2019 Security 100: 20 Coolest Endpoint Security Vendors

Fortifying The Endpoint

An increase in threats such as malware, ransomware, and advanced persistent threats (APTs) has boosted the need for strong endpoint security offerings. The globalization of industries and an increase in enterprise endpoint-targeted attacks has challenged businesses to up their endpoint protection around specialized threats.

As cybersecurity threats become more advanced, companies have increasingly turned to endpoint detection and response (EDR) offerings to provide both signature-less detection as well as signature-based detection. Legacy endpoint players have turned to everything from partnerships, agreements, mergers and acquisitions, and new product development to achieve growth in the global EDR market.

As part of CRN's annual Security 100 list, here's a look at 20 companies making their mark in the endpoint security space.

Avast Software

Vince Steckler, CEO

Prague, Czech Republic

Avast in April applied to list its shares on the London Stock Exchange in a move that valued the company at around $3.2 billion, raising $200 million in gross primary proceeds. Seven months later, it launched Avast Mobile Security for iOS users, which guards their identity and provides safe and private browsing.

Bitdefender

Florin Talpes, Founder and CEO

Bucharest, Romania

Bitdefender unveiled a single-agent, single-console endpoint protection offering that combines prevention and hardening with advanced endpoint detection and response. It also moved beyond its endpoint security roots with the acquisition of network behavior, traffic analytics and threat intelligence vendor RedSocks Security.

Carbon Black

Patrick Morley, President and CEO

Waltham, Mass.

Carbon Black in May vowed to continue its channel focus as it uses some of the proceeds from its $152 million IPO to expand its footprint outside the U.S. Five months later, the company updated CB ThreatHunter to continuously collect unfiltered data, making it easier for security teams to proactively hunt threats and disrupt active attacks.

CrowdStrike

George Kurtz, President/CEO & Co-Founder

Sunnyvale, Calif.

CrowdStrike’s new automated threat analysis offering delivers customized indicators of compromise, intelligence and SOC automation to businesses of all sizes. The company received an additional $200 million in private equity funding in June.

Cybereason

Lior Div, CEO & Co-Founder

Boston, Mass.

Cybereason in May launched a Technology Partner Program focused on integrating its endpoint Deep Hunting Platform with other leading SIEM, SOAR and threat intelligence platforms. Seven months later, the company unveiled several new features to empower security analysts at Global 2000 organizations.

Cylance

Stuart McClure, CEO & Founder

Irvine, Calif.

Cylance in November agreed to be sold to BlackBerry for $1.4 billion to add artificial intelligence, algorithmic science and machine learning to cybersecurity scenarios to better prevent known and unknown threats. One month later, it debuted automated processes and procedures to ensure consistent incident response across the enterprise.

Dell Security

Michael Dell, Chairman and CEO

Round Rock, Texas

Dell’s new programs and incentives are fast-tracking partners’ delivery of digital, IT, security and workforce transformations for their customers. Dell also debuted a joint IoT offering with Microsoft that relies on analytics applications, management tools and edge gateways to enable network security from edge devices to the cloud.

ESET

Richard Marko, CEO

Bratislava, Slovakia

ESET in August tapped 12-year Ingram Micro veteran Brent McCarty to lead its North American business and expand enterprise and MSP relationships. One month later, it launched a flexible, cloud-based remote security management offering specifically designed to address the IT security challenges faced by SMBs.

Fidelis Cybersecurity

Nick Lantuh, President & CEO

Bethesda, Md.

NetWitness founder and former eSentire executive chairman Nick Lantuh was named to the top role at Fidelis Cybersecurity in April. Five months later, the company completed a $25 million funding round, and planned to use the money to expand its go-to-market initiatives and invest in its Managed Detection and Response service.

F-Secure

Samu Konttinen, President & CEO

Helsinki, Finland

F-Secure’s endpoint detection and response offering helps organizations catch fileless attacks, privilege escalation and other advanced tactics. In June, the company acquired MWR InfoSecurity, which has a threat hunting platform that provides proactive attack detection and a suite of managed phishing protection services.

