Amazon’s AWS Q2 Earnings Preview: Cloud Sales, Profit And AI

Amazon’s second-quarter 2023 earnings report is on Thursday, with AWS’ cloud sales, operating income and artificial intelligence push set to take center stage.

Will Amazon Web Services’ revenue growth rate continue to fall? Did the world’s No. 1 cloud computing market-share leader keep its parent company Amazon [AMZN] profitable in second-quarter 2023? Does AWS have any generative artificial intelligence announcements up its sleeve during Amazon’s earnings report Thursday?

CRN breaks down these questions and more ahead of Amazon and AWS’ second-quarter 2023 financial earnings results slated for Aug. 3.

AWS is Amazon’s $85 billion cloud computing company that owns approximately 32 percent of the global cloud infrastructure services market. The Seattle-based cloud giant has witnessed some sales headwinds as of late, with AWS’ sales growth rate dropping several percentage points each quarter for the past year.

[Related: AWS Easily Beats Microsoft In $120B IaaS Cloud Market: Gartner]

AWS Q2 Earnings Estimate: $21.5 Billion

The Zacks Consensus estimate is that AWS will report net sales of $21.5 billion for second-quarter 2023, which would mark the company’s slowest sales growth rate in years.

In first-quarter 2023, AWS generated total sales of $21.4 billion, up 16 percent year over year. For the full-year 2022, AWS increased annual sales by 29 percent to over $80 billion.

Another key figure to look at is AWS’ operating income as operating expenses have increased by billions of dollars over the past several quarters.

AWS did confirm with CRN earlier this year that the cloud company would be affected by Amazon’s 9,000 layoff round in 2023. “AWS head count is higher now than it was in 2021 due to rapid growth,” AWS told CRN in April. “These role eliminations only impact a small, single-digit percentage of AWS employees.”

Wall Street and financial analysts are projecting Amazon reports second-quarter 2023 total earnings of roughly $131.5 billion, which would represent an 8.5 percent sales increase year over year.

Here are the five most important things to watch for during Amazon and AWS’ second-quarter 2023 earnings results on Aug. 3, as well as the recent results of Google Cloud’s and Microsoft’s quarterly earnings.

Will AWS Sales Growth Rate Continue To Be Lower?

The Zacks consensus estimate is that AWS will report net sales of $21.5 billion for second-quarter 2023, which would represent only a 9 percent year-over-year sales growth rate.

This would mark AWS’ slowest sales growth in years. AWS’ year-over-year revenue growth rate has been dropping by several percentage points each quarter.

In first-quarter 2022, AWS sales increased 37 percent year over year to $18.4 billion.

In second-quarter 2022, AWS revenue grew 33 percent year over year to $19.7 billion.

In third-quarter 2022, AWS sales increased 27 percent year over year to $20.5 billion.

In fourth-quarter 2022, AWS revenue grew 20 percent year over year to $21.4 billion.

In first-quarter 2023, AWS sales increased 16 percent year over year to $21.4 billion.

The Takeaway: If AWS reports single-digit cloud sales growth or anything close to it, its longtime cloud market dominance run might be put into question.

Can AWS Get A Hold On Operating Income And Expenses?

AWS’ operating expenses have ballooned over the past several quarters as the company pours billions each quarter into expanding its global market reach and customer base.

During its most recent quarter, AWS’ operating expenses increased to $16.2 billion in first-quarter 2023, an increase of $4.3 billion compared with operating expenses of $11.9 billion in first-quarter 2022. This led to AWS’ operating income to fall from $6.5 billion in first-quarter 2022 to $5.1 billion year over year.

Similarly, in fourth-quarter 2022, AWS’ operating expenses increased to nearly $16.2 billion, an increase of 30 percent compared with $12.5 billion year over year. This led AWS’ operating income in fourth-quarter 2022 to decrease to $5.2 billion, down from $5.3 billion year over year.

For full-year 2022, AWS’ operating expenses hit $57.3 billion, up from $43.7 billion in 2021.

The Takeaway: On a quarter-over-quarter basis, AWS’ operating expenses have been basically flat at $16.2 billion over the past two quarters. Any significant increase in AWS’ operating expenses has hopefully passed.

Can AWS Keep Amazon Profitable?

