Behind The Numbers: Why Rapid Enterprise Storage Growth Seems To Be Over

It's looking like the storage business growth is petering out, with sales from most vendors flat of falling with a couple exceptions, an observation that holds true whether you consider the IDC numbers or the vendors' own quarterly financial reports.

A Few Bright Spots In What Could Be A Long Night

The heady days of enterprise storage growth are over. While the flash storage array part of the market is still seeing double-digit revenue growth, total storage sales growth seems to have plateaued, and the total industry is at risk of shrinking.

IDC last week published its latest Worldwide Quarterly Enterprise Storage Systems Tracker, and reported that the total first quarter 2019 worldwide enterprise storage systems market revenue fell 0.6 percent compared to last year to reach $13.4 billion. This was despite a 14.1-percent growth capacity shipped over last year to 114.2 exabytes.

However, the worldwide external enterprise storage systems market, which does not count capacity shipped inside enterprise servers, actually showed a 5.0-percent year-over-year growth during the quarter to $6.9 billion.

The storage industry is complicated, and so there is no single number that looks at how the industry, and the individual vendors, are faring. So turn the page, and come along with CRN to look at the storage numbers from a few different angles.

Flash Storage Sales The Bright Spot, But…

While IDC estimates of overall enterprise storage revenue relies in large part on how it counts the vendors' sales, there are some numbers not directly reflected in its reporting on those sales.

The fastest-growing part of the storage industry remains flash storage. IDC estimated that all-flash storage array sales grew 17.5-percent year-over-year to reach $2.47 billion, which suggests all-flash storage accounts for about 18.5 percent of total enterprise storage sales.

Sales of hybrid flash storage, which combines flash and spinning disk in an array, reached $2.81 billion, up 8.6 percent over last year, to account for about 21.0 percent of total enterprise storage sales.

However, these numbers show signs of a slowdown in sales. IDC estimated that fourth quarter 2018 all-flash sales rose 37.6 percent year-over-year, compared to a 54.7-percent growth in the first quarter of 2018. Hybrid flash array sales in the fourth quarter rose 13.4 percent year-over-year, compared to a 23.8-percent growth in the first quarter of 2018.

Next, let's break the overall enterprise storage sales down in three different ways.

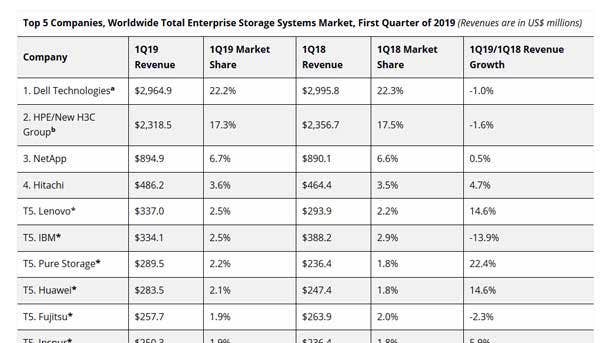

Worldwide Total Enterprise Storage Systems Sales Leaders

This takes into account not only the external storage sales, but also the amount of storage sold internally as part of a server.

Here, the server vendors are high on the list of revenue generators, given the capacity that is sold in their servers. That Dell Technologies leads in total enterprise storage systems sales is no surprise, given its strong legacy EMC storage business combined with the largest market share of the server market, according to IDC. The same goes for HPE, which IDC said is the second largest server vendor. Hitachi and IBM are also listed in the top five worldwide external enterprise storage systems market.

Note that there are four companies on this list--Lenovo, Huawei, Fujitsu, and Inspur--who are not on the list of top five external storage sales leaders.

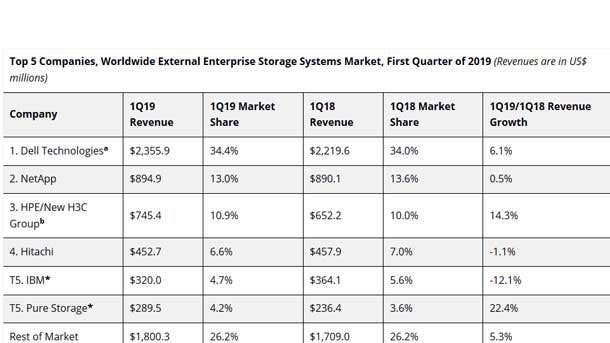

Worldwide External Enterprise Storage Systems Sales Leaders

As with the previous page, there are more than five companies in the "top five." This is because IDC calls it a tie if two or more vendors have a difference of 1 percent or less in revenue for the quarter.

While Dell Technologies remains the top vendor in external storage, NetApp jumps to number two, ahead of HPE. Rounding out the top five are Hitachi Vantara, IBM, and Pure Storage, with the latter technically tied according to IDC's definition. Four of the six "top five" vendors saw growth during the quarter, although NetApp's growth of just 0.5 percent barely counted. Hitachi Vantara and IBM sales fell year-over-year.

Storage Sales According To The Vendors

IDC estimates its storage revenue numbers based on discussions with vendors, and is focused primarily on the enterprise hardware.

When the publicly-listed vendors report sales, however, they measure storage differently. Storage sales from vendors' quarterly financial reports are given as a single number which includes hardware, software, and related sales, and in some cases include component sales.

