The Coolest Big Data System And Platform Vendors Of The 2019 Big Data 100

Part 2 of CRN's 2019 Big Data 100 looks at the companies you need to know that provide big data systems and platforms.

Big Data Foundations

Businesses and organizations undertaking big data projects select applications, analytical tools and data management software from among hundreds of vendors. Ultimately, however, those projects will run on systems – from on-premises servers to cloud platforms – sourced from leading vendors, many of them the biggest names in the IT industry.

As part of the 2019 Big Data 100, we've put together a list of companies that provide on-premise and cloud systems and platforms that serve as the foundation for many big data initiatives.

This week CRN is posting the Big Data 100 list in a series of slide show for vendors of software for business analytics, data management and integration, data science and machine learning, and big data systems and platforms.

Amazon Web Services

Top Executive: CEO Andy Jassy

Amazon Web Services provides the cloud-based platform for a range of big data services, from data storage (Amazon S3) to an ever-expanding array of data management and business analytics software.

The AWS analytics lineup includes Redshift data warehousing, Athena SQL query for S3 data, and Kinesis for analyzing real-time video and streaming data.

Data management offerings include the Aurora managed relational database, DynamoDB NoSQL database, EMR hosted Hadoop framework, AWS Glue data preparation and loading, and AWS Lake Formation for building data lake systems.

Cloudera

Top Executive: CEO Tom Reilly

Big data platform vendor Cloudera became even bigger in January when it merged with rival Hortonworks and is now wrestling with the task of rationalizing the Cloudera and Hortonworks product lines.

Built around its Cloudera SDX (shared data experience) framework, Cloudera's product portfolio includes data engineering, data science, operational databases and analytical databases.

Specific products include the Enterprise Data Hub platform, DataFlow for real-time streaming data, and Data Science Workbench for data science tasks.

Dell EMC

Top Executive: CEO Michael Dell

Dell EMC provides servers, storage systems and other hardware systems for storing, managing and analyzing data, including its PowerEdge servers and VxRack and VxRail systems.

Dell bundles the hardware with core software to create big data bundles such as Ready Solutions for Big Data analytics, Ready Solutions for AI, Ready Architectures for Hadoop and Ready Architectures for Splunk.

The solutions include other Dell EMC products such as the Dell Boomi data integration platform and software from other vendors such as Cloudera Enterprise and Hewlett Packard Enterprise's BlueData Epic for deploying Data-as-a-Service systems.

Top Executive: CEO Sundar Pichai

Google provides a number of cloud data storage, management and analysis services with its BigQuery analytical data warehouse and Google Analytics analysis tools.

Google Data Studio is the company's cloud software for building dashboards and reports.

Hewlett Packard Enterprise

Top Executive: CEO Antonio Neri

Hewlett Packard Enterprise develops a wide range of data center infrastructure products for big data management and analysis applications, including high-performance computing servers for on-premises, cloud and hybrid systems. HPE Moonshot and HPE ConvergedSystem for Big Data are two such systems.

The company also offers a range of big data services including analytics and data management services, business intelligence modernization services and IT Consulting Services for Big Data.

Hitachi Vantara/Pentaho

Top Executive: CEO Brian Householder

Hitachi Vantara incorporates the Hitachi Data Systems storage system business with the company's Pentaho business analytics software (which Hitachi acquired in 2015) and Hitachi Insight Group – the latter focused on Internet of Things solutions.

Hitachi Ventara markets data and analytics solutions for data governance and regulatory compliance, cybersecurity analytics, customer 360-degree view, data monetization, data warehouse optimization, data quality optimization, enterprise data lakes and streamlined data refining.

IBM

Top Executive: CEO Ginni Rometty

IBM is a long-time player in the big data arena, from its Cognos business analytics and reporting tool to its advanced Watson AI systems. The company's solutions span a broad range of analytics, data management, data science and AI, and unified data governance and integration.

IBM's products include the Db2 database (including cloud, data warehouse and SQL engine editions), the Informix database, the Netezza data warehouse appliance, the SPSS statistical analysis software and Cognos. IBM InfoSphere Information Server combines data integration, data quality and data governance capabilities.

But Watson is increasingly the core of many of IBM's big data efforts. The Watson Discovery Service, for example, is a suite of APIs that help businesses ingest and analyze big data.

MapR Technologies

Top Executive: CEO John Schroeder

MapR offers the MapR Data Platform, based on MapReduce technology and a high-performance NoSQL database, for big data analytics and AI tasks. The system incorporates a number of analytical and open-source tools including Apache Hadoop, Hbase, Spark, Drill and Hive.

In November MapR debuted the Clarity Program, including a new product release and a free assessment service, in a bid to snag Hortonworks customers worried about the merger with Cloudera.

