The Biggest IT Executive Moves Of 2022

Sandy Hogan of Sada, Rick Ribas of Thrive, Sowmyanarayan Sampath of Verizon Business, Kevin Ichhpurani of Google Cloud and Nicole Dezen of Microsoft are among the listmakers.

A new channel chief at Microsoft. Sada’s first global chief revenue officer. And a new CEO for Verizon Business.

These are some of the biggest executive moves of importance to channel partners, as ranked by CRN.

These executives were chosen for their impressive resumes, their influence on channel partners, their expertise in the channel and their potential to continue to dominate headlines in 2023.

[RELATED: 30 Notable IT Executive Moves: November 2022]

Many executives and rank-and-file employees have moved jobs amid the global pandemic, a period dubbed The Great Resignation.

Now, however, businesses are readying themselves for a potential recession in the U.S. due to rising inflation and interest rates. Multiple vendors have conducted layoffs – although, customer spending on digital transformation and updating their technology infrastructure reportedly remains strong despite economic concerns.

Some of the people appearing on CRN’s 2022 Biggest IT Executive Moves list include:

* Sandy Hogan, Sada chief revenue officer

* Rick Ribas, Thrive channel chief

* Sowmyanarayan Sampath, Verizon Business CEO

* Kevin Ichhpurani, channel chief at Google Cloud

* Nicole Dezen, chief partner officer at Microsoft

Here are CRN‘s biggest executive moves of 2022.

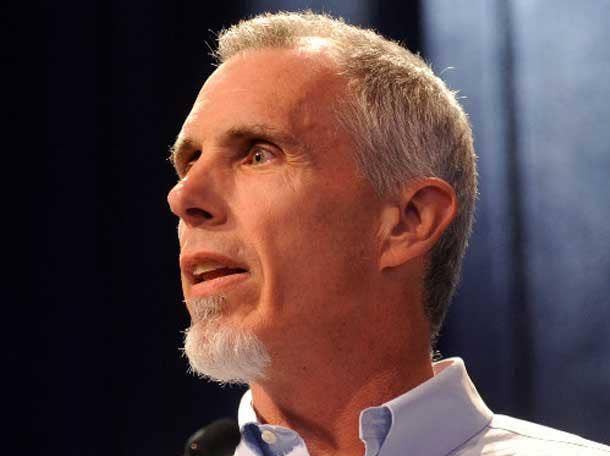

Alan Masarek

During the summer, Alan Masarek became CEO of Avaya.

Masarek joined the Durham, N.C.-based unified communications business after more than five years as CEO of Vonage. He left Vonage in 2020.

His resume includes more than two years at Google as director of Chrome and applications. He joined with the 2012 acquisition of Quickoffice, which he co-founded in 2002.

He has now given himself the task of shifting the portfolio and customers entirely to cloud – private, multi-tenant or somewhere in between.

The company saw missed revenue targets and layoffs in 2022, but an updated and simplified product roadmap, investment in partners and exploration of hybrid cloud opportunities could make 2023 a different story.

Dee Burger

Insight Enterprises – No. 17 on CRN’s 2022 Solution Provider 500 – named Capgemini veteran Dee Burger its new president of North America business last year.

Burger reports to Insight CEO Joyce Mullen and is responsible for the North America business operations of Chandler, Ariz.-based Insight. That includes heading up partner management, Insight Public Sector, commercial and enterprise sales, and solutions delivery.

He spent the last 29 years at Paris-based solution provider Capgemini, most recently serving as executive vice president of global business lines in North America covering cloud infrastructure, insights and data, business services, and consulting and engineering.

He also led the company’s transformation program for its North American businesses and oversaw its digital and cloud practices.

Sanjay Poonen

Cohesity landed former VMware executive Sanjay Poonen as CEO and president last year.

Before joining the San Jose, Calif.-based data security and management company, Poonen was chief operating officer of VMware.

He led sales, marketing, services and appliances, while playing a critical role in doubling the company’s revenues from $6 billion to $12 billion during his eight years at VMware.

Poonen was in the running to become CEO of VMware last year following the departure of Pat Gelsinger who left to become CEO of Intel. However, VMware selected longtime engineering leader Raghu Raghuram to take over the company.

Gee Rittenhouse

Gee Rittenhouse became CEO of Skyhigh Security at the start of 2022.

