The 17 Biggest News Stories Of 2017 (So Far)

The Year So Far

Compiling a list of the 17 biggest news stories for 2017 (so far) proved to be a relatively easy task. It's been an eventful six months in the IT industry and the channel – but then, isn't it always?

As is often the case, acquisitions, mergers and divestitures accounted for some of the biggest news stories in the first half of the year. That included the merger of CSC with Hewlett Packard Enterprise's enterprise services business, HPE's acquisitions of SimpliVity and other companies, and Verizon's buyout (finally) of Yahoo. In some cases the news wasn't the acquisition itself but the aftermath, as with the launch of the Dell EMC partner program after Dell's $65 billion acquisition of EMC last year.

Not all the big news stories were deliberate events. Widespread Amazon Web Services and Microsoft cloud outages, SSD component shortages and massive ransomware attacks disrupted wide swaths of the industry in the first six months of the year.

And then there were the big-picture stories, the trends sweeping the industry, led by the efforts by just about every vendor and solution provider to get positioned for the coming Internet of Things revolution.

What do you think have been the biggest IT industry news stories of 2017 so far? Take a look at our list, concluding with the most important story, and see if you agree.

(For more on the "coolest" of 2017, check out "CRN's Tech Midyear In Review.")

17. Avaya Files For Bankruptcy Protection, Sells Networking Business To Extreme Networks

Business communications service provider Avaya shook up its customers and channel partners when it filed for Chapter 11 bankruptcy protection in january, citing its $6 billion debt and need to raise $600 million for a debt maturity payment by October.

CEO Kevin Kennedy called the move "the best path forward" for Avaya, including restructuring the company's balance sheet and reducing its debt load. Partners called the bankruptcy filing a "solid" first step toward getting the company back on a solid footing.

In March Avaya struck a deal for Extreme Networks to acquire Avaya's networking business for $100 million. Extreme completed that acquisition on July 17.

16. Verizon Closes $4.5 Billion Yahoo Acquisition After Negotiating A Discount

On June 13 telecommunications giant Verizon finally closed on its long-gestating acquisition of Web portal company Yahoo and its popular media assets, including its sports and finance content. Verizon is combining Yahoo's assets with the AOL media and content assets it bought in 2015.

The $4.48 billion purchase price was $350 million less than the $4.83 billion price the two companies initially agreed on when they struck the acquisition deal in May 2015. Verizon negotiated the lower price after Yahoo disclosed that it had been hit with two massive security breaches in 2013 and 2014 that compromised more than 1.5 billion subscriber accounts.

Also on the Verizon front, in May the company beat out rival AT&T with a $3.1 billion, all-stock bid to acquire wireless spectrum holder Straight Path Communications.

15. Xerox Completes Its Split Into Two Companies

Channel mainstay Xerox spent much of 2016 preparing for its split into two companies, one an $11 billion company retaining the Xerox name focused on document technology, and the other a $6.7 billion business process services company called Conduent.

The split was officially executed on Jan. 1 and the two companies went their separate ways.

Management said the goal was to make Xerox a more focused company. And it took a significant step toward that vision on March 29 when it debuted 29 new printers and multifunction devices – the first product launch since the split and the biggest in the company's history.

And in April Xerox signaled its commitment to the channel when it hired longtime channel champion Pete Peterson away from Tech Data for a new channel post focused on driving best channel practices and helping to grow the company's channel sales.

14. Private Equity Company Buys West Corp. In One Of The Industry's Biggest Acquisitions

Private equity giant Apollo Global Management struck a $5.1 billion deal to buy telecom service provider West Corp. in the largest IT industry acquisition so far this year.

The acquisition, announced May 9, ended a six-month period during which West Corp. was reviewing strategic alternatives for its future. Apollo is paying $23.50 per share for West Corp. and assuming more than $3 billion of the company's debt, putting the total value of the deal at approximately $5.1 billion.

