Salesforce Co-CEO Marc Benioff: Our Business Model Has ‘Resilience and Durability’

“We‘ve delivered really strong revenue growth, profitability and cash flow, showing yet again the resilience and durability of our business model in this economic environment,” Salesforce co-CEO Marc Benioff said on an earnings call this week.

Salesforce co-CEO Marc Benioff used his company’s quarterly earnings call this week to detail a more “measured” customer buying environment, drum up interest for his marquee Dreamforce conference, hint at future acquisitions and defend the “resilience and durability” of his company’s business model.

The San Francisco-based front-office software vendor expects to keep benefitting from the ongoing rush of business-customers adopting digital transformation tools, Benioff said – a trend that has also benefited partners of Salesforce and other software vendors.

“You saw the results for the quarter,” Benioff said on an earnings call Wednesday. “We‘ve delivered really strong revenue growth, profitability and cash flow, showing yet again the resilience and durability of our business model in this economic environment.”

[RELATED: SALESFORCE CUTS GUIDANCE, REPORTS ‘MEASURED’ CUSTOMER BUYING AMID ECONOMIC UNCERTAINTY]

What Did Marc Benioff Say On Salesforce’s Earnings Call?

On the plus side, during the second quarter of Salesforce’s fiscal year – a quarter that ended June 30 – Slack’s $381 million in total revenue was better than expected. The “professional services and other” segment beat expectations with $577 million. And Salesforce had its fifth consecutive quarter with 40-plus percent growth in the number of 100,000-plus customers on Slack.

But Tableau saw decelerated growth, Salesforce executives cut their guidance around what revenue to expect for the fiscal year and they said customers are in a “more measured buying environment,” with longer sales cycles, more layers for getting deals approved by customers, deal compression and weakness among small and midsize businesses.

His words and Salesforce’s performance appear to have kept up some investment banks’ good feelings toward the company.

“Front office software will clearly see some demand hits around the edges given the macro and CRM‘s (Salesforce’s) guidance will be scrutinized on the Street as possibly the first shoe to drop in a broader slowdown in the software world over the next 6 to 9 months given the macro,” investment bank Wedbush said in a report. “That said, we believe this is more of a modest resetting of expectations given the macro and is a prudent approach given the Rubik’s Cube backdrop that could prove to be a conservative outlook from CRM.”

According to a report from Morgan Stanley, a survey the investment bank did during the second quarter “supports the notion Digital Transformation initiatives remain high on the CIO priority list (#4 overall), largely focus on front office,and is expected to be amongst the most defensible projects (#3 most defensive),” good news for Salesforce and its partners.

“This gives credence to Salesforce‘s argument the demand didn’t go away, but is just taking longer to convert,” according to the Morgan Stanley report.

Likewise, Gireesh Sonnad, CEO of New York-based Salesforce partner Silverline, told CRN in a recent interview that a new practice around the media and entertainment industry and growth in Canada have contributed to 20-plus percent growth in sales year over year expected by Silverline.

“We’re having a really, really nice growth year, which we’re excited about,” Sonnad said. “We’re surpassing the growth of last year, which is exciting. And really feeling like we’re coming out of some of the stickiness that we saw in the last couple of years, if you will, which has been great.”

Here’s more of what Benioff had to say on the call.

Exchange Rate Hit

You saw the results for the quarter. We’ve delivered really strong revenue growth, profitability and cash flow showing yet again the resilience and durability of our business model in this economic environment.

Revenue in the quarter was ($)7.7 billion up 22 percent year over year, or 26 percent growth in constant currency.

We had a great quarter but, yet again, the dollar had an even stronger quarter. And we continue to see the impact on foreign exchange and currency fluctuation on our financials. For Q2, we saw approximately $250 million of headwind revenue, which is roughly $50 million more than we assumed in our guide last quarter.

And we now expect a total of $800 million foreign exchange headwind year over year for the full fiscal year. Operating margin in the quarter was 19.9 percent. And we delivered ($)334 million in operating cash flow.

Our remaining performance obligation – or the total undelivered contract value that we have with our customers – is really an incredible ($)41.6 billion. And this is revenue signed. It‘s not yet recognized.

More ‘Measured’ Customer Buying

Over the last few months, I’ve met with hundreds of CEOs with economists, business leaders, political leaders and other experts about their business and where they see this global economy heading.

And I don‘t think it’s going to surprise anyone – everyone has got a slightly different answer. And it doesn‘t matter who you speak to. Could be a different geography, a different position.

Everybody sees things a slightly different way right now. But what we do now, and what I think everyone will agree on, is that digital transformation remains the No. 1 priority for CEOs, and that every digital transformation begins and ends with the customer.

That‘s what continues to drive our business forward. And it’s why Salesforce is the No. 1 CRM (customer relationship management tool) by market share globally, according to the IDC software tracker.

