10 Storage Startups To Watch

2009 has seen a lot of activity from startups in the storage industry.

Part of that activity comes from opportunities brought about by the economic downturn, as sales by larger, more established vendors slip, leaving the door open to more nimble smaller players that can come in with alternative solutions.

However, credit also has to be given to the innovative skills of entrepreneurs in the storage space. Some of them may eventually crash and burn, but others may experience incredible success either as a stand-alone company or as an acquisition target.

Remember, EMC once was a startup memory manufacturer selling office furniture to pay the bills. And EqualLogic once was a startup developer of something called iSCSI before it eventually became the rock on which Dell is building its storage and its channel future.

Atrato, Westminster, Colo., designs and manufactures storage arrays for high-performance applications that require 24x7 access. The company's Velocity1000 array fits up to 160 500-GB hard drives, or 80 TBs, in a 3U rackmount space, or about 1 PB in a standard 42U rack.

The arrays are unique in that they are built around mobile PC hard drives that require only 5 watts of power per drive vs. 13 watts for an enterprise drive.

While mobile drives lack the firmware and mechanical technologies that let enterprise drives compensate for vibration caused by the rotation of multiple hard drives in a tight space, Atrato's software accounts for that rotational vibration and provides full disk analysis and failure analysis of drives.

Atrato last month expanded its management team with the addition of Marty Sos as vice president of sales. Sos, who is responsible for worldwide sales and developing OEM and channel routes-to-market, was the former vice president of sales at Plasmon.

Axcient, Mountain View, Calif., came out of stealth mode in 2009 with the introduction of a hybrid storage service that combines an on-premises storage appliance with an Internet-based storage service that together lets customers back data up both locally for fast restores and online for safe archiving.

Axcient's hybrid storage protection strategy includes two parts.

The first is "cloud" storage, whereby customer data is encrypted and sent over the Internet to be stored in a redundant storage infrastructure that is owned and hosted by Axcient itself in multiple collocation sites.

This is tied to an appliance with a capacity of between 500 GB and 10 TB for local backup and recovery. Built in conjunction with Bell Microproducts, the appliance includes RAID capability and redundant power supplies. Incremental changes in customer data is encrypted and backed up on a regular basis.

In May, Axcient secured a new round of funding worth $2 million, a follow-up to its A-round of $6 million.

The company is pursuing a channel-only business model.

Pliant Technology, Milpitas, Calif., this month became the latest entrant into the fast-growing enterprise flash drive market with the release of its Lightning family of solid state drives (SSDs).

The Lightning SSDs feature the SAS interface, and are available in a 2.5-inch form factor with capacity of 150 GB and in a 3.5-inch form factor with capacities of 150 GB or 200 GB.

For reliability, the SSDs are built without a write cache. Greg Goelz, vice president of marketing for the company, said write caches often can fool a host into thinking data was written to a drive when it may not have been, and are usually turned off by enterprise disk drive users.

Pliant works with distributor Bell Microproducts, which assembles the SSDs. The company is pursuing a channel-only policy, except for a handful of OEMs.

Pliant in March received $15 million in Series C funding.

Pranah Storage Technologies, St. Paul, Minn., in July launched for its SMB customers a channel-only storage appliance that combines a purpose-built hardware box combined with a software stack that includes thin provisioning, snapshot, and both NAS and iSCSI SAN capabilities.

The company's new storage appliance also includes 10-Gbit Ethernet connectivity; support for SAS, SATA and Fibre Channel hard drives; dual controllers and power supplies; three fans; and an enclosure to make it easy for solution providers to configure the storage capacity.

Options include distributed file systems, tiered storage and synchronous and asynchronous replication.

The Pranah 2000 series appliances starts at $2.15 per GB for a 1U enclosure configured with a dual controller and 8 TB of iSCSI storage. When configured with 80 TB in a 4U form factor, the price drops to about 61 cents per GB.

For partners, Pranah offers a 30-percent margin on the enclosures. More important, those enclosures are shipped without hard drives, allowing solution providers to configure them as needed for specific customers.

Rebit, Longmont, Colo., last year launched a series of backup products geared toward consumer and small office/home office clients, and plans to launch higher-end products, featuring NAS connectivity, for small-business clients by the end of the year.

Rebit's backup products plug into a desktop PC via the USB port and automatically perform file-level continuous data protection. Whenever a file changes or a new file is created, it is automatically backed up.

In addition to backing up customers' files, the Rebit devices also back up everything else, including the Windows operating system, software applications, drivers, passwords and preferences so that the user can completely restore his or her PC after a system crash.

Rebit gets more than half of its revenue through indirect sales channels, and also makes its software available to OEMs. The company in June signed a global OEM relationship with Seagate, which is offering Rebit's software with its Replica PC backup appliance.

SandForce, Saratoga, Calif., is a developer of processors for the building of enterprise SSDs from commodity NAND flash memory.

The company used last month's Flash Memory Summit to demonstrate the SandForce SF-1000 SSD processor in SSD applications using MLC Flash.

