State of Technology: Security - By The Numbers

Everything Channel's Institute for Partner Education and Development (IPED) surveyed solution providers to get a closer look at the products, services and trends driving the security market now and in the future. Here's what the channel had to say.

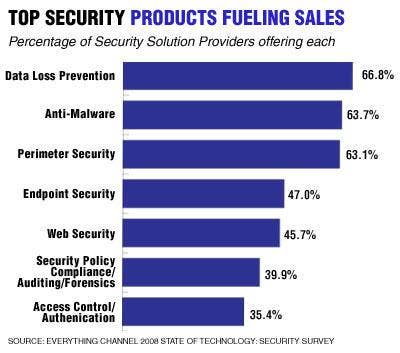

Data loss prevention (DLP) sits atop the food chain as the security technology most offered by solution providers. Nearly 67 percent of partners surveyed said they offer DLP solutions to their customers. Anti-malware, perimeter security, end point security and Web security rounded out the top five most popular offerings.

Read The Full Report.

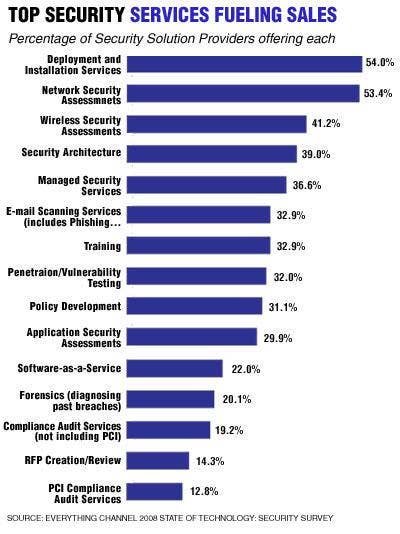

Security solution providers said deployment and installation services are their most commonly offered professional services, with 54 percent of partners including them in their portfolio. Network security assessments followed closely behind, with just over 53 percent of partners offering them. Wireless security assessments, security architecture and managed security services rounded out the top five most popular security services offerings.

Read The Full Report.

When VARs look ahead to the future, they named access control and authentication as the No. 1 technology area they plan to add to their portfolios within the next 18 months. Security policy compliance solutions ranked second on the list, followed by DLP.

Read The Full Report.

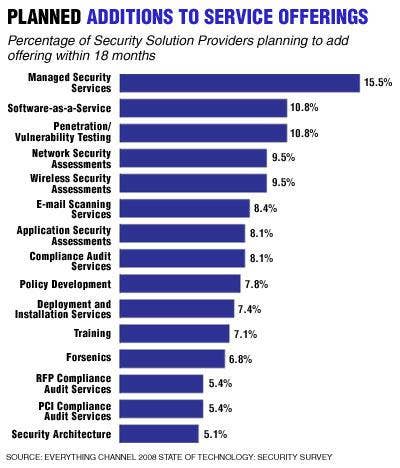

On the services front, solution providers said they are eyeing managed security services as the No. 1 security services offering they plan to add within the next 18 months. Software-as-a-Service ranked No. 2, with penetration and vulnerability testing rounding out the top three.

Read The Full Report.

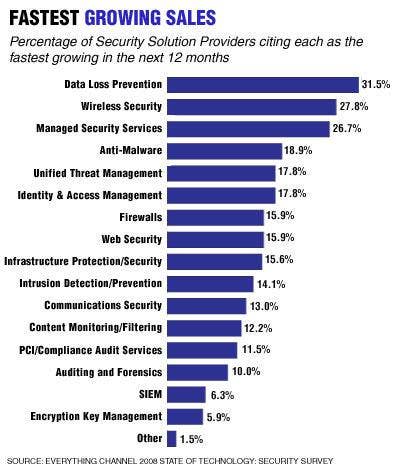

Solution providers said their biggest security sales growth opportunity over the next 12 months will come from data loss prevention solutions, with nearly 32 percent of partners designating DLP as their fastest growing technology. Wireless security is hot on DLP's heels, with nearly 28 percent of partners naming it their fastest growing technology. Managed security services rounded out the top three.

