5 Companies That Came To Win This Week

For the week ending Oct. 23, CRN takes a look at the companies that brought their ‘A’ game to the channel.

The Week Ending Oct. 23

Topping this week’s Came to Win list is Dell Technologies for launching Project Apex, the company’s long-term strategy for developing and selling as-a-service products.

Also making the list are Datto for its successful IPO on the New York Stock Exchange, Intel for ramping up its 10nm chip production and recording 100 “Tiger Lake” design wins, cybersecurity company Artic Wolf for a $200 million funding round, and systems integrator Cognizant for a key acquisition in the IoT space.

Dell Unleashes Its As-A-Service Strategy With Project Apex

Dell Technologies unveiled its long-term as-a-service strategy this week, saying the new Project Apex will impact how Dell develops products, sells solutions to customers, and enables channel partners to drive recurring revenue.

The goal with Project Apex is to simplify how customers and channel partners access Dell’s as-a-service portfolio, from servers and hyperconverged infrastructure to PCs and client technology offerings. The company is starting with the launch of the Dell Technologies Storage as a Service offering.

Project Apex will unify Dell’s as-a-service and cloud strategies, technology portfolio and go-to-market efforts to provide a consistent experience wherever a workload is running, whether it’s on-premises, at the edge or in public clouds, according to the company.

IDC forecasts that by 2024 more than 75 percent of infrastructure at the edge and more than 50 percent of all data center infrastructure will be consumed as a service.

In addition to the APEX announcement at the Dell Technologies World Digital Experience conference this week, the company debuted the Dell Technologies Cloud Platform and the Dell Technologies Cloud Console, unveiled the Cloud PowerProtect for Multi-Cloud managed service, and announced expanded pricing for pre-configured, pay-per-use products and services under the Flex On Demand financial program.

Datto Goes Public As ‘MSP’ On NYSE, Shares Trade At $27

Managed services provider, storage and data back-up vendor Datto wins applause this week for completing its long-awaited bid to go public when the company’s shares began trading on the New York Stock Exchange under the symbol “MSP.”

CEO Tim Weller rang the opening bell as shares in the cloud-based platform company opened at $27 per share. The company, which got its start in a Connecticut basement in 2007 by founder Austin McChord, expects to raise $594 million from the IPO, some of which will be used to pay off debt.

In the IPO filings Weller said the company plans to target SMB customers who look to MSPs as critical partners in their digital transformation journeys.

Cybersecurity vendor McAfee also gets a shoutout for its own IPO this week when it’s shares began trading on the NASDAQ at $20 per share.

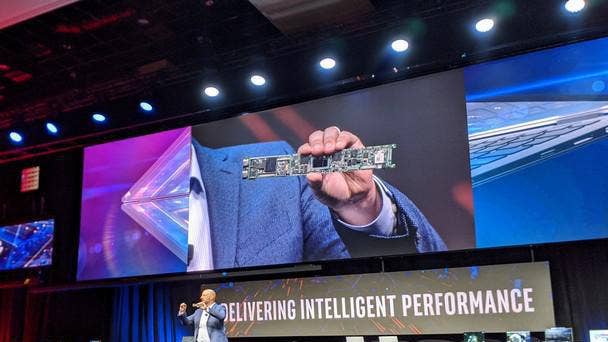

Intel Ramps Up 10nm Production, Highlights “Tiger Lake” Design Wins

Intel has started up its third 10nm manufacturing plant, the company said this week, which means that 10nm production volume will be 30 percent higher compared to earlier forecasts. Intel is also expecting 100 laptop designs to ship by the end of 2020 with its new 10nm Tiger Lake CPUs – twice the number Intel had previously forecasted.

Intel, which held its Intel Partner Connect virtual event this week, plans to launch its new Intel Partner Alliance channel program in January. This week Intel executives said the program will better reflect the diversity of business models among its partners and give them the proper recognition for growing with Intel – including better ways to maximize program benefits and earn points for redeeming products.

Intel also has begun shipping its first discrete graphics card, the Intel Iris Xe Max, while reporting its first power-on for its second discrete graphics card, code-named DG2, for the high-performance gaming segment.

And Intel has debuted new FPGA-based SmartNIC technologies that the chipmaker says will “super-charge” cloud data centers and 5G networks. The SmartNICs are part of a growing portfolio of connectivity products from Intel meant to help data center and network operators improve the performance and total cost of ownership for how data flows from one point to another.

Managed Security Company Arctic Wolf Closes $200M Funding Round

Security operations technology developer Artic Wolf disclosed this week that it closed a new $200-million funding round that puts the company’s value at $1.3 billion. The additional funding brings the company’s total financing to $348 million.

Arctic Wolf provides managed detection and response services via its cloud-native Arctic Wolf Platform.

The additional funding will be used to fuel the company’s growth, accelerate development, recruit new channel partners – the company works exclusively through indirect channel partners – and build a stronger international presence. The company also could tap into the money to make acquisitions, although there aren’t any on the immediate horizon.

Cognizant To Acquire AWS, Microsoft IoT Partner Bright Wolf

Keeping up its recent pace of strategic acquisitions, global systems integrator Cognizant this week announced a deal to acquire Bright Wolf, an industrial IoT solutions provider that partners with Amazon Web Services and Microsoft.

The acquisition is expected to boost Cognizant’s smart products offering and expertise in building and deploying industrial IoT solutions, given Bright Wolf’s proficiency in applications like asset performance management, predictive maintenance and yield optimization.

Cognizant will use Bright Wolf, based in Durham, N.C., as the hub of a new IoT innovation lab in the Raleigh-Durham/Research Triangle Park area.

The Bright Wolf deal is Cognizant’s eighth acquisition this year: Recent acquisitions include strategic service providers 10th Magnitude and New Signature.