AWS has been critical to Amazon’s ability to make a profit in recent years.

AWS parent company Amazon generated $127.4 billion in sales during first-quarter 2023 with operating income of $4.8 billion. In first-quarter 2023, AWS reported $5.1 billion in operating income, meaning AWS kept Amazon profitable during the quarter.

For fourth-quarter 2022, Amazon captured $149 billion in revenue with operating income of $2.7 billion. AWS’ operating income was $5.2 billion during the quarter, meaning AWS was as important as ever to keep Amazon a profitable company.

For all of 2022, Amazon reported operating income of $12.2 billion. AWS’ full-year 2022 operating income was $22.8 billion.

The Takeaway: AWS is the main reason why Amazon is a profitable technology conglomerate. With AWS sales potentially decreasing in second-quarter 2023, it will be interesting to see if Amazon can still become a profitable company.

Is A New Gen AI Announcement In Store?

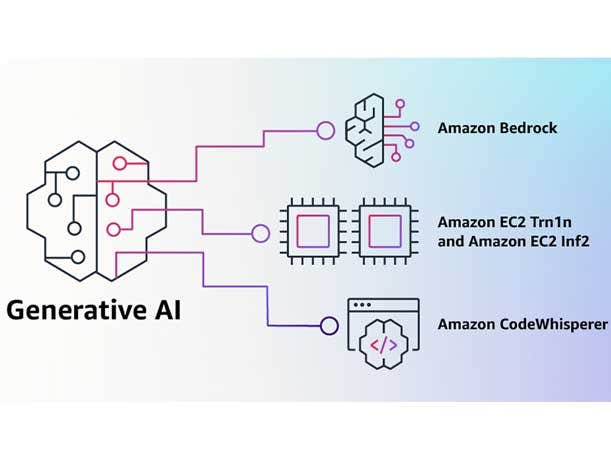

AWS’ most bullish push this year is undoubtedly artificial intelligence, specifically around the generative AI market. The company has launched new AI-specific programs, products, services and formed brand-new partnerships with vendors in a move to plant its generative AI stake in the ground.

On the innovation front, AWS launched Amazon Bedrock for building and scaling generative AI applications; new ML-powered features in Amazon SageMaker; and new Amazon EC2 Inf2 instances aimed at lowering the cost of running large-scale AI workloads.

To drive AI sales, AWS started providing resources to channel partners to help them begin or advance their generative AI customer journeys, including accelerators such as AWS Solutions Library, AWS Solutions Construct and Partner Solutions Factory.

“Generative AI has burst onto the scene and promises to significantly accelerate machine learning adoption,” said Amazon CEO Andy Jassy earlier this year. “We have been working on our own LLMs [Large Language Models] for a while now, believe it will transform and improve virtually every customer experience, and will continue to invest substantially in these models across all of our consumer, seller, brand and creator experiences.”

The Takeaway: There’s a possibility that Amazon and AWS unveil some sort of generative AI announcement, whether it be a new partnership, service or even a way of tracking momentum during its second-quarter 2023 earnings call on Thursday.

How Will AWS Stack Up Against Microsoft And Google Cloud?

AWS’ two biggest cloud rivals, Google Cloud and Microsoft, both reported their quarterly earnings results last week.

Google Cloud had a strong second-quarter 2023 by generating over $8 billion in revenue, up 28 percent year over year compared with $6.28 billion in second-quarter 2022.

In addition, Google Cloud generated record operating income of $395 million during second-quarter 2023. During the same quarter one year ago, Google Cloud reported an operating loss of $590 million. This means Google Cloud improved its operating income by nearly $1 billion year over year during second-quarter 2023.

Microsoft does not provide Azure sales figures. The company includes Azure sales alongside server products and other cloud services in its Intelligent Cloud business unit.

Microsoft’s Intelligent Cloud unit reported sales of $24 billion, up 15 percent year over year. Azure and other cloud services revenue grew 26 percent year over year. Operating income increased 20 percent year over year to $1.7 billion.

The Takeaway: Google Cloud reported 28 percent sales growth year over year, while Microsoft reported a 15 percent growth rate. It will be interesting to see if AWS’ growth rate is on par with Google and Microsoft, or if it’s drastically lower—potentially 9 percent—like financial analysts are predicting.