Now, for those of you who‘ve been on these calls with us, you know we’ve all been through a number of these economic cycles, and we‘ve especially seen that over our last 23 years.

And ones like this come around, we see customers becoming more measured in the way they buy. Sales cycles can get stretched. Deals are inspected by higher levels of management. And all of this, we began to start to see in July.

Nearly everyone I‘ve talked to is taking a more measured approach to their business. We expect these trends to continue in the near term. And we’ve reflected this in our guidance. Given the significant impact of foreign exchange and buyers being more measured, we’re revising our fiscal ’23 revenue guidance to ($)30.9 billion to ($)31 billion, or about 17 percent growth year over year, or 20 percent in constant currency.

At the same time, we‘re maintaining our fiscal year ’23 operating margin guide of 20.4 percent and expansion of 170 basis points year over year.

This is further evidence that we remain deeply committed to consistent, disciplined margin cash flow and revenue growth as part of our long-term plan to drive both top and bottom line performance. We have the right team, the right products, the right playbook for getting to ($)50 billion in revenue in fiscal year ’26.

On Executive Changes

Brian (Millham, Salesforce’s new chief operating officer) is employee number 13 and has been helping us to build this company from its earlier days. As chief operating officer, Brian is going to continue to lead our customer success organization and now adds global sales to his responsibilities.

Bringing our incredible customer success ecosystem and … sales even closer under Brian will help us to deliver the full power of Salesforce to every one of our customers in the new economy.

And we’re so fortunate that Gavin Patterson has taken on this important new role as chief strategy officer, helping us to guide our strategic direction. And thank you and congratulations to Gavin.

I‘m so grateful to Gavin who for the last two years during the pandemic has overseen one of Salesforce’s most rapid growth periods in Salesforce history. When I look back the last three years, I saw it was really only two years ago, in fiscal year ’21 when we did about I think it was about ($)5.1 billion … something like that. And then last year, I think for Q2, we did something like ($)6.3 billion. And now we’re doing ($)7.7 billion … It‘s an incredible trajectory of growth from over the last 24 months. And I couldn’t be more proud of Gavin to help us during that period and now Brian, in your COO role. … Brian, he‘s been a trusted part of our management team for over 20 years. And, look, the last time he was the head of sales was only two years ago when we went into the pandemic and went through the transition with Keith (Block, former co-CEO, who left in 2020). … I put Brian in for I think one or two quarters to run global sales. Did a fantastic job. He didn’t want to continue with it.

So we asked Gavin (Patterson, current chief strategy officer, moved from previous role of chief revenue officer) to step up from his role. … (I’m) really proud of Gavin for the last now two years. … I asked Brian if he would come in and take this forward and he agreed. And I couldn‘t be more grateful to that.

And I know we have just a trusted hand, in terms of a transition period. I couldn‘t imagine anybody who will operate the organization so seamlessly and transparently and with ease. And everybody has such a good relationship already with Brian. And here he runs our forecast calls. He’s already been a key part of our sales program. I don‘t expect any transition period at all, and I’m holding him to that, actually.

On Cut Guidance

We took the guide(ance) down, really, around two points. One (reason) is the foreign exchange environment is obviously just unprecedented. And we talked about that last quarter as well.

I think maybe we were one of the first to really see what was going on, somehow. Just being on the ground in some of these countries that have been so dramatically hit.

But to look at where we are right now with the Yen, look where we are right now with the Euro -- I think the Euro maybe just broke parity yesterday -- we‘re really in an unprecedented moment in foreign exchange.

And on the other side, as I said, and I think as the team has really emphasized, starting in July, we started to see some metrics where we‘re like, ‘Where do we exactly want to be for the year?’ And what is appropriate for us? And how do we correctly characterize where the business is?’

And that is really how we put together this guide(ance), which we think is the appropriate way to communicate the status of the business.

Preview For Dreamforce

(I’m) really going to be spending as much time as I can with customers at Dreamforce. This is our opportunity to really understand, deeply, across a wide spectrum of our customers -- geographies, verticals -- what it is that they are seeing in their own businesses. ... When you look at all the stories that we‘ve seen, especially during this pandemic surge over the last two years, it’s incredible what folks have done with their businesses.

When we get to this moment, I don’t think it’s a huge surprise that customers are more measured. Everybody is wondering exactly where the economy is going and how things are moving forward.

So this is a point where people are taking a little bit of a breath and then they will reassess. And then when they get their confidence and full vision for the next stage of their company, they come in. And until then, it‘s a lot of the transactional business that we would normally see and move forward with.

Comparing With SAP

(This quarter was) kind of a milestone. I’m a big fan of SAP, and I have a lot of respect for their business and what they’ve done in the market over the last 40, almost 50 years.

