Channel Affinity Index: What Drives Loyalty?

Affinity Category Profiles

• Storage Management Software

• Portals And Content Management

• Networking Infrastructure

• Server Application Virtualization

• External Storage Hardware

• SMB Storage Virtualization

• Systems Management Software

In the 2008 Affinity Index, VARs rated vendors of SMB products in 15 different weighted criteria, providing the most in-depth profile yet of what makes a vendor successful, or unsuccessful, in the channel. The Index provides not only a detailed analysis of the VAR-vendor relationship, but also shows how vendor performance impacts the channel's relationship with end users. One of the key findings of the study is that even large, well-established vendors can risk losing market share if they don't focus on areas that are important to solution providers.

VAR response to the results was swift, mostly expressing the hope that vendors would take the findings to heart.

"It's essential for vendors to react to the feedback they get from the partner community," said Dave Gilden, partner and COO of Acuity Solutions, Tampa, Fla. "And not only is it important for them to identify what we're looking for from them, but to make sure that they're prioritizing our needs in the same way that they do."

Bruce Geier, president and CEO of Technology Integration Group (TIG), a San Diego-based solution provider, said the research could benefit both solution providers and vendors. "I think we solution providers always try to compare ourselves to our peers. We want to know what's succeeding for them, what vendors are good for them," Geier said. "And the vendors should want to see what's going on, to see what we view as important. If we don't see the same things as important, I don't think vendors will see any traction."

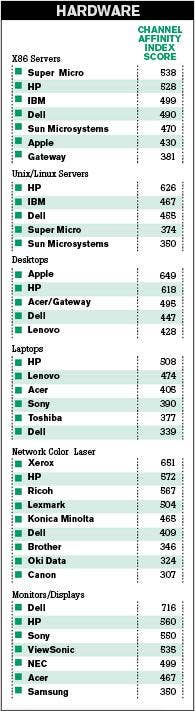

The Affinity Index is based on a maximum score of 1,000, but vendors scored in the 300 to 700 range in most technology segments, evidence that there is plenty of dissatisfaction with vendors in the channel, said Stan Elbaum, practice director of worldwide channel intelligence and analysis for IPED.

[Click here for the Channel Affinity Scores]

"Even the ones with the highest scores have a lot of opportunity and the ones with low scores have a lot of threat," Elbaum said. "Even the best guys are at risk. They may have good scores, but there's a difference between having a leading score and knowing precisely where the gap exists between them and their competitors."

While no vendor came close to a perfect score, the wide range of scores of vendors in a particular category is telling, Elbaum said. The ratio between some vendors is two or three to one, he said. "That's gigantic," Elbaum said. "That's not 25 percent different; that's saying somebody is doing much, much better and much, much worse."

Because the Index score is comprised of factors carrying different weights, it allows vendors to focus on improvements where they are relatively weak. "It's harder to take a broad brush to fix specific things," Elbaum said. "Now they can cherry-pick where they want to focus and have a better chance of closing the gap," he said.

James Huang, partner marketing manager at Amax Information Technologies, a Fremont, Calif.-based system builder, said vendors should focus more on addressing partner needs. "I would hope vendors would value [our feedback], especially when the economy is bad," Huang said. "If a vendor doesn't support their channel, I don't know how you sell their product."

Key Criteria

Overall, the research shows that a wide variety of factors were deemed more important in different technologies and for different vendors, but Elbaum said three criteria typically received more weight than others: ROI, competitive displacement and services attach rate.

It's important to solution providers that end users can achieve a satisfactory ROI with a vendor's products, Elbaum said. "In fact, ROI is a prime determinant of the overall ranking. If you score low, it's hard to make it up."

"ROI is the name of the game," said TIG's Geier. "The value has to be there, not only from the ability to achieve the results, but in creating a long-term environment with the customer. For us, ROI has become the prevalent reason to sell stuff. If you can't make money selling a product, why sell it."

Regarding competitive displacement , vendors have to have programs that are very targeted and focused to score high, Elbaum said.

"Vendors that don't score very high may not have the special programs to allow the channel to target a specific competitor. Pure competitive displacement based solely on brand is hard to achieve. A corollary of that, co-existence with another vendor, is also a highly desired state, according to Elbaum. "Is it really plug and play? Those kinds of things tend to score very high," he said.

A vendor's cooperation with its solution providers can have an impact on how those VARs can displace the competition, Amax's Huang said. He cited winning a big education deal with a reseller customer because nobody wanted to deal with the support headaches that often came with using the legacy vendors. "Big companies have no personalized service. The support is not there," he said.

The services attach rate was deemed important for more than just the implementation of a product, Elbaum said. Training, re-engineering and other business process changes are also included. "That becomes increasingly important within the solution itself because it offers the channel a major revenue opportunity," he said.

The ability to bring more services into a deal helps make a solution provider more profitable and helps forge a better relationship with the vendor, said Jeff Albright, founder of Albright Consulting Services, an Evansville, Ind.-based solution provider.

"The services are probably most important to us. That's our core business. IBM is a good example with their security initiative with ISS. It's a golden opportunity," Albright said.

One Size Doesn't Fit All

The research clearly shows that large vendors won't see value in a one-size-fits-all channel program because solution providers often sell only a portion of their product portfolio and, in many cases, they have different needs for different products from the same vendor, Elbaum said.

