10 Cool Tech Companies That Raised Funding In July 2021

Next-generation technology developers in cybersecurity, AI, big data management and the Internet of Things were among the startup companies that reported new rounds of funding in July.

Follow The Money

Startups pushing technology boundaries in cybersecurity, machine learning, big data management and the Internet of Things were among the companies that attracted new venture financing in July.

Netskope, a leading developer of SASE (Secure Access Service Edge) software, and AI platform provider DataRobot topped this month’s list with $300 million funding rounds.

Cybersecurity startups Cybereason and Arctic Wolf also reported impressive funding infusions as did GRC (governance, risk and compliance) tech developer LogicGate and accounting workflow automation software company FloQast.

What follows are our picks for 10 cool tech startups that landed new funding in July.

Netskope

Headquarters: Santa Clara, Calif.

CEO: Sanjay Beri

Funding: The $300 million Series H round of funding brings Netskope’s valuation to $7.5 billion.

Investors: The round was led by existing investor ICONIQ Growth with participation from all other major existing investors including Lightspeed Venture Partners, Accel, Sequoia Capital Global Equities, Base Partners, Sapphire Ventures and Geodesic Capital.

What the company does: Netskope is a leading developer of SASE (Secure Access Service Edge) software that combines wide-area networking and network security technologies into a single cloud service.

CEO Quote: “We started Netskope because we saw a cloud-centric, digital-first future of business that simply can’t be achieved using legacy approaches to security and networking. We were SASE before the term ‘SASE’ existed and today we are seeing our vision manifest across the globe as enterprises increasingly turn to Netskope to enable secure digital transformation.”

DataRobot

Headquarters: Boston

CEO: Dan Wright

Funding: The $300 million Series G funding round brings DataRobot’s valuation to $6.3 billion.

Investors: The round was led by return investors Altimeter Capital and Tiger Global and joined by new investors Counterpoint Global (Morgan Stanley), Franklin Templeton, ServiceNow Ventures and Sutter Hill Ventures.

What the company does: The DataRobot AI Platform performs a range of automated machine learning, MLOps, data science, data preparation and automated time series tasks.

CEO Quote: “This new investment further validates our vision for combining the best that humans and machines have to offer in order to power predictive insights, enhanced data-driven decisions, and unprecedented business value for our customers. DataRobot is seeing more customers across the globe choose our platform to solve their biggest challenges at scale.”

Cybereason

Headquarters: Boston

CEO: Lior Div

Funding: A $275 million Series F round of “crossover financing”

Investors: The round was led by Liberty Strategic Capital (whose founder and managing partner is former Treasury Secretary Steve Mnuchin) with additional backing from Irving Investors, certain funds advised by Neuberger Berman Investment Advisers LLC and Softbank Vision Fund 2.

What the company does: The company develops the Cybereason Defense Platform, operation-centric cyberattack protection software.

CEO Quote: “Over the past year, we’ve experienced hypergrowth across the globe as defenders recognize that ending advanced attacks isn’t possible using solutions that rely on meaningless alerts and human intervention. Existing—even ‘next-gen’ –solutions are fundamentally flawed, creating the dynamic we have today where the defender is constantly struggling to keep pace with attackers. Unlike our prolific alert-generating competitors, Cybereason takes an approach that enables defenders to end malicious operations instantly, resulting in the most comprehensive prevention, detection and response solution on the market.”

Arctic Wolf

Headquarters: Eden Prairie, Minn.

CEO: Brian NeSmith

Funding: The $150 million Series F round of funding brings the company’s valuation to $4.3 billion.

Investors: Viking Global Investors, Owl Rock (a division of Blue Owl Capital) and other existing investors participated in the round.

What the company does: Arctic Wolf develops security operations, managed detection and response, and managed security awareness systems.

CEO Quote: “Since the founding of the company, we believed that the security operations market is ripe for disruption as existing solutions were failing customers and not keeping pace with the increased sophistication of cyberattacks. The valuation we received during this funding round is not only a testament to our enormous success in establishing Arctic Wolf as the leader in security operations, but also speaks to the explosive global demand we are seeing from organizations looking to protect their hybrid work environments, drive secure cloud adoption, and formulate an actionable strategy to end cyber risk.”

LogicGate

Headquarters: Chicago

CEO: Matt Kunkel

Funding: The $113 million Series C round of funding brings the company’s total financing to $156 million.

Investors: The round was led by growth equity firm PSG while existing investor Greenspring Associates “meaningfully increased its commitment” beyond its original investment.

What the company does: LogicGate develops GRC (governance, risk and compliance) software with plans to expand into risk quantification and prioritization.

CEO Quote: “Today the market for risk and compliance tools is experiencing significant growth and innovation, which we believe is similar to the CRM market 10 [to] 15 years ago. The capital that we raised can provide us with the fuel that we need to continue building market share.”

