HPE CEO Antonio Neri On GreenLake’s Lowest Cost-Per-Workload Advantage And Why It Is ‘Better Than Public Cloud’

HPE CEO Antonio Neri Wednesday argued that the GreenLake edge-to-cloud platform with its lowest-cost-per-workload advantage and pay-per-use metering capability is “even better than public cloud.”

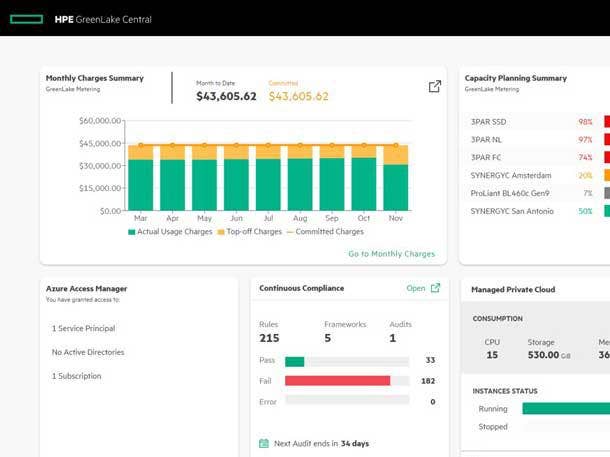

HPE’s GreenLake Metering Capability Does Away With Public Cloud ‘Overprovisioning’

Hewlett Packard Enterprise CEO Antonio Neri Wednesday said the HPE GreenLake model provides the lowest cost per workload with a “true metering” capability that tops public cloud overprovisioning.

HPE’s 2017 acquisition of Cloud Cruiser, the basis of the GreenLake pay-per-use metering functionality, provided the company with a “huge difference” over leasing models from competitors and an even bigger differentiator versus public cloud, said Neri at HPE’s annual securities analyst meeting.

“It is true metering,” said Neri. “I actually would argue it is even better than the public cloud, because when you go to the public cloud you tend to overprovision resources. In our case, we actually can scale that resource exactly to the need of that application and meter that and charge for that. So now customers can add capacity on demand.”

The HPE GreenLake pay-per-use model, in fact, actually provides the “lowest cost per workload,” said Neri. “That is especially true when an application requires significant data egress and ingress, which is the majority of the cost—not the cost of compute—or in cases where workloads are largely predictable, which means you don’t have to scale up or down all the time or if data protection services are needed.”

Here’s a look at other “big advantages” that Neri spoke about at HPE’s annual securities analyst meeting.

HPE’s Partner Ecosystem Is ‘Core’ To The GreenLake Strategy

HPE’s partner ecosystem is a “big advantage,” with a 75 percent increase in year-over-year growth in the number of partners actively building and selling the HPE GreenLake edge-to-cloud platform.

“Our partner ecosystem is core to our strategy,” said Neri. “We have great interest from our partners, many of whom want to build their entire business and business solutions on the HPE GreenLake platform. This includes distributors, value added resellers, systems integrators, ISVs and service providers.”

A big reason for the significant adoption of GreenLake by partners is HPE’s channel commitment and its decision to build GreenLake from the start to be sold with and through partners with open cloud APIs, said Neri. “These APIs, include security, hybrid orchestration, metering, billing, services and also a marketplace where they can offer their unique solutions,” said Neri.

HPE has partners of all sizes, including Green Tea Technology, a born-in-the-cloud company that has singled out HPE’s billing and metering capability as a big advantage over competitors.

Neri, for his part, praised Green Tea Technology for selling HPE GreenLake to startups and small to medium businesses.

“Green Tea actually reflects a new breed of channel partner that is embracing hybrid selling because they see the demand not just across the large enterprises, but from organizations of all sizes,” he said.

HPE’s Sustainability Advantage With HPE Financial Services

HPE GreenLake’s sustainability advantage is driving customer adoption with the ability to flexibly scale IT resources driving significant cost efficiencies, said Neri.

