2016 Data Center 100: 20 Virtualization Vendors

Data Center 100: Top 20 Virtualization Vendors

There was a time when server and desktop virtualization were the only game in town, but those days are long gone. Now, the industry's attentions have shifted to areas like data virtualization, which solves tough storage related challenges; and network virtualization, which pools routers and switch hardware and lets it be managed by software.

There's also hyper-convergence, the moniker for software that combines compute, storage and networking functions and lets it run on industry standard x86 server hardware.

Many organizations are using virtualization to cut costs and make their infrastructure more easily managed, and it's clear there's still plenty of innovation going on in this space.

Actifio

Ash Ashutosh, CEO

Headquarters: Waltham, Mass.

Actifio's copy data virtualization technology is billed as a way to cut down on data storage costs by getting rid of unnecessary files stored in production networks. The vendor said it also cuts software licensing costs by replacing backup, disaster recovery, business continuity and other types of storage software.

AppSense

Scott Arnold, CEO

Headquarters: Sunnyvale, Calif.

AppSense is widely seen as the leader in the virtualization of user profile data, which is key to personalizing virtual desktops. More recently, it has been pitching its Application Manager software as an endpoint security play, and its partners say that message is resonating with customers.

Bromium

Ian Pratt, CEO

Headquarters: Cupertino, Calif.

Bromium uses virtualization to isolate Windows functions into a piece of software it calls a ’microvisor.’ It lets malware execute, but blocks it from moving beyond and into other parts of the network, which mitigates the impact of breaches and users that mistakenly open malware-infected files.

Citrix Systems

Kirill Tatarinov, CEO

Headquarters: Fort Lauderdale, Fla.

Citrix leads the desktop virtualization space but is facing fierce challenge from rival VMware in the end-user computing space. The company also does server virtualization, and is in the process of a corporate restructuring around core areas of expertise, which includes spinning off assets like the GoTo line of SaaS apps.

CloudPhysics

Jeffrey Hausman, CEO

Headquarters: Mountain View, Calif.

Launched by former VMware storage engineers, CloudPhysics sells a Software-as-a-Service that uses predictive analytics to monitor virtual and cloud environments to ensure they're running at peak efficiency. VMware co-founders Diane Greene (now with Google) and Mendel Rosenblum were early investors.

Delphix

Jedidiah Yueh, CEO

Headquarters: Menlo Park, Calif.

Delphix sells software that allows a single copy of a database to be shared in multiple cloud-based instances using virtualization. The company solves the time-consuming challenge of setting up new databases, and has attracted several Fortune 500 firms as customers. Delphix also partners with Amazon Web Services, VMware, Dell, SAP and other vendors.

Ericom Software

Joshua Behar, CEO

Headquarters: Closter, N.J.

An early entrant to the virtualization market, Ericom specializes in server-based application access, virtualization and RDP acceleration solutions. It pitches its PowerTerm WebConnect desktop virtualization and application delivery software as a less expensive alternative to Citrix XenApp/XenDesktop.

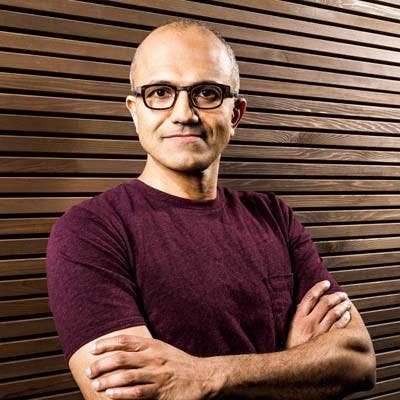

Microsoft

Satya Nadella, CEO

Headquarters: Redmond, Wash.

Microsoft focuses on server virtualization with Windows Server and Hyper-V, and has been slowly but steadily gaining ground on market leader VMware since entering the market in 2008. The company also does desktop virtualization.