Before joining San Jose, Calif-based Skyhigh – the renamed security service edge (SSE) business of McAfee Enterprise – Rittenhouse spent eight years at Cisco.

For more than three years, he was responsible for the company’s $3.38 billion cybersecurity business, which is focused on network, cloud, and email security, identity and access management, advanced threat protection, and unified threat management.

Prior to leading the entire cybersecurity business, Rittenhouse spent two years overseeing the product portfolio.

Robert Vrij

Denali Advanced Integration – a 30-year-old family-owned business and No. 34 on CRN’s 2022 Solution Provider 500 – hired Robert Vrij last year as CEO.

It’s the first time someone from outside the Daher family has taken the top executive role at the Redmond, Wash.-based solution provider.

Vrij is a veteran executive who previously served as CEO of Openwave Systems and Alcatel-Lucent USA, and was a senior vice president and managing director for Hewlett Packard Enterprise until 2016.

Sandy Hogan

Sada – No. 102 on CRN’s 2022 Solution Provider 500 – brought on Sandy Hogan as its first global chief revenue officer last year.

Hogan will help with the Google Cloud partner’s global expansion, acquisition strategy and relationships with customers and stakeholders.

She joined Los Angeles-based Sada after more than two years as VMware’s channel chief – formally, the senior vice president of worldwide commercial and partner sales.

Her other experience includes about a year with Rackspace, leaving the company in 2020 as executive vice president of the Americas.

She spent about two years with Here Technologies, leaving in 2019 as senior vice president and general manager of the Americas.

Her resume includes more than 15 years with Cisco, leaving in 2017 as global vice president of the digital transformation group.

Jeff Dobbelaere

Jeff Dobbelaere ascended from the role of chief operating officer for Mainline Information Systems – a member of CRN’s 2022 Managed Service Provider 500 – to CEO last year.

Dobbelaere took the top spot at Tallahassee, Fla.-based Mainline after the departure of President and CEO John McCarthy – a situation that appears to have resulted in a legal battle.

Dobbelaere is a nearly 20-year Mainline veteran. He became interim CEO in April and started at Mainline as a systems engineer in 2002, according to his LinkedIn account.

Some of the company’s successes since announcing the CEO change include landing the expert-evel partner designation within Fortinet’s Engage Partner Program.

Joe Quaglia

Trace3 – tied for No. 36 on CRN’s 2022 Solution Provider 500 – created a president position for Joe Quaglia, who joined the company early in 2022.

Quaglia came to the Irvine, Calif.-based provider after more than 14 years with Tech Data a before it merged with Synnex.

With more than 34 years in the industry, Quaglia is focusing on growing the Irvine, Calif.-based company through its customer base, new talent and geographical footprint.

Chris Remy

In September, Chris Remy became the CEO of Convergence Networks – No. 409 on CRN’s 2022 Solution Provider 500.

Remy succeeded company founder Mat Lafrance and joined soon after Portland, Ore.-based Convergence made Michael Maddox its president and purchased SWAT Systems, a Seattle-based managed services provider

Before Convergence, which is owned by private equity investment firm Riverside Partners, Remy worked at Mobile Technologies (MTI) for more than 12 years, leaving the company in 2020 as CEO.

He brings to Convergence leadership skills for technology in industries including retail, health care and food – the specialties of MTI. Convergence’s industry specialties include health care, manufacturing, insurance, nonprofits and engineering.

James Buie

Involta – No. 257 on CRN’s 2022 Solution Provider 500 – gave its president, James Buie, the CEO role in 2022.

Buie joined Cedar Rapids, Iowa-based Involta in 2016 as chief financial officer to further drive profitability for the company and expand its nationwide footprint.

As CFO, he grew the company’s hybrid cloud and strategic consulting offerings through acquiring BluPrairie and IT Lynk. In 2020, he became president of the company where he restructured the firm’s operations to help scale and deliver services to accelerate growth.

Before Involta, he was the senior vice president of Flexential from 2012 to 2016 and the vice president of Comcast from 2002 to 2011.

As president and CEO, Buie plans to focus on the company’s growth across all sectors, lead Involta’s pioneering edge practice and integrate a higher level of sustainability initiatives across the company’s data center portfolio. Buie will also help strengthen the company’s channel focus and expand partner base.

