Microsoft WPC: 10 Issues Ballmer & Co. Must Address

The Microsoft Evolution

It's been a busy few weeks for Microsoft: unveiling the Windows Surface tablets, buying social networking vendor Yammer for $1.2 billion, the announcement of Windows Phone 8. All this with Windows 8, the next generation of the company's flagship product, waiting in the wings.

But some of Microsoft's latest moves have raised questions among channel partners about just how they fit into the company's long-range vision. When Microsoft unveiled Surface, it said the tablet would be sold through retail with no mention of the channel. And Microsoft's expansion into cloud computing is leaving some longtime partners feeling unsure about their role going forward.

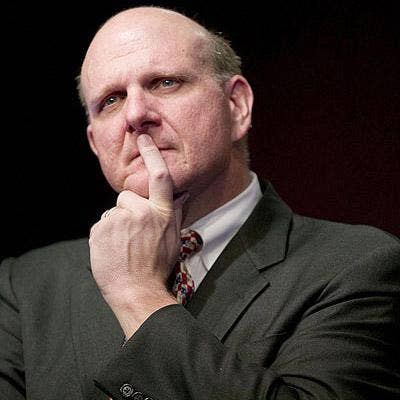

Some 15,000 are expected to attend the Microsoft Worldwide Partner Conference in Toronto next week, and partners will be seeking answers to these and other questions. Here are 10 things we'd like to see Microsoft CEO Steve Ballmer (left) and other Microsoft executives address at the event.

A Channel Role For Windows Surface Tablets?

Last month Microsoft debuted its Windows Surface tablet in a move that took the industry -- and Microsoft partners -- by surprise. Microsoft is hoping the bold decision to develop its own tablet products will help it gain a bigger foothold in the tablet market, where it largely has been absent.

But the announcement only said the Surface tablets will be sold through Microsoft's retail stores and some online sites -- no mention of the channel. That disappointed the company's thousands of channel partners, who were left wondering what role, if any, they might have in selling the Microsoft tablets.

Microsoft executives and channel managers have since been silent on the topic. We're hoping that at WPC Microsoft execs shed more light on any partner opportunities.

The Channel Role In Microsoft's Cloud Strategy

Microsoft has been steadily pushing its way into the cloud with such products as Office 365, Dynamics CRM Online and Windows Intune. While Microsoft has touted the partner opportunities for some cloud products such as Intune, just how the channel fits into other aspects of the Microsoft cloud vision have been hazy.

Take, for example, Office 365, the cloud version of Microsoft's desktop application suite. While partners can develop services around Office 365, Microsoft has angered some partners by controlling the billing for the on-demand service.

Combined with other slights -- perceived or otherwise -- some partners are questioning whether Microsoft is finding ways to go around the channel and work directly with customers. Spelling out what Microsoft's cloud direction means for channel partners would go a long way toward allaying those concerns.

Windows 8 Timetable

The latest word is that Microsoft could announce the Release To Manufacturing (RTM) of Windows 8 this month, the last step before the product is generally available.

So far Microsoft has only said that Windows 8 will be available by the end of this year. But it's now July and Microsoft should have a better idea of when the next generation of the PC operating system will be available. Partners, after all, need to develop their plans for selling the product and upgrading their customers.

Most speculation on Windows 8 availability has centered on October. But speculation isn't much for partners to build business plans around. Probably the biggest applause line Ballmer can deliver in his Monday keynote speech is a specific ship date for Windows 8.

Plans For Attracting ISVs To Windows 8, Windows RT

The success or failure of an operating platform can hinge on whether there is a sizable ecosystem of third-party applications available to run on it. Certainly the 500,000 applications available for Apple's iOS were a factor in the phenomenal success of the iPhone and iPad.

So a big question mark for Microsoft is how many applications will be available for the Windows 8 Metro user interface and for the Windows RT edition that's developed to run on ARM-based devices -- primarily tablet computers? While Windows 8 is supposed to be backward-compatible with applications developed for older versions of Windows, they won't support Metro or run on Windows RT.

Some information about Microsoft's plans to recruit ISVs to the new platforms would be welcome at WPC.

