The 10 Coolest New Hyper-Converged Systems Of 2018

CRN breaks down the hottest hyper-converged infrastructure offerings of the year as the hyper-converged infrastructure market hits a sales record high in 2018.

HCI Market Hits Its Stride

The hyper-converged infrastructure market is maturing at a high speed with revenue from HCI growing at a blistering pace in 2018, highlighted by a sales increase of 78 percent year over year in the second quarter to $1.5 billion.

Hyper-converged infrastructure is reducing complexity in the data center and being leveraged to better support business-critical enterprise applications from companies including Microsoft, Oracle and SAP. HCI offerings are making substantial inroads into a broader set of use cases and deployment options. In 2018, HCI vendors including Nutanix, Dell EMC, Cisco, Pivot3 and Hewlett Packard Enterprise expanded their strategies to better embrace hybrid and multi-cloud and offer more compute-only, storage-only and software-defined networking options.

CRN breaks down 10 of the hottest hyper-converged offerings of the year.

Cisco HyperFlex

Cisco HyperFlex was revamped in 2018 with new multi-cloud and container capabilities as well as support for Microsoft's Hyper-V hypervisor. The offering is delivered as an appliance and integrates the company's Unified Computing System (UCS) servers, Cisco Intersight cloud-based management, third-party hypervisors, and its HX Data Platform data and storage management software. The San Jose, Calif.-based networking giant has added certified GPUs on the platform as well. Businesses can execute tasks such as installation, upgrades and active management of several HyperFlex clusters spread across multiple data centers, enabling customers to save money and improve operational efficiency. In addition, Cisco formed a hyper-converged partnership with Veeam in August to infuse Veeam's data management platform into HyperFlex.

Dell EMC VxRail

Continually being updated in 2018, Dell EMC's hyper-converged offering, VxRail, is one of the most popular in the market. Powered by VMware's vSAN and built on Dell EMC PowerEdge servers, the offering is the only full VMware integrated offering for software-defined data centers. It offers single-node, nondisruptive scaling and storage capacity with a pay-as-you-grow approach. The offering has been growing at a triple- digit clip this year. In 2018, Hopkinton, Mass.-based Dell EMC broadened its PowerEdge server choices for HCI and improved the VxRail release cycle to include the latest vSAN software within 30 days of general availability. The offering also now includes support for VMware Cloud Foundation and fully automated network configuration with Dell EMC's Networking SmartFabric Services. The enhancements enable VxRail to scale more rapidly and reduce network configuration and administration work through integration with VxRail Manager and VMware vSphere.

HPE SimpliVity

Hewlett Packard Enterprise CEO Antonio Nero told CRN that the company’s hyper-converged business has grown significantly this year and is on pace to generate more than $1 billion in 2018. HPE SimpliVity integrates HPE servers, third-party server virtualization software and data services for storage efficiency functions. The offering provides a set of global multisite data management functions anchored by an always-on global deduplication and compression architecture. It also includes a set of backup/recovery and clones with disaster recovery capabilities. Through its acquisition of Plexxi this year, HPE added a new composable mesh network fabric to bring software-defined networking to SimpliVity. Palo Alto, Calif.-based HPE also expanded hypervisor support and launched models leveraging its latest generation of servers and networking technologies.

Huawei FusionCube

The China-based communications and infrastructure giant's FusionCube includes software-defined storage, Huawei's own KVM-based and Xen-based FusionSphere hypervisors with support for VMware as well. This year, Huawei added new SAP HANA database support and improved its storage performance and DBMS support. Theoffering can also now integrate with Amazon Web Services for backup as well as integration with Microsoft Azure and the Azure Stack. It comes as a packaged offering that is integrated with Huawei's own infrastructure. Huawei partners with software vendors including Oracle and SAP to certify their applications on the HCI offering. FusionCube can be used for a wide range of applications but is leveraged mostly by midsize enterprises for high-density, server-virtualized workloads, VDI and mission-critical applications.

