NetApp Channel Chief Jim Elder: Big Changes, Opportunities Coming For Partners

Jim Elder tells CRN in a wide-ranging conversation about his priorities for NetApp in 2020, how the company is reorganizing its channels, and how it plans to compete against Dell EMC's new PowerStore storage line.

Navigating NetApp In A Sea Of Change

NetApp is a company in flux. It has over the past year caught industry observers by surprise with a drop in revenue even as it continued to pioneer the seamless integration between on-premises and cloud infrastructures with technologies that manage data the same wherever it resides.

Some of the biggest impacts of these changes fall on NetApp's indirect channel community, which is where the company gets about 80 percent of its total revenue. That makes Jim Elder a key part of NetApp's forward-looking plans. Elder, a nearly-three-year NetApp employee who in September became the company's channel chief, has been working with partners on NetApp's new sales reorganization, future changes to its channel program, and taking advantage of its latest cloud-focused technologies to better serve clients while improving their profits.

Elder recently spoke with CRN to discuss the changes and their impacts on the company and the channel. He also touched on how big changes in the company's executive team will impact partners, whether NetApp Insight will be a live or virtual conference, and even on how partners can counter Dell EMC's new PowerStore storage systems. For a look at what's happening at NetApp, turn the page.

What are your priorities for NetApp's channels in 2020?

My philosophy at a high level is, it's all about the partner sellers. Partner sellers sell a vendor for three reasons. One is You sell what you know and what you're comfortable with. Two, you sell with who you know and who you can trust. And third, you sell what you can obviously and maybe most importantly know you can make money selling.

From a NetApp perspective, we have a solid foundation in two of those boxes. We have great relationships with our channel partners and great local relationships with our selling teams. ... We're going to look to grow that community at a local level across both our commercial and enterprise sales teams. So we clearly check that box.

I think we clearly check the box of making money as well. We have a robust deal registration process, a robust rules of engagement process that really has weight behind it. And so our partners know and can trust that when they engage us in an opportunity, we're not going to go take that deal direct. We're going to protect the investments they make with us to help us win that business.

And the third area?

A continual challenge for NetApp as we expanded our portfolio, including some of the acquisitions and our push into the cloud, is a constant battle to keep channel sellers informed and up to speed on the product portfolio. My emphasis this year is really broadening the lens of opportunities so those partner sellers [see how] NetApp's new expanded portfolio fits with their end customers

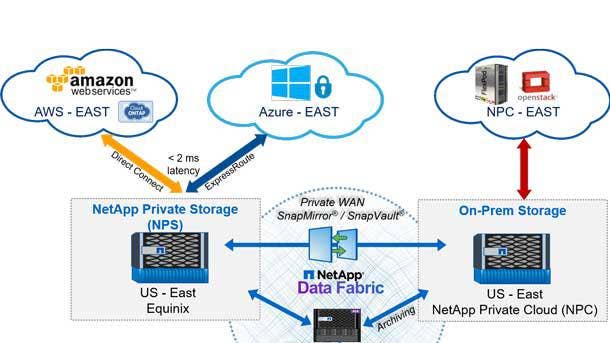

We're going to do that with various initiatives. We're going to drive with my partner managers with a lot of enablement work, a lot of demand generation work. My major focus is, how do we make our partners sellers more comfortable talking about the cloud and NetApp's incredible Data Fabric story [and] our cloud-connected flash story. How do we enable them to be very comfortable with those conversations.

NetApp is reorganizing its sales from a focus on enterprise vs. commercial to a regional focus. How will that work?

Just to be clear, we're still driving a segmented model. We have enterprise and commercial sales teams. We're changing the way those teams are led and aligned. Where last year we had a more delineated structure between enterprise and commercial at a national level, now that will be done at more of what we're calling areas. We're dividing the U.S. into north, south, and west areas. Each of those areas will be led by a sales vice president. David Sznewajs is the leader that's been named for the north area. David's been with NetApp for a number of years. On the west, that'll be Mike Bush. I believe he's a 20-year veteran of NetApp. And for the south, it's David Young. David, I believe, is the newest of the three. He's been with us I think for a little over a year.

Benny Cifelli will continue to be our general manager for Canada. And through this structure, I'm running the America's partner organization, including all of the Americas, North America, South America. But I also become the general manager for the Latin America businesses, running our sales teams for Latin America.

How will those new teams work?

