NetApp CFO Ron Pasek On Cloud, Keystone, Dell, And Slowing FlexPod Sales

NetApp has a bright future thanks to its unique hybrid multi-cloud and Data Fabric strategies, Ron Pasek tells CRN.

Eye On The Future

Everyone has the occasional bad day. For NetApp, it was a bad quarter, its first fiscal quarter of 2020 and the steep fall in its share price, to be exact, which dominated the conversation three months ago.

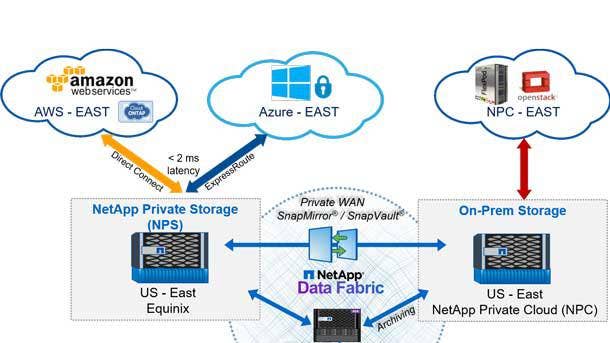

Since then, however, the company has seen strong fundamentals thanks to a growing hybrid multi-cloud business and the continuing acceptance of its Data Fabric strategy for tying storage seamlessly across on-premises and multiple cloud environments. Last month, the NetApp Insight conference saw the unveiling of its Keystone platform for managing data across on-premises and cloud environments the same regardless of whether customers prefer consumption-based pricing, managed services, or owning the hardware. Together, they set the stage for likely future growth.

Ron Pasek, NetApp executive vice president and chief financial officer, sat down for a conversation after last week's second fiscal quarter 2020 financial analyst conference call to talk about not only the quarter, but about many facets of the company. The conversation touched on many topics, including NetApp's channel strength, its growing HCI hyper-converged infrastructure business, the slowing of its FlexPod converged infrastructure business, and his take on recent Dell Technologies cloud-focused news. (Hint: He called it a "yawner.")

For a look at these and other topics related to the future of NetApp, turn the page.

What part of NetApp's business is going through indirect channels? And how is that changing?

The percent of total revenue that flows through partners is about the same. It's usually about 80 percent through partners, 20 percent direct. It might vacillate a point or two a quarter. Given that total revenue is down 10 percent, obviously channel revenue is down. But we're outlooking the full year to start showing improvement. We gave a specific guide for Q3 that has us down 6 percent, full-year guide down 8 percent, which implies Q4 is essentially flat. So we should start seeing exiting the year flat and probably start to grow next year.

So when NetApp's revenue goes up or down, the percentage that goes to channel partners remains fairly constant?

Yeah, it doesn't really change that much. Enterprise license agreements are always direct. So those generally show up as a higher mix of direct than indirect.

How about FlexPod sales? I know NetApp just recently introduced new models, but can you talk about FlexPod sales and how they are changing?

It's still a really good product. We partner with Cisco. They provide the compute and networking, we provide the storage. It's a meet-in-the-channel product which you can only buy through a partner. It's still very successful. think there is a little bit of a hiatus right with FlexPods. We don't we don't give a run rate number, but it's a substantial piece of our all-flash business.

What's behind the hiatus?

If you just look at that market, it hasn't been growing. And there was a point about a year-and-a-half ago where we were growing and the market wasn't. Now the market's not growing, and we're not either. It doesn't display It isn't displaced by HCI, but there some cases where customers look at HCI more often than not, even though those two products are not interchangeable.

Talk a little bit about how sales of NetApp's HCI are doing.

We don't break out HCI alone. We actually disclose our private cloud business, which is a combination of HCI, SolidFire, and StorageGRID. And that business grew about 30 percent year-on-year.

So that business segment including HCI, StorageGRID, and SolidFire, are sales of all three components growing?

We don't disclose it, but in aggregate they have been growing. You might see fits and starts thinning out what the compare is. But yeah, in general, all three would grow.

