CRN Exclusive: NetApp CEO George Kurian On Keystone, Clouds And Competition

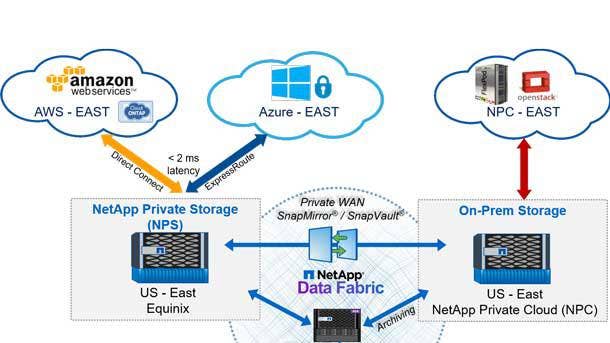

NetApp's Data Fabric has moved from vision to reality, particularly with the new Keystone consumption pricing, and no other vendor can manage data across on-premises data centers to public clouds as tightly as NetApp does, Kurian tells CRN in an interview at the NetApp Insight 2019 conference.

NetApp Moves Beyond Storage To Embrace Cloud Everywhere With Keystone

NetApp Tuesday introduced its NetApp Keystone cloud consumption model that it said for the first time lets businesses bring the flexibility and the pricing characteristics of the cloud to manage data seamlessly whether it is stored in on-premises data centers, public or private clouds, or multi-cloud environments. The goal of NetApp Keystone is to enable customers to purchase their on-premises and cloud-based data management capabilities either outright or on a consumption basis without worrying about future requirements as data can be migrated as needed.

NetApp CEO George Kurian sat down with CRN during the company's NetApp Insight 2019 conference to discuss how Keystone works with the company's Data Fabric technology as part of a seamless data management capability.

Kurian, who dislikes discussing competitors by name, said there are no other vendors even close to offering the types of cloud-based data management capabilities that NetApp does, but instead more often than not talk about the cloud and add just a thin veneer of consumption to their legacy storage systems.

Kurian also discussed NetApp's HCI hyper-converged infrastructure, recent executive changes, the company’s lower-than-expected revenue report, and its acquisition strategy in a wide-ranging conversation with CRN.

What's your key message for Insight this year?

We have three key messages. First is, our read on the market, of where customers were headed and what ingredients were required for customer success in a digital era, is playing out exactly as we predicted. Hybrid multi-cloud is the architecture that customers are building today. And the Data Fabric is essentially the underpinning of that.

Second, NetApp is available on all the big public clouds to help you build hybrid architectures between your data center and the public cloud.

Third, with NetApp Keystone, we are bringing the cloud-like customer experience and business model and consumption offerings to your data center.

You use the term 'data fabric' a lot, sometimes as 'Data Fabric' as in the NetApp technology with a capital 'd' and 'f,' and sometimes as a general industry term with a small 'd' and 'f.' Given that NetApp invented the term, how you differentiate between the two?

We think that, frankly, it's both. Our customers will need to build an architecture to integrate and orchestrate data in a hybrid cloud world. And we think the industry definition of that is data fabric.

With a small 'd' and small 'f.'

Yes. And we think that that will be a go-forward part of every customers' IT architecture, just like there was client/server computing. And so that's an industry-standard term. I think we feel fortunate that we were the people that coined that phrase and gave it to the market a few years ago, and we see that coming to realization. To help our customers build their data fabric, we have built a portfolio of capabilities that we call NetApp Data Fabric vision or Data Fabric strategy.

You don't really call it a 'vision' anymore, right?

It was a vision five years ago, and now it's much more of a real architecture and solution portfolio.

If you look at all the companies out there, who would you say are NetApp's top competitors?

I don't think we see our traditional competitors as our go-forward competitors. I think that they, frankly, have stayed on-premises, tied their innovation to hardware with maybe a thin veneer of consumption on top of it. And they really don't have any idea of where the cloud is headed. I think the people that are innovating are primarily innovating in the computing layer to build multi-cloud. And so it's co-existence with them. If you look at VMware, they really are trying to build a hybrid multi-cloud architecture. You look at the major cloud providers, they're mostly trying to build hybrid multi-cloud architectures. And our opportunities are to work alongside with them to really solve the data part extraordinarily well.

At its recent Pure Accelerate 2019 conference, Pure Storage introduced what sounds like NetApp's Data Fabric, the idea of being able to start migrating data seamlessly between on-premises and different clouds. How do you see that as different from what NetApp is doing?

Welcome to the party. You're five years late.

OK, but they're here, they've joined the party.

Listen, I think anybody that denies that hybrid multi-cloud is the architecture for customers is, frankly, not part of the go-forward architecture for most customers. And so I think it will be an inevitable reality that others will have to find a way to say that they are playing a hybrid multi-cloud game. It's technically extraordinarily complex to do what we're doing. We have been working on it for five to seven years. And so I think that others have got their work cut out for them. Good luck to them.

So who would you see as you go-forward competitors then?

