for business climate/competitive environment.

North Carolina’s net job loss February to July 2020 was 7.1 percent of the workforce (No. 22) with the unemployment rate standing at 7.6 percent (No. 12) in July. The state’s GDP declined 5.1 percent in the first quarter of 2020 (No. 11).

The Tar Heel State is No. 9 in taxes and regulatory environment with its low (4.63 percent) corporate income tax. But North Carolina could improve on its No. 24 ranking in workforce education and experience.

No. 8: Minnesota (No. 14 in 2019)

Number of CRN Solution Provider 500 Companies: 13

COVID-19 Business Impact Rank: 32

Minnesota’s net job loss February to July 2020 was 8.5 percent of the workforce (No. 31) with the unemployment rate standing at 8.6 percent (No. 22) in July. The state’s GDP declined 4.0 percent in the first quarter of 2020 (No. 12).

The North Star State is No. 9 in business climate/competitive environment (U.S. News ranks Minnesota No. 3 for economic stability and potential), No. 10 in entrepreneurship and innovation, and No. 11 in workforce education and experience.

Where Minnesota stumbles is on the taxes and regulatory environment front where it ranks No. 43 because of its high corporate income tax (9.8 percent, behind only Iowa, New Jersey and Pennsylvania) and relatively high sales tax (7.46 percent).

No. 7: Texas (No. 4 in 2019)

Number of CRN Solution Provider 500 Companies: 29

COVID-19 Business Impact Rank: 49

Texas’ net job loss February to July 2020 was 6.9 percent of the workforce (No. 21) with the unemployment rate standing at 8.6 percent (No. 22) in July. While the Lone Star State’s GDP declined only 2.5 percent in the first quarter of 2020 (No. 3), the state is a low No. 41 in business environment and workforce support conditions and No. 39 among states with the most affected small businesses due to COVID-19.

Texas continues to rank high in the Best States survey as a place to operate a solution provider business. This year the Lone Star State is No. 1 in business climate/competitive environment and No. 6 in entrepreneurship and innovation.

Texas is No. 3 in the number of new businesses and No. 2 in the number of small businesses – prospective clients for a solution provider.

Both Forbes’ Best States for Business 2020 and CNBC America’s Top States for Business 2019 rank Texas No. 4 for the strength of its economy.

Texas is No. 19 for tax burden: It has no corporate or individual income tax, although its 8.19 percent sales tax is on the high side.

No. 6: Massachusetts (No. 22 in 2019)

Number of CRN Solution Provider 500 Companies: 19

COVID-19 Business Impact Rank: 47

Massachusetts’ net job loss February to July 2020 was 12.6 percent of the workforce (No. 48) with the unemployment rate standing at 17.4 percent (the highest among all states at No. 50) in July. The state’s GDP declined 5.1 percent in the first quarter of 2020 (No. 30).

Massachusetts, like a few other states like California, are a mixed bag for solution providers. They can present more business opportunities than many other states and often have deep pools of highly educated workers. But they can be very costly places to do business – everything from high employee salaries and other operating expenses to high corporate and individual income taxes and property taxes.

Massachusetts, as it has been in recent years, is No. 1 in the Best States survey for workforce education and experience. The Bay State is ranked No. 1 as the most educated state in surveys by U.S. News and WalletHub and tech jobs account for 11.5 percent of the total workforce (No. 1). Massachusetts is No. 3 for entrepreneurship and innovation behind only tech hubs California and Washington.

But Massachusetts remains among the worst-ranked states for taxes and regulations (No. 46) – especially due to its high property and unemployment taxes – and high labor and operating costs (No. 49).

No. 5: Georgia (No. 15 in 2019)

Number of CRN Solution Provider 500 Companies: 11

COVID-19 Business Impact Rank: 15

Georgia’s net job loss February to July 2020 was 5.1 percent of the workforce (No. 6) with the unemployment rate standing at 7.6 percent (No. 12) in July. The state’s GDP declined 4.7 percent in the first quarter of 2020 (No. 19).

Georgia has been on the rise in our Best States survey in recent years and this year the Peachtree State is No. 4. Georgia’s business climate/competitive environment is an enviable No. 3 (behind only Texas and California) and the state ranks No. 8 in state infrastructure. It also has relatively low labor and operating costs (No. 11).

