Here’s The Annual Public Cloud And SaaS Bill In 2024: Report

Many businesses are spending between $1.2 million to $24 million on public clouds each year, while annual SaaS spending is typically between $600,000 and $12 million. CRN breaks down new customer spending results on public cloud and SaaS costs based off a new Flexera report.

Nearly one-third of cloud customers are spending over $12 million per year in public clouds—such as AWS, Microsoft Azure and Google Cloud—while another one-third of organizations are spending between $2.4 million to $12 million each year.

That’s according to Flexera’s new 2024 State of the Cloud Report, which surveyed over 750 IT professionals and executive leaders mostly representing enterprise companies headquartered in the U.S.

Looking at yearly Software as-a-Service (SaaS) spending, roughly two-thirds of businesses are paying between $600,000 and $12 million annually, while 22 percent of organizations are spending over $12 million.

[Related: Nvidia’s 10 New Cloud AI Products For AWS, Microsoft And Google]

Flexera’s findings shed light on just how much businesses are paying for SaaS and public cloud solutions typically from leading cloud computing providers AWS, Google, IBM, Microsoft and Oracle.

CRN takes a deep dive into specific data results from Flexera’s new report on just how much businesses are spending annual on cloud computing and SaaS, as well as generative AI (GenAI) adoption of cloud provider’s AI tools.

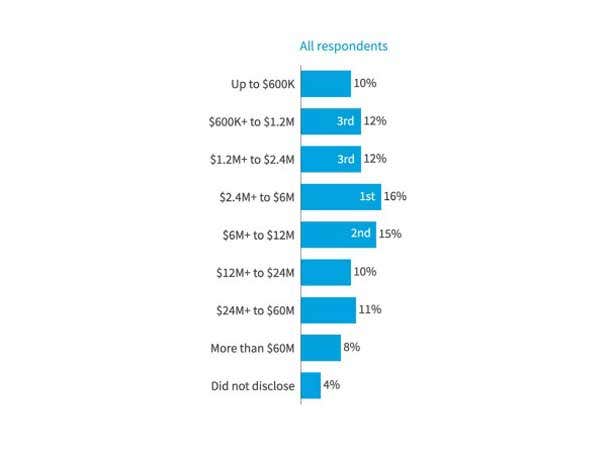

Annual Public Cloud Spending In 2024

As public cloud adoption continues to accelerate in 2024, Flexera asked its 753 respondents who mostly worked at companies with 1,000 to 10,000 employees how much they spend yearly on public clouds.

Approximately 10 percent are spending $600,000 or lower, 12 percent are spending between $600,000 and $1.2 million, while another 12 percent are spending between $1.2 million and $2.4 million.

Moving up the spending range, 16 percent of respondents report public cloud spending between $2.4 million and $6 million, 15 percent spend between $6 million and $12 million, and 10 percent are spending between $12 million and $24 million.

At the top of the spending tier, 11 percent of businesses are spending between $24 million and $60 million, while 8 percent of respondents report spending over $60 million on public clouds annually.

Click through for information annual spending on public clouds, SaaS and generative AI.

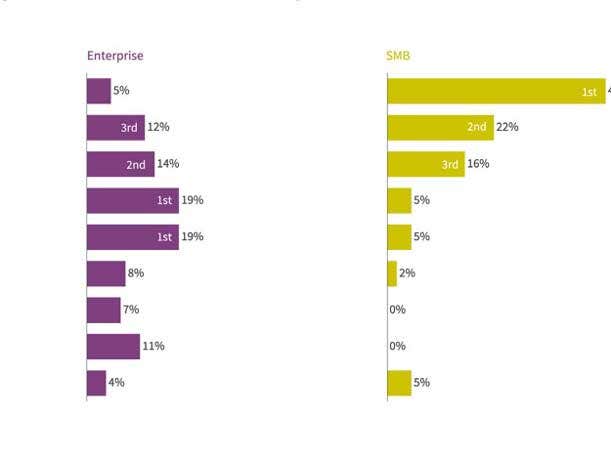

Annual Public Cloud Spend: Enterprises Vs. SMBs

The annual spending levels on public cloud between enterprises and SMBs differ vastly.

Well over half of SMBs—61 percent—are spending less than $1.2 million annually on public clouds, compared to only 15 percent of enterprise.

Less than 10 percent of SMBs are spending over $6 million annually on the public cloud. Comparatively, over half of enterprises—53 percent—are spending at least $6 million or more on an annual basis.

Flexera said there was a 21 percent increase in 2024 year over year in organizations spending $1 million or more per month on public clouds.

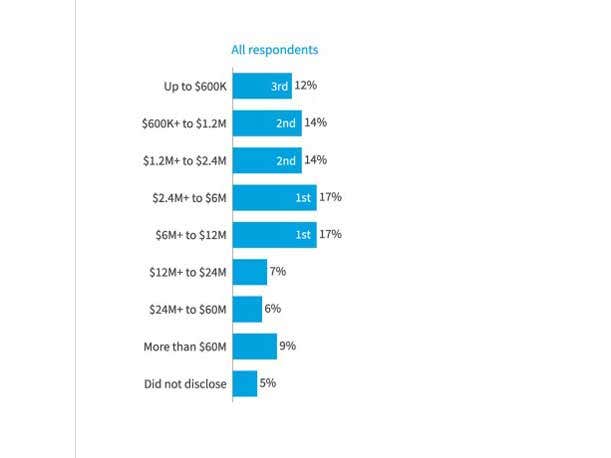

Annual SaaS Spending

Flexera said SaaS adoption is at an all-time high, but businesses face challenges such as cost management.