Version Of Microsoft Office For The iPad

Microsoft appears set to launch Office 2013, the next release of one of the vendor's cash-cow products, shortly after WPC. But right now Microsoft is missing out on a growth opportunity by not offering a version of Office for the fastest-growing IT platform in the market right now: Apple's iPad (left).

Sure, Microsoft is trying to compete with the iPad with its Surface tablets. But the iPad isn't going away and there are a lot of iPad owners who would welcome an iPad edition of Office to help them use the Apple device for business tasks. Yes, that might eat into the potential Surface market a bit. But "co-opetition" is what this industry is all about. Without an iPad version of Office, Microsoft might be leaving some money on the table.

What's Up With Skype?

It's been more than a year since Microsoft revealed its $8.5 billion acquisition of Voice-over-IP service provider Skype (the deal actually closed in October). And while there's been a lot of talk about integrating Skype with Xbox, Lync, Windows and Windows Phone, the work seems to be taking longer than anticipated.

Microsoft must take care to avoid integrating Skype so deeply that it loses what made it such a success in the first place. But the real payoff will come when Skype adds value to other Microsoft products. Some updates on what's happening with Skype and what it could mean for channel partners are in order.

A Yammer Road Map

It was just last week that Microsoft said it is acquiring social networking services company Yammer for $1.2 billion, and the deal hasn't even been wrapped up yet. But given that Yammer will give Microsoft a quantum leap in social networking, an area where it's lagging competitors, it's never too soon to start talking about what it means for the channel.

Microsoft -- and its partners -- could recognize significant opportunities by linking Yammer with Office 365, Dynamics ERP and CRM applications, SharePoint and other Microsoft products. But Yammer is a Software-as-a-Service application and a big question is whether partners will be able to sell it to customers.

Helping Partners Cope With VDI Licensing Issues

Microsoft is adding a license requirement to Windows 8 Software Assurance that will raise costs for companies that use Apple iPads and other non-Windows devices to access virtual desktop infrastructure. Partners are expecting a backlash from customers over the new Companion Device License (CDL) requirement, which some industry observers see as an effort to slow iPad sales.

Microsoft should use WPC as a forum to explain its thinking behind the CDL move and say how it intends to help partners deal with unhappy customers.

You can also expect a good deal of chest-thumping at WPC about the competitive advantages of Microsoft's Hyper-V v3, due out later this year with Windows Server 2012, against chief competitor VMware.

Addressing The Nokia Problem

Microsoft seems to have finally gotten its act together in the smartphone space -- as far as offering a software platform (Windows Phone) that can compete with Apple's iPhone and Google Android. Last month Microsoft debuted Windows Phone 8 that's based on the same core technology as the Windows 8 PC and tablet operating system that's due out later this year.

But Microsoft's efforts to gain ground in the smartphone market are being hobbled by the financial struggles of Nokia, its chief handset manufacturer partner. Adding to Nokia's woes was Microsoft's announcement that owners of phones running Windows Phone 7.5 and earlier won't be able to upgrade to Windows Phone 8, a move that seriously handicaps Nokia's efforts to sell Windows Phone-based Lumia smartphones (left) in the short run.

Microsoft needs act now to maintain any Windows Phone momentum. There are reports it's developing its own phone, and there are rumors Microsoft (or another manufacturer such as Samsung) might move to buy Nokia.

Channel Opportunities With Kinect

Kinect in the video gaming space has been one of Microsoft's unqualified product successes. Microsoft likes to trumpet the fact that the product holds the Guinness World Record for the fastest-selling consumer electronics device (8 million units in its first 60 days of availability).

But Microsoft also realizes the Kinect's potential in a wide range of commercial markets. At the International Consumer Electronics Show in January, Ballmer outlined plans to release a version of Kinect for use beyond the Xbox game controller. A few weeks later the commercial version of Kinect for Windows software development kit was released.

The Kinect potential beyond traditional IT is enormous for channel partners working in such specific industries as health care, manufacturing, education and more. Microsoft should use WPC as an opportunity to recruit and educate partners in what could be one of its biggest future growth areas.