But Georgia’s workforce education and experience rank remains a relatively low No. 31: The state is No. 30 in science and engineering bachelor’s degrees among the workforce. Georgia is also a relatively poor No. 33 in taxes – despite a reduction in the corporate income tax from 6 percent to 5.75 percent starting in 2019.

No. 4: Maryland (No. 13 in 2019)

Number of CRN Solution Provider 500 Companies: 19

COVID-19 Business Impact Rank: 19

Maryland’s net job loss February to July 2020 was 8.3 percent of the workforce (No. 29) with the unemployment rate standing at 8.0 percent (No. 16) in July. The state’s GDP declined 5.0 percent in the first quarter of 2020 (No. 25).

Maryland has moved up in this year’s Best States rankings thanks to higher scores for workforce education and experience (to No. 2) and in business climate/competitive environment (to No. 15).

The Old Line State is No. 1 in the number of workers with advanced STEM degrees and No. 3 in workers with bachelor’s degrees in engineering and science. Tech jobs account for 10.3 percent of the workforce (No. 5).

But Maryland is No. 41 for taxes and regulations, with its 8.25 percent corporate income tax, and No. 30 for relatively high labor and operating costs.

No. 3: Virginia (No. 17 in 2019)

Number of CRN Solution Provider 500 Companies: 46

COVID-19 Business Impact Rank: 29

Virginia’s net job loss February to July 2020 was 7.9 percent of the workforce (No. 24) with the unemployment rate standing at 8.4 percent (No. 20) in July. The state’s GDP declined 3.8 percent in the first quarter of 2020 (No. 11).

Virginia’s No. 3 overall ranking gets a big boost from its No. 4 rank in workforce education and experience: Tech jobs within the Old Dominion State account for 10.7 percent of the workforce (No. 2) and the state ranks No. 4 in both workers with science and engineering bachelor’s degrees and advanced STEM degrees. (There’s a reason Amazon chose Virginia for its much ballyhooed second headquarters.)

Virginia is No. 8 in business climate/competitive environment, not surprising given the booming (and seemingly recession-proof) economy of the Washington D.C. region. Virginia also ranks No. 3 in personal cost of living/quality of life thanks to its relatively low sales tax and its $97,059 median tech industry wage (No. 4).

No. 2: Utah (No. 3 in 2019)

Number of CRN Solution Provider 500 Companies: 2

COVID-19 Business Impact Rank: 43

Utah frequently makes the top five of the CRN Best States study and has previously been No. 1.

Utah’s net job loss February to July 2020 was 3.7 percent of the workforce (No. 2) with the unemployment rate standing at 5.1 percent (No. 2) in July. The state’s GDP declined 3.1 percent in the first quarter of 2020 (No. 5). But the state’s COVID-19 business impact rank suffers from low ranks for available resources to cope with the pandemic crisis (No. 44) and small business financial conditions (No. 43).

Utah is No. 2 for its low labor and operating costs and an enviable No. 4 in taxes and regulations: The Beehive State has relatively low corporate and individual income taxes (4.95 percent for each) and middle-of-the road sales tax (7.18 percent).

But unlike many low-cost, low-tax states, Utah boasts a well-educated and experienced workforce (No. 9 among the states). Tech jobs account for 9.4 percent of the state’s total workforce (No. 8) and the state is also No. 8 in the available workforce with STEM advanced degrees.

While Utah’s economy is only No. 31 in size among the 50 states (2019 GDP $188.5 billion), the state is No. 6 for business climate/competitive environment – the tech sector accounts for 11.2 percent of total gross state product (No. 9) – and No. 15 for entrepreneurship and innovation.

No. 1: Washington (No. 5 in 2019)

Number of CRN Solution Provider 500 Companies: 10

COVID-19 Business Impact Rank: 6

Washington is usually in the top 10 of the Best States list and has been as high as No. 2. But this year the Evergreen State is No. 1, dethroning Florida, which has been No. 1 for four years in a row. Washington’s ascendancy shouldn’t be a surprise since the Seattle-Bellevue-Redmond region has become one of the country’s leading tech centers and is home to two IT giants with trillion-dollar market capitalizations.

Washington’s net job loss February to July 2020 was 8.2 percent of the workforce (No. 27) with the unemployment rate standing at 9.8 percent (No. 29) in July. The state’s GDP declined 5.0 percent in the first quarter of 2020 (No. 25).

