The 10 Biggest EMC Stories Of 2015

The EMC Rollercoaster

EMC seemed to jump from one dramatic development to another this year. Whether it was defending itself against pressure from activist investor Elliott Management, acquiring high profile cloud provider Virtustream or agreeing to be acquired by Dell, EMC and its chairman and CEO Joe Tucci navigated a seemingly endless sea of challenges and opportunities.

At this time next year, the Hopkinton, Mass.-based firm could be a division of Dell. Here are the 10 biggest EMC stories of 2015.

10. Tucci Succession, Exec Payouts in Dell Deal

One of the biggest questions hanging over EMC this year was if and when Chairman and CEO Joe Tucci would step down. Tucci at one time said he'd retire when his contract expired last February. Instead, the 68-year-old chief executive has been working without a contract since then. Earlier this year, he said he'd stay on as CEO until EMC's board took action to replace him. But in late July he said the board was "actively engaged" in CEO succession planning. Analysts speculated that part of the reason Tucci stayed on so long was to make sure his vision for the EMC federation of companies, which can be complex and confusing for partners and customers, was sustained.

When the Dell acquisition is closed, Tucci and five other top EMC execs stand to collect nearly $150 million in severance if they leave the company within two years.

9. Tucci Talking VMware Investors Off The Ledge After Merger Announcement

News that Dell planned to acquire EMC sent shares of VMware, which is 81 percent owned by EMC, plummeting. The declines were spurred by general uncertainty, as well as Dell's proposal to issue a special "tracking stock" tied to VMware's performance as part of the transaction. Those declines were on top of the steady declines EMC's stock price had experienced over the last year, and the situation prompted EMC CEO Joe Tucci to publicly reassure investors.

"VMware is vital to the strategic success of EMC's combination with Dell," Tucci told investors during a conference call about a week after the merger announcement. "There should be no question about the alignment of interests between Dell and the holders of tracking stock and the holders of VMware common stock. Dell will be the largest economic owner of VMware by a wide margin, so no one has greater incentive to drive VMware growth and value than Dell."

8. EMC Tightens Its Belt

After months of pressure from activist investors insistent on breaking up EMC's federation of companies in order to maximize shareholder value, EMC executives in July signaled they'd rather cut their way to better shareholder value than break up the federation, which they consider the key to future success and earnings strength. CEO Joe Tucci announced an aggressive, $850 million cost-cutting program intended to better align EMC and its federation of companies for the industry-wide transformation away from traditional data storage hardware to the digital solutions enterprise customers are demanding.

The plan included layoffs, a business transformation agenda and a redesign of business processes. The effort could also result in getting rid of products and/or businesses that aren't showing strong growth. Investors weren't the only focus in the belt tightening, however. EMC's earnings had been lackluster for several quarters, and when the cost cutting measures were announced, the company was simultaneously reporting year-over-year profit declines and skinny revenue increases.

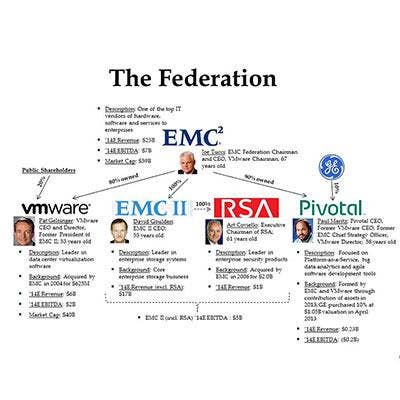

7. EMC Fights To Keep Its 'Federation' Together

The fight to break up EMC's federation of companies – EMC Information Infrastructure, VMware, Pivotal and RSA – began last year when activist investor Elliott Management argued it would be the best way to boost EMC's disappointing earnings. However, it was a move EMC, and especially CEO Joe Tucci, opposed.

Tucci, the architect of the federation strategy, argued that combining the businesses set the table for success in the long term as the IT industry transitions from a focus on hardware to software and services. That message was largely accepted by partners and customers that understand the benefits of having the different companies within the federation working together. And since announcing its proposal to acquire EMC, Dell has said it intends not only to keep the EMC federation in place, but to emulate the strategy itself.