In the demonstration, the SF-1000 SSD processor performed more than 30,000 sustained, random 4-KB write I/Os per second to a single SATA drive, and more than 130,000 sustained, random 4-KB write I/Os per second through a PCIe card solution connected to four drives.

The SF1000 processors feature a standard 3-Gbpersecond SATA host interface connecting up to 512 GB of commodity NAND flash memory. The company said that SF1000based SSDs can sustain peak performance for fiveyear enterprise life cycles without artificial daily usage restrictions or costly overprovisioning techniques.

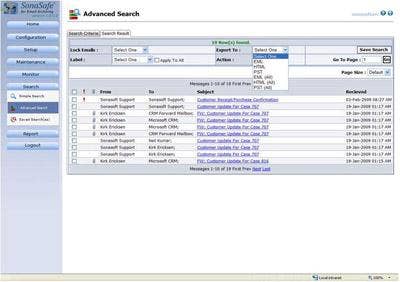

Sonasoft, San Jose, Calif., develops technology that archives four types of data most likely to be used by SMBs: Microsoft SQL data, Microsoft Exchange e-mails, files that need to be backed up and recovered, and data needed for compliance purposes.

The vendor's SonaSafe data archiving software is available in four flavors: SonaSafe for SQL Server, SonaSafe for Exchange Server, SonaSafe for File Systems and SonaSafe for Email Archiving.

Avnet, the company's distributor, also is porting the software onto Hewlett-Packard servers and selling the offering as a preconfigured appliance to its solution provider customers.

Sonasoft currently targets customers via a mix of direct and indirect sales, but is in the process of migrating to a 100 percent channel model.

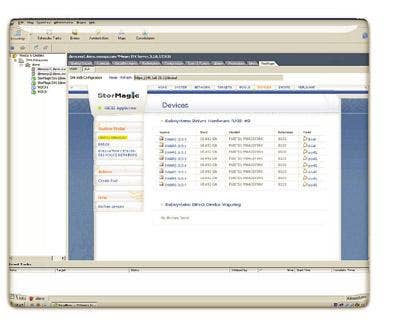

StorMagic, Eden Prairie, Minn., started as a developer of shared storage appliances, but then found that its software could also be implemented on virtual appliances.

That software, SvSAN, allows the deployment of high-availability shared storage in VMware virtual server infrastructures. Aimed at small and midsize businesses, it enables a virtual SAN to be created in the host server's internal disk storage and one or more attached external arrays.

When customers purchase two SvSAN virtual appliances and configure them on two separate physical host servers, they get a high-availability offering that allows active-active mirroring between the two.

SvSAN also provides the ability to migrate virtual servers from one physical host to another via VMware's VMotion functionality without a separate shared storage device.

The SvSAN storage virtual appliance supports VMware vSphere 4 as well as VMware ESX and VMware ESXi server virtualization platforms.

The software lists for less than $2,000, but a free version for managing up to 2 TB of capacity with no expiration date is available to qualified users.

Storwize, Los Gatos, Calif., is taking a different tack in the move to cut the capacity needed to store data.

The company's STN-6800 appliance compresses primary storage data by up to 90 percent before that data goes to be further optimized for archiving, tape backup, disk backup and moving across the WAN.

When used in VMware environments, the STN-6800 can deliver up to five times the number of VMware VMDK files, which include virtual machine images, when compared to noncompressed data, all with no performance degradation, Storwize said.

Storwize gets almost all its revenue from indirect sales, with the few direct customers holding on from the days when it first released its appliances in 2007.

Storwize plans eventually to take all its customers indirect by recruiting solution providers with experience in storage and data reduction.

The company this summer brought in Bill Cordero, the former senior director of worldwide sales at Data Domain, to be its vice president of worldwide channel sales.

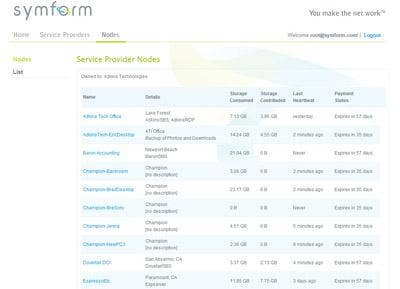

Seattle-based Symform this month unveiled technology that protects a customer's data by breaking it into tiny blocks, encrypting those blocks, and then dispersing them across the Internet.

The Symform Cooperative Storage Cloud technology breaks a copy of a customer's backup into 64-MB blocks, encrypts those blocks, fragments those blocks into 1-MB fragments, adds 32 1-MB parity fragments for redundancy and then scatters those 96 fragments to storage nodes around the world.

Those cloud storage nodes are provided by every customer of the service by designating a small part of their own storage capacity to be used as a node for storing fragments of other companies' data.

Security for the data comes from encrypting it and fragmenting it before it is dispersed into the storage cloud.

The service has a street price of between $30 and $50 per month per server, regardless of the capacity of the stored data. Solution providers pay Symform about $15 per month per server regardless of capacity, giving partners margins of 50 percent to 100 percent.