HPE CEO Antonio Neri: Why VMware Cloud On Dell EMC Is ‘Irrelevant’

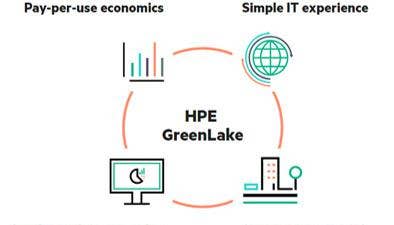

HPE CEO Antonio Neri says VMware Cloud on Dell EMC lacks the DevOps and pay-per-use public cloud-like capabilities of HPE GreenLake.

HPE GreenLake Is Paying Off For Partners

Hewlett Packard Enterprise CEO Antonio Neri said the company’s GreenLake pay-per-use model is paying off for partners and customers.

In fact, Neri said that the shift to higher margin offerings like GreenLake is driving an increase in partner profitability.

That transition to higher recurring revenues was one of the highlights of HPE’s fiscal third quarter results with the company reporting a robust 34 percent year over year increase in gross margin. “What that means for partners is they are making more money,” said Neri in an interview with CRN. “That is the bottom-line.”

Overall, HPE said GreenLake sales in the quarter grew at 10 percent year over year. Excluding one large deal from the year-ago quarter, GreenLake sales were up 42 percent in the quarter. HPE GreenLake sales through partners was up 112 percent in the quarter.

“We continue to see high double digits or triple digit (growth in channel sales of GreenLake) in some cases depending on the tier of the channel partner on the adoption of GreenLake,” said Neri.

HPE GreenLake is now one of HPE’s fastest growing businesses,said Neri. “Customers are choosing HPE GreenLake for choice, flexibility and speed to market,” he said.

HPE stepped up its pay-per-use sales offensive with the launch this week of VMware Cloud Foundation on GreenLake, running on HPE’s breakthrough Synergy composable infrastructure. Sales of HPE Synergy composable cloud infrastructure were up 28 percent year over year in the quarter.

Dell Technologies, for its part, attempted to steal the thunder from HPE GreenLake by announcing at VMworld that its Cloud Data Center-as-a-Service offering—running VMware Cloud on Dell EMC infrastructure —is publicly available in the U.S. The Dell offering is based on its VxRail hyper-converged enterprise-grade platform.

Neri has committed to transforming the entire HPE portfolio to an Everything-as-a-Service model by 2022. His rallying cry to partners: “Follow our lead and you will make more money in the areas ultimately customers are shifting to.”

What were the highlights of the quarter?

We executed with unbelievable discipline this quarter in a market that is obviously slower than we have seen before. That resulted in what I call strong profitability. We significantly expanded profitability and delivered a record level of free cash flow. What that means for partners is they are making more money. That is the bottom line.

Follow our lead and you will make more money in the areas ultimately customers are shifting to. One of the areas customers are shifting to is as a service. We continue to see high double digits or triple digit [growth] in some cases depending on the tier of the channel partner on the adoption of GreenLake.

Everytime I meet with a channel partner they want to know more about GreenLake, they want to get more training and have access to our [sales] tools.

Some of our competitors are jumping on this including our venerable competitor [Dell Technologies] trying to imitate what we do. Imitation is a form of flattery. The reality is we have been way ahead in that market for years. It is difficult to catch up.

Partners see the advantage and the momentum [with HPE GreenLake] and they want to be part of it. The more partners get on board, the more money they are going to make. Obviously the profit [from GreenLake] is shared with our partners.

How does HPE GreenLake stack up against Dell Technologies’ new VMware Cloud on Dell EMC Data Center-as-a-Service offering, which just became available in the US.?

I don’t think you can stack it up against GreenLake. First off, the name of the offer is completely irrelevant. They are offering the old [data center model]. The data center doesn’t mean anything anymore. We are talking about cloud, DevOps and an experience. To me even the name of the offer means nothing more than a leasing offer that you can consume on a memory [basis], which is not how customers buy [in a pay-per-use model]. What we see customers consuming is by [virtual machine] and by container—which is basically a combination of compute, storage, networking and memory, not just how much memory you consume—and that is what I am going to charge you. That is not what customers are looking for. That is not the same as the public cloud. That [Dell Data Center-as-a-Service] offer has no comparison to the public cloud.

