CRN Exclusive: Rubrik CEO Bipul Sinha On IPO, Getting Acquired, And John Chambers' Investment

Rubrik, John Chambers, And The Future

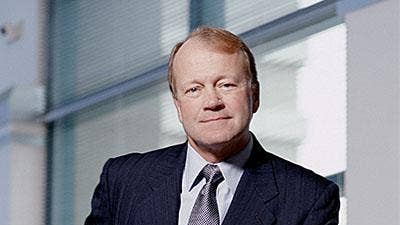

Data protection and data management technology developer Rubrik in August got an endorsement of its technology and its future path that many companies could only wish for: an investment from John Chambers.

Chambers, Cisco's Chairman Emeritus and former CEO, took an unspecified investment stake in Palo Alto, Calif.-based Rubrik and joined the company as a board adviser. He said in a blog post at the time that he had seen Rubrik co-founder and CEO Bipul Sinha build his company into one with a clear path to becoming a multibillion-dollar business and "one of the world’s next great enterprise technology companies."

For Sinha, the investment from Chambers was more than a source of funding to help carry the company toward an IPO. Sinha told CRN recently that Chambers, with his experience running large enterprise companies, would actually become a mentor to him, offering advice on how to grow Rubrik.

Sinha, in a wide-ranging conversation with CRN, also discussed Rubrik's plans for the future, and dispelled any notions that Rubrik might be looking at being acquired.

Here’s insight from Sinha into how hot data management company Rubrik is doing.

How important to Rubrik is that personal investment from John Chambers?

John, as you know, is a world-class business leader. He took Cisco from a $17 billion to a $47 billion business. And along the way, he created one of the most important IT enterprise IT companies ever. Rubrik is growing. We are now crossing 1,200 employees operating in 29 or 30 different countries around the world. And as we are scaling the business and finding newer routes to market, John's expertise and experience in helping build a large global business [makes it] really critical for me to learn from him and get his guidance as we go on this journey.

Rubrik has had some good funding rounds in the past. Is the funding from Chambers in itself that important?

The thing is, when you add a leader like John, you need to make sure that he's invested in your business. And getting investment from him makes him vested in the business.

How much did John Chambers invest in Rubrik?

That we are not disclosing.

What is the total investment in Rubrik so far?

$292 million.

Does that include Chambers' investment?

I think it does. I don't have the exact number.

In addition to investing in Rubrik, Chambers will be a board adviser. How involved will he be in terms of working with you and with Rubrik's plans to move forward?

He's going to be very involved. My whole idea of John is to get his mentorship, get his guidance as we scale the company. He will be very, very involved in operations, go-to-market, and overall scaling of the business.

Since leaving Cisco, has John Chambers invested in any other companies similar to the way he invested in Rubrik?

I don't believe so. In enterprise infrastructure IT, I believe we are the only company. He has invested in other [areas], but in the enterprise infrastructure space, we are the only company, as far as I know.

Congratulations. That sounds like a good endorsement of Rubrik.

Everybody understands he is a very successful and a very experienced leader, and having his endorsement and help and guidance in scaling the business is invaluable for us.

There's plenty of talk about Rubrik being an acquisition target. Is Rubrik talking with anyone about the possibility of being acquired?

No.

But it's kind of hard to dismiss the idea that some larger vendor might want to have the type of technology that Rubrik developed, which is unique in how it works with the cloud. …

Yes, we are focused on cloud. We have made a company that is built to scale. We are adding people around the world. We want to be a large, independent, public company for the next 30, 40 years.

Is Rubrik a profitable or at least a cash-flow-positive business yet?

We're investing heavily in the business. We want to build Rubrik into a very large business. We can become profitable if we want to, but right now we are investing. In just the past 18 months, we went from 250 employees to over 1,200 employees.

Does Rubrik have plans to do an IPO?

Our ultimate goal is to be a public company. But we'll decide to go public when we feel like we have cost, structure, the right timing for us, and the right timing for the market.

Does Rubrik have any strategic investors?

No. We have not taken any strategic money so far.

Does Rubrik have any reseller or OEM agreements with other vendors like, say, Cisco?

No. Not yet.

Is that something that you'd like to see? Or do you prefer Rubrik maintains its independent channel strategy?

We have an independent channel strategy. But we are working with all the major server manufacturers on meet-in-the-channel models.

When can we expect to hear more about that?

We are a software company. We sell it with the Supermicro [server] platform as our own branded device, and as software on Cisco UCS, HPE, Dell, Lenovo, and all of the platforms. We are taking an equal opportunity approach.

When you say you sell it on the Cisco and Dell and other platforms, is that via a meet-in-the-channel approach where partners sell the hardware and software and integrate it?

Yes.

As you look at the rest of 2018, what are some things Rubrik is looking at in terms of product and program developments?

We don't comment typically on our road map. But one thing I can tell you is that you'll see product innovation from us on our SaaS platform as well as new data management applications. We'll continue to innovate on our core data management and backup and recovery platform.

How has Rubrik's acquisition in February of Datos IO gone?

It has been working wonderfully. Datos IO was building a complete platform for a new generation of cloud-native applications stacks. We are selling that into large enterprises.

Does Rubrik have an acquisition strategy going forward?

Yes, in a multitude of areas.

Can you give us any hints?

No, I can't talk about that.