OK. But you can't give me any actual numbers.

We don't break out each segment. So no.

Last fiscal quarter, the big news from NetApp was its unexpected drop in revenue which led to a perception that NetApp might be having some issues. Given that, what is NetApp doing to overcome that perception?

What we described last quarter and we [said again this quarter] is, we have healthy gross margins. We've now have 11 consecutive quarters of an increase in year-over-year in product margins. We've been diligent in managing our expense structure. We've gotten the company well over 20-percent operating income profitability. We're returning cash to shareholders in the form of a dividend and buyback.

So what I'm telling you is, we don't have a business model issue. It's a top line issue. And what we described last quarter was the way we can deal with that is to hire more direct customer-facing demand creation people. So we talked last quarter about adding 200 incremental demand creation people into the sales force without increasing our overall spending envelope. And we're well on our way. I won't give you the number. We're not disclosing the number that we did in Q1, but we're at least on our way to doing that and fulfilling that commitment. What that says is, when we are in front of customers with the right product, we win and we create demand. And it's not an issue of people not wanting to buy our products. It's making sure we're in front of the right customers.

NetApp has a big focus on cloud-first and its Data Fabric. Do NetApp's customers understand the company's approach to the cloud and tying on-premise and the cloud together, or do channel partners still have to do a lot of evangelizing?

I will tell you, when we're in front of customers, and we describe our hybrid multi-cloud strategy, it resonates incredibly well. It solves a huge pain point our customers have, which is, 'How do I manage my data seamlessly on-prem and in multi-cloud environments?' It's not hard to explain that story. They get it instantly. I think the only thing I would say is, we need to make sure more people understand it. So getting those extra demand-increasing resources out there, getting more partner mindshare will help get that message out to a broader set of customers that are ideal for us to do business with.

When you look at NetApp's channel partner base, what percent of your partners are carrying that message through. and how many have yet to really pick up on that message and bring it to clients?

I don't know if I can give you a number. But I can tell you it resonates with partners as well. They're talking to the same customers. and they realize this is a definite solution to a pain point that customers have. So I think many partners are embracing the strategy. They figure out how to put services around some of what we're doing. And absolutely, they understand that that solves a problem that they have, too, in helping customers.

What was your biggest takeaway from the NetApp Insight conference a couple weeks ago?

I've been at Insight every year since I've been in the company. I think this year was notably different in the sense that, in the past, we've talked about Data Fabric. Even though we knew what it was, I think some of our customers were trying to figure out what that was. I think Data Fabric is a lot more real. There are a number of customer testaments about the fact that they have their own data fabric, and each customer has to figure out what their data fabric strategy is. I think the whole hybrid multi-cloud thing resonated more clearly with customers now than ever before. There were more customers and partners there this year than in any other year in terms of percent of total attendees. So I think our vision is becoming a lot more understood and accepted. And it's resonating, and I think you're going to see, as we start to get back to growth, it's going to be a huge differentiation against many of our competitors,

How far is NetApp along in terms of getting ready to deploy its NetApp Keystone initiative which was unveiled at Insight?

Many of those elements of Keystone, for instance, running NetApp applications, file system, or OS in the public clouds, have been around for a while. That's not new. We have done business with customers on-prem. Getting it to scale and managing it seamlessly for customer is a little bit new. But , many elements of that story have been around. The only thing that we did, really, was put a nice wrap around it and show customers that we're indifferent to how they want to do business with us.

Last question. Dell Technologies last week launched, I guess we could call it its long-awaited, cloud initiatives focusing on more than just cloud on Dell EMC hardware. How does NetApp see last week's Dell EMC announcement?

You know, if they had an announcement on this last week, I didn't even see it. So it didn't even hit my radar. So I gotta tell you, that means it's probably a yawner.

It's only their biggest announcement of the year, probably.

Yeah, I don't know. I think most of their cloud strategy is really around VMware. I think what most people have been waiting is to see what their midrange [storage array] refresh is going to look like.