The benchmark—like it or not—is the public cloud experience. It is the simplicity of the experience and the ability to consume the resources to run a workload. We offer through HPE GreenLake the public cloud experience and economics on-prem with even more flexibility than the public cloud. With HPE Synergy and now with VMware Cloud Foundation, we are able to compose and decompose at the speed of the application versus just spinning a VM and letting the VM sit there. Unless you shut that VM off in the public cloud they keep charging you. There is no way to compare one to the other (HPE GreenLake versus Dell Data Center as a Service).

What does HPE cloud composability mean to the GreenLake experience versus Dell?

Dell does not have a composable cloud story. It has VMware, but that is not Dell. It is just an ownership position. Second is the fact that the composability has to happen both at the software level and at the infrastructure level. We offer both with openness and choice.

That is why our announcement with VMware [to provide VMware Cloud Foundation on HPE GreenLake] is important. We give customers an ecosystem. They choose what is best for them. For me it is important that we give customers that choice.

The infrastructure really matters. That is why HPE Synergy is a clear point of differentiation. With Synergy you have the ability to compose every aspect of that infrastructure and make it available as a DevOps [platform] to enterprises so they can consume it as a service. That is why we treat everything in that infrastructure as a pool of resources that becomes fluid to the needs of the apps and data.

One thing Dell has said is they will give you Data Center-as-a-Service, but they will charge you based on how much memory you consume. That is not DevOps. That is the old way to consume infrastructure. That is why I feel so good about our differentiation.

The magic really happens first in the experience. Second that experience is enabled by software. That is why HPE OneView is a critical point of differentiation. Third is how you bring that infrastructure together. Now with assets like Plexxi and HPE OneView and InfoSight [AI-based predictive analytics] we provide a truly integrated experience, whether it is rack or blades. That is why I feel good about our differentiation.

HPE Synergy is more than a $1.5 billion business for us. Eighteen months ago it was zero. Now we have more than 2,000 customers on board.

Does Synergy and the HPE software-defined stack make VMware run better on HPE than on VxRail and Dell systems?

VxRail does not compete with Synergy. VxRail competes in the traditional hyperonverged space. At scale that infrastructure is not the right infrastructure. That is why Synergy works so great. When you are talking about 400 nodes and thousands and thousands of VMs at cloud scale, that is when you use Synergy. We have the entire portfolio with Synergy and [HPE] composable rack. Whether it is Synergy as a blade [infrastructure] or composable rack as a rack infrastructure it is the same experience at scale. When you go down to a remote office or small private cloud deployment, that is where you would use HPE SimpliVity. The single pane of glass with HPE OneView allows you to manage the same experience whether you are on hyper-converged or composable cloud. Obviously we provide choice to customers whether it is Vmware, Nutanix, [Microsoft] Azure Stack or Red Hat for that matter. We give customers the choice. The simplicity of the hybrid layers is where we really focus and then package all of it as a service so [customers] can accelerate those [business] outcomes.

What impact is your commitment to provide the entire HPE portfolio in an Everything-as-a-Service model by 2022 going to have on a partner’s ability to make more money?

The reality is we have no choice. Customers are demanding that. Whether it is us or the partners, we all have to get on board. The sooner the better. The world is hybrid, and more of that hybrid world is moving to as a service. We have no choice.

When you are in that contractual as-a-service framework, we see better margins and better services attach rate. Therefore you make money everywhere. You get a long-term customer because you are no longer trapped in the procurement process competing in reverse auctions. You are competing on value. You hold that customer for a longer period of time. It is an elastic contract so you can scale up and down as the customer needs to.

But the reality is we see more and more customers scaling up – not scaling down. The margins are better for both HPE and partners, and we have recurring revenue from the services, including the financing piece of it. Obviously HPE puts its balance sheet to work on the financing side for our partners. Not all partners have the balance sheet to participate [on their own]. So we bring a lot of value to our partners to grow with us and make more money.

What are the midmarket and SMB opportunities you see for HPE partners?

I think it is one of the largest opportunities we have as a company. Historically we have been under-penetrated there. The team has done a very good job of scaling up our inside-to-outside sales and complimenting that with our partner reach. For us, using inside sales to hunt [for new business] together with our partners is super, super critical. We are bringing the new skill sets there to compete and win. Obviously we continue our IT transformation with our ecommerce platform and we are leveraging the digital marketing capabilities that [HPE Chief Marketing Officer] Jim Jackson has been working on for the last couple of years. We are bringing the right demand generation for the right offers which ultimately shows up as pipeline for our partners.

To me when I think about growth and profit, SMB and the low end of the midmarket are critical to both us and our partners.