The 10 Biggest Microsoft Channel News Stories Of 2022

Innovations in Teams, Azure and security plus radical changes to the vendor’s partner program – from New Commerce Experience to partner capability scores – defined 2022 as a pivotal year for Microsoft.

Innovations in Teams, Azure and security plus radical changes to the vendor’s partner program – from New Commerce Experience to partner capability scores – defined 2022 as a pivotal year for Microsoft.

Leadership for the Redmond, Wash.-based tech giant exits 2022 acknowledging some vulnerability to customers tightening spending and lengthening the time it takes to close a sale, but unwavering in its belief that the quality of and demand for its core technologies – including cloud computing, security and workplace applications – can prove attractive in a potential recession.

“Technology is a deflationary force in an inflationary economy,” CEO Satya Nadella said in his annual letter in October “Every organization in every industry will need to infuse technology into every business process and function so they can do more with less. It’s what I believe will make the difference between organizations that thrive and those that get left behind.”

[RELATED: Top 10 Biggest Google Cloud News Stories Of 2022]

Microsoft Changes In 2022

Entering 2023, Microsoft has to make moves to earn back some partner trust and enthusiasm – especially among smaller partners that help the vendor reign supreme with workplace IT for Main Street.

Microsoft saw revenue of $198.3 billion for its full 2022 fiscal year – which ended June 30 – an increase of 19 percent year over year ignoring foreign exchange rates.

Partners and the stakeholders will watch the company to see if it can best that growth rate this current fiscal year even with a slowing economy, growing competition in cloud and security and partner program changes that have left some partners disappointed and frustrated.

For now, let’s look back on the biggest news stories of the year for Microsoft channel partners.

10. Microsoft, AWS Spar Over Competitive Practices

This year, a volley of public digs between Microsoft and Amazon Web Services – frequently considered the No. 2 and No. 1 vendors for cloud computing market share – appeared to start with a February post by Judson Althoff, Microsoft executive vice president and chief commercial officer, on Microsoft-owned social media network LinkedIn.

Althoff posted a link on LinkedIn to an article about the Amazon Care telehealth service rolling out nationwide and brought up repeated criticism of how Amazon treats partners.

In July, an AWS executive got the chance to return the favor with a dig at Microsoft licensing policies and antitrust investigation in Europe.

Matt Garman, AWS’ senior vice president of sales and marketing, wrote on LinkedIn that Microsoft’s “recent licensing rhetoric” is “a troubling admission of the same anti-competitive tactics that many companies have been raising with them for years, but went unheeded until they were put before the European Commission.”

Justin Stenger, Microsoft’s senior commercial executive for independent software vendors and gaming, defended his company in comments on Garman’s post.

“How many cloud providers does AWS allow to run AWS software?” Stenger asked. “What Amazon IP does Amazon allow customers to run in the Microsoft Cloud?”

In August, Microsoft announced policy changes in an attempt to quell the controversy in Europe. The changes included removing the ability to outsource Services Provider Licensing Agreements (SPLAs) on data centers from Microsoft itself and cloud rivals Google, Alibaba and AWS.

In a statement to CRN at the time, an AWS spokesperson called the changes even more restrictive for competition.

Cloud rival Google also entered the fray, with the company’s vice president of government affairs and policy at Mountain View, Calif.-based Google Cloud, posting on social media network Twitter to say that Microsoft’s changes continue to lock customers into its cloud.

9. Microsoft Boosts Security Offerings

Microsoft has been asserting its position as a security giant with new innovations in its offerings – even as third-party security vendors such as CrowdStrike put the company’s products down as not secure enough for customers.

Some of Microsoft’s most interesting security investments for the year were shown during Ignite in October, including Defender for DevOps, automatic ransomware attack disruption with Microsoft 365 Defender and a new public preview of Microsoft Entra Identity Governance.

In May, Microsoft announced three expanded services under a new category called Microsoft Security Experts. In August, the company revealed Microsoft Defender Threat Intelligence and Microsoft Defender External Attack Surface Management as an expansion of its Defender security product suite.

Microsoft also flexed its security prowess this year by getting involved in world conflicts. In April, for example, the tech giant took credit for disrupting cyberattacks conducted by an attacker connected with Russia and aimed at organizations in Ukraine, the United States and European Union.

Even still, as a worldwide top supplier of infrastructure and applications, Microsoft had to contend with its fair share of attacks in 2022 as well. In March, for example, Microsoft confirmed that hacker group Lapsus$ gained “limited access” to the tech giant through a single compromised account while dismissing any elevation of risk from the attack.

