Amazon Vs. Microsoft Vs. Google: Cloud Earnings Faceoff

Here’s a breakdown of AWS, Microsoft and Google Cloud’s recent earnings results comparing revenue totals, cloud growth, operating income, and global market share.

The three largest cloud providers on the planet have each reported their financial results for the final three months of 2022, as CRN compares cloud revenue, sales growth, operating income, and total worldwide cloud market share for Amazon, Google and Microsoft.

Each of these three cloud titans shined in their own way during fourth quarter calendar year 2022, with Google witnessing the most cloud sales growth, Microsoft having the best operating income performance, and Amazon winning the most market share.

Amazon and Google reported their fourth quarter 2022 financial earnings results this month, while Microsoft also recently unveiled the results for its second fiscal quarter 2023. For all three tech giants, these quarterly numbers reflected earnings results for October through Dec. 31, 2022.

[Related: AWS Q4 Earnings Takeaways: Slow 2023 Ahead, Amazon Layoffs]

AWS, Google Cloud, Microsoft Azure

Amazon’s cloud business is Amazon Web Services (AWS), while Google’s cloud arm is Google Cloud. Microsoft still does not provide sales figures for its public cloud Azure business. Microsoft includes Azure revenue as part of its Intelligent Cloud segment.

In addition to Amazon, Google and Microsoft reporting their recent earnings, new cloud market share data for fourth quarter 2022 was released this week by IT market research firm Synergy Research Group.

Enterprise spending on cloud infrastructure services reached $61.6 billion in the fourth quarter of 2022, with AWS, Microsoft and Google leading the way, according to Synergy’s market data.

In aggregate, Amazon, Microsoft and Google accounted for 66 percent of the worldwide market. Synergy predicts that the cloud market will continue to grow strongly over the coming years.

CRN breaks down the three cloud leader’s latest earnings results by comparing total cloud revenue, cloud sales growth, operating income and global cloud market share.

Total Cloud Revenue

AWS: $21.4 Billion

Microsoft: $21.5 Billion

Google: $7.3 Billion

Amazon Web Services and Microsoft appear to be neck-and-neck in terms of total cloud sales during the final quarter of 2022. However, Microsoft does not break out its Azure cloud sales numbers. Instead, Azure sales are included in Microsoft’s Intelligent Cloud segment which also includes server products and other cloud services.

AWS generated total sales of $21.4 billion for the Seattle-based cloud giant in fourth quarter 2022.

Microsoft’s Intelligent Cloud business generated $21.5 billion in revenue during the last three months of 2022 for the Redmond, Wash.-based company.

Mountain View, Calif.-based Google Cloud generated total sales of $7.3 billion during the fourth quarter of 2022.

Cloud Sales Growth

Google Cloud: 32%

AWS: 20%

Microsoft: 18%

Google Cloud continues to grow sales at a faster pace than Microsoft and AWS, although it’s important to note that Google’s total cloud revenue is smaller than its competitors.

Google Cloud’s $7.3 billion in revenue represents a 32 precent increased year over year compared to $5.5 billion in fourth quarter 2021.

AWS sales of $21.4 billion represents a 20 percent increase year over year compared to $17.8 billion in fourth quarter 2021.

Microsoft’s Intelligent Cloud segment generated $21.5 billion in sales, up 18 percent year over year compared to $18.3 billion. Microsoft said Azure and other cloud services revenue increased 31 percent year over year but did not provide exact Azure figures.

Operating Income

Microsoft: $8.9 Billion

AWS: $5.2 Billion

Google Cloud: $480 Million Loss

Both AWS And Microsoft Intelligent Cloud segment reported generated solid operating income, while Google Cloud has yet to turn a profit.

Operating income for Microsoft’s Intelligent Cloud segment reached $8.9 billion, up from $8.3 billion year over year.

AWS reported operating income of $5.2 billion, slightly down year over year compared to $5.3 billion in fourth quarter 2021.

Google Cloud reported an operating income loss of $480 million. However, this operating loss was much lower than the $890 million loss Google Cloud generated in fourth quarter 2021. Google Cloud’s quarterly operating loss has been steadily declining year after year.