Read The Full Report.

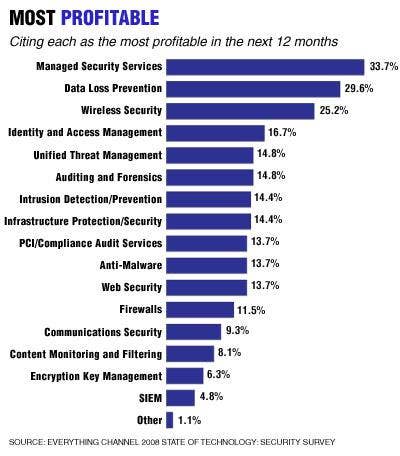

When it comes to profitability, solution providers said managed security services are at the top of the heap. Nearly 34 percent of channel partners named managed security services as their most profitable security offering. DLP, wireless security, identity and access management and unified threat management made the top five.

Read The Full Report.

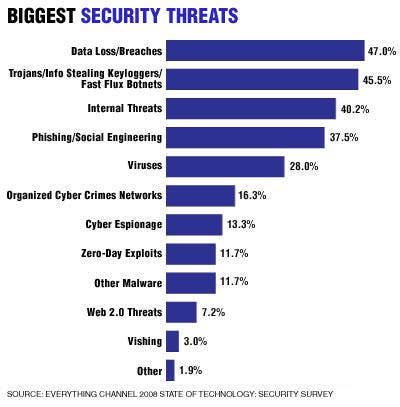

The biggest security threat currently facing customers comes in the form of data loss and breaches, according to surveyed solution providers. Malware such as Trojans and info-stealing keyloggers are the second biggest threat, followed by internal threats, phishing/social engineering and viruses.

Read The Full Report.

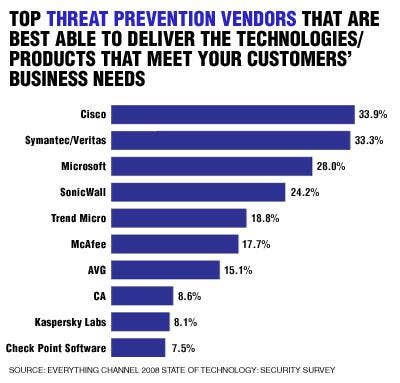

Solution providers looking at threat prevention vendors in areas such as perimeter security, anti-malware, end point security and Web security said Cisco Systems is the vendor best able to deliver the technologies and products that meet customers' needs. Symantec came in a close second, with Microsoft in third.

Read The Full Report.

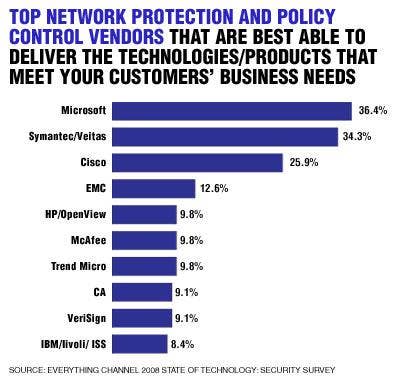

For network protection and policy control, including technologies such as DLP, access control, and security policy compliance, Microsoft is the vendor best able to deliver technologies and products that meet customers' needs, solution providers said. Symantec placed second and Cisco third.

Read The Full Report.

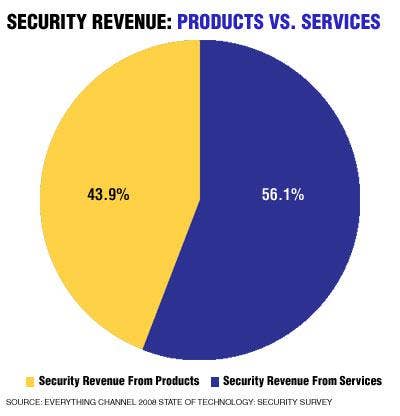

Security solution providers said they make the majority of their revenue (56.1 percent) from services, making it a bigger piece of the sales pie than products.