“Because customers can flexibly scale their IT to meet their business demand, the platform actually reduces IT inefficiencies, which are a significant source of cost and environmental impact for many organizations,” said Neri. “This is important because our customers are actually increasingly linking digital transformation with sustainable business transformation.”

For example, one multinational chemical company is transitioning to an HPE GreenLake solution that is expected to result in a reduction of more than 2,000 tons of carbon dioxide per year, said Neri. “That is going to happen because our solution only uses half of the rack space with 17 percent less energy, while reducing the number of maintenance contracts and cost to the customer because we offer them a complete solution,” he said.

HPE Financial Services is also driving that sustainability advantage with a trade-in program that repurposes IT assets from customers through HPE technology renewal centers around the world, said Neri.

In 2021, of the three million IT assets recovered by HPE Financial Services, 85 percent got a “second life,” driving an additional revenue stream for HPE while at the same time reducing customer costs, waste and carbon footprint, said Neri.

HPE’s Aruba Advantage With Expanded Edge Market Opportunities

HPE’s Aruba edge business is opening the door to new GreenLake opportunities with a plan to move into the core data center switching market and further into security, said Neri.

The core data center switching and security push will increase HPE Aruba’s total addressable edge market opportunity from $48 billion to $91 billion by 2025, said Neri.

The HPE GreenLake edge-to-cloud architecture has opened the door for HPE to “build a modularized set of (core data center switch) product offerings for the top of rack and eventually in the data center itself,” said Neri. “So we believe we have the right to play there, and customers are asking us to manage that with a consistent experience. That is where the Aruba experience brings us to the table because the way we manage those ports, whether it is in the branch, the campus or top of rack, is the same thing.”

The switching additions would build out the HPE Aruba portfolio into the upper-most reaches of the data center to address even the most data intensive hyperscaler and enterprise networking capabilities.

With integration of Aruba into HPE GreenLake, HPE now has 65,000 GreenLake customers, targeting nearly $1 billion of annualized recurring revenue this year with $7.7 billion in total contract value.

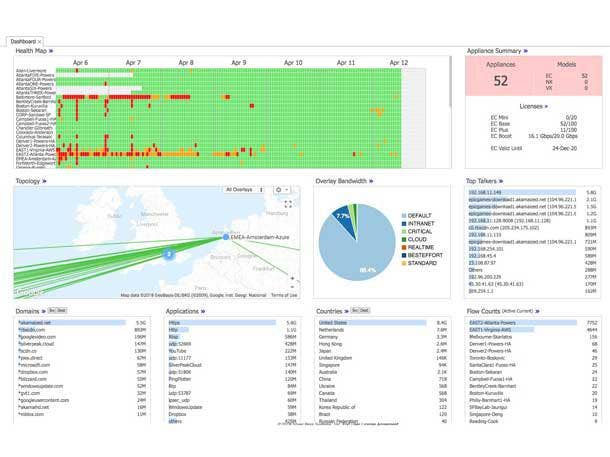

“Scale matters,” said Neri. “Today HPE GreenLake enables more than 120,000 users, powers more than two million connected devices, and here is the trick: it actually manages more than one exabyte of data for our customers.”

A 96 Percent Customer Retention Rate

HPE GreenLake with “industry-leading operational support and managed services” is driving a 96 percent customer retention rate, said Neri.

Customers “love” the platform and are expanding and renewing their GreenLake cloud services, said Neri.

Nokia, for example, is using HPE GreenLake to help Nokia Cloud and Network Services advance its 5G strategy, said Neri. “The HPE GreenLake platform today offers more than 10,000 Nokia developers a flexible and elastic cloud platform, making them more agile,” he said.

HPE GreenLake—which doubled the number of net new GreenLake logo wins in the most recent quarter—spans all industries and geographies, said Neri. “Our platform draws customers in and enhances the relevance of our entire HPE portfolio,” he said.