**## **8. Microsoft Updates Azure Capabilities****Microsoft continues to invest in its Azure cloud products in an effort to best AWS as the No. 1 cloud provider. Microsoft CEO Satya Nadella also repeatedly referred to Azure as “the world’s computer.”During Microsoft Build, the vendor unveiled new access to Azure OpenAI Service, AI dashboards in Azure Machine Learning and a web application routing add-in for Azure Kubernetes Service.Along with the previews, Redmond, Wash.-based Microsoft announced new generally available features for its cloud service, including Microsoft Intelligent Data Platform, document and conversation summarization with Azure Cognitive Service for Language and a ledger feature for Azure SQL Database.

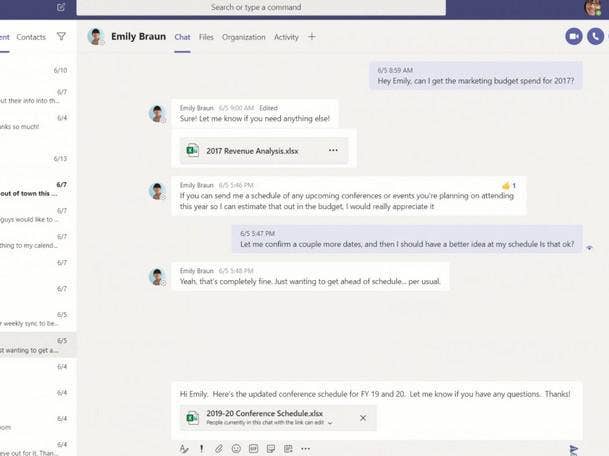

**## **7. Microsoft Invests In Teams Innovation****In 2022, Microsoft continued to roll out new innovations involving its popular Teams collaboration application.During Microsoft’s Build conference in May, the vendor showcased Loop components across Teams chats, a Teams JavaScript 2.0 software development kit (SDK) and Teams Toolkit for Visual Studio Code, among other updates.The company also expanded access to new Teams software development kit (SDK) extensions for developers to build “live share” capabilities into applications.At the vendor’s annual Inspire partner event, which happened in July, Microsoft introduced a Microsoft Digital Contact Center Platform offering, which combines technology from Teams, Azure and other portfolio products with voice-to-text company Nuance – Microsoft closed on the $16 billion acquisition in March.The company also made the Teams Connect Shared Channels feature and a new feature called video clip generally available.And during the annual Ignite conference, held in October this year, Microsoft unveiled a private preview of Mesh avatars for Teams meetings and a preview of a Teams Premium add-on. Microsoft made Teams Phone Mobile generally available, among other updates.

Rodney Clark

6. Microsoft Channel Chief Departure

In May, Microsoft channel chief Rodney Clark left the vendor after more than a year in the role and after more than 24 years with the company.

Clark’s formal title at the Redmond, Wash.-based tech giant was corporate vice president of channel sales. He’d been Microsoft channel chief since March 2021, succeeding Gavriella Schuster.

Clark was the face for Microsoft’s partner program overhauls throughout 2022, including the new commerce experience and launching the Microsoft Cloud Partner Program.

On June 1, Clark joined Johnson Controls as the company’s vice president and chief commercial officer.

Following the departure of channel chief Rodney Clark, Microsoft made major changes to its partner organization leadership, breaking up the duties of “channel chief” into several leadership positions among long-time Microsoft employees.

The changes included moving Nick Parker up to the role of president of the Industry & Partner Sales (IPS) organization and making Nicole Dezen “chief partner officer” and corporate vice president of the Global Partner Solutions (GPS) organization.

Parker has worked at Microsoft for more than 20 years. Dezen had the title of corporate vice president of device partner sales before her promotion and has worked at Microsoft since 2007.

David Smith became vice president of channel sales and Julie Sanford became vice president of partner go-to-market (GTM), programs and experiences. Both report to Dezen.

Smith focuses on sales and business growth with channel partners, according to Microsoft. He has worked at Microsoft for more than 23 years.

Sanford is accountable for partner programs and GTM engines. She has worked at Microsoft for more than 15 years.

5. M365 Price Increases

Independent of NCE – but perhaps helpful for partners who had to talk with customers about monthly and annual pricing – was a price increase across multiple Microsoft products in March.

Microsoft 365 (M365) Business Basic increased by $1, from $5 to $6 per user per month. M365 Business Premium increased by $2, from $20 to $22. Office 365 (O365) E1 increased $2, from $8 to $10.

O365 E3 increased by $3, from $20 to $23. O365 E5 increased $3, from $35 to $38. And M365 E3 increased $4 from $32 to $36.