Washington is No. 3 in workforce education and experience: Microsoft, Amazon and other tech companies in the region undoubtedly act as a tech talent magnet. The state is No. 2 in entrepreneurship and innovation and tech jobs account for 10.7 percent of the total workforce, tied with Virginia for No. 2 and behind only No. 1 Massachusetts.

Washington is No. 7 in business climate/competitive environment and No. 2 in entrepreneurship and innovation. The tech sector accounts for 20.2 percent of total gross state product – No.1. The state’s robust GDP growth prior to the pandemic was among the highest performing states and organizations like U.S. News and WalletHub rank Washington No. 1 for economic growth and economic development efforts.

Although Washington has no individual or corporate income tax, the state is ranked No. 30 because its 9.23 percent sales tax is among the nation’s highest.

Methodology And Data Sources

This year’s Best States analysis incorporated many of the same criteria and data sources used in previous years – updated with the most recent data available. New criteria considered in this year’s analysis included the concentration of bachelor’s and advanced degrees in science, engineering and STEM disciplines, R&D intensity, technology company density, terrestrial broadband access, and the number of solution providers as a percent of all businesses (solution provider saturation) in a state, among others.

As in previous years the criteria and data were organized in categories with rankings given to each state in each category, as well as an overall ranking. The categories included labor and operating costs, workforce education and experience, taxes and regulatory burden, state infrastructure, and personal cost of living/quality of life. Data was also analyzed to rank states for their levels of entrepreneurship and innovation, and business climate/competitive environment.

During the analysis, data was weighted according to the results of a CRN Research survey of solution providers to determine the importance of each criteria.

A state’s rise or fall in the Best State’s rankings from one year to the next may be due to actual changes in a state’s situation (a significant tax rate hike or cut, for example, or significant expansion of a state’s tech sector). State rankings can also change with the inclusion of new data that can provide a clearer analytical picture of a state, with changes in the analytical weighting of the data, or any combination of these.

This year, given the sudden onset of the COVID-19 pandemic and the resulting recession from shuttered economies, we have sought to provide insights into the business impact of those events and what they might mean for the channel.

State-by-state criteria included GDP declines in the first quarter when the crisis hit, employment declines between February and July, economic impact rankings, the impact on small businesses, available resources and support for individuals and businesses to cope with the crisis, and economic recovery efforts.

Data used in the Best States analysis came from a wide range of sources. The annual CompTIA Cyberstates report was the data source for a number of criteria including tech industry employment and wages, the number of tech business establishments in each state, and the tech sector as a percentage of total gross state product.

Most of the state taxation data, including corporate, sales and personal income tax rates, came from The Tax Foundation’s State Business Tax Climate Index.

Government agencies are a critical Best States data source including the Bureau of Labor Statistics (unemployment rates and union affiliation), the Bureau of Economic Analysis (state GDP), the Small Business Administration and the SBA Office of Advocacy, the U.S. Census Bureau, the U.S. Federal Aviation Administration and the U.S. Department of Transportation.

Data from a range of private research, educational institutions, government agency and media sources are used in the analysis including multiple reports from WalletHub, the Bloomberg 2020 U.S. State Innovation Index, CNBC America’s Top States for Business, U.S. New Best States Rankings, and the Carsey School of Public Policy at the University of New Hampshire.

Data for the personal cost of living/quality of life section came from the Tax Foundation, Experian, HomeSnacks.net, Forbes Best States for Business 2020, the American Automobile Association, CompTIA and other sources. State infrastructure data was obtained from Fastmetrics.com, BroadbandNow.com, U.S. News Best States, the U.S. Department of Transportation, AllTransit.CNT.org, and the Robert Woods Johnson Foundation’s National Health Security Preparedness Index.

The COVID-19 Impact section relied on data from the U.S. Bureau of Economic Analysis, the U.S. Bureau of Labor Statistics, The Centers for Disease Control and Prevention, the Carsey School of Public Policy at the University of New Hampshire, and WalletHub reports (“State Economies Exposed to Coronavirus” and “States with the Most Aggressive Measures in Limiting Virus Exposure”).

The number of solution providers per state – and the solution provider competitive saturation rank – came from a database maintained by The Channel Company, the parent company of CRN. The ranking was calculated based on the number of businesses in each state per solution provider – an indication of the competition a solution provider would face in recruiting customers.