They will handle the end customer-facing sales teams, and then the partner organizations will be reporting to me. But we have aligned very tightly with those three areas in my organization, so we'll have two major partner organizations under me. One will handle our national partners, our big national partners that have meaningful business with us in multiple areas, and I'll have a regional partner organization that will be exactly aligned with that north-south-west model. The leaders of each of those partner areas--again, north, south, and west--will report to me but dotted line and working very closely and being perfectly aligned with the area VPs. The channel reports into a centralized function under me, but it's totally aligned with the selling motion of our sales team.

NetApp for the last couple of years has been emphasizing Data Fabric and the need to connect on-premises storage closely to the cloud. Have all NetApp partners fully pivoted to the cloud?

There's still a huge opportunity on-prem. I won't say we've over-pivoted [to the cloud] as our value on-premises is even higher because of our easy connectivity story to the cloud. We've been talking a lot about the cloud. But this year there is a get-back-to-the-core focus of really leveraging our strength with our cloud-connected story to win on-prem business. We fully believe it's a hybrid multi-cloud world, [and] there's going to continue to be a huge on-prem piece to that....

We've been driving some very successful initiatives with partners built around cloud design workshops. NetApp has our own professional services offering where we go in and do full storage assessments for end customers and help them optimize their storage for what makes the most sense to be on-prem, what makes the most sense to be in the cloud. And we actually transfer that knowledge to partners to allow them to go in and provide these services. And some of our partners are way out ahead of us on that.

What are some things you would like to change in the partner program for 2020?

We've got to keep it simple, especially as our portfolio becomes more enhanced with different offerings. It's very easy to try to get very specific with partners and tie incentives around specific products. Working with Chris (Lamborn, head of NetApp's global partner go to market and programs), we've made a lot of progress this year as we roll out our programs that will be more broad brushed and very simple to drive the over-arching initiatives that we want to drive, which is expanding our cloud footprint and leveraging the strength of the Data Fabric story to drive into net new customers. At the high level, those are the two things that our incentive programs are going to drive.

What do you look for when recruiting new partners?

In this new world of cloud and A.I. we're seeing a lot of specialist partners come into the business. We're also seeing a lot of the consolidation as some of our existing large partners are acquiring some of those specialty partners for their expertise, especially around cloud. In the A.I. space, we've got a great partnership with Nvidia, and for us there our strategy is matchmaking some of our existing partners with some of Nvidia's specialty partners to combine forces. [There's] a small set of partners with very high levels of expertise in A.I. and with a lot of data scientists. In those cases, the solutions they're building for the end customers requires a lot of hardware and software expertise. A.I. is really useless if you don't have the data to feed into the A.I. engine, And those data scientists are not experts on the hardware side. So there's a great opportunity for us to pair those specialists with our existing partners to enable them to go to market with a full A.I. solution

NetApp has gone through a number of big executive changes in the last year, including bringing on Cesar Cernuda as its new president and the departure of several executives including Henri Richard (executive vice president of worldwide field and customer operations). Is there anything channel partners should be concerned about?

While there's always change that we're managing through, I feel like we're coming to the end of this season of change especially with the naming of the new incoming president. We're very excited to have him join. Underneath that, you've got highly tenured people here at NetApp that are engaging with partners including my boss Alex Wallner (senior vice president of worldwide enterprise and commercial field operations) who runs the worldwide enterprise and commercial business. He's a 20-year veteran of NetApp. I think the partners are going to continue to see a consistent face from NetApp.

One of NetApp's primary selling points is that nearly all NetApp's storage products run the same storage operating system, while competitor Dell EMC has traditionally had multiple incompatible products. What kinds of sales points is NetApp giving its channel partners to compete against the new Dell EMC PowerStore which is expected to replace multiple product lines?

It's great to see our competitors follow our lead and try to consolidate. This just speaks to our strength. And with that product line being first generation, we look to capitalize on that, and just reinforce the strength of our Ontap story with our partners. I think it's always flattering to have one of your big competitors adopt your strategy.

What's NetApp's current thinking in terms of its NetApp Insight conference, typically held in the Fall. Are you still hoping to do a live conference? Or are you starting to consider alternatives?

Our Insight EMEA event we just completed a couple weeks ago was a completely virtual event. It was an incredible event.

We're evaluating our options. NetApp has extended our work from home out through the end of October. So between now and then I wouldn't expect us to be also driving any big partner or end-customer in-person events. We're certainly looking at how we engage virtually. But for me personally, the channel's a people business. I can't wait to get the restrictions lifted and get back on planes to go be with my partners, and I look forward to when we are able to renew our in-person events.