Intel’s 9 Biggest Moves Under Pat Gelsinger In His First 3 Years As CEO

From massive spending cuts to road map changes for its accelerator chips, CRN dives deep into Intel’s nine biggest developments since Pat Gelsinger became its CEO three years ago.

It’s been three years since Pat Gelsinger became Intel’s CEO, and there’s no doubt that he’s already left an outsized mark on the semiconductor giant by evolving its business model in the hope that it will remain central to global chip needs for the decades to come.

When Gelsinger became Intel’s eighth leader in its 55-year history on Feb. 15, 2021, it marked a grand return for the semiconductor veteran, who spent the first 30 years of his career at the chipmaker before becoming a top executive at Dell EMC and then CEO of VMware. After re-joining Intel, Gelsinger referred to this latter period as his “11-year vacation.”

[Related: Analysis: How Nvidia Surpassed Intel In Annual Revenue And Won The AI Crown]

“I believe Intel has significant potential to continue to reshape the future of technology and look forward to working with the incredibly talented global Intel team to accelerate innovation and create value for our customers and shareholders,” Gelsinger said when he was announced as the successor to Intel CEO Bob Swan in mid-January 2021.

Throughout his tenure as Intel’s CEO, Gelsinger has made sweeping changes to the company, including the establishment of a new strategy called IDM 2.0 that involves a massive build-out of new fabs in the West and the revitalization of its contract chip manufacturing business.

With the need to invest tens of billions of dollars into this strategy, Gelsinger has narrowed the company’s focus to chip design, with a primary focus on CPUs, accelerator chips and networking chips, and chip manufacturing, which now comes with an expanded purview of fabricating chips designed by Intel as well as external companies.

This has resulted in Intel exiting several businesses and spinning off others that were adjacent to the company’s primary ways of making money. Some of these businesses had been accumulated through acquisitions by Gelsinger’s predecessors while others came from in-house development and research efforts over several years, if not a decade or longer.

All of this has been done in the name of helping Intel not just recover from several years of stumbles in chip manufacturing that allowed it to fall behind Asian foundry rivals. More importantly, the actions taken by Gelsinger and his leadership team are meant to fling Intel ahead of its competitors in advanced chip-making capabilities by 2025 and make the company the second largest contract chip manufacturer by revenue five years later.

Working to achieve these lofty goals hasn’t been without its challenges for Intel. In addition to cutting several businesses loose over his tenure, Gelsinger announced in October 2022 that the company would cut spending by billions of dollars over the next three years. This has resulted in an unspecified number of layoffs since then.

What follows is an in-depth recap of Intel’s nine biggest moves under Gelsinger and what has happened since those developments were announced. These developments include Intel’s IDM 2.0 strategy, the launch of Intel Foundry, the multibillion-dollar spending cuts as well as Intel’s decision to shake up its accelerator chip road maps and expand its software business.

IDM 2.0 Strategy

A little more than a month after Pat Gelsinger became CEO, he announced a bold, new manufacturing strategy for the company called IDM 2.0.

IDM 2.0 is an evolution of Intel’s integrated device manufacturing model, where it manufactures the chips it designs using a global network of fabrication plants owned by the company.

Announced on March 23, 2021, Gelsinger said Intel would double down on manufacturing with plans to build new fabs in the West and use that fab network to build a new contract chip manufacturing business under the name Intel Foundry Services as part of IDM 2.0. (Less than three years later, the business’s name was changed to Intel Foundry.)

Gelsinger said Intel’s plan to build more fabs in the U.S. and Europe, among other global locations, would help balance out the heavy concentration of foundry plants in Asia.

“We are the only company with the depth and breadth of software, silicon, platforms, packaging and process with at-scale manufacturing our customers depend on for their next-generation innovations to meet this moment and position our company for the future,” he said at the time.

At the same time, Gelsinger said Intel would increase its reliance on external foundries—which include companies like TSMC and Samsung—in situations where it would benefit the company’s products from cost, performance, scheduling and supply perspectives.