Regarding annual spending on SaaS, approximately 12 percent of respondents are spending $600,000 or lower, 14 percent are spending between $600,000 and $1.2 million, while another 14 percent are spending between $1.2 million and $2.4 million.

Moving up the spending range, 17 percent of respondents report SaaS spending between $2.4 million and $6 million, 17 percent spend between $6 million and $12 million, and 7 percent are spending between $12 million and $24 million.

At the top of the spending tier, 6 percent of businesses are spending between $24 million and $60 million on SaaS, while 9 percent report spending over $60 million on SaaS annually.

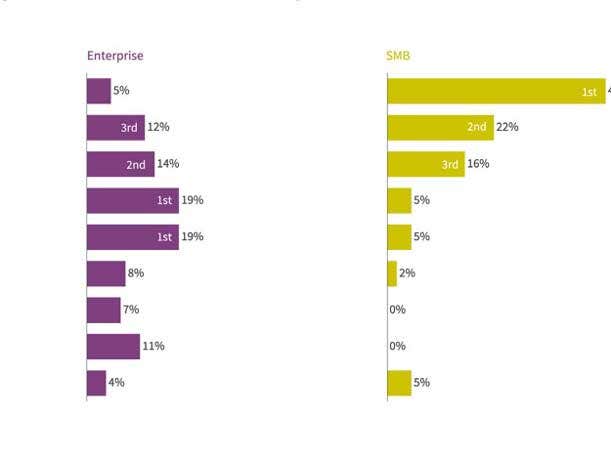

Annual SaaS Spend: Enterprises Vs. SMBs

Similar to public cloud spending, there’s a large difference in the annual amount of money enterprises are spending on SaaS compared to SMBs.

Approximately 45 percent of SMB companies spend $600,000 or less on SaaS each year, compared to only 5 percent of enterprises.

Another 38 percent of SMB companies are spending between $600,000 to $2.4 million in SaaS. Comparatively, 38 percent of enterprises spend between $2.4 million to $12 million each year on SaaS.

There are basically no SMBs who are spending over $12 million per each on SaaS, while 26 percent of enterprises are spending over $12 million annually.

Interestingly, 11 percent of enterprises are spending more than $60 million each year on SaaS.

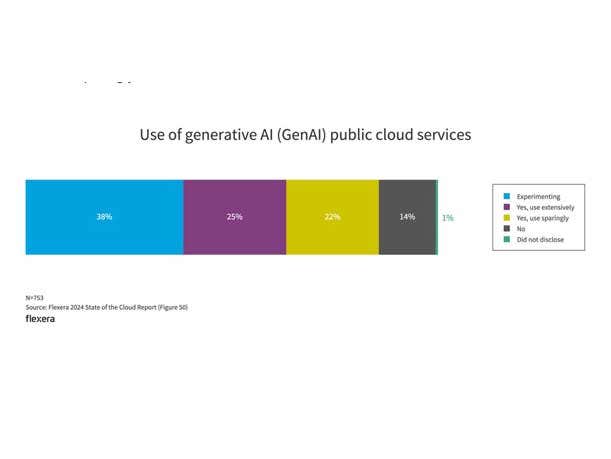

Who's Using GenAI Public Cloud Services?

Generative AI is one of the most popular topics in the tech industry this year. The largest cloud providers in the world—Amazon, Google and Microsoft—are pouring millions of dollars into creating new GenAI solutions helping to fuel the AI boom.

Flexera said in the face of ongoing economic uncertainties, many organizations are investing in transformative initiatives such as generative AI.

One-quarter of respondents say they are already using GenAI services from cloud providers extensively.

About 22 percent are using GenAI public cloud services sparingly.

Most respondents, 38 percent, are currently experimenting with GenAI public cloud services.

Fourteen percent of businesses reported not using any GenAI public cloud services.

Overall, nearly half of all respondents are using some form of GenAI cloud service.

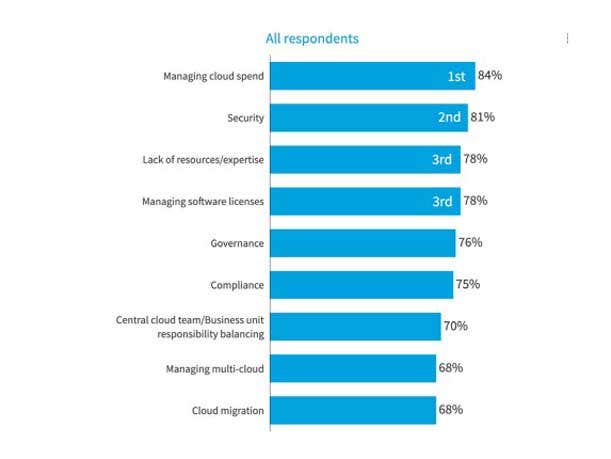

The Top Cloud Challenges Of 2024

For the second year in a row, managing cloud spend topped cybersecurity as the top challenge facing all organizations leveraging cloud computing.

This shift is likely due to organizations becoming more comfortable with cloud security, while the increased use of cloud services leads to increased spend. Flexera said managing this spend has become a priority for organizations.

Approximately 84 percent of businesses reported better managing cloud spending was their biggest cloud challenge, followed by 81 percent who said security.

Other top cloud challenges facing organizations today are a lack of resources and expertise, as well as managing software licenses—both at 78 percent.

Cloud governance, regulatory compliance, cloud migration and managing multiple clouds were also high on the list of customers top challenges in 2024.