Veeam’s Ratmir Timashev On Public Cloud Backlash, Office 365 Growth And ‘Aggressive’ Acquisition Strategy

Veeam Co-Founder Ratmir Timashev Ready For Hybrid Cloud Battle

Backed by a whopping $500 million in new funding, Veeam has an eye-popping growth plan in 2019 that includes multiple acquisitions, driving Office 365 channel sales, and major partner investments.

“I think we’ll acquire two, three, four or five companies [in the next year],” said Ratmir Timashev, co-founder and executive vice president of sales and marketing for Veaam, in an interview with CRN. “It won’t be big companies. We’re not going to buy Commvault. It’s all about innovative technologies.”

Veeam is coming off a record-breaking 2018, with bookings totaling $963 million, up 16 percent year over year. The data protection and management software star added 48,000 new customers last year with similar growth plans in 2019.

In an interview with CRN, Timashev talks about Veeam’s fastest growth area in the company’s history, M&A strategy, the “war” for hybrid cloud dominance, and the serious issue with customers buying public cloud solutions without any backup.

With $500 million now in Veeam’s wallet, how aggressive is your acquisition strategy and what technologies are you looking to acquire?

We will be aggressive. We’re looking at artificial intelligence, data management, containers, KVM, OpenStack, machine learning, data governance—all that stuff. It broadens our backup to data management and takes it from on-premise to multi-cloud. … I think we’ll acquire two, three or four or five companies [in the next year]. It won’t be big companies. We’re not going to buy Commvault. It’s all about innovative technologies. We acquired N2W Software, which is a good example of great innovative technology because they’re a leader in AWS backup. We want a leader like that who is small, but very useful for cloud cost optimization, for example. Or we want to acquire and look at Kubernetes, containers and KVM providers.

You said possibly a cloud cost optimization company. What’s the biggest challenge for customers trying to do multi-cloud, hybrid cloud?

The biggest challenge is cloud lock-in. [Microsoft] Azure and AWS want to lock you in. They want you to consume more and more and more. We want to provide freedom from cloud lock-in and offer cloud mobility and cost optimization—that’s what we’re doing. We’re looking to acquire a cloud cost optimization company, and maybe we will acquire it and give it to customers for free because it’s just an add-on to our data management story. We want companies to be free and understand where the cost is coming from, but also provide this data mobility. Customers don’t like monopolies and lock-ins. They want hardware freedom and software freedom.

How tough is it to get out of AWS and Azure?

Extremely tough. Everything is designed for you to consume, consume and consume. Then taking the data back is expensive. It’s zero expensive to put the data in. It’s extremely expensive to take that data out. Veeam provides our Cloud Mobility, where we can take your AWS workload, backup on-premise and convert it to VMware, Azure or to really anything.

Are you seeing public cloud backlash from customers where the pendulum is swinging back to on-premise?

Totally. Today, lots of customers are thinking, ‘How do I move some data from public cloud back to on-premise?’ Because public cloud is expensive and complex. There has to be a balance and there has to be freedom. Veeam provides that freedom because we are hardware- and cloud-agnostic. We’re in the middle. We move the data for backup, compliance and for governance. Customers use Azure and AWS for test and development, but test and development at some point become mission-critical. At that point, they start to think, ‘How do I bring my mission-critical [data] back on-premise?’

What is the biggest mistake customers make with public cloud?

Customers think that Azure backs up their data—incorrect. Azure provides the resilient infrastructure, not the data backup. Yes, Microsoft is supposed to make sure the service doesn’t go down, but the data is your responsibility. … The most important reason to back up Office 365, AWS and Azure is it’s your data, it’s not AWS’ data. It’s their infrastructure, but the data is yours. The second reason is ransomware. The third reason is viruses. The fourth reason is governance and compliance. It’s your responsibility to protect the data.

Are we going to see high-profile cases where companies that use Office 365 or Azure lose their data and it impacts their company?

They’ll go bankrupt. It will happen often in the future. It’s going on now. … They should buy Veeam, it’s not that expensive.

How often is a customer buying a public cloud solution that’s not properly backed up?

In 95 percent of the cases. They just don’t know. They don’t think about it. They think everything is included in that cloud service—incorrect. The data is yours. You own that. Partners have to educate together with us. We have great content for partners on why you need to tell your customers to back up Office 365, for example. It’s your data, not AWS’ data.