Micro Focus

Top Executive: CEO Stephen Murdoch

Micro Focus provides a range of enterprise applications and software systems, including DevOps, IT management and security. In big data the company offers software and solutions for information management and predictive analytics.

The company's portfolio includes the Vertica analytical database for real-time analytics, which was acquired from Hewlett Packard Enterprise in 2017. Other products include the Idol cognitive search and discovery tool, the ArcSight Data Platform and ArcSight User Behavior Analytics.

Microsoft

Top Executive: CEO Satya Nadella

Software giant Microsoft offers a broad range of software products that cut across all the categories in our big data roundup. The product portfolio includes the flagship SQL Server database and popular Power BI business analytics software.

Microsoft has been aggressively expanding its big data offerings for its Azure cloud platform, including Azure SQL Database, Azure Cosmos DB and Azure Stream Analytics, along with the HDInsight Hadoop and Spark service.

Oracle

Top Executive: CEOs Safra Catz and Mark Hurd

Oracle's big data offerings have long expanded beyond its flagship Oracle Database software to include products that span all big data technology categories.

Oracle's portfolio today includes the Big Data Discovery visual analysis tool, Oracle Data Mining and other business analytics software; multiple databases including MySQL, NoSQL and TimesTen; the Oracle Data Warehouse; data integration and transformation tools such as Oracle Data Integrator; and complete systems including the Oracle Big Data Appliance and the Oracle Exadata Database Machine.

As with most of its software portfolio Oracle has been aggressively moving its big data offerings to the cloud in recent years.

Pivotal Software

Top Executive: CEO Rob Mee

While Pivotal's main focus is helping customers build and deploy applications, the company operates a division that focuses on big data products including the Pivotal Greenplum massively parallel processing data platform for advanced analytics and Apache MASlib system for in-database analytics.

Salesforce.com

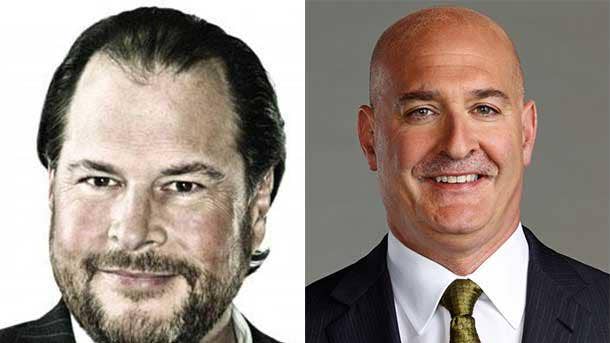

Top Executives: CEOs Marc Benioff and Keith Block

While Salesforce.com's focus is on cloud CRM and salesforce automation applications, the company develops Einstein Analytics (previously known as Wave Analytics), the company's AI-powered business analytics software that runs on the Salesforce cloud platform. The lineup includes Einstein Predictions with automated discovery and predictive insights capabilities.

SAP

Top Executive: CEO Bill McDermott

SAP offers a number of business analytics products that work closely with the company's operational applications, including the SAP Analytics Cloud, SAP Lumira data visualization software, the SAP BW/4HANA data warehouse system, SAP Crystal Reports reporting software and the SAP BusinessObjects Business Intelligence Suite analytics software.

SAP develops its software on its HANA in-memory database platform, the core of the company's data management technology. The company also markets the SAP Data Hub, a comprehensive package of data integration, processing and governance tools.

Snowflake Computing

Top Executive: CEO Bob Muglia

Cloud data warehouse service provider Snowflake Computing is one of the fastest growing companies in the big data arena in recent years, despite competing with Amazon Web Services, Google and Oracle, among others.

In October the company raised $450 million in growth funding, bringing its total funding to $923 million and its pre-money valuation to $3.5 billion. In February the company announced that it more than tripled its revenue and its customer base in its fiscal year ending Jan. 31.

Teradata

Top Executive: President and CEO Oliver Ratzesberger

A pioneer in the data warehouse arena, Teradata offers both cloud and on-premises data warehouse and data analytics systems including Teradata Vantage, a platform for "pervasive data intelligence," IntelliCloud analytics-as-a-service, and the IntelliSphere comprehensive analytics ecosystem management portfolio.

In April Teradata expanded the Vantage platform with a turnkey on-premises option and adding the AWS Marketplace as a channel for acquiring Teradata software on an as-a-service basis.

Yellowbrick Data

Top Executive: CEO Neil Carson

Yellowbrick Data has developed an all-flash, small-factor data warehouse appliance designed to compete with more complex, more expensive data warehouse systems. Yellowbrick is particularly targeting owners of aging Netezza data warehouse systems with a next-generation alternative.

The company emerged from stealth mode just last August and announced that it had received $44 million in Series A funding. In February Yellowbrick hired database luminary Brian Bulkowski as the company's chief technology officer.