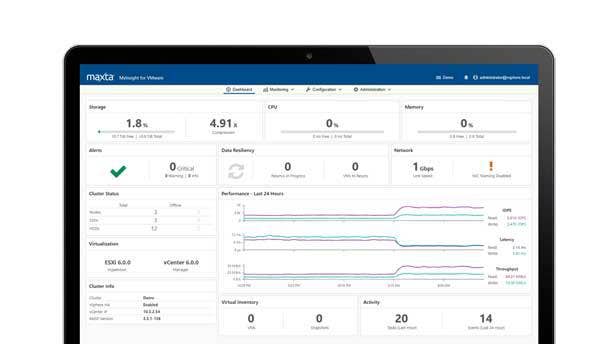

Maxta Hyperconvergence Software

Maxta's Hyperconvergence Software enables organizations to create an HCI architecture from nearly any x86 hardware of their choice as it supports every major server brand including Cisco, Dell EMC, Hewlett Packard Enterprise and Lenovo. The software has feature-rich data services and granular QoS and application configuration capability. This year, Maxta added cloud-based proactive maintenance analytics and support for Red Hat virtualization. The Santa Clara, Calif.-based company recently joined forces with distributor Arrow Electronics to offer hyper-converged bundled, pre-configured systems on servers from Intel, Dell, Lenovo and Supermicro. The hyper-converged software can be hosted in the AWS public cloud to enable data replication and disaster recovery in EC2. Customers can toggle compression and deduplication based on the application's performance and capacity needs.

Nutanix Enterprise Cloud

A pioneer and longtime leader in the hyper-converged space, Nutanix's Enterprise Cloud received the highest score in Forrester's Hyper-Converged Infrastructure report that ranked all of the top hyper-converged offerings in the market. The company's flagship product is delivered as software and hardware appliances and as a cloud service, combining storage, hypervisor, security, software-defined networking and management. In 2018, Nutanix introduced a slew of new software capabilities and hardware models targeting edge and remote/branch office deployments. New products include Calm for application and automation; Epoch for application and performance management; Flow for software-defined networking; and Beam for cost and security compliance. The San Jose, Calif.-based company recently said it has an install base of 11,500 customers.

Pivot3 Acuity

Pivot3 has been a consistent player in the HCI market for years with a large install base including U.S. defense and intelligence government agencies. The Austin, Texas-based vendor launched its Acuity X3 Series this year aimed at bringing enterprise-grade features to the SMB, remote and branch office, and edge markets. Acuity features policy-based QoS software that serves multiple and mixed-application workloads. The offering delivers consistent and predictable flash performance using NVMe flash and supports both cache and persistent storage tiers. It integrates with the Pivot3 management application and enables single-pane-of-glass management of on-premises and cloud deployments. Pivot3 targets a broad range of applications but is primarily used for high-density and virtualization workloads such as VDI and mission-critical applications at remote office/branch office or edge locations.

Red Hat Hyper-Converged Infrastructure For Cloud

Red Hat this year released its Hyper-Converged Infrastructure for Cloud that combines Red Hat OpenStack solutions and its Ceph Storage into a single offering with common life-cycle support. The flexible offering supports modern workloads with scalable architectures on industry-standard hardware. The offering leverages Red Hat's own KVM hypervisor and Gluster storage virtualization. In 2018, Raleigh, N.C.-based Red Hat added the HCI cloud to its virtualization offering. Businesses can leverage the company's extensive OS, storage and cloud management tools to manage HCI. The global provider of Linux-based stacks of open-source software acquired storage software startup NooBaa in November with plans to leverage the company's technology into its hyper-converged offerings. IBM has since unveiled plans to acquire Red Hat for $34 billion, with the deal expected to be completed in the second half of 2019.

Scale Computing HC3

Scale Computing's HC3 is built on its own KVM-based hypervisor along with software-defined storage, networking and web-based multi-cluster management. Scale Computing H3C is sold as an appliance priced per node or as software through OEMs including Lenovo and offers easy installation, data services and streamlined management. Individual nodes or clusters can be connected by replication and used for remote availability. This year, Scale Computing partnered with data center power management vendor APC by Schneider Electric to create a new "micro data center in a box." Scale Computing was previously deployed primarily in data centers of midsize enterprises, however, in 2018 the company gained traction in distributed enterprises, retail and remote offices and branch offices. In October, the Indianapolis-based company received nearly $35 million in funding to drive innovation and channel expansion.

VMware vSAN 6.7

This year, VMware launched a major update to its vSAN software-defined, hardware-agnostic software with vSAN 6.7, tailor-made for hyper-converged infrastructure offerings. vSAN 6.7 has a new HTML 5 user interface, the ability to integrate its performance and capacity monitoring capabilities with VMware vCenter, and can bring more workloads to the platform with an emphasis on cloud-native applications. All VMware hypervisors now include vSAN; businesses just need to activate the hyper-converged function. The offering is deployed in a wide range of use cases across midsize and global enterprises for virtual desktop infrastructure (VDI), remote office/branch office environments and Tier 1 applications. The Palo Alto, Calif.-based server virtualization leader also has a technology partnership with Amazon Web Services to enable hybrid cloud, including VMware vSAN as a service.