With the company embracing chiplet designs for new processors, this would allow Intel to rely on internal and external manufacturing processes for different chiplets on the same product.

Intel kicked off its IDM 2.0 strategy with a roughly $20 billion investment for two new fabs in Arizona, but in the nearly three years since the original announcement, the company announced a $20 billion fab site for Ohio and a $33 billion fab site for Germany.

The company also plans to spend up to $4.6 billion for an assembly and test facility in Poland and said it may build another such site in Italy.

From the beginning, Gelsinger has insisted that Intel’s big fab build-out in the West would require incentives from governments to balance out the massive footprint of chip manufacturing plants in the East that have been heavily subsidized by the likes of Taiwan, South Korea and other nations.

In the U.S., lobbying by Gelsinger and other industry officials for semiconductor incentives led to Congress in 2022 passing the CHIPS and Science Act, which includes $52 billion in subsidies for new chip manufacturing plants built in the country.

A year and a half after the bill’s passage, the U.S. government hasn’t yet doled out any subsidies for eligible fab projects like Intel’s. In early February, the chipmaker said it was delaying completion of its Ohio fab site once again, to late 2026, due to market challenges and the fact that the U.S. government hasn’t begun issuing grants to chip manufacturers building fabs yet.

Manufacturing Node Acceleration

A few months after Pat Gelsinger revealed Intel’s IDM 2.0 strategy, the CEO disclosed the company’s plan to not only catch up with top foundry rivals TSMC and Samsung in advanced chip-making capabilities but to surpass them by 2025.

Announced on July 26, 2021, Gelsinger’s plan seeks to return the chipmaker to “process performance leadership” after it fell behind in advanced capabilities for several years due to major delays with its 10nm and 7nm manufacturing processes.

The plan calls for Intel to introduce four advanced manufacturing nodes in five years following the debut of its 10-nanometer SuperFin process in 2020. Each node would come with a significant increase in performance-per-watt over the previous one.

This would result in the company achieving “performance-per-watt parity” with foundry rivals in 2024 and “process performance leadership” in 2025, Gelsinger promised at the time.

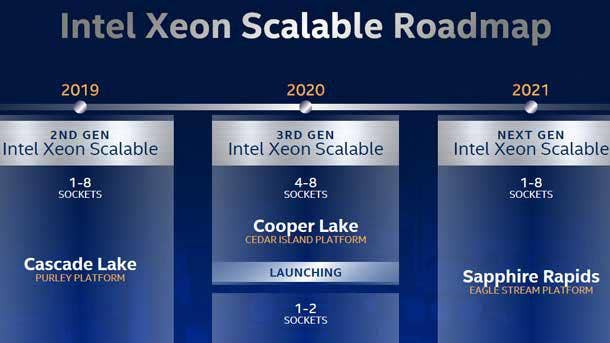

The first node, Intel 7, was previously known as 10nm Enhanced SuperFin. At the time of the 2021 announcement, Intel said it would debut the node in the 12th-generation Core processors, code-named Alder Lake, for PCs in 2021. The company added that Sapphire Rapids, the code name for fourth-gen Xeon Scalable CPUs, would use the node and enter production in early 2022.

While Intel hit its launch target for Alder Lake, the company ended up delaying the launch of Sapphire Rapids by roughly a year for reasons not related to manufacturing.

The second node, Intel 4, previously known as Intel’s 7nm process, marked the company’s full embrace of EUV lithography “to print incredibly small features using ultra-short wavelength light.”

Intel said Intel 4 would be ready for production in the second half of 2022, with products using Intel 4 shipping in 2023. These products included Meteor Lake, now known as the Core Ultra processors for AI PCs, and Granite Rapids, a new generation of Xeon Scalable processors.

By early December 2022, Intel said the Intel 4 node was “manufacturing ready.” A year later, Intel marked the launch of Meteor Lake with laptops using the chips readily available.

Granite Rapids, on the other hand, was delayed to a 2024 release because Intel decided to move the processor to a next-generation node, Intel 3, and move to a biannual release schedule. In its place, Intel released Emerald Rapids in December 2023 as its fifth-generation Xeon Scalable lineup, which uses the same Intel 7 node as Sapphire Rapids.

