The Top 5 Best-Selling Server Brands Of Q2 2017

Market Mayhem

HPE held a firm grip on the top spot in a U.S. server market that declined 9 percent in the second quarter, but archrival Dell EMC was the only vendor to show shipment and share increases during the period, according to data from The NPD Group, a Port Washington, N.Y.-based market research firm.

NPD's numbers are based on U.S. server sales completed through the channel in the second quarter, and the picture they paint is of a rapidly contracting market. In total, the top vendors shipped 104,983 servers through the channel in the U.S. during the quarter; that's down 9 percent from the 115,889 shipped in the same period a year prior, NPD said.

The competition is intense, and a vendor that makes gains is doing so at the expense of its rivals. The only two major vendors to make any considerable gains during the quarter were HPE and Dell EMC, and they did it as competitors Lenovo, Cisco and Supermicro declined.

Click through to see how the top five vendors in the U.S. server market stacked up in Q2.

The NPD Group tracks monthly technology sales-out information from the largest IT distributors and commercial resellers (including CDW, Insight, PCM, Zones and others) in North America, down to the item level and with overlap removed.

5. Supermicro

San Jose-based server firm Supermicro shipped 2,418 units through the channel in the U.S during the second quarter, a 34 percent decline from the same period a year prior, when it shipped 3,683 units. The company's unit share dipped as a result, declining to 2.3 percent from 3 percent a year ago, according to NPD.

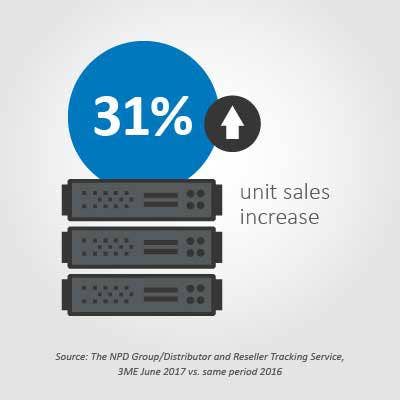

4. Dell EMC

Dell EMC shipped 8,151 servers through the channel in the U.S. during the second quarter, according to NPD. While that total was bested some major competitors, the Round Rock, Texas, IT behemoth was the only major vendor to register an increase in the number of units shipped, and it wasn't a small increase. Dell EMC beat its total from the second quarter of 2016 by 31 percent, and it finished the quarter with a 7.8 percent unit share, an increase of 2.4 percent over the same period a year earlier.

3. Cisco Systems

Cisco shipped 9,801 servers through the channel in the U.S. during the second quarter, according to NPD. That's down 15 percent from the 11,484 units it shipped in the same period a year earlier. The decline in units sold also impacted Cisco's unit share, which dipped to 9.3 percent from 10 percent a year earlier.

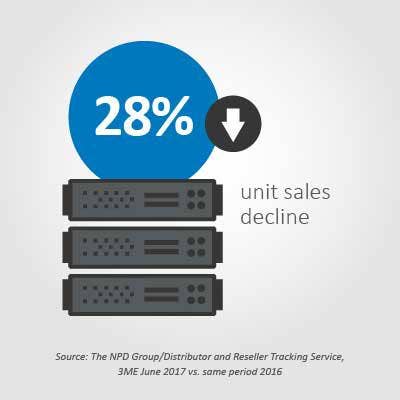

2. Lenovo

Beijing, China-based Lenovo is a PC powerhouse but has struggled to realize a consistent data center strategy since it acquired IBM's x86 server business nearly three years ago. In the second quarter, the company sold 11,592 servers through the channel in the U.S., according to NPD. That total represents a 28 percent decline from the 16,019 units sold in the same period a year prior. As a result, Lenovo's unit share dipped to 11 percent from 14 percent a year earlier.

1. HPE

HPE sold 71,710 servers through the channel in the U.S. during the second quarter, according to NPD. That gave the Palo Alto, Calif., company control of 68.3 percent of that market during the quarter, but it also represented a 7 percent decline from the 77,272 units it shipped in the same period a year earlier. But while the number of servers HPE sold may have dropped, it gained 1.6 percent unit share, indicating that while the number of servers it sold dropped, it was nevertheless able to capitalize on the steeper declines experienced by competitors like Lenovo and Cisco.