Involta owns and operates more than 10 data center facilities and an in-house 12,000-plus fiber-mile network. Investment firm owner Carlyle wants to expand Involta’s operations beyond the Midwest, the Pacific Northwest and Southwest.

Rick Ribas

Thrive – No. 172 on CRN’s 2022 Solution Provider 500 – hired Rick Ribas last year as its new channel chief, with the goal of strengthening the company’s competitive differentiators and leveraging new disruptive technology.

Ribas – formally known as Foxborough, Mass.-based Thrive’s executive vice president of channels and alliances – brings more than 30 years of business and global channel experience to the role.

Before Thrive, he was senior vice president of channels and alliances for Fusion Connect. He left the company after about a year, according to his LinkedIn account.

Ribas worked at LogMeIn for about a year, holding the title of vice president of global channels. He also worked at Intelisys for more than nine years, leaving in 2020 with the title of senior vice president of national partner sales.

In its announcement of his hiring, Thrive credited Ribas with helping drive Intelisys to an acquisition by ScanSource.

He also founded Online Telecommunications, one of the first telecommunications consulting companies in the country. He ran the business as CEO for about a decade before it sold to a carrier in 1999.

Kevin Shank

In 2022, Kevin Shank returned to CompuCom – No. 49 on CRN’s 2022 Solution Provider 500 – taking on the role of CEO.

Before coming to Fort Mill, S.C.-based CompuCom, Shank served as president of the North American arm of U.K.-based Computacenter.

He joined Computacenter in late 2020 when Computacenter acquired Pivot Technology Solutions, a U.S.-based solution provider where Shanks last served as CEO and a member of the board of directors.

He previously spent nine years at CompuCom, leaving the company in early 2014 as executive vice president to join Pivot.

Eric Schwartz

Eric Schwartz became CEO of CyrusOne – No. 40 on CRN’s 2022 Solution Provider 500 – in October.

Since his hiring, CyrusOne has invested in growing its overseas resources, which includes breaking ground on its first facility in the Spanish market – a data center in Madrid.

Prior to joining Dallas-based CyrusOne, Schwartz was an executive at Equinix the past 16 years – leading the Europe, Middle East and Africa (EMEA) region from 2008 to 2019.

He more recently served as Equinix’s chief strategy and development officer for more than three years, working on data center development joint ventures.

Russ Reeder

Russ Reeder took on the CEO role at Netrix – No. 190 on CRN’s 2022 Solution Provider 500 – at the start of last year.

Reeder had served on Bannockburn, Ill.-based Netrix’s board before taking the top job.

Before coming to Netrix, Reeder served as CEO of Infrascale, a cloud-based data protection company, for about two years.

He also worked as president and CEO of the U.S. business of OVHcloud, a French cloud computing company. There, he oversaw the acquisition and integration of vCloud Air from VMware in 2017.

He views organic growth through the sales team and inorganic growth through acquisition as the key to Netrix’s success.

After Reeder landed the top job at Netrix, the company bought Argentina-based development operations (DevOps) specialist Edrans and BTB Security, a cybersecurity and digital forensics solutions company.

Brian Roach

Red River – No. 50 on CRN’s 2022 Solution Provider 500 – brought on a new CEO in spring with a history in regulated industries at SAP.

Before joining Claremont, N.H.-based Red River, Brian Roach ran SAP North America’s regulated industries practice, working with federal, local and state government clients as well as customers in higher education, aerospace, defense, utilities, and healthcare.

Roach also led the national government business for six years at Juniper Networks.

After Roach came on board, Red River saw an expansion with several key vendor partners. The provider signed a multi-year strategic collaboration agreement with Amazon Web Services, landed an advanced specialization for Microsoft Azure Virtual Desktop and achieved Cisco Gold Provider status in managed business communications and Meraki software-defined wide area network (SD-WAN).

All of these investments appear to position Red River well for the year ahead.

Gary Steele

Splunk landed Proofpoint founder and CEO Gary Steele as its top executive to help the security and observability vendor further scale its business.

The San Francisco-based data platform giant hired Steele for his ability to scale software-as-a-service operations and grow a multi-billion-dollar global enterprise during his two decades leading Proofpoint.

Under Steele’s watch, Splunk debuted the next generation of its core on-premises and cloud systems, offering up a wave of new capabilities and features that will help customers collect, manage and search increasingly huge volumes of machine data.