The third node, Intel 3, was expected to be ready for manufacturing in the second half of 2023, and the company ended up achieving that milestone in the fourth quarter of that year.

Gelsinger said in January that Intel plans to release in the first half of 2024 a new version of Xeon processor that will use Intel 3. Code-named Sierra Forest, the server CPUs will make use of Intel’s efficiency cores—which had only appeared in client processors previously—enabling it to pack up to 288 cores in a single package. Granite Rapids will follow “shortly thereafter,” he added.

The fourth node, Intel 20A, is expected to enter production in 2024 and usher in the beginning of what Intel is calling the “angstrom era.” This refers to how the company will start measuring transistor features in angstroms, which are one-tenth the size of a nanometer.

The company said Intel 20A would make use of two breakthrough technologies. The first, RibbonFET, will “enable faster transistor switching speeds while achieving the same drive current as multiple fins in a smaller footprint. The second, PowerVia, will optimize “signal transmission by eliminating the need for power routing on the front side of the wafer.”

In January, the chipmaker said it plans to launch its first Intel 20A product, a new generation of client processors code-named Arrow Lake, in the second half of this year.

The fifth node, Intel 18A, was originally slated for 2025, but last month Gelsinger said the node would achieve “manufacturing readiness” in the second half of this year.

Intel also said in January that one of its first Intel 18A products, a follow-up to Meteor Lake called Lunar Lake, will start shipping in the second half of this year. The company then said in February a follow-up to Sierra Forest called Clearwater Forest would use 18A and launch in 2025.

Echoing comments Gelsinger made roughly two-and-a-half years ago, the CEO said in the company’s January earnings call that Intel 18A will bring it back to “process leadership.”

Beyond 2025, the chipmaker plans to introduce 18A’s successor, Intel 14A, in late 2026 for commercialization, the company revealed at a February event.

Intel also disclosed last month that it plans to introduce modified versions of Intel 3, Intel 18A and Intel 14A that have been optimized to improve performance, introduce new features or implement its Foveros Direct 3-D stacking technology for advanced chip designs.

Business Unit Reorganization

A month before Gelsinger announced his manufacturing node acceleration plan in 2021, he orchestrated a reorganization of Intel’s business units outside of the Client Computing Group.

This resulted in the company splitting what it called the Data Platforms Groups into two organizations: the Data Center and AI Group and the Network and Edge Group.

The Data Center and AI Group brought together Intel’s Xeon server CPUs, FPGAs, Optane memory and storage products and AI chips from its Habana Labs business unit. Gelsinger appointed longtime Intel executive Sandra Rivera to lead the group.

The Network and Edge Group, on the other hand, combined products from the company’s Network Platforms Group, Internet of Things Group and Connectivity Group. Gelsinger appointed Intel senior fellow and Barefoot Networks co-founder Nick McKeown as the group’s leader.

Navin Shenoy, who led the Data Platforms Group up until that point, left the company in connection with the restructuring, according to a filing with the U.S. Securities and Exchange Commission.

Gelsinger also created two new business units.

He established the Software and Advanced Technology Group and appointed Intel CTO Greg Lavender to lead the organization, which is focused on driving “Intel’s unified vision for software, ensuring it remains a competitive differentiator for the company,” Intel said in 2021.

The other group formed by Gelsinger was the Accelerated Computing Systems and Graphics Group, for which he chose Intel’s chief GPU architect, Raja Koduri, to lead. The group was focused on building a business out of the company’s discrete GPU products for PCs and data centers as well as custom ASIC designs, such as the cryptocurrency-mining Blockscale ASIC.

Like Intel’s other business units besides the Software and Advanced Technology Group, the Accelerated Computing Systems and Graphics Group was established as a reportable segment for the company’s earnings reports.