Apollo hopes that by acquiring West Corp. it can capitalize on customer migrations to cloud-based solutions. The deal is expected to close by the end of the year.

13. The Return Of McAfee

McAfee, the security software heavyweight that Intel acquired in 2010 for $7.7 billion, became an independent company once again as a stand-alone $2 billion security software vendor.

The spinoff, announced in September, involved selling a 51 percent stake in McAfee to TPG Capital in a deal worth $4.2 billion, including $3.1 billion in cash to Intel and a $1.1 billion equity investment by TPG.

But McAfee finds itself in an increasingly competitive security technology market where big, established companies like it and Symantec are re-inventing themselves as they face competition from a wave of startups like Cylance and Crowdstrike. Newly free of Intel, can McAfee become more nimble and succeed in today's rapidly changing security industry?

12. Cognizant Strikes Deal With Activist Investor Elliott Management

Activist investor Elliott Management acquired sizable stakes in such companies as BMC Software and Citrix Systems in recent years and waged lengthy battles with their directors over demands the companies restructure, improve their profitability and return more profits to shareholders. Many observers expected the same in late 2016 when Elliott Management acquired a 4 percent stake in systems integrator Cognizant and demanded changes.

But rather than go to war, Cognizant took a different tact and quickly struck a deal with Elliott Management, announcing on Feb. 8 an agreement to appoint three independent members to its board of directors and create a financial policy committee. More importantly, Cognizant said it would invest more in new technology practices such as digital transformation services, expand profit margin targets and return $3.4 billion to shareholders through dividends and share repurchases.

Cognizant CEO Francisco D'Souza hailed the deal as an opportunity to accelerate change within the company. Could it be a model for other IT companies that are under pressure to re-invent themselves?

11. Google Hit With $2.7 Billion Fine By European Union

European Union regulators had charged Google with allegedly engaging in antitrust behavior by giving its own comparison shopping service an "illegal" advantage, using its dominant position in internet search to stifle competition. So Google was braced for a hefty fine.

But observers were stunned June 27 when the European Commission hit Google with a whopping $2.7 billion fine in the case, the largest ever imposed by the governing body. It far exceeds the $1.2 billion fine the EC levied against Intel in 2009 in another antitrust case.

10. Cisco Moves into Cloud System Monitoring With $3.7 Billion AppDynamics Acquisition

AppDynamics was a hot company with its technology for monitoring and managing cloud applications and was on the eve of an expected IPO in January when Cisco swooped in with a deal to buy it for $3.7 billion. The deal closed in March.

It was one of the IT industry's biggest acquisitions in the first half of 2017. But equally important was what the acquisition meant to Cisco in its efforts to transform itself from a networking hardware vendor into a supplier of software-centric solutions.

As businesses move to the cloud and undertake digital transformation projects, the need for real-time visibility and intelligence at the network, application and security layers is critical. Cisco partners applauded the acquisition, saying the AppDynamics technology would open up a world of opportunities for them.

9. IT Vendors, Solution Providers Rush To Position Themselves For The IoT Goldrush

Research firm IDC issued a report in June forecasting that spending for Internet of Things hardware, software, services and connectivity would grow 17 percent this year and reach $1.4 trillion by 2021. What's more, the report said the real value of IoT lies in the software and services used to capture, analyze and act on the data generated by IoT systems – the kind of software and services offered by solution providers.

In the first half of 2017 IT vendors were almost tripping over themselves to expand their IoT offerings. None more so than Intel, which debuted an IoT platform for the retail industry in January and an IoT system for the shipping and logistics industries (jointly developed with Honeywell) in May. Perhaps Intel's biggest move was its deal in March to acquire Mobileye, a developer of components for connected cars, for a whopping $15.3 billion.

Intel wasn't alone, of course. In May Cisco debuted the IoT Operations Platform to help partners and customers deploy IoT solutions. In June Hewlett Packard Enterprise unveiled the HPE Edgeline Services Platform for managing and controlling industrial connected systems and networks, including IoT devices. Amazon Web Services launched its Greengrass software for linking IoT "edge" devices to the AWS cloud. And Microsoft emphasized the importance of building a rich IoT channel ecosystem.