Steele founded Proofpoint in November 2002, took the company public in April 2012 at a valuation of $385.6 million, became chairman in 2018, grew Proofpoint’s workforce to 3,300 staff and engineered the company’s $12.3 billion sale to Thoma Bravo in August 2021.

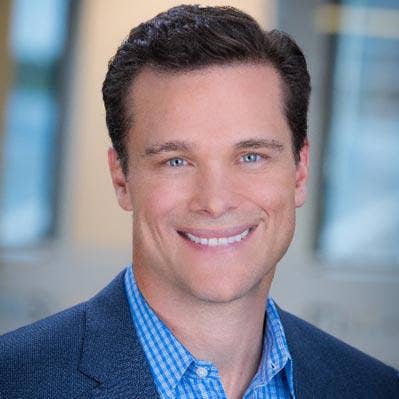

Sean Kerins

Sean Kerins became president and CEO of Arrow Electronics in June, getting the ultimate promotion after 15 years with the distributor.

Kerins served as the Centennial, Colo.-based company’s chief operating officer previously and as president of Arrow’s global enterprise computing solutions business starting in 2014.

On the company’s earnings call in November – after Kerins’ first full quarter as CEO – Arrow reported its best third quarter in history, with sales growth of 14 percent to $9.27 billion.

Kerins is prioritizing customer service and support, investments in design and engineering capabilities – plus navigating a significant backlog, strong demand in the West and tough macroeconomics in China and the East, according to a transcript of the call.

Paul Bay

Ingram Micro started 2022 with a change in CEO, with Paul Bay taking the reins after about 24 years with the distributor.

Bay had previously headed Irvine, Calif.-based Ingram’s North America business for nine years and held the role of president of the Global Technology Solutions business for two years. His promotion came six months after Platinum Equity bought Ingram and rivals Tech Data and Synnex merged to form distribution powerhouse TD Synnex.

Some of Ingram’s big moves in 2022 after Bay took the top job include the launch of its Xvantage digital twin platform, filing paperwork to become a publicly traded company and expanding its relationships with Amazon Web Services, Okta, Check Point and Nvidia, among other vendors.

Todd Surdey

Todd Surdey became channel chief of Zoom in 2022.

Surdey came to San Jose, Calif.-based Zoom from Google, where he most recently served as vice president of global security sales before leaving the company in May.

Prior to his stint at Google, Surdey served as chief revenue officer of Palo Alto Networks’ Cortex business. No stranger to the channel, he also served as senior vice president of Americas enterprise and commercial sales and senior vice president of sales and routes to market for the company.

In addition, Surdey has held leadership roles at SAP, Salesforce and VMware, where he was co-channel chief for an ecosystem of more than 70,000 partner organizations.

Randall Porter

Telecommunications giant AT&T named Randall Porter channel chief last year.

Porter has served in a variety of positions for the Dallas-based carrier giant during his more than 24-year tenure, with more than 10 years spent in the channel.

He worked in several finance and marketing roles before becoming assistant vice president of marketing looking after the company’s wireless, applications and IP portfolio.

Prior to his current position, he served as vice president of strategic alliances at AT&T Business.

Before that, Porter was vice president of partner management and business development. He has told CRN that he sees big channel opportunities around 5G, fiber, contact center and other offerings.

Kate Johnson

In 2022, Kate Johnson became the top executive at telecommunications giant Lumen Technologies, formerly CenturyLink.

A technology leader of nearly 30 years, Johnson brings experience leading digital and business transformations to drive growth for Monroe, La.-based Lumen.

She has held leadership roles across a variety of Fortune 100 companies including Oracle and General Electric, as well as other tech firms, such as Red Hat.

Most recently, Johnson served as president of Microsoft U.S., overseeing the company’s sales, services marketing and operations. During her four years in the role, she led the U.S. division through a cultural transformation while nearly doubling enterprise revenue.

Sowmyanarayan Sampath

Verizon Business appointed Sowmyanarayan Sampath its new CEO in July.

Sampath previously served as Basking Ridge, N.J.-based Verizon’s chief revenue officer starting April 2021. In his new role, Sampath will report directly to Verizon CEO Hans Vestberg.

Sampath has spent the past eight years at the telecommunications giant, serving as president of global enterprise for more than a year.