6. EMC Enters Hyper-Converged Market With VxRack

At its annual EMC World conference in May, EMC announced that it was making its first foray – through its VCE unit – into the red-hot market for hyper-converged infrastructure with its new VxRack line. VxRack is a new chapter for the traditional EMC, and it also marks a new phase in the company's relationship with networking giant Cisco Systems, which partnered with EMC to start VCE and still owns about 10 percent of that company. Rather than use Cisco switching as part of VxRack, EMC relies on Taiwan-made white box switches. Until VxRack, VCE used Cisco's UCS servers and Nexus switches, but after Cisco sold most of its stake in VCE, EMC began offering systems that used VMware NSX rather the Cisco ACI, which had been the VCE factory-installed option for software-defined networking.

5. Cisco Will Remain Committed To VCE Partnership With EMC After Dell Acquisition

EMC's VCE partnership with Cisco was called into question in the wake of Dell's October acquisition announcement. Almost as soon as the deal was announced, though, EMC and Cisco issued assurances to partners and customers reassuring them that the companies remained committed to VCE. Partners believed the Dell-EMC merger would mark the end of EMC and Cisco's collaboration on VCE, despite the companies' long-term, engineering, resale and support agreements. However, Dell CEO Michael Dell and EMC CEO Joe Tucci reached out to Cisco top executives John Chambers and Chuck Robbins to assure them that the partnership would continue.

4. Elliott Management Pressure, Truce

EMC spent most of the year under a truce with activist investor Elliott Management, after Elliott managed to get two people onto EMC's board of directors. Elliott, which began acquiring EMC shares in 2014, had loudly demanded the company spin off business units, including VMware, in order to put more money in shareholders' pockets. The truce was set to expire at the end of September, but was extended through October in order for EMC to formulate a formal response to the activist's campaign. The company's proposed acquisition by Dell was announced Oct. 11.

3. Virtustream Buy

In July, EMC signaled that it was ready to enter the cloud services market – and disrupt itself – with its $1.2 billion acquisition of Virtustream. The move positioned EMC to compete with Amazon Web Services, but it also threatened to compete with other EMC properties, namely VMware's vCloud Air. EMC argued that Virtustream distinguished itself as a high-end cloud provider in contrast to the more pedestrian vCloud Air. EMC partners told CRN at the time that Virtustream would allow them to do cloud migrations in a fast and simple way.

2. Exit of VMware from Virtustream Business

In a move to maximize value for shareholders, EMC and VMware intended to make Virtustream a 50/50 joint venture that would operate alongside vCloud Air and take on AWS. The joint venture was supposed to close in January, but in December, VMware quietly pulled out of the deal. VMware had warned in regulatory filings that several factors could kill the Virtustream deal, and partners told CRN that uncertainty around the Dell-EMC merger and how the companies would be integrated caused concern. Partners argued that VMware's exit from the deal would cause confusion in the market, and could possibly signal VMware's exit from the EMC "federation" of companies.

1. Dell-EMC Merger

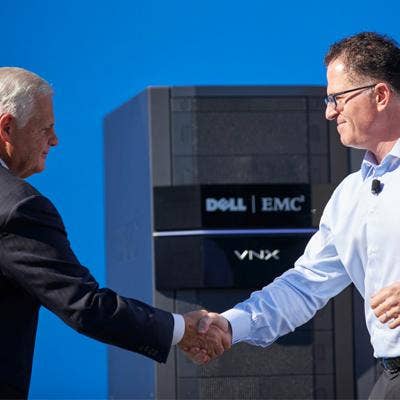

Rumors were already swirling that EMC and Hewlett-Packard were working on a merger when in October Dell announced that it had reached an agreement to acquire the Hopkinton, Mass.-based data storage giant in a deal worth $67 billion. The acquisition would create the largest, privately held technology firm in the world, and free EMC of the pressure to break up its so-called "federation" of companies for the sake of activist investors.

Top executives from both companies argued that the two businesses were overwhelmingly complementary, with very little overlap and the power to pull Dell into the high end of the market. Still, EMC's share price continued to decline after the deal was announced, and investors have become anxious, making demands that EMC take action to protect shareholder value and even filing lawsuits claiming breach of fiduciary duty.

Dell and EMC expect to complete the merger between May and October of 2016.