Here's Who Made Gartner's 2015 Magic Quadrant For Secure Web Gateways

Securing Customers In The SWG

There are a lot of options in the secure Web gateway (SWG) market, but some are better than others. Protecting customers against Internet threats, the solutions typically go head to head with firewall, IPO and UTM solutions, a competitive landscape that market research firm Gartner expects will grow more aggressive as vendors start to integrate SWGs with those solutions and take the necessary steps to dive into cloud-based SWG services. This year's Magic Quadrant, which ranks the vendors based on their completeness of vision and ability to execute on that vision, had three Leaders (high in both categories), two Challengers (high in execution but low in vision) and eight Niche Players (low in both categories). Take a look at how the vendors stacked up.

Leader: Zscaler

Gartner named cloud-based secure Web gateway provider Zscaler a Leader in this year's Magic Quadrant report. The San Jose, Calif.-based vendor has been making big changes over the past year, adding network sandboxing and next-generation firewalling services, as well as add-on services for cloud-based anti-malware, data loss prevention and secure Wi-Fi services. In its report, Gartner praised the company's fast growth and technology.

"Zscaler continues to be the fastest-growing vendor in this market, as well as one of the most innovative vendors," the report said. "Zscaler is a good option for most enterprises that are seeking a cloud-based SWG."

Zscaler

Strengths: Gartner praised the wide reach of Zscaler's malware-detection engines across all types of content as well as its global cloud footprint, the largest of all the vendors on the list. On top of that, Gartner said the vendor "leads the SWG market" in collocating, direct peering and other cloud areas. Gartner also highlighted the company's optional streaming log service, which can be integrated and analyzed by a SIEM solution.

Cautions: Gartner said downsides to the Zscaler solutions include a lack of severity indicators for prioritization and the ability for knowledgeable users and some port-evasive applications to circumvent the recommended use of PAC files.

Leader: Blue Coat

Sunnyvale, Calif.-based Blue Coat has had a busy 2015 so far, with the company announcing in May its $2.4 billion acquisition by private equity firm Bain Capital from previous owner Thomas Bravo in a move that preps the company to go public once again. Gartner said the company, which offers appliance-based and cloud-based SWGs as well as other appliance-based products, is a "good candidate" for large enterprises as it is scalable, with a cloud option to extend its appeal to "most" enterprise clients. For those reasons, Gartner named Blue Coat a Leader in this year's Magic Quadrant report.

Blue Coat

Strengths: Gartner said Blue Coat's ProxySG solution is "the strongest proxy in the market in terms of breadth of protocols and the number of advanced features." Gartner praised the company's hybrid offering as a "single pane of glass" solution for policy management as well as its integrated detection capabilities. Finally, Gartner said a strength for Blue Coat is its "strong support" for SSL.

Cautions: One big drawback for Blue Coat's solution is its high price point, Gartner said. The vendor also lacks a cloud-based sandbox, which leaves cloud-only Blue Coat customers without a way to use a network sandbox, as well as a way to monitor all network traffic in most popular deployment methods of its ProxySG solution.

Leader: Websense

Gartner's third Leader in the secure Web gateway market is Websense, an Austin, Texas-based company that appeals to mostly midsize companies with offerings in both SWG appliances and a cloud-based service. In April, Websense was acquired from owner Vista Equity Partners by major defense contractor Raytheon, a move Gartner said could "result in a reduced focus on its core SWG functionality" as it focuses more on threat defense. That being said, Websense still held on to a strong spot in the top ranking in Gartner's Magic Quadrant this year.

Websense

Strengths: For those looking for a hybrid SWG strategy, Gartner said Websense is a "strong offering" with centralized management, cloud-based Web Sandbox Module and DLP technology in its appliances. Gartner also praised Websense's mobile support strategy, particularly for integrated AirWatch customers.

Cautions: Gartner said customers who want to switch from Websense's cloud-only service Cloud Triton Manager run into a hurdle, as it is a different console from its hybrid and on-premise solutions. Gartner also said that it "rarely sees" Websense's blade-server appliance X10G in enterprises and a lack of an ISP or telecom partnership "limits Websense's ability to target large enterprises with its cloud-based service."

Challenger: Cisco

With a collection of recent acquisitions under its belt, including Sourcefire, Cognitive Security and ThreatGRID, Cisco has been investing heavily across its security portfolio. That theme was echoed at its most recent partner conference in Montreal.

That being said, Gartner dropped the San Jose, Calif.-based vendor from a Leader position to a Challenger one, as the company has made "slow progress" in its hybrid SWG strategy and "nonuniform threat detection capabilities." By missing out on those areas, Gartner said Cisco is "missing an opportunity" to help customers add more cloud services.

Cisco

Strengths: Citing the use of technology from the company's key acquisitions, Gartner praised Cisco's "multiple layers on a single appliance," including adaptive scanning, advanced malware protection from the Sourcefire acquisition, file analysis and alerts, as well as sandboxing from the ThreatGRID acquisition. In addition, Gartner praised Cisco's Layer 4 Traffic Monitor feature, which it said "improves its malware detection capability" by extending visibility across all ports and protocols. Gartner said services also benefit from integrations into Cisco's broad portfolio of solutions.

