5 Things To Watch For In Dell Technologies Q1 Financial Results

Demanding Markets

Demand for profitable data center gear, the bruising PC market, the response to memory and SSD shortages and progress on cost cutting efforts are likely to be topics of discussion for Dell Technologies executives when the company reports first quarter financial results Thursday.

Thursday's report marks the second full quarter since Dell's $58 billion acquisition of EMC last September, and the company is carrying a lot of confidence following the annual Dell EMC World conference last month.

Still, Dell Technologies, the largest privately held IT firm in the world, isn't immune to challenges in key markets, particularly the continued contraction and consolidation of the global PC market, which is dominated by Dell and its two main PC rivals, HP Inc. and Lenovo. In the data center, Dell EMC has to contend with softening demand for high-end gear and an all-out assault by competitors like HPE and Cisco.

Here are five things to look out for in Dell Technologies Q1 financials.

Rising Prices Prompted By SSD, Memory Shortages

Dell EMC execs are keeping a very close eye on the ongoing memory and SSD shortages. In March, CFO Tom Sweet and enterprise infrastructure chief David Goulden discussed strategy around the shortages. The executives said it was unlikely that Dell Technologies would be able to avoid making price increases altogether, but said making list price adjustments and setting limits on discounts could soften the blow. Goulden said the increased performance of all-flash technology makes that market resilient in the face of price increases.

Progress On $416M Cost-Cutting Effort

Look for an update on Dell Technologies' $416 million job cutting effort. The program is designed to eliminate overlapping positions created by the combination of Dell and EMC, and it also completes the $150 million in personnel reductions begun by EMC in 2015. Dell Technologies has said overlap between the two companies is minimal, but bringing together 140,000 employees is bound to result in some duplicate positions.

The Incredible Shrinking PC Market

Dell's PC business booked an 11 percent year-over-year sales increase in the last quarter, but Sweet acknowledged that as the market continues to consolidate, it becomes more important for the company to take share from competitors. In the U.S. market, though, Dell ceded share to HP Inc., the only vendor to make share gains in the first period of 2017. Dell expects the PC market to continue its 2 percent-per-quarter declines, and Sweet said he expects Dell to get a bump from increased adoption of Microsoft's Windows 10 operating system.

Market Highs And Lows

Dell EMC has seen strong demand for data center gear, but Goulden last quarter said the company was experiencing softness in the high end of the market, growth in the midmarket and strong growth in all-flash technology. The company has also been seeing strong growth in hyper-converged infrastructure, including triple-digit growth in demand for the popular VxRack and VxRail appliances.

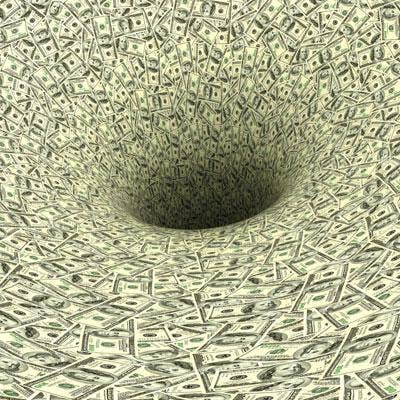

The Debt Game

Dell Technologies has been aggressive about paying down the $45.9 billion in debt it took on in order to complete the $58 billion acquisition of EMC last September. So far, the company has paid down some $7 billion of that total. Taking on debt and paying it down relatively quickly has been part of Chairman and CEO Michael Dell's strategy since the took the company he founded private in 2013 with $25 billion in debt that has today been all but erased.