“I am confident these changes will help us accelerate our pace, as they fully align our organization against our priorities: one clear voice to the customer, distinct business units focused on leadership products, four functional organizations to ensure flawless execution and ongoing innovation, and the horizontal support organizations needed to fuel our strategy and culture for today and the future,” Gelsinger wrote in an internal memo seen by CRN back in 2021.

In the two-and-a-half years since the business unit reorganization, the groups have gone through a few leadership and organizational changes.

Several months after Intel launched its Arc GPUs for PCs, the company in December 2022 decided to restructure the Accelerated Computing Systems and Graphics Group. This resulted in Intel splitting up organization the two groups, moving its data center GPU activities under the Data Center and AI Group and its client GPU activities under the Client Computing Group.

In addition, Intel moved Koduri back to his previous role as chief architect, which gave him purview over not just GPUs but also CPU and AI products as well. A few months later, in March 2023, Koduri left Intel to form a startup focused on creating an “AI-first” digital creative cloud platform.

In February of last year, McKeown stepped down as the Network and Edge Group’s leader to become its chief innovation officer, handing the reins to Sachin Katti. McKeown changed roles when he returned to the company after being on medical leave in 2022.

In October of last year, the company announced its plan to spin off the Programmable Solutions Group, which runs Intel’s FPGA business, into a standalone organization after previously being part of the Data Center and AI Group. Intel said at the time that it expects the group to go public by 2026.

Intel Foundry

In February, the chipmaker announced the official launch of its contract chip manufacturing business and renamed it to Intel Foundry, dropping “services” from the original name.

The company said Intel Foundry would differ from Asian foundry giants TSMC and Samsung by operating at the “world’s first systems foundry designed for the AI era.”

With a goal of displacing Samsung to become the world’s second-largest foundry by 2030, Intel Foundry seeks to set itself apart from rivals by offering “full-stack optimization from the factory network to software,” according to the company.

This means the foundry business is developing several layers of technologies in concert with each other, from the process technology, transistors and interconnects; to the design platform, core and accelerator technologies and advanced packaging technologies; to the system architecture, software and applications and workloads, according to Intel executive Craig Orr.

The chipmaker believes this approach is necessary to enable continued growth that is expected in the AI computing space, where “the number of computations needed to train an AI model” will double every 10 months, Orr said.

“We think we're really well suited to create this next generation of systems that will help our customers and our industry commercialize AI and do so in a way that's sustainable,” he added.

As part of an internal foundry model Pat Gelsinger announced in October 2022, Intel Foundry will treat the company’s internal product design teams and external chip designers equally as customers. In turn, both groups will have to compete for business with Intel Foundry.

Orr said this ensures there is “clarity in terms of financials” for Intel Foundry, which will become a reportable segment with the company’s upcoming first-quarter earnings report, so that the business is “able to benchmark and get very competitive against” other foundries.

It also shows potential and existing customers of Intel Foundry that it’s independent from the rest of the semiconductor giant’s businesses, he added.

“It helps our customers feel the trust because we’re now independent, we can make decisions about capacity allocations, technology, preferences and so on independently based on what’s best for that [business with a profit and loss statement],” Orr said.

Back when Gelsinger announced the internal foundry model in 2022, he said the move would allow Intel’s business unit, design and manufacturing teams to create “consistent processes, systems and guardrails.” It would also help Intel “identify and address structural inefficiencies that exist in our current model by driving accountability and costs back to decision-makers in real time.”

In turn, the internal foundry model would give these teams “the tools and transparency they need to find the most effective and cost-efficient solutions before implementation in silicon, ultimately helping us maximize factory output, reduce costs and shorten design cycles,” Gelsinger said.

“For example, our business unit and design teams will be able to consider the potential impact on their margins if they want to run an additional product stepping, while the manufacturing team will be able to assess requests based on actual costs and impact on factory output,” he said.

Gelsinger called this the next phase of Intel’s IDM 2.0 strategy, an evolution of its integrated device manufacturing model where it fabricates the chips it designs. The first phase included Intel’s push to introduce five process nodes in four years and build new manufacturing capacity in the West.