Cautions: Gartner said Cisco "has not demonstrated significant focus in the SWG market," resulting in a flat market share since its 2009 acquisition of ScanSafe. As customers look for hybrid solutions, Gartner said, Cisco has also been "slow" to integrate its cloud and on-premise solutions.

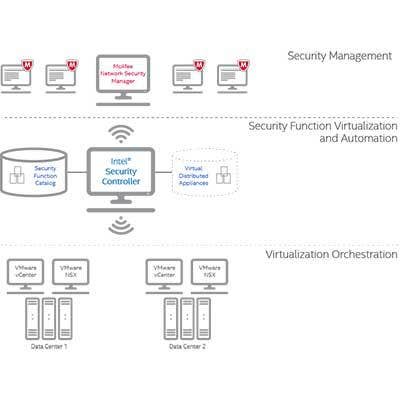

Challenger: Intel Security

Intel Security dropped this year from Leader to Challenger on the Gartner Magic Quadrant ranking because of what the research firm called a lack of completeness of vision, particularly around sales and distribution and a focus on endpoint-redirection to the cloud. The Santa Clara, Calif.-based company has also faced a slew of executive departures over the past year, including some of its top channel execs and its former President Michael DeCesare. That being said, Gartner said that overall, Intel represented a "good candidate" for enterprise customers.

Intel Security

Strengths: In a hybrid-cloud world, Gartner said, Intel Security has the flexible controls and synchronizations for "good implementation" of hybrid and on-premise environments. Gartner also praised the vendor's integrations and ability to scan SSL traffic.

Cautions: As a caution, Gartner highlighted Intel Security's lack of a cloud-based sandbox, which leaves all-cloud customers without a network sandbox technology. Gartner also said customers were "dissatisfied" as Intel Security has been "slow" to add key cloud features, such as IPsec support, expand its global footprint and form partnerships with leading ISP or telecom carriers, which "limits" its ability to target large enterprises. From a mobile security perspective, Gartner said Intel Security uses proxy settings for its iOS and Android devices, which "can easily be defeated by knowledgeable users."

Niche Player: Trend Micro

Over the past year, Trend Micro has been working to update its roster of channel partners, cutting those that were underperforming, demoting some to a lower status and actively recruiting new quality partners. From a technology point of view, Gartner named the Tokyo-based company as a Niche Player for secure Web gateways, saying it is a good fit for companies that "already have a strategic relationship with the company." The company offers both an on-premise solution and a cloud service for secure Web gateway options.

Trend Micro

Strengths: Gartner said Trend Micro's overall portfolio is a big add-on to its SWG offering, including threat intelligence, script analyzer capabilities and botnet detection. Gartner also praised the company's single licensing model and broad geographic coverage.

Cautions: Gartner said some elements missing from the Trend Micro lineup included cloud-based malware sandboxing, SIEM integration, DLP support and global data centers. Gartner also said Trend Micro's separate consoles add complexity as companies' needs evolve.

Niche Player: Barracuda Networks

A Niche Player this year under Gartner's ratings, Barracuda focuses mostly on solutions for SMBs and small enterprises with its Web Filter appliances. Last year, the Campbell, Calif.-based company was recognized by Gartner as a Challenger, but dropped based on "stagnant market share." More recently, the company has been working to ramp up its channel program, launching a revamped program in April to add a new level and a new MSP program. The company also created a new role for head of global channels in May, naming former Arcserve exec Chris Ross as senior sales vice president, global channels.

Barracuda Networks

Strengths: Gartner said Barracuda's Instant Replacement program, comprehensive application control and mobile data management were big positives for the vendor's secure Web gateway offering. Gartner said customers also praised its easy deployment and management.

Cautions: Barracuda's focus on SMBs has made it difficult appealing to enterprises, as the feature requirements are different. Gartner said the vendor has also bet big on its partnership with Lastline for advanced threat defense, something that could play against Barracuda if Lastline is acquired.

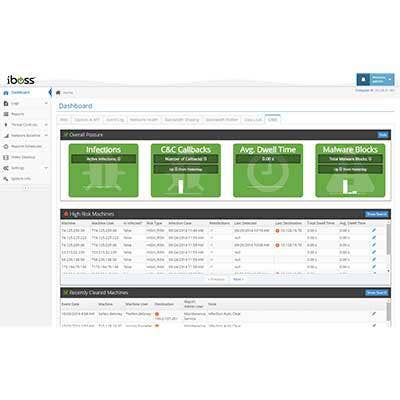

Niche Player: iboss

Based in San Diego, Calif., iboss offers solutions for APT, mobile security and Web security. The company's secure Web gateway option includes both an appliance-based option and a cloud-based service. The company was named a Niche Player by Gartner on its 2015 Magic Quadrant.

"Iboss is a good option for midsize or large enterprises and for K-12 schools in supported geographies," Gartner said.