Kaspersky Lab

Eugene Kaspersky, CEO

Moscow, Russia

Kaspersky Lab’s Kaspersky Web Traffic Security reinforces web gateways to protect corporate networks from a variety of web-based attacks and decreases IT support overhead. The company has tasked global sales leader Maxim Frolov with driving more enterprise sales and business with top-selling partners in North America.

Malwarebytes

Marcin Kleczynski, CEO

Santa Clara, Calif.

Malwarebytes in May acquired Binisoft, creator of Windows Firewall Control, to improve how the product is managed and USB Flash Drives Control to regulate how USB removable drives are used. It later unveiled Malwarebytes for iOS with call and web protection for Safari, text filtering and ad blocking combined for mobile devices.

McAfee

Chris Young, CEO

Santa Clara, Calif.

McAfee reemerged as a mobile security player in July and introduced new endpoint, automation and orchestration offerings that scale to meet the needs of larger businesses. Three months later, the company debuted MVision EDR, which takes context and data present at the endpoint and moves it to the cloud to allow for analytics and automation.

Opaq

Glenn Hazard, Chairman and CEO

Herndon, Va.

Opaq introduced network segmentation capabilities to its security offering to thwart threats that move laterally between workstations, servers and other endpoints. It also closed a $22.5 million Series B funding round to support its go-to-market initiatives for delivering security-as-a-service to midsize enterprises via its partners.

SentinelOne

Tomer Weingarten, Co-Founder and CEO

Mountain View, Calif.

SentinelOne's new console expands its detection capabilities into multitenancy and role-based access environments while enhancing the admin experience. It also added Endpoint Firewall Control and Device Control to its platform to make it easier to fully replace incumbent endpoint vendors in a customer’s ecosystem.

Sophos

Kris Hagerman, CEO

Abingdon, United Kingdom

Sophos in October introduced endpoint detection and response to its Intercept X offering to make threat tracking accessible to businesses with more limited resources. Three months later, it purchased cloud infrastructure vendor Avid Secure to provide end-to-end protection around AWS, Microsoft Azure and Google.

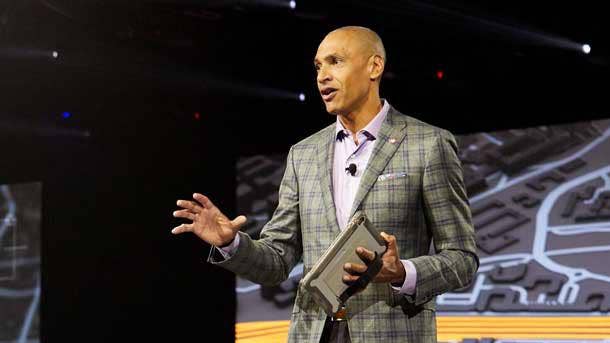

Symantec

Greg Clark, CEO

Mountain View, Calif.

Symantec’s Targeted Attack Analytics looks at the machines in an enterprise and collates the telemetry with the endpoints to verify if there’s an attack taking place. Its Managed Cloud Defense, meanwhile, detects, protects and responds to cloud issues by correlating cloud-based attack activity with its Global Intelligence Network.

Tanium

Orion Hindawi, Co-Founder and CEO

Emeryville, Calif.

Tanium in September launched Tanium Map, which visually charts critical business applications, the endpoints that connect to them, and the infrastructure they depend on. The company received a $175 million investment from TPG Growth in May and hauled in $200 million more in an October round led by Wellington Management.

Trend Micro

Eva Chen, CEO

Tokyo, Japan

Trend Micro’s Writing Style DNA sounds the alarm when emails are suspected of impersonating an executive or other high-profile user as part of a Business Email Compromise attack. Its Apex One, for its part, enhances automated detection and response and provides actionable insight consistently across SaaS and on-premises deployments

Webroot

Mike Potts, President and CEO

Broomfield, Colo.

Webroot in October launched Webroot WiFi Security, a VPN that provides a powerful layer of security that protects users from visiting risky sites. Four months later, Carbonite revealed plans to purchase Webroot for $618.5 million, which will create a company that can deliver backup and recovery and cloud-based security on the endpoint.