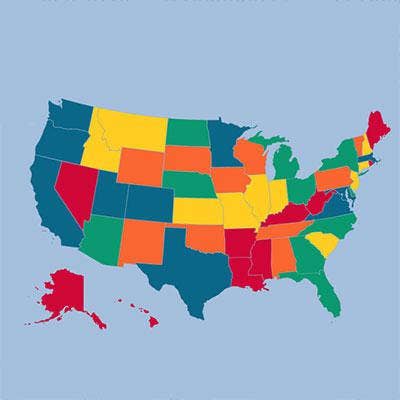

2015 Best (And Worst) States For Taxes

Tax (Dis)incentives

A solution provider can put a lot of effort into growing the business and expanding its top-line revenue. But high taxes can erode hard-won profits. And red-tape regulations can be a hurdle to growth.

As part of the 2015 Best States to Grow a Solution Provider Business analysis, we've looked at the corporate income tax, property tax, and state and local sales tax rates that businesses have to pay in each state. (Personal income tax rates were part of the overall Best States analysis, but were included in the Personal Cost of Living section and do not figure into these rankings.) We've also factored in the regulatory burden states place on companies (as calculated by the Forbes Best States for Business report).

The following are the 10 states with the overall lowest tax and regulatory burdens, using tax rate information from the Tax Foundation (taxfoundation.org), listed from No. 10 to No. 1 – the most business-friendly state. That's followed by the 10 states with the overall heaviest tax and regulatory burden, listed from No. 41 (out of all 50 states) to No. 50 – the least business-friendly state.

Best States No. 10: North Carolina

Corporate income tax rate: 6.0%

Combined state and average local sales tax rate: 6.90%

Property tax rank: 29

Best States No. 9: Virginia

Corporate income tax rate: 6.0%

Combined state and average local sales tax rate: 5.63%

Property tax rank: 26

Best States No. 8: Alabama

Corporate income tax rate: 6.5%

Combined state and average local sales tax rate: 8.91%

Property tax rank: 10

Best States No. 7: Georgia

Corporate income tax rate: 6.0%

Combined state and average local sales tax rate: 6.96%

Property tax rank: 30

Best States No. 6: Ohio

Corporate income tax rate: 0.0%

Combined state and average local sales tax rate: 7.10%

Property tax rank: 20

Best States No. 5: Oklahoma

Corporate income tax rate: 6.0%

Combined state and average local sales tax rate: 8.77%

Property tax rank: 11

Best States No. 4: Colorado

Corporate income tax rate: 4.6%

Combined state and average local sales tax rate: 7.44%

Property tax rank: 22

Best States No. 3: Utah

Corporate income tax rate: 5.0%

Combined state and average local sales tax rate: 6.68%

Property tax rank: 4

Best States No. 2: North Dakota

Corporate income tax rate: 4.5%

Combined state and average local sales tax rate: 6.56%

Property tax rank: 2

Best States No. 1: Missouri

Corporate income tax rate: 6.3%

Combined state and average local sales tax rate: 7.81%

Property tax rank: 7

Worst States No. 41: Maryland

Corporate income tax rate: 8.3%

Combined state and average local sales tax rate: 6.00%

Property tax rank: 41

Worst States No. 42: Minnesota

Corporate income tax rate: 9.8%

Combined state and average local sales tax rate: 7.20%

Property tax rank: 34

Worst States No. 43: California

Corporate income tax rate: 8.8%

Combined state and average local sales tax rate: 8.44%

Property tax rank: 14

Worst States No. 44: Maine

Corporate income tax rate: 8.9%

Combined state and average local sales tax rate: 5.50%

Property tax rank: 40

Worst States No. 45: Massachusetts

Corporate income tax rate: 8.0%

Combined state and average local sales tax rate: 6.25%

Property tax rank: 45

Worst States No. 46: Illinois

Corporate income tax rate: 9.5%

Combined state and average local sales tax rate: 8.91%

Property tax rank: 44

Worst States No. 47: Vermont

Corporate income tax rate: 8.5%

Combined state and average local sales tax rate: 6.14%

Property tax rank: 48

Worst States No. 48: Connecticut

Corporate income tax rate: 9.0%

Combined state and average local sales tax rate: 6.35%

Property tax rank: 49

Worst States No. 49: New Jersey

Corporate income tax rate: 9.0%

Combined state and average local sales tax rate: 6.97%

Property tax rank: 43

Worst States No. 50: Rhode Island

Corporate income tax rate: 9.0%

Combined state and average local sales tax rate: 7.00%

Property tax rank: 47