FloQast

Headquarters: Los Angeles

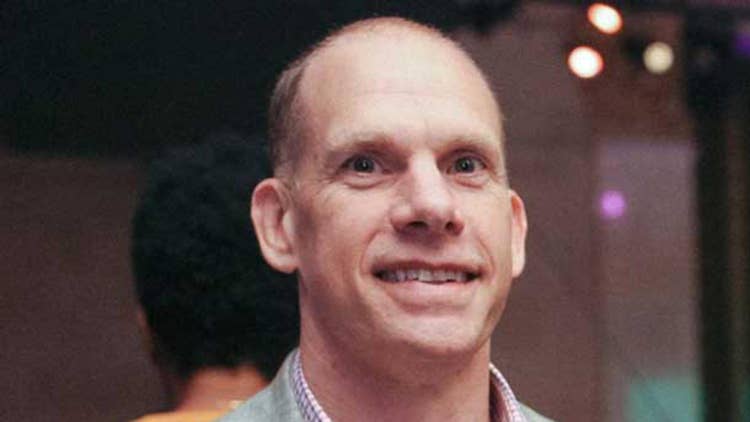

CEO: Mike Whitmire

Funding: The $110 million Series D round of funding brings the company’s valuation to $1.2 billion.

Investors: The round was led by Meritech Capital with participation from Redpoint Ventures, Sapphire Ventures, Coupa Ventures and continued participation from prior investors including Insight Partners, Polaris Partners and Norwest Venture Partners.

What the company does: FloQast develops accounting workflow automation software.

CEO Quote: “Our customer community continues to drive our workflow innovation by finding new applications for our technology. This, coupled with the growing importance of finance and accounting in digital businesses, requires controllers to become more operationally involved than ever before. As a result, FloQast is perfectly positioned to deliver the next generation of accounting and finance modernization without disrupting the critical core work that these professionals must deliver every day.”

1Password

Headquarters: Toronto

CEO: Jeff Shiner

Funding: The $100 million Series B round of funding brings the company’s valuation to $2 billion.

Investors: The round was led by Accel with participation from new investors including Ashton Kutcher’s Sound Ventures, Kim Jackson’s Skip Capital and “a number of prominent enterprise and consumer technology executives.”

What the company does: 1Password develops privacy and security technology including enterprise password management software.

CEO Quote: “Over the last year our personal and professional lives have merged, making passwords even more essential to accessing apps and services we love—and need—to get work done. This investment from a range of industry luminaries signals a commitment to protecting businesses and families. We’re already working closely with our experienced investors to accelerate growth into new areas, including secrets management, as we help customers stay ahead of the never-ending parade of threats.”

Silk

Headquarters: Needham, Mass.

CEO: Dani Golan

Funding: $55 million in Series D funding

Investors: The round was led by S Capital with participation by existing investors Sequoia Capital, Pitango, Globespan, Ibex and Vintage, along with new investors Clal Insurance, Bank HaPoalim, Meitav Dash and Menora Mivtachim.

What the company does: Silk develops database optimization technology that “supercharges” databases and improves the performance of cloud-based systems.

CEO Quote: “The cloud vendors are now beginning the fight over customers’ databases and other mission-critical ‘crown jewels.’ To win this fight, they need to guarantee that customers will meet their own end users’ SLAs, by enabling prime scalability and performance of their mission-critical applications. Having this capital allows us to bring the vision of accelerated cloud adoption to a wider audience.”

Replicated

Headquarters: Culver City, Calif.

CEO: Grant Miller

Funding: A $50 million Series C round of funding.

Investors: The round was led by Owl Rock, a division of Blue Owl Capital, with participation from Lead Edge Capital, Headline, and existing investors including Two Sigma Ventures, Amplify Partners, BoldStart, Ridgeline and Heavybit.

What the company does: Replicated develops technology that software vendors use to operationalize and scale the delivery of their applications into complex, enterprise multi-premise environments (including on-premises and private cloud).

CEO Quote: “We believe the future of enterprise software delivery is multi-prem, the ability for software vendors to offer their applications to any customer environment with ease,” said Grant Miller, Replicated co-founder and CEO. “Securing this funding will allow Replicated to continue revolutionizing how software is delivered and how enterprises manage it.”

Everactive

Headquarters: Santa Clara, Calif.

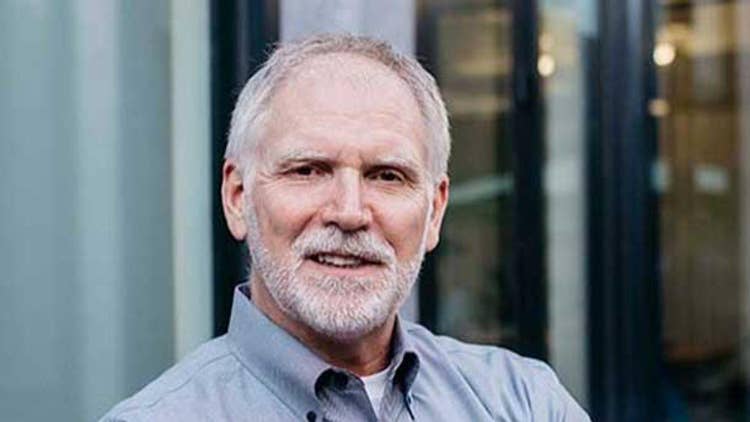

CEO: Bob Nunn

Funding: A $16 million Series C strategic funding round (adding to the $35 million raised in Series C funding in September 2020).

Investors: 3M, Ericsson and Armstrong International.

What the company does: Everactive develops batteryless, wireless Internet of Things solutions including Industrial IoT sensors.

CEO Quote: “The breadth of industries that Everactive’s investors represent signals the exciting promise of the application of this technology across a variety of sectors. We will leverage the funding to grow an ecosystem through which Everactive’s technology will enable a wide array of high-value, high-volume solutions across industries including manufacturing, food and beverage, CPG, pharmaceutical and biotechnology, petrochemical, oil and gas and more.”