CRN last week looked at total storage sales as reported by top vendors during their most recent fiscal quarters, which correspond roughly with the first calendar quarter:

-- Dell EMC 1Q'20: $4.0 billion, down 1% YoY

-- Western Digital 3Q'19: $3.7 billion, down 26% YoY

-- Seagate Technology 3Q'19: $2.31 billion, down 18% YoY

-- NetApp 4Q'19: $1.59 billion, down 3% YoY

-- Hewlett Packard Enterprise 2Q'19: $942 million, up 3% YoY

-- IBM 1Q'19: $336.7 million (estimated), down 13% YoY

-- Pure Storage 1Q'20: $326.7 million, up 28% YoY

-- Marvell Technology Group Q1'20: $287.7 million, down 12% YoY

-- Commvault 4Q'19: $181.4 million, down 2% YoY

-- Carbonite 1Q'19: $82.1 million, up 27% YoY

Now turn the page to look at how the individual companies fared.

Dell Technologies

No matter how you measure it, Dell Technologies, which combines Dell and EMC, is the top storage vendor.

Dell Technologies on May 30 reported its first fiscal quarter 2020 storage sales of $4.0 billion, which was down about 1 percent over last year. That includes not only its total and its external enterprise storage sales, but also a large presence in the storage software, data protection, and data management markets.

When it comes to total enterprise storage systems hardware sales, IDC said Dell Technologies in the first calendar quarter saw a 1.0 percent revenue drop over last year to $2.97 billion, giving it a 22.2-pecent share of the market.

For enterprise externals storage, Dell Technologies' first calendar quarter sales of $2.36 billion gave it a 34.4-percent market share. That revenue number was up 6.1 percent over last year's sales.

HPE

Hewlett Packard Enterprise on May 23 reported second fiscal quarter 2019 storage revenue of $942 million, which was up 3 percent over its second fiscal quarter 2018 revenue. Like Dell Technologies, the HPE numbers includes software, data protection products, and non-enterprise hardware.

HPE was the second largest total enterprise storage systems seller, with sales of $2.32 billion, down 1.6 percent, according to IDC. However, take away the server part of the business, and HPE was number three with sales of $745.4 million, up 14.3 percent, IDC reported.

Note that IDC reports a combined revenue for HPE and the New H3C Group. New H3C Group is the exclusive provider of HPE servers, storage, and related technical services in China.

NetApp

NetApp has been the recovery king in the storage industry, with strong growth in the last few years taking the company to nearly the top of the business. However, despite a 25-percent increase in all-flash storage revenue during its fourth fiscal quarter of 2018 compared to a year ago, a combination of inconsistent go-to-market execution, poor execution on renewals, and a fall in its OEM business led to a 3-percent drop in total sales to $1.59 billion, the company reported on May 22.

IDC estimated NetApp's enterprise storage system revenue to be $894.9 million, giving the vendor the No. 2 spot in the worldwide external enterprise storage systems market and the number-three spot in the worldwide total enterprise storage systems market.

Hitachi Vantara

Hitachi Vantara, which is the new name for the part of Hitachi that includes its IT equipment, big data and analytics, and IoT businesses, doesn't publicly break out its storage numbers.

However, IDC estimated the company's first calendar worldwide total enterprise storage systems revenues rose 4.7 percent over last year to $486.2 million, while its worldwide external enterprise storage systems sales fell 1.1 percent to $452.7 million. In both cases, that was good enough for the number-four spot in both lists.

IBM

IBM on April 16 reported that its first fiscal quarter 2019 storage revenue fell 13 percent over last year. However, it did not break out actual storage revenue in its quarterly financial report. CRN estimated that IBM's revenue for the quarter was $336.7 million.

IDC estimated IBM's total enterprise storage systems revenue to be $334.1 million, down 13.9 percent, and external storage system sales to be $320.0 million, down 12.1 percent. In both cases, that was good enough for fifth place.

Pure Storage

Pure Storage, which like NetApp is focused solely on the storage market, on May 22 reported first fiscal quarter 2020 revenue of $326.7 million, up a strong 28 percent year-over-year. That made Pure Storage the fastest growing storage vendor, and it did so on the back of its all-flash storage-focused business.

IDC estimated Pure Storage's enterprise storage hardware sales in the first calendar quarter to be $289.5 million, or up 22.4 percent over last year. That gave Pure Storage a tie with IBM for the number-five spot in external enterprise storage system sales, and a tie with Lenovo, IBM, Huawei, Fujitsu, and Inspur for number five in total enterprise storage system sales.

Lenovo

Lenovo appeared in the top-five list of total enterprise storage systems sales for the first time with a 14.6-percent growth over last year to reach $337.0 million in the first quarter of 2019. The company's storage growth is based in part on a growing but still fairly small storage business combined with its strong $1-billion-plus server sales.

Lenovo has traditionally relied on OEM partners for the bulk of its storage business, but has recently done more development of its own storage technology.

The Others

IDC, in its first quarter 2019 enterprise storage numbers, also includes data from companies less-well-known in the West, as well as sales by storage developers to cloud hyperscalers.

In the total enterprise storage systems market, three Asian companies--Huawei and Inspur from China, and Japan-based Fujitsu, accounted for $791.5 million in sales, or about 5.9 percent of the total market. On top of that, ODM direct sales to hyperscalers reached $2.95 billion, down 5.3 percent over last year. IDC also called out the "Rest of Market" which sales of $2.00 billion, up about 1.8 percent.

In the external enterprise storage systems market, the "Rest of Market" sales amounted to $1.80 billion, up about 5.3 percent over last year.