A Growing Hybrid Cloud Market Opportunity

The HPE hybrid cloud market opportunity is growing 1.8 times from about $150 billion to more than $250 billion by 2025 as GreenLake expands into new market segments.

Not only that, but hybrid cloud adoption is growing from 50 percent of customers preferring hybrid multi-cloud today to about 70 percent of customers within three years, according to a Bain and Company survey, said Neri.

Neri, in fact, was one of the first to predict the hybrid cloud opportunity with HPE, as far back as six years ago declaring the hybrid cloud mandate. “In 2016 we declared the world would be hybrid,” he said. “Thank about it—more than six years ago!”

Furthermore, HPE committed in 2019 to shift its entire portfolio to an as-a-service model by 2022. HPE, in fact, this year followed through on that pledge, completing the as-a-service transition with its entire portfolio.

“We have shifted both our product and services mix as well as how we deliver that mix to our customers,” said Neri. “I am personally incredibly proud that we have taken decisive and important actions to transform HPE. Our evolution to a platform-based model fueled by a software- and services-rich portfolio is already delivering strong results that translate into value for our shareholders.”

HPE’s total orders—including as-a-service bookings—are the highest ever this year, said Neri, “demonstrating enduring demand for our differentiated edge-to-cloud platform.”

HPE is on track to deliver its largest annualized revenue run rate ever with the highest earnings per share based on continuing operations since HPE became an independent company in 2015.

Lowest Cost Per Workload With A Unified Cloud Experience

HPE’s GreenLake pay-per-use platform is providing the “lowest cost per workload” with “proven cost advantages” in the most demanding application scenarios, said Neri.

“That is especially true when an application requires significant data egress and ingress which is the majority of the cost—not the cost of compute—or in cases where workloads are largely predictable, which means you don’t have to scale up or down all the time or if data protection services are needed,” said Neri.

The hybrid multicloud adoption for the most demanding workloads is accelerating across many industry verticals, said Neri.

“While the world is already hybrid—there is no discussion about that—and is getting more so, we know the cloud experience restricts those organizations from achieving the cloud experience they need,” he said. “And what is the result? The result is a fragmented operating model with data silos and disconnected data sets.”

Customers are looking for a way to “unify” the multi-generational IT strategy and journey with a “consistent cloud experience across all their applications and data,” said Neri. “These are exactly the challenges HPE’s edge-to-cloud strategy is designed to solve.”

HPE GreenLake provides a foundation for customers to drive the data-first digital transformation aimed at simplifying and modernizing infrastructure with “one unified hybrid cloud services experience,” said Neri. “It empowers customers to access, analyze and extract value from their data across the public cloud, data centers—wherever they are—more and more in colocation [facilities,] and, as we think about the future, more and more at the edge.”

A Recession Will Drive Further GreenLake Momentum

With the threat of a recession looming, Neri predicted that an economic downturn would cause customers to embrace GreenLake adoption at a more rapid clip.

“If we have a recession—which people are thinking about these days—then that will actually accelerate [GreenLake momentum] because people are not going to stop [investing in digital transformation],” he said. “They are not going to say, ‘I am not going to do anything.’ People have to continue to accelerate the digital transformation. I think that is a tailwind for us to get that adoption faster.”

HPE intends to grow GreenLake “very, very rapidly,” with a plan to increase investments in the platform by about 27 percent in the new fiscal year, said HPE CFO Tarek Robbiati. This as HPE expects its GreenLake annualized recurring revenue run rate to grow at a compound annual growth rate of 35 percent to 45 percent from Fiscal Year 2022 to Fiscal Year 2025.

The increased investment comes with the consumption model driving a “richer mix of software and services” that is increasing both “durable recurring revenues and higher gross margins,” which will drive greater free cash flow, said Neri.

“We have a strategy that others try to emulate,” said Neri. “We see that every day: everybody is trying to copy what we do. But the experiences we offer are distinctive. We have created a performance culture that drives results. I often say that HPE does not wait for the next big thing to happen. We accelerate what comes next for our customers, our company and our shareholders.”