The vendor would go on to raise prices on M365 and O365 nonprofit plans in September. The price changes include the nonprofit Microsoft Office 365 E1 license increasing by 25 percent, going from $2 to $2.50.

The nonprofit Microsoft Office 365 E3 increased by 28 percent, going from $4.50 to $5.75. The nonprofit Microsoft Office 365 E5 license increased by 9 percent, going from $14 to $15.20. The nonprofit Microsoft 365 E3 license increased by 13 percent, going from $8 to $9.

And lastly, nonprofit Microsoft 365 Business Premium licenses increased by 10 percent, going from $5 to $5.50.

4. End Of Gold And Silver

Oct. 3 marked the start of Microsoft’s Cloud Partner Program and the general availability of six partner designations, replacing Microsoft’s classic “silver” and “gold” competencies.

Microsoft’s stated goals for the new partner program included simplifying how partners work with the Redmond, Wash.-based technology giant and adding more ways for partners to differentiate themselves.

New designations for partners include infrastructure; data and artificial intelligence; digital and application innovation; modern work; security and business applications.

The vendor also promised industry-focused designations for partners, including financial services, retail, sustainability and health and life sciences.

3. Microsoft Partner Capability Score

With the end of gold and silver designations came a new measure for determining who becomes a Microsoft “solutions partner” – the partner capability score (PCS).

Like the 20 percent premium on month-to-month commitments, the score has proven controversial among partners who have voiced confusion on how to earn points and criticized the scoring system for emphasizing net new customers over keeping existing customers loyal.

Partners had until Sept. 30 to renew legacy competencies and thus keep the benefits they had under gold and silver – even though the gold and silver badges are gone.

Partners who renewed those benefits have until their first anniversary date after Oct. 3, 2022, to earn one of the new designations and receive that designation’s partner benefits.

Partners who don’t have a new designation after that anniversary date can pay a fee to retain old benefits or buy Microsoft Action Packs.

Partners can still receive legacy incentives on non-commercial offers that aren’t available through NCE – including offers for education, government and nonprofit customers.

2. SMB Deal Moderation

Microsoft hinted at partner program changes eating into some of its revenue throughout the year – not to mention a slowing economy affecting its work with small and midsize businesses (SMBs)

During the vendor’s quarterly earnings call in April, covering the quarter that ended on March 31, Chief Financial Officer Amy Hood said that lower-than-expected Office Commercial products revenue was due in part “to the transition from our Open Licensing program to our Cloud Solution Provider Program.”

She also said that “it‘s just taking us a little longer to onboard all of this (partner) community” to a new way of transacting. The company did not explicitly mention New Commerce Experience on the call.

During Microsoft’s quarterly earnings report in July, the vendor said that “partner transition work” had a negative effect on growth with small and midsize business customers.

For the quarter that ended June 30, Microsoft saw “moderation” in SMB deals, which had a negative effect on paid Office 365 commercial seats, the Enterprise Mobility + Security business and Windows commercial products and cloud services revenue. All of those business segments still grew overall year over year.

And finally, during the October earnings report covering the quarter that ended Sept. 30, Hood said SMB deal moderation continued.

Still, Hood noted a lot of work during the quarter came by partners and Microsoft sales and customer success teams optimizing customer Azure and cloud workloads as Azure growth continues to decelerate.

On workload optimization, “we saw that across all segments,” Hood said. “If there was one segment where I may have seen it a bit more, I would say, in the small or midsize segment of the market. That tends to be more through partner[s]. We rely on partners to help customers do those same optimizations and prepare workloads.”

1. The Year Of NCE

Three letters – NCE – dominated Microsoft partner conversations in 2022.

Microsoft’s new commerce experience – an umbrella term for changes the vendor made to its partner program with the goal, according to Microsoft, of simplifying how partners and customers buy licenses – became available for seat-based Microsoft 365, Dynamics, Power Platform and Windows 365 offers on Jan. 10.

On March 10, NCE became the only way for new transactions between partners and customers.

NCE has proven controversial with partners due to a 20 percent premium put on month-to-month subscriptions, which are popular with customers of Microsoft services-led partners. Instead, partners have told CRN, customers are incentivized to buy annual subscriptions.

The problem with annual subscriptions for partners is that partners can be on the hook for paying the duration of the subscription should a customer go out of business, get acquired or need fewer licenses.

What’s more, partners and customers are stuck together during the length of the contract and partners are stuck with their distributors (known as “indirect providers” by Microsoft). Partners have asked Microsoft for a way to make licenses portable so that they can accept new customers who leave their existing MSP.

Microsoft has indefinitely delayed enforcing renewals of subscriptions through NCE, but partners who sell certain products under the old system may miss out on incentives starting Dec. 31.