Between 2018 and 2020 he served as chief financial officer and group strategy and transformation for Verizon’s Media Group, which contained the company’s Yahoo and AOL assets.

Bill Hustad

Bill Hustad joined Okta toward the middle of 2022 as channel chief – or formally, identity vendor’s senior vice president of global partners and alliances.

Hustad will lead the San Francisco-based company’s global partner team and be responsible for Okta’s indirect go-to-market strategy, execution and bookings globally.

Near the end of 2022, he told CRN about upcoming changes to the partner program, with new incentives, enablement and other resources for partners to grow alongside the identity and access management vendor and build predictable revenue.

He previously spent five years at Splunk, serving as vice president of alliances and channel ecosystems during that time.

Jason Beal

In November, seven months after global investment firm KKR took over the company, Barracuda Networks hired its first head of global channel strategy and development – Jason Beal.

Beal’s hiring is a strong signal to the importance of the channel in Campbell, Calif.-based Barracuda’s sales strategy.

He has previously worked in top channel positions at AvePoint, Palo Alto Networks and Ingram Micro. Beal is tasked with coordinating various Barracuda partner programs around the world.

Beal previously served as senior vice president of global channel and partner ecosystems at AvePoint, a provider of data protection, governance and cloud migration solutions.

Before AvePoint, he held top channel positions at Palo Alto Networks and Ingram Micro.

Tom Evans

Tom Evans is one of the more recent executive changes to make the list – becoming channel chief of Palo Alto Networks just in December.

And yet, with cybersecurity set to dominate partner conversations with customers in 2023 and possibly resist any budget cuts in a potential recession – Palo Alto Networks and Evans’ team should prove influential in the channel looking ahead.

Evans has worked at Santa Clara, Calif.-based Palo Alto Networks since 2018, serving in various channel leadership roles over the years.

Before joining Palo Alto Networks in late 2017, Evans worked in channel posts at K2 and F5 Networks. He worked at K2 for more than a year and F5 for more than 10 years.

Along with Evans’ appointment, Palo Alto Networks revealed plans to make major enhancements to its global partner program over the next year as a result of market and company changes that are transforming the cybersecurity landscape.

The company is in the process of moving separate global partner programs under its already existing NextWave partners program.

In addition, Palo Alto Networks also plans to roll out new opportunities for partners to specialize in specific product and service niches as they seek to strengthen their ties to the company.

Michael Rogers

Michael Rogers became channel chief of cybersecurity vendor CrowdStrike in February and oversaw the unveiling of a new partner program meant to broaden sales with a new elite tier of partners as well as through smaller services-led partners.

Rogers has been with Austin, Texas-based CrowdStrike for more than four years in channel executive roles, starting with a job as director of public cloud partners in 2017.

He was involved in indirect sales for two decades prior to joining CrowdStrike, spending nearly two years at SecurityScorecard and Tanium running global channels and global VAR, consulting and systems integrator partners, respectively.

Prior to that, Rogers spent eight years at Sophos and seven years at McAfee, culminating in roles leading global alliances and OEM and overseeing global SMB sales, respectively.

CrowdStrike and Microsoft have battled publicly over which is the more secure investment – adding third-party providers like CrowdStrike to the stack, or having a unified position with Microsoft offerings.

Still, with cybersecurity as one of the technology fields likely to resist spending cuts in an uncertain economy, Rogers and the CrowdStrike team will likely prove influential over how partners build their practices to keep customers’ information safe.

Matt Hicks

Matt Hicks ascended to the top job at Red Hat in the summer and has promised that partners will serve an essential role in bringing the IBM subsidiary’s tools to market as it works to broaden its reach in multi-cloud and edge environments.

Hicks continues the Raleigh, N.C.-based company’s emphasis on technical prowess for its leaders – he joined Red Hat in 2006 as a developer on the IT team and was a key member of the engineering team behind Kubernetes platform Red Hat OpenShift and helped to expand the portfolio to handle multiple clouds, the edge and other environments.

He also helped spearhead new managed cloud solutions, artificial intelligence capabilities and cloud-native applications, among other Red Hat offerings.

Executives at Red Hat parent company IBM have long touted the open-source tools vendor as key to the tech giant’s growth last year and in 2023. While IBM and Red Hat continue to operate separate partner programs, the upsell opportunity for partners in each system looking to grow can’t be understated.