What’s hot right now for Veeam in terms channel sales growth?

Office 365 is the fastest-growing product for us. Backup of Office 365 is the fastest-growing product in the history of Veeam. It grew from $3 million in 2017 to $18 million last year to $40 million this year. That’s all recurring, subscription revenue. It’s all partners. We have to educate partners and partners have to educate the customers because customers think that Microsoft backs up their data. Microsoft does not back up their data. You’re responsible. If the virus gets into your email, Microsoft is not responsible. Office 365 right now is a big market for us. It’s an annual subscription.

What’s your channel growth strategy in 2019?

We have already expanded our channel dramatically. In the last two years, [Hewlett Packard Enterprise] has become our No. 1 reseller so we dramatically expanded it to HPE’s channel. Our channel was VMware’s channel, but there’s a lot of overlap between HPE and VMware. Then we signed a reseller agreement with Cisco, so we now have Cisco’s channel. Then a reseller agreement with NetApp. It’s all about channel. HPE, Cisco and NetApp resellers are now ours, and we also recently we signed with Lenovo. We are the primary data management and data protection vendor for them. So when HPE, Cisco and NetApp resellers put together the whole solution, they need us because without us they don’t have a data management story—they only have a hardware story. They see Veeam as something that ties all the pieces together for resellers. So instead of selling one [HPE] 3Par box, for example, now they sell multiple 3Par boxes plus they sell HPE StoreOnce because now it’s the whole data management, backup, replication and disaster recovery story. It’s helping them to complete the whole story instead of just selling a hardware box.

What types of new partners and channel investments are you looking to invest some of your $500 million in?

We are going to do huge investments in the channel because that has been our strategy always. But now we have to expand our channel not just from VMware to HPE to Cisco to NetApp, but also to AWS, Azure and Office 365. Google is coming soon as well. Everything we do is 100 percent channel and 100 percent service provider.

Where should Veeam partners place their bets?

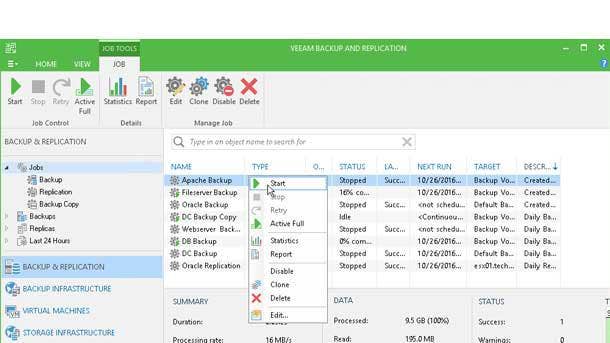

Partners need to think how they have to evolve their resell model to a hybrid resell services model. Veeam is the best platform to provide additional services—data management, backup and disaster recovery. So our latest release of Veeam Availability Console, it’s a specific platform for service providers. We introduced the third tier. So now our resellers, through the console, can resell our service provider services so they don’t have to build it. They can just resell it as part of, for example, Office 365 or Azure or AWS. So they don’t have to build from scratch Backup as a Service or Disaster Recovery as a Service. Partners have to evolve their business to services. So reselling AWS, Azure or other services like Office 365, backup, disaster recovery, governance like data management—we help them tie them all together.

What technology or market is Veeam laser-focused on?

There is only a very short window of two or three years to own a market. After you own this market, nobody can compete. It took us two or three years to become the leader in VMware backup. Now there’s a new shift to hybrid cloud and the war is happening right now. Whoever wins this market is going to own the majority of that market—the winner will take like 40 percent of the market. Right now, we are fighting with the legacy vendors and newcomers. So in 2019 and 2020, it’s going to be who owns that data management and data backup market in multi-cloud. We already own the VMware on-premise market. Microsoft gave up Hyper-V in favor of Azure. They couldn’t focus on both Azure and Hyper-V. So VMware owns on-premise and we back it up. Now it’s multi-cloud, hybrid cloud. Our vision is we have to win this war. The war is right now. We have to add a lot of capability. We have to move our platform from on-premise to the cloud and we have to provide cloud mobility, data governance, data management and data security in the hybrid cloud world.

In hybrid cloud, if we win it, we will grow from $1 billion to $3 billion in the next several years. We need to win the hearts and minds of the people who are building hybrid cloud.