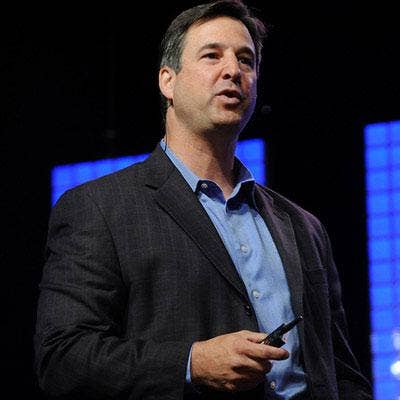

Marius Haas On Why There's 'Zero Debate' About The Value Of Dell EMC's End-To-End Portfolio

The Dell EMC Value Creation

Dell EMC President and Chief Commercial Officer Marius Haas speaks with CRN about the strategic dialogues that are taking place today with partners and how there is 'zero debate' on which company is giving them the opportunity for long-term value creation around a broad end-to-end portfolio.

Get more of CRN's coverage of Dell EMC World 2017.

What are you seeing in the competitive landscape that makes you confident?

You don't need to look very far. Look at the quarter HPE had last quarter compared to ours. Most, if not all, of their businesses were in decline mode and we were on the other side.

We've got good, strong growth in all our business areas. Look at the growth in all-flash arrays, it's almost a $1 billion run rate. We took the No. 1 position worldwide in units shipped in servers. The indication shows that we're only going to expand on that this coming quarter. We see our converged infrastructure business growing at a $400 million run rate right now. We have 16 quarters in a row of share gains in PCs. Our XC Series in storage grew triple digits. I can go on and on and on. We got 62 product awards at CES, more than we had last year, and last year was a record year already. Add all that up and you've got to be feeling pretty darn good about what's happening.

What are you seeing from your most successful partners? What do they do right that you'd like to see replicated across the partner base?

They're being extremely proactive about engagement. They're putting forth aggressive plans that we're jointly developing. We get into a cadence where we jointly say, 'Did we do what we said we were going to do? Did we have all of the key milestones aligned?'

They're engaging down to the territory level with the reps so that everyone knows exactly their capabilities and what opportunities we ought to be looking for. They're doing the certifications around the incremental lines of business they want to carry. All of that. There's clearly a sense of urgency among the partner ecosystem. There are partners that will do inorganic moves in order to have a faster ramp to providing a broader range of business as part of their portfolio. They're looking at all options to partner stronger with Dell Technologies.

And you'll help them with those things, whether it's M&A, or deeper engagement with Dell Technologies, or finding opportunities?

Yeah. The strategic dialogue that happens with our partners is impressive. We get all kinds of requests from our partners to help them, from multiple different angles. That makes you a stronger strategic partner for them. It's not just a channel to funnel orders, it's a dialogue around what are the strategic levers? What are the operating levers? What are the financial levers that make them successful and make us successful together?

What are you showing partners in that position to convince them it's the right move?

You start with the overall program elements: predictability of engagement, the level of profitability they can have. You start with those two because historically those are areas where they might have felt more comfortable elsewhere. Then it's truly a strategic conversation around which partner is going to provide you with long-term value creation opportunities with a broad portfolio. There's zero debate on that. It's us. You get them through the strategic components on what are the customers going to ask for and where are you going to be positioned long term for success, and then we go through some of the operational hurdles they think they need to get through, and off we go.

What's your call to action for partners?

Engage and take advantage of opportunities. If I step back, I'm very proud of the team. The 'say/do' ratio is very high. We said we were going to create an industry-leading program that has three core pillars to it: simplicity, predictability and profitability. It was going to be designed with and for the partners, and the feedback has been positive to the point that the profitability — there are partners that can get between 1.5 and eight times as much return on earnings from what they had last year. Some of them are even telling us to make it less rich and provide more incentive to your sales makers to generate even more demand.

How useful is it to you as a privately held company to be able to take a long view on things like performance indicators and growth?

It makes a huge difference. You go away from a 90-day sprint to a long-term value creation approach. Invest now for the results you're trying to achieve long term, all with an eye on how you help the partner ecosystem and how you bring customers together. It's night and day in the way you think and it translates to a different approach, a much more fruitful one.