“Google Cloud remains very focused on its path to profitability,” said Google CEO Sundar Pichai during the company’s earnings call.

Cloud Market Share For Q4 2022

AWS Q4 2022 Market Share: 33%

Microsoft Q4 2022 Market Share: 23%

Google Q4 2022 Market Share: 11%

AWS still remains the dominant cloud infrastructure services market share leader, although Microsoft is gaining share, according to new data from IT market research firm Synergy Research Group.

Amazon, led by AWS, is No. 1 in terms of cloud services market share during the fourth quarter 2022—winning 33 percent market share. However, this represented flat year over year share growth compared with AWS’ 33 percent share in fourth quarter 2021, according to data from Synergy Research.

Microsoft ranks No. 2 in cloud market share by capturing 23 percent share in fourth quarter 2022. Microsoft’s share jumped by 2-points year over year, from 21 percent share in fourth quarter 2021 to 23 percent share.

Google, led by Google Cloud, ranks No. 3 in cloud market share by winning 11 percent market share in fourth quarter 2022. This represents a 1-point increased compared to Google’s 10 percent share of the cloud market in fourth quarter 2021.

Amazon, Google, Microsoft Leaders Remarks On Layoffs

Three of the largest and most critical technology conglomerates in the world—Amazon, Google and Microsoft—all recently announced massive layoffs.

On a worldwide basis, Amazon is laying off 18,000 employees, Google is cutting 12,000 team members and Microsoft is letting go of 10,000 of its staff. These layoffs total roughly 40,000 employees being let go from the three companies which will occur mostly in the first quarter of 2023.

Amazon CEO Andy Jassy: ‘Hardest Decision’ He’s Ever Made

Amazon CEO Andy Jassy said terminating 18,000 employees was the “hardest decision” he’s ever been part of. “Those [layoffs] were all done with an eye toward trying to streamline our cost but still be able to invest in the things that we think really matter over the long term,” said Jassy.

Amazon said it took a $640 million hit—mostly in severance costs—during the quarter as part of the massive employee layoffs unveiled in January.

Google Will Hire In ‘Priority Areas’ In 2023

Google CEO Sundar Pichai said the 12,000 layoffs at his company will cost roughly $2 billion in severance charge during its current first quarter 2023. “We did a rigorous review across criteria and functions to ensure that our people and roles are aligned with our highest priorities as a company and we announced a reduction in our workforce,” Pichai said during the company’s earnings call.

However, Google’s Chief Financial Officer (CFO) Ruth Porat added that her company will “continue hiring in priority areas with a particular focus on top engineering and technical talent,” in 2023.

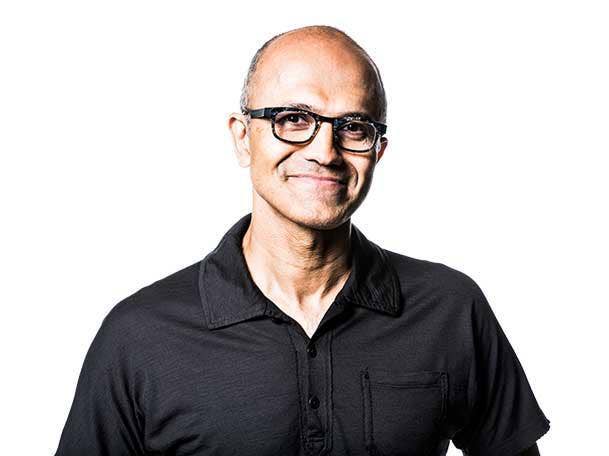

Microsoft To Increase Headcount By End Of Q4

Microsoft CEO Satya Nadella didn’t speak much regarding his company’s 10,000 layoffs during Microsoft’s earnings call, although Microsoft CFO Amy Hood said her company will be growing its headcount over the next six months.

“By the time that we get to the end of [fiscal fourth quarter 2023], you’ll see very moderated headcount growth on a year-over-year basis in addition to some the prioritization decisions we’ve made,” said Hood.