8. Massive AWS, Microsoft Service Outages Raise Concerns About Public Clouds

A service outage that hit Amazon Web Services' S3 cloud storage systems on Feb. 28 wreaked havoc around the world, disrupting websites and internet services for millions of users. A few days later Amazon apologized and blamed the outage on a botched effort by an employee to debug a billing system.

In March customers of Microsoft's cloud services were inconvenienced by several system outages, including storage availability issues with the company's Azure public cloud service in mid-March and a 17-hour Office 365 service outage on March 21 that kept users from accessing their OneDrive accounts.

With an increasing number of businesses dependent on cloud-based IT systems, the outages served as a wake-up call for solution providers and their customers of the potential pitfalls of putting all your IT resources in one public cloud basket. While public cloud systems offer cost advantages, the outages made clear the advantages of having a comprehensive cloud strategy incorporating both public and private cloud services with the requisite security and redundancy built in.

7. The Ongoing Saga Of Broadcom's Acquisition Of Brocade Communications

Semiconductor maker Broadcom announced on Nov. 2 an agreement to acquire networking systems supplier Brocade Communications Systems for $5.9 billion. But Broadcom said it was buying Brocade for its Fibre Channel SAN switching business and planned to spin off Brocade's IP networking business – including Ruckus Wireless, which Brocade acquired in May for $1.2 billion.

The result was a steady stream of news in the first half of 2017, much of it about a series of deals for Broadcom to sell off pieces of Brocade once the acquisition is done.

Most notable was the announcement that Arris International would acquire Brocade's network-edge portfolio, including the channel favorite Ruckus Wireless, for $800 million. Extreme Networks agreed to purchase Brocade's data center networking business. And Pulse Secure said it would buy Brocade's virtual application delivery controller business.

But Brocade's limbo status created uncertainty for the company's channel partners and their customers. Partners have reported that customers have held off closing deals and delayed purchasing Brocade and Ruckus products. A restructuring of Brocade's sales operations in May added to the confusion with partners reporting some sales lost to rival vendors.

6. IT Vendors, Channel Struggle With Memory And SSD Component Shortages

In the first half of 2017 IT vendors, solution providers and systems builders wrestled with short supplies of solid-state drives, some times making it difficult to deliver servers and storage systems to customers on time.

The shortage was believed to result from a combination of the fast-growing demand for SSDs as their per-gigabyte price neared that of hard disks; and a transition by manufacturers of NAND memory toward 3-D NAND technology.

The shortages also led to higher server and PC prices. Solution providers said their revenue, profitability and cash flows were impacted by the shortage and in some cases they lost deals when they could not supply customers with needed systems.

5. Massive DDoS And Ransomware Attacks Raise The Security Stakes

IT security threats have been on the rise in recent years with highly publicized attacks against companies such as Yahoo, Sony and Target. But several widespread ransomware and Distributed-Denial-of-Service attacks this year have really caught everyone's attention and provided clear evidence of how serious the security problem has become.

A global attack that became known as WannaCry crippled as many as 200,000 computers across 150 countries in mid-May, especially targeting health-care organizations and telecommunications companies. WannaCry was particularly pernicious because it combined ransomware with a computer worm – a never-before-seen combination that allowed the attack to spread so quickly.

In late June a second widespread ransomware attack, which appeared to begin in the Ukraine, quickly spread around the world hitting companies in the legal, shipping and pharmaceutical industries. The attack increased worries about the vulnerability of critical infrastructure and Internet of Things networks.

Security concerns around IoT networks were also in the spotlight in April when a massive DDoS attack against an unnamed U.S. college was made public. Experts said the incident, described as an application layer attack, was evidence of how IoT attacks are evolving to become more elaborate and more sophisticated.