For example, a solution provider might sell a vendor's servers or laptops, but not its storage or software offerings. If a vendor has a single channel program for all those partners, it may be hurting itself.

The study also found that VARs did not give vendors good grades in one area because they view them as a strong performer on a broad level. That allowed vendors with small market share to score well in a particular product category if a larger vendor isn't addressing customers' concerns in that specific area. Consider the case of Super Micro Computer Inc. in San Jose, Calif.

IPED found that the vendor, which focuses on custom systems, finished seventh in market share among x86 server vendors in terms of closing deals in the first half of the year, but Super Micro finished first in the Affinity Index Score in that area.

"Super Micro has been very supportive of the channel," said Amax's Huang. "They always release the latest and greatest in time with a lot of choices, and they've been doing a good job supporting the channel in both pre- and postsales."

Thus far, Super Micro hasn't capitalized on its strong showing by closing more deals with VARs, but the potential is there, Elbaum said. Solution providers planned to close only 0.4 percent of the value of all x86 server deals in the second half of the year with Super Micro, after having closed 0.5 percent of the value of all deals in the first half. That indicates that the company could be underserving solution providers, Elbaum said.

Meanwhile, it appears that Hewlett-Packard Co. is forging ahead as a market leader with server-selling solution providers. VARs plan to close x86 server deals with HP 37.5 percent of the time in the second half of 2008, compared with 34.8 percent of actual closed deals in the first half of the year. HP finished a close second behind Super Micro in the Affinity Index for x86 servers.

In the Unix server market, HP showed even greater market-share gains. VARs planned to close 45.8 percent of all server proposals with HP in the second half of the year. In the first six months of 2008, HP closed 35.8 percent of Unix server proposals. Not so coincidentally, HP's Channel Affinity Index score in Unix/Linux Servers (626) was dramatically higher than the closest competitor, IBM (467).

"HP's Unix servers are definitely a solid offering," Geier said. "They've worked very well with the channel there. It's easier to get access to all the things we need."

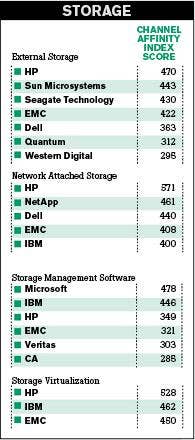

In external storage products, HP was only the sixth vendor in terms of planned deal-closing market share in the second half of the year, at 5.8 percent of all proposals. But that number was up from 3.6 percent of actual deals closed in the first half. HP finished first in the Channel Affinity Index with a 470 score in External Storage, edging out Sun Microsystems Inc. (443), Seagate Technology (430) and EMC (422), among others.

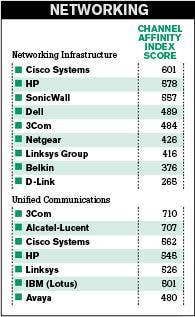

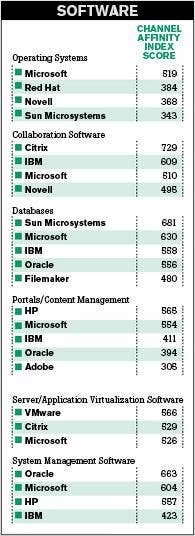

HP had the greatest overall showing, scoring the highest Affinity Index marks in six categories: Unix/Linux Servers, Laptops (508), Network Attached Storage (571), Storage Virtualization (528), Portals/Content Management (565) and External Storage. HP also finished second in x86 Servers, Desktops, Network Color Laser Printers, Monitors/ Displays and Networking Infrastructure. The Palo Alto, Calif.-based company was mentioned in 14 of 19 categories. Citrix's 729 score in Collaboration Software was the highest Affinity Index score in any category.

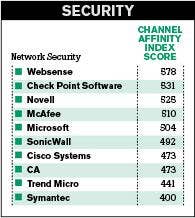

Microsoft appears in eight categories, including a first-place Affinity Index showing in Operating Systems (519), where solution providers apparently have overcome some of their Vista concerns. Among the 15 criteria scored in the Operating Systems category, VARs gave the most weight, 11 percent of the total score, to end customer brand preference. Given Microsoft's Index score, it appears VARs and end users still value Microsoft's OS more than the Linux offerings from Red Hat (384) and Suse Linux (368).

"It boils down to, especially on the desktop, what else are they going to use?" said Jay Tipton, vice president of Technology Specialists, a Fort Wayne, Ind.-based solution provider. "Anyone that says Linux is taking over the desktop is just fooling themselves unless they get a Microsoft emulator. And Microsoft would buy that up before it becomes too big anyway."

When it comes to virtualization software, Microsoft still rules, but VMware is gaining ground fast while also garnering the best Affinity Index Score in that category. Microsoft had the highest market share in first-half deals closed (42.9 percent) and in second-half deals planned to close (38.5 percent), but VMware was closing the gap (22.7 percent and 27.2 percent, respectively). VMware's Affinity Index score of 566 edged Citrix (529) and Microsoft (526) in a category where VARs chose the services attach rate (10 percent) as the most important criteria.

As the results show, channel relationships are very organic. And neither vendors nor VARs can afford to sit still, letting the market dictate when and how they should react. VARs say the 2008 Affinity Index provides a tool for both to take charge.

SOURCE: CHANNEL AFFINITY INDEX, THE INSTITUTE FOR PARTNER EDUCATION & DEVELOPMENT (IPED), A DIVISION OF EVERYTHING CHANNEL