How do you communicate that to partners?

The partner community has got the long-term strategic lens on it, especially when you see some of the dynamics happening in the market with some of our competitors. They're not as well positioned, their trajectory is changing and the customer base is asking for a broader engagement with us. They're all looking at it more broadly. Here's the No. 1 technology company that I need to have in my portfolio with the best intellectual property portfolio of anyone out there. What can I do to create a long-term relationship with Dell Technologies that both of us can get extremely excited about? That's the conversation.

Do you have your eye on increased or a greater number of incentives to encourage that cross-selling motion?

We clearly have put forth a very, very attractive and profitable program right now. There are some partners telling us it's too rich. But we've always said

we've got big ears. Anything partners have that they recommend that will help with progressing the business forward together at an accelerated rate, we're all ears. We'll listen, and we'll make tweaks here and there in response to what the partner community feels will be the best solution out there. As of right now, feedback has been phenomenal. We're working through some of the field engagement areas. Partners are giving us feedback on better ways to manage deal registration, better ways to use field engagement models, all of that we're incorporating as we get the feedback.

What are the benefits of having internal Dell sales executives working as the demand generation engine for partners?

I think we've done a very good job in the mapping of our resources to the point where we want to make sure we've got the coverage ratios right. We want to make sure we've got the account bases right. We want to make sure we're extremely predictable with our partner ecosystem as far as the account base we want them to go after. Then, it's our collective job to figure out how we find those opportunities as effectively and efficiently as possible together, and where can we bring together the partners' expertise with our expertise. The more we're aligned to efficiently cover the broadest set of the market, the more successful it's going to be. That's been a big part of the heavy lift. When we designed the program, when we designed the go-to-market coverage models, [we made] sure we're as efficient and effective as possible. There's no doubt there are components of our portfolio that are in commoditization mode. The differentiation sits in our relationships, in our engagement capability and our velocity. If we do all of those well and efficiently with our partner ecosystem, we will continue to take a disproportionate share of the market, which is what we're doing today.

How big a boost do you think you can get from the combination of Dell Networking and VMware's NSX? That seems like an area that's ripe for growth.

I think that's spot on. Some of the internal estimates are that NSX might be significantly bigger than what's been done already with the ESX ecosystem, and

that's big. There's certainly a very strong interest in the open networking ecosystem, the value proposition we've started on the networking side, and in addition to that what VMware's doing with NSX. It's a very strong partnership and we see strong synergies.

How has the integration gone so far? What have you learned? What's surprised you?

We say as an executive team that the one surprise we've had is that we haven't had big surprises. Having been part of some pretty big integrations, this has gone way smoother with a lot of work and a lot of focus and a lot of great people. Did we stub our toes here and there? Yes. Would we have liked to get our partner plans out earlier? All of that you uncover when you go and do a deeper dive. Do we still have work to do? Yes. Were there major negative surprises? No. The motivation of the team is very high, extremely high. They understand that the opportunity is now. The portfolio has never been better. The partner program has never been better. Our ability to disrupt the market, the competitive landscape, is enormous. The receptivity of the customer base is better than ever. It all comes down to execution.

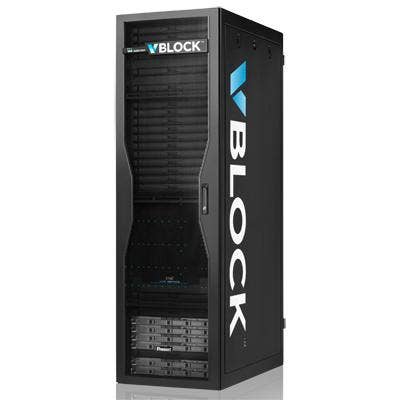

VBlock had a huge quarter, and that's a line that's not necessarily in the spotlight these days.

We've told our customers we're going to continue to support it. It's an important part of the architecture, and the last thing we're going to do is leave a customer behind. We made a commitment that's very similar in midrange storage. We made a commitment to continue to drive Compellent, and we're going to do that. There should be no concerns from a customer perspective as to the portfolio, and you're seeing that reflected in the results.