Read The Full Report.

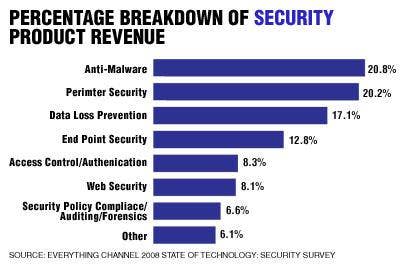

When solution providers dissected their security sales streams, they said antimalware provides the biggest revenue chunk. Perimeter security, DLP, end point security and access control/authentication round out the top five.

Read The Full Report.

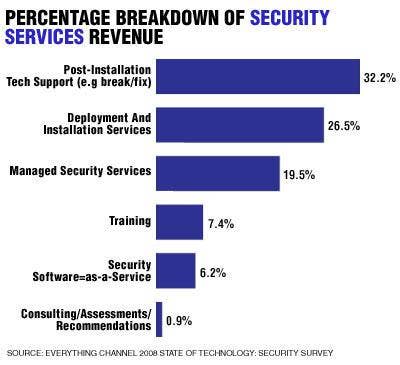

Solution providers said post-installation tech support provides the biggest chunk of their security services revenue. Deployment and installation services came in at No. 2, with managed security services at No. 3.

Read The Full Report.

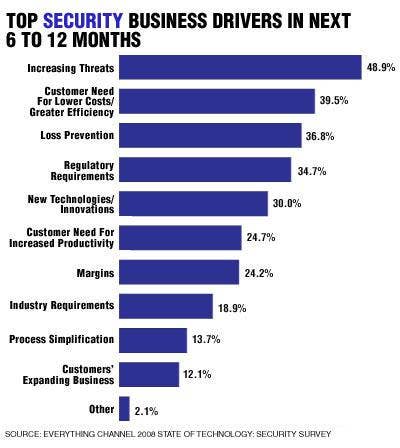

Nearly 49 percent of partners said that the increasing number of security threats is spurring their security business, making it the top sales driver. Customers' need for lower costs and greater efficiency ranked No. 2, with loss prevention at No. 3.

Read The Full Report.

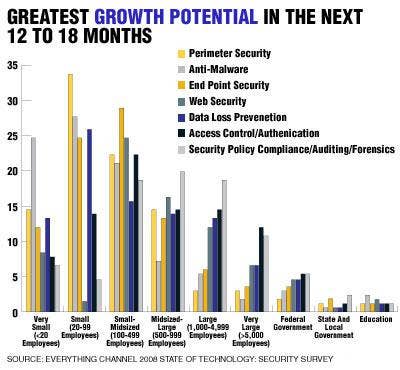

Businesses with under 20 employees are poised to snap up anti-malware solutions, while small companies with 20 to 99 employees are looking at perimeter security. End point security will make a big splash with businesses between 100 and 499 employees, while security policy compliance should play big with midsized-large and large customers, solution providers said.

Read The Full Report.

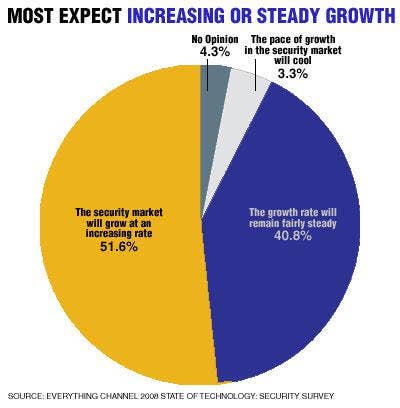

Solution providers are optimistic about the future of the security market. Nearly 52 percent said they expect the market to grow at an increasing rate, while nearly 41 percent predicted that the growth rate will remain fairly steady. Only 3.3 percent said they expect the growth rate in the security market to cool.