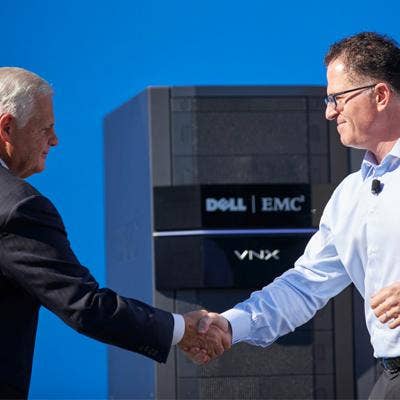

4. Newly Merged Dell EMC Launches Its New Partner Program

In September 2016 Dell completed its $65 billion acquisition of storage giant EMC, creating an IT industry heavyweight and channel powerhouse. But for the two companies' hundreds of solution provider partners, the real question was what the new Dell EMC channel program would look like.

On Feb. 4 Dell EMC executives unveiled a single partner program with the stated goal of offering the most profitable partner program in the industry. The program, for instance, doubled the storage system rebates from the legacy EMC program and rewarded partners for selling converged and hyper-converged systems. The vendor also said it would pump $150 million into partner incentives in the coming fiscal year.

Partners praised the scope of the program, calling it a game-changer and a key element in Dell EMC's efforts to compete with Hewlett Packard Enterprise, Cisco Systems and Lenovo.

3. Tech Data Acquires Avnet Technology Solutions

On Feb. 27 distributor Tech Data acquired Avnet Technology Solutions, Avnet's $9.65 billion value-added distribution business, for $2.6 billion in a move that remakes the IT distributor landscape.

By acquiring Technology Solutions, Clearwater, Fla.-based Tech Data vastly expands its product portfolio of systems for the data center, cloud computing, security, mobility, big data analytics, the Internet of Things and vertical industries. It also increases the share of Tech Data's revenue generated by more complete IT solutions.

In June CEO Bob Dutkowsky said that thanks to the acquisition, Tech Data is gaining market share in key countries and product categories.

2. HPE Expands Its System Lineup With SimpliVity, Nimble And Niara Acquisitions

Hewlett Packard Enterprise continued to remake itself in the first half of 2017 with a series of blockbuster acquisitions of companies with disruptive technologies that expanded HPE's product lineups in hyper-converged and flash storage systems.

In January HPE struck a deal to acquire SimpliVity for $650 million, instantly boosting HPE's competitive position in the red-hot hyper-converged systems market against rivals Cisco, Dell EMC and Nutanix. HPE completed the acquisition on Feb. 17.

In March HPE agreed to buy Nimble Storage, a developer of leading-edge flash storage systems, for $1.09 billion. The acquisition was completed April 17.

In February, between those two major acquisitions, HPE also bought Niara, a startup developer of security analytics and network forensics technology, in a move to boost HPE's Aruba ClearPass network security portfolio.

All these acquisitions came as HPE spun off its Enterprise Services operation, which merged with CSC to form DXC Technnology. Combined, all these moves are designed to better position HPE as it continues to remake itself following the 2015 split of the old Hewlett-Packard Co. into two companies.

1. CSC, HPE Enterprise Services Merge To Form DXC

Nearly a year in the making, CSC closed its merger with Hewlett Packard Enterprise's Enterprise Services on April 3, officially opening for business as DXC Technology, a $26 billion solution provider behemoth.

CSC and HPE initially announced the plan in May 2016, and throughout the rest of the year and into 2017 continued making preparations for the merger. The new company's operating structure and executive lineup was announced Feb. 2 and the DXC name was unveiled two weeks later. The deal was sealed March 27 when CSC shareholders gave their approval.

In addition to providing more traditional IT services DXC, led by President and CEO Mike Lawrie, is focused on digital transformation, business process services and industry-specific technology and services.

On July 5 DXC announced that it had acquired Tribridge, an integration services company that works with Microsoft's Dynamics 365 cloud applications. Combining that with the DXC Eclipse business makes DXC a power player in the Microsoft applications arena.