Kate Woolley

Although the fruits of Kate Woolley’s labor as IBM’s latest channel chief have only been revealed at the start of 2023 – the tech giant’s Partner Plus program – Woolley should be recognized for her work in 2022 listening to the tens of thousands of partners in IBM’s ecosystem and preparing them for the changes to come.

Woolley became Armonk, N.Y.-based IBM’s channel chief in January 2022 after more than a year as IBM CEO Arvind Krishna’s chief of staff. Her resume includes more than 14 years with Bain & Co., leaving Bain in 2020 as a partner.

While in her role as IBM’s top channel executive, Woolley has seen the company double the number of channel-facing sellers to more than 2,000, expanded partnerships with tech heavyweights and rolled out partner access to training, badges and enablement IBM sales employees get.

While IBM has made less of a splash in cloud computing as rivals Amazon Web Services and Microsoft, the vendor’s embrace of hybrid cloud, artificial intelligence and cybersecurity solutions could end up putting it in a healthier position for growth should the United States enter a recession this year.

And IBM promises a healthy multiple for partners – for every $1 of hybrid platform revenue, IBM and ecosystem partners can generate $3 to $5 of software, $6 to $8 of services and $1 to $2 of infrastructure revenue, according to the company.

Kevin Ichhpurani

Although Google Cloud has had to fight its larger cloud rivals Amazon Web Services and Microsoft for market share – and its parent company has had to contend with a widespread advertising revenue decline amid a shaky economy – channel chief Kevin Ichhpurani is saying all the right things to indicate the vendor’s serious approach to growing its partner program.

Ichhpurani ascended to the top channel executive position when predecessor Carolee Gearhart left Mountain View, Calif.-based Google in February. He has taken control over a combined ecosystem and channel sales team into a single partner organization to streamline its go-to-market abilities.

Before his promotion, Ichhpurani had been at Google Cloud for five years. He came from GE Digital, where he was executive vice president of emerging industry solutions and global channels for about a year.

Ichhpurani’s resume includes about a year with EY, holding the title of senior partner of global markets. He also spent about 12 years with SAP, leaving in 2016 as executive vice president of business development and global ecosystem.

Also going for Google Cloud partners is a goal of 100 percent partner attachment to all sales deals and professional engagement – a goal espoused by Google Cloud CEO Thomas Kurian.

Nicole Dezen

The saying goes, you usually don’t change horses midstream. And yet, Microsoft saw a change with its senior-most channel executive role – with former channel chief Rodney Clark not only leaving the company in May, but Microsoft breaking up his responsibilities among three new roles for executives promoted from within.

At the top of the partner organization is Nicole Dezen, who holds the title of chief partner officer and corporate vice president of Redmond, Wash.-based Microsoft’s Global Partner Solutions organization. She reports to Nick Parker, the former CVP of GPS and the new president of the Industry & Partner Sales (IPS) organization.

Other title changes to accompany Dezen’s include David Smith becoming vice president of channel sales and Julie Sanford serving as vice president of partner go-to-market (GTM), programs and experiences. Both will report to Dezen.

Smith focuses on sales and business growth with channel partners while Sanford is accountable for partner programs and GTM engines.

Dezen had already been promoted in August to the role of CVP of device partner sales. She has more than 25 years of tech sales experience, including 15 at Microsoft. Dezen joined Microsoft in 2007. Past titles include general manager for consumer device sales in the United Kingdom and Ireland.

Dezen and her team oversaw the continued execution of Microsoft’s sweeping partner program changes in 2022 – namely, the implementation of Microsoft’s new commerce experience (NCE) and partner capability scores (PCS).

The two changes continue to prove controversial as 2023 gets underway. All eyes within the tech giant’s 400,000-member partner ecosystem are on Dezen and her team on how they will stick the landing as Microsoft remakes its partner program.

Going for the tech giant is, despite the headaches of its partner program changes, Microsoft remains the No. 2 cloud vendor in the market.

The vendor also has plenty of product offerings – including cybersecurity, its Teams collaboration application and its Dynamics customer relationship management (CRM) tool – that could cover multiple customer needs as the economy continues to look shaky.

Plus, the Microsoft multiple for partners – with services-led partners making $7.63 for every $1 of Microsoft revenue – is hard to break away from for partners who have built a strong practice with the vendor.