We're focused on our customers. We articulated the idea of Data Fabric when no one else thought it was real. Clearly, we are breaking new ground. We're breaking new ground on the technology side, and we're breaking new ground on the business model side. And I keep telling our teams it's much more important to focus on customers rather than on competitors. So that's what we're doing. I think we see that containers and microservices, the cloud-native movement which is happening at scale, is enormously beneficial to customers. Because now you get to marry flexibility and portability on the application layer with a Data Fabric architecture. So we think that's an awesome innovation. And, you know, if you marry microservices and containers with the Data Fabric, that's the cloud architecture to win, and we're doing that.

So how far along are you are that?

We are well down the road, and you'll see much more exciting innovations to come there.

Any hints on what's coming next?

I think just stay tuned. We posited the idea of building a data fabric as a requirement for customers. We announced our software on the first public cloud five years ago at Insight. And we've accomplished an enormous amount of technology innovation in the last five years alongside the biggest cloud providers in the world, some of the leading software companies in the world. We've coupled that with business model innovation.

How does NetApp Keystone fit in with that?

What's unique about Keystone is, unlike other players in the market who were saying they can help you get a new business model in your data center, we're doing two things that are different. The first is we're saying that that business model is not only for your data center, but gives you all the flexibility of hybrid multi-cloud. And why is that helpful? It's because the natural state of most IT landscapes today are in a state of flux. So you go to a customer that says, 'Hey, I want to build a private cloud with you. And by the way, I may not be operating that private cloud in the future. I might want to move into a public cloud.' We are the only one in the market [that lets them] do that. The second is that the technology underpinnings below Keystone are hyperscale-ready. We have brought to a data center the cloud automation and cloud experience that today runs data services in the world's biggest hyperscalars.

HPE this summer introduced Nimble Storage dHCI, a hyper-converged infrastructure offering it called disaggregated HCI because it made the compute and storage sides separately scalable. That sounds a like lot NetApp's HCI offering. Is this type of hyper-converged infrastructure a future trend?

That's always been our HCI architecture. Again, just like Data Fabric, we pioneered the concept that HCI is really about a converged management and control plane and disaggregated data planes. I think that we see the market headed our way as opposed to the legacy way. I think the next set of control planes in that architecture will be the cloud-native control planes. Kubernetes will be the control plane for the data center, not a virtual machine-based control plane. And that's the next set of innovations you'll see from us.

Do you expect other vendors to move this way as well now that NetApp and HPE have done it?

You'll have to ask them, to be honest. We think that this is where the market is headed. But individual vendors have their own point of view. I can't comment.

This year, we've seen several key people leaving NetApp, including former president and vice chairman Tom Mendoza and former executive vice president Joel Reich. Is NetApp going through any reorganization that is causing the departures?

It's a natural evolution of our leadership team and ongoing transformation of the company. I think Tom and Joel had been at NetApp for a long time, and it was a natural kind of transition and retirement path for both of them. And I wish them well. They've served us well. And you couldn't ask for a better group of guys to have been a part of NetApp. And I think that we're a place that can attract a lot of talent, not just because of the innovation that we're bringing to the market, but the quality of company we are, and the values we've stood for and demonstrated over the last 25 years. And so I think I'm excited about, you know, the ongoing transformation of our team and always look at change as an opportunity, and am going to operate that way.

Now, these happened at the same time that NetApp also consolidated its cloud infrastructure and its storage systems and software into a single business unit under Brad Anderson. Did the shift in NetApp's organization have any influence on personnel changes?

Not necessarily. I think that we look at opportunities through transitions to get our business better. And certainly there are things that we want to accelerate in our innovation portfolio that the new structure facilitates. And so I don't think they're causal. I think they may be correlated.

Regarding NetApp's acquisition strategy, there are rumors that NetApp might be looking to acquire one of the smaller data protection vendors. Anything to that rumor? Is that a direction that you would want to go, or would you rather stay away from that market?

I'm not going to comment on rumors. I think we always look at acquisitions as a way to expand the portfolio and strategic relevance of our company. And, you know, we think about a lot of different ideas. I'll just leave it there.

This past financial quarter saw a year-over-year drop in NetApp revenue. That was big news given that NetApp's growth in the past few years has been actually very good. How should people think about NetApp in terms of its future growth? I know you don't want to talk specific numbers. But why should people not be concerned about NetApp and its future?

We're well positioned along multiple dimensions for the data-centric era. We have the industry-leading portfolio of technologies for the data center. You saw our results with the Gartner Magic Quadrant. You saw leadership positions in all of the different technologies that customers need for data management in the data center. We are also uniquely positioned in the public cloud in a way that no one else is, and our margins and business models are extraordinarily strong. We generate more than a billion dollars of cash a year, operating margins are strong, gross margins are up. We really have to go back and focus on our top line and execute better, and we're doing that.

What have you done to execute better since the last fiscal quarter results?

We're paying attention to detail. We've made some changes to our leadership team. You should expect that we bring in new leaders that will accelerate the changes that we need to see. And so we're just, you know, follow through, follow through, follow through with the core of execution.