Midokura

Dan Mihai Dumitriu, CEO

Headquarters: San Francisco

With a focus on network virtualization, Midokura sells software that decouples Infrastructure-as-a-Service from network hardware in cloud environments, paving the way for customers to use distributed application workloads. It recently formed a global reseller agreement with Dell that includes jointly developed go-to-market strategies.

Nutanix

Dheeraj Pandey, CEO

Headquarters: San Jose, Calif.

The leader of the small-but-growing hyper-converged infrastructure market, Nutanix's technology is often used with virtual desktop deployments. Last year, it unveiled its own KVM-based server hypervisor and management software and is now going head-to-head against VMware in the data center.

Parallels

Birger Steen, CEO

Headquarters: Renton, Wash.

Parallels sells desktop and application virtualization software for desktops and mobile devices, and is best known for technology that lets Windows run on Macs. The company also has a service provider business, and after splitting the company into two last year, rebranded it as Odin and sold it to Ingram Micro.

Primary Data

Lance Smith, CEO

Headquarters: Los Altos, Calif.

Founded by former executives from storage vendor Fusion-io (now part of Sandisk), Primary Data focuses on data virtualization space. Its flagship DataSphere product virtualizes data using metadata, which helps ensure that apps are getting sufficient storage resources—without overprovisioning storage.

Ravello Systems

Rami Tamir, CEO

Headquarters: Palo Alto, Calif.

Ravello uses technology known as nested virtualization— hypervisors running inside virtual machines—to migrate workloads from VMware private clouds to Amazon Web Services and Google Cloud Platform public clouds. It does this without requiring apps to be rebuilt, which solves what has been a time-consuming and expensive challenge.

Re d Hat

James Whitehurst, CEO

Headquarters: Raleigh, N.C.

The industry's first billion-dollar Linux vendor, Red Hat sells a server and desktop virtualization offering called Red Hat Enterprise Virtualization, which is based on OpenStack and KVM. Red Hat partnered with longtime rival Microsoft last year and its software now runs on the Azure cloud.

RES Software

Al Monserrat, CEO

Headquarters: Strafford, Pa.

RES started out in the user data virtualization space and has since branched out into security and IT management. Its software leverages predictive analytics to identify anomalous behavior in a user's workspace while also letting IT admins lock down apps and data to specific sets of users.

SimpliVity

Doron Kempel, CEO

Headquarters: Westborough, Mass.

The No. 2 player in the hyper-convergence space, SimpliVity's technology combines server virtualization, storage, networking, WAN optimization and other functions in software that runs on x86 server hardware. The company pitches its technology as a cheaper, on-premise option for running workloads than the Amazon Web Services cloud.

Teradici

Dan Cordingley, CEO

Burnaby, B.C

Teradici is known for PC-over-IP, software and hardware technology that boosts multimedia performance on virtual desktops and devices, allowing 3-D graphics and high-definition video to run over a remote connection. The company is a key partner of VMware and works with Amazon Web Services.

Unidesk

Don Bulens, CEO

Headquarters: Marlborough, Mass.

Unidesk competes in the virtual desktop space as a challenger to Citrix and VMware. Its technology virtualizes everything above the hypervisor, including Windows applications and users, as separate layers that simplify deployment and management. Its technology is integrated with VMware Horizon View, Citrix XenDesktop and Microsoft Remote Desktop Services.

VDIWorks

Mark Taylor, CEO

Headquarters: Austin, Texas

VDIworks sells virtual desktop and cloud computing software, including VDI Pro, a virtual desktop delivery platform that handles deployment of cloud-hosted VDI or Desktop-as-a-Service. Its software supports HTML5 clients and is integrated with the XenServer Hypervisor.

VMware

Pat Gelsinger, CEO

Headquarters: Palo Alto, Calif.

Synonymous with server virtualization, VMWare has branched out into storage, desktop and network virtualization. While vSphere server virtualization is still the main product, the company says 2016 will be the year when revenue from the newer technologies starts to outpace the traditional cash cow.