Iboss

Strengths: On the positive side, Gartner said iboss offers a solution combining malware detection, sandboxing, analysis, and full SSL content inspection at the gateway. Gartner also praised its flexible bandwidth controls and reporting capabilities.

Cautions: Gartner warned that customers looking into iboss's cloud services "test it carefully," as many don't adopt it as a pure cloud service. The research company also cautioned that customers outside of North America should double check that there's enough service and support in their region.

Niche Player: ContentKeeper

Another Niche Player in the secure Web gateway market is ContentKeeper, a lesser-known company based in Australia that is just started to expand into the North American market. The company offers both SWG appliances and cloud-based services, which are primarily targeted at the government, education and commercial markets.

ContentKeeper

Strengths: Gartner praised ContentKeeper's high throughput, ability to inspect SSL traffic and its overall support and service. On top of that, Gartner said, the company's mobile device offerings make it especially appealing to schools.

Cautions: On the downside, Gartner said, ContentKeeper struggles because its hosted offering does "not scale as dynamically as shared multitenant clouds" and its workflow tools "need improvement." On top of that, Gartner said, ContentKeeper's reputation has not yet set it head to head against other advanced threat companies.

Niche Player: Symantec

Symantec's security portfolio is in for a change as the company prepares for its upcoming split into two separate storage and security companies, the latter of which will be led by current CEO Michael Brown. The split will help Mountain View, Calif.-based Symantec drive more focus, flexibility and investment in independent security and storage portfolios, Brown said at the time. Within its security portfolio, Symantec has two offerings for secure Web gateway -- a cloud-based offering and an on-premise appliance. The company's SWG offering, while it has some shortcomings, is a "good option" for SMBs, Gartner said, but "has significant limitations" in the enterprise. For that reason, Symantec was named a Niche Player in Gartner's SWG Magic Quadrant.

Symantec

Strengths: Gartner highlighted Symantec's DLP support, flexible policy configurations and multiple language offerings. Integrations with the company's "strong malware research labs" are also a major positive for the vendor's SWG solution, Gartner said.

Cautions: Gartner cautioned that Symantec didn't have an integrated hybrid offering, leaving customers looking for a hybrid offering to use two consoles. Gartner said the vendor also "needs improvement" with its mobile device support as well as lacks a network sandbox, IPsec and General Routing Encapsulation tunnels.

Niche Player: Sophos

Yet another Niche Player on Gartner's Magic Quadrant list for secure Web gateways was Sophos, which tailors a wide variety of security solutions for small and midsize companies. 2015 has been a big year for the U.K.-based company so far, with the announcement of a $1.6 billion IPO, acquiring email security company Reflexion Networks and new channel leadership driving the company to new levels around the cloud. For SWG, Sophos offers the Sophos Web Appliance and SWG functionality integrated in with its UTM appliance, offerings that Gartner said are well-tailored for midsize organizations.

Sophos

Strengths: One big advantage for Sophos is "ease of use" and strong service and support, Gartner said. The company's strong tools in the malware detection space as well as its endpoint detection platform also are a boost for the company's solution in the market, Gartner said.

Cautions: While the company's ease of use is a plus for SMBs, Gartner said it can be "limiting" for enterprises. Gartner also said the company is "in midtransition to a more unified offering" between its UTM, cloud and SWG offerings, which creates a challenge as the capabilities are "vastly different."

Niche Player: Trustwave

Trustwave has had a big year so far in 2015, with the April announcement of its acquisition by Singapore Telecommunications Limited (Singtel), a move the company said at the time would boost its managed security services offering. The Chicago-based company offers a wide portfolio of security solutions, including a proxy-based SWG appliance focused around malware detection. Gartner said the company is a "good option" for those already using other Trustwave solutions or those looking for an offering focused on managed services. For that reason, Gartner named it a Niche Player on this year's Magic Quadrant list.

Trustwave

Strengths: In the report, Gartner praised Trustwave's features such as application control support and integrated DLP engine. The company's Managed Anti-Malware Service is also a plus, Gartner said, adding as-a-Service offerings for deployment, management and monitoring, as well as extensive research from investigations and penetration tests.

Cautions: Downsides to the Trustwave SWG solution include a lack of a cloud-only SWG offering and network sandboxing capabilities, Gartner said. In addition, Gartner said the company's mobile device support and dashboard control are both "weaker" than those of competitors.

Niche Player: Sangfor

At the bottom left of Gartner's Magic Quadrant is Sangfor, a China-based security vendor with a variety of security offerings. The company's SWG products are a major part of the company's portfolio, accounting for around half of its revenues, Gartner said. The company has two offerings for SWG, one targeted at China and the other at English-speaking countries, though most of its revenue comes from the former. For that reason, Gartner said Sangfor's SWG offerings are good for customers based in China.

Sangfor

Strengths: Gartner praised Sangfor's "strong" application controls and features such as a wireless control, cloud-based sandbox and in-line transparent bridge mode for bandwidth control.

Cautions: Gartner didn't have a long list of negatives for Sangfor, saying only that the company lacked a cloud-based SWG service and calling its dashboard "basic," and that it "lacks severity indicators to prioritize alerts."