And to see our business in July do more than they reported in June, in terms of revenue, that was very meaningful to me, and I‘m very grateful and proud of our team for hitting this tremendous level of scale.

Still Acquisitive

We have such massive cash flow that I think it‘s completely appropriate for us to look at how we’re handling our dilution, for example. I think that‘s been on the table for a while.

And a lot of my conversations with investors, they bring it up. We‘ve waited for that moment. I think now is the right moment where we can say we’re going to directly address this with our first ever share repurchase (of) $10 billion. I‘m very excited about it. At the same time, I don’t think that that takes M&A (mergers and acquisitions) off the table.

I think that we continue to look for opportunities. We want to be able to use our cash constructively. This is important for us. It doesn‘t mean that we’re not going to have different kinds of guardrails for M&A. … And you can see, we‘ve picked up some great companies. Whether it was ExactTarget, which was the beginning of really augmenting Customer 360 with our Marketing Cloud.

And then moving on to MuleSoft was amazing, it really provided all the integration and the conductivity. And then on to Tableau and giving this extension of analytics. So important to so many of our largest customers. And then Slack. … We‘re a different company because we had an acquisition strategy over the last decade. I don’t think we necessarily need to break that. But at the same time, we need to be paying attention to dilution and overall, making sure that we have (a) correct capital allocation strategy as well.

Integrating With Slack

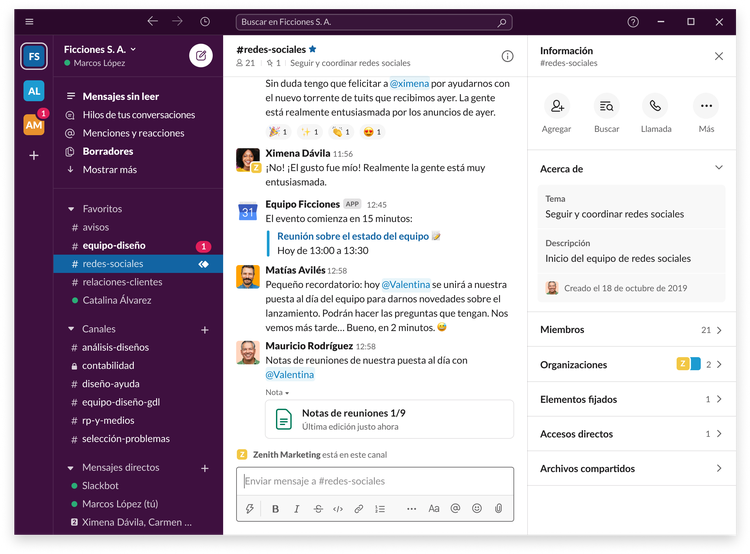

A lot of the reasons that we bought the company (Slack) – that they really could benefit from our credibility with customers and our distribution capacity have really paid out. It‘s such a great product.

And in June, you probably know that Bret (Taylor, co-CEO) and I did the world tour in New York. Many of you were there. But the day before was the Frontiers conference for Slack.

And if you haven‘t looked at the demo, you really should. Because the product has come a long way since we bought the company. It’s an incredible piece of technology … You have to see it to believe it. I mean, don‘t you agree? And for a lot of you coming to Dreamforce, I think you’re going to see how a lot of our products have become Slack-first. And also the number of integrations that we‘re going to be able to kind of bring for companies. … We’ve integrated Slack with Tableau, which is really cool, right? So you can do collaborative analytics. … A lot of our customers still haven’t seen this (spectrum of Slack integrations.)

And I think that‘s why I’m so excited about Dreamforce. Because when you come to Dreamforce, and you see the keynote, obviously, this will be highlighted.

And I think customers will see in real time what we saw, for example, at Frontiers. Even we didn‘t really have the opportunity because the code was so fresh and integrated … I think that when you start to see the incredible innovations that have happened in the Salesforce core clouds like Sales, like Service, Marketing, Commerce, even Tableau.

You combine that with Slack. You bring that into the Customer 360 with MuleSoft, the single source of truth. The way it‘s all being integrated with this customer data platform.

I don‘t think anyone else has this vision or is trying, even, to execute it. … For us, just trying to communicate our vision, this is like probably the most exciting thing going on here.

We just brought 500 of our top executives together for our second-half kickoff and to show them what we‘re so excited about. And I don’t think anybody walked away, not thinking that we‘ve not only got a world-class product that’s highly differentiated. But we‘re really where a lot of our customers are trying to get to in the next level of their customer experience. And … digital transformation is underway, but we all know that every digital transformation is beginning and ending with the customer. And you’ve got to have this beginning. You have to begin with the end in mind. That’s all about building this Customer 360. And you‘re going to see this at scale when we all get to Dreamforce.