Read The Full Report.

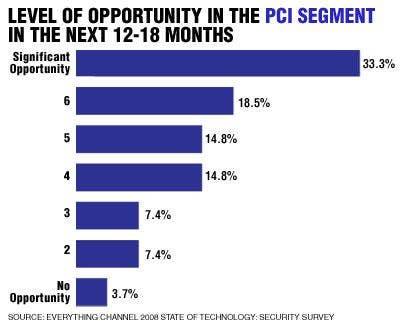

Security regulations around the Payment Card Industry (PCI) are creating significant sales opportunities for the channel, partners said.

Read The Full Report.

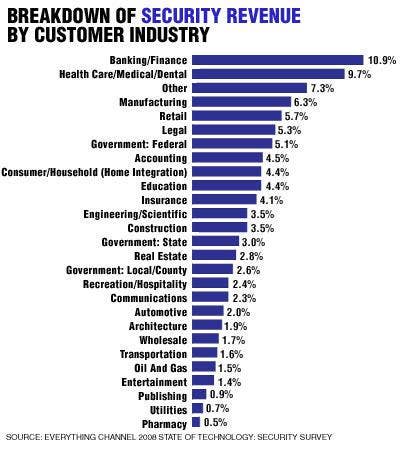

While vertical markets across the board need security solutions, banking and finance is the customer segment where solution providers are finding the biggest sales opportunities. Healthcare placed second on the list.

Read The Full Report.

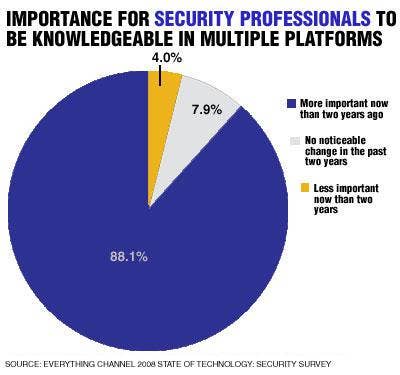

Over 88 percent of solution providers said it is more important now than two years ago for security professionals to be knowledgeable in multiple platforms.

Read The Full Report.

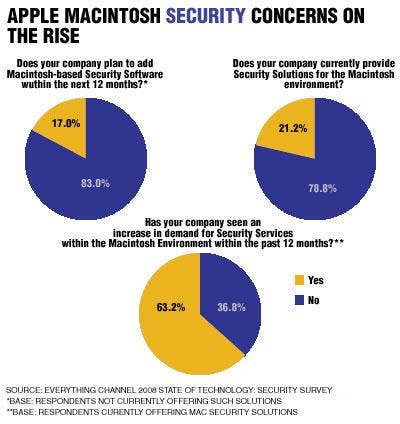

Solution providers said threats to the Apple Macintosh platform are on the rise, with 83 percent of partners not currently offering Mac-based security solutions planning to get in the game over the next year.

Read The Full Report.

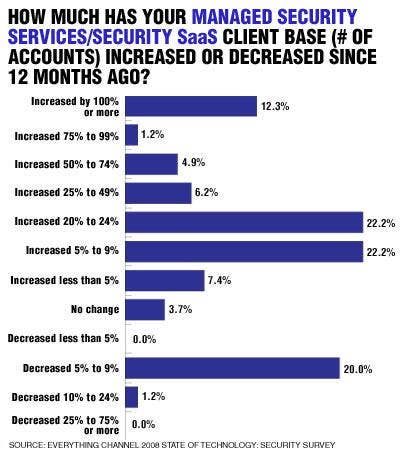

Over 40 percent of solution providers said their managed security services/SaaS client base has grown by 5 percent to 24 percent over the last 12 months.

Read The Full Report.