“This is a significant evolution in how we think and operate as a company, but the systems and infrastructure that served us well in the IDM 1.0 world will not enable us to achieve the full potential of IDM 2.0,” he said.

Multibillion-Dollar Cost-Cutting Initiative

Pat Gelsinger announced in October 2022 that Intel would cut spending by as much as $10 billion through 2025 to weather an “abrupt and pronounced slowdown in demand.”

In an earnings call, Gelsinger said Intel would make $3 billion in cuts in 2023 and that the total reduction in spending could reach $8 billion to $10 billion by the end of 2025.

The cuts would include a reduction in headcount, according to Gelsinger.

In the same call, Intel CFO David Zinsner (pictured) added that the savings would come from “portfolio cuts, rightsizing of our support organizations, more stringent cost controls in all aspects of our spending and improved sales and marketing efficiency.”

While Intel has not disclosed how many employees were laid off as a result of the cost-cutting initiative, the company said in a January filing with the U.S. Securities and Exchange Commission that the 2022 restructuring program cost $1.3 billion through the end of 2023. These costs were split between severance and benefit arrangements that were paid out to impacted employees.

The layoffs impacted an undisclosed number of employees in Intel’s channel sales organization, Dave Guzzi, general manager of global channel sales, told CRN in March of 2023. This resulted in Intel changing its coverage model for an unspecified number of channel partners, who now receive support from authorized Intel distributors instead of Intel salespeople, according to Guzzi.

In addition to conducting layoffs, Intel has saved money by temporarily cutting the salaries of executives and senior employees as well as exiting non-core businesses, spinning off additional businesses and selling stakes in another business.

Business Exits, Spin-Offs And Stake Sales

Over the course of Pat Gelsinger’s three-year tenure as Intel’s CEO, the chipmaker has exited several businesses, spun off additional businesses and sold stakes in another business.

Some of these developments happened before Intel announced its multibillion-dollar cost cutting initiative in October 2022, but all of them have helped with Gelsinger’s push for Intel to focus on its core chip design and manufacturing businesses in addition to saving the company money.

These are the businesses Intel exited before the major spending reduction drive started:

- In August 2021, Intel reportedly shut down the Intel Sports division and sold a portion of the operation to Verizon. This business mostly revolved around 3-D technology called True View that generates 360-degree replays from sports events using volumetric data captured by dozens of high-definition cameras.

- In July 2022, Intel said it sold its Intel Drone Light Shows business to Nova Sky Stories, a company started by Elon Musk’s brother, Kimbal.

- Also in July 2022, Intel said it would exit its Optane business, which included memory modules for PCs and servers that combined the persistent qualities of storage. It also included SSDs with lower latency and higher endurance than traditional NAND flash drives.

These are the businesses Intel excited after it started making major spending cuts in 2022:

- In January 2023, Intel said it would end future investments in its Tofino network switch chip product line that originated from its 2019 acquisition of Barefoot Networks.

- In March 2023, Intel said it had exited its wireless wide area network (WWAN) business that developed 4G LTE and 5G connectivity solutions for PCs. As part of the move, the company transferred its 5G software technologies to chip designers MediaTek and Fibocom.

- In April 2023, Intel said it had shut down its pre-built server system business, the Data Center Solutions Group, and sold it to Taiwan-based Tyan parent company MiTAC.

- Also in April 2023, Intel said it had discontinued its Blockscale 1000 Series ASIC for cryptocurrency mining. It has not announced any new products since then.

- In July 2023, Intel announced that it planned to exit its NUC mini PC business. A month later, the company announced it had given Taiwanese electronics giant Asus a non-exclusive license to sell, support and develop NUC mini PCs.

- In October 2023, Intel announced that sold its silicon photonics-based pluggable optical transceiver business to U.S. electronics manufacturer Jabil.

When Intel announced the divestment of its silicon photonics transceiver module business in October of last year, Gelsinger said on an earnings call that it marked the 10th business the company had exited, allowing it to generate $1.8 billion in annual savings.

In addition to these business exits, the company has spun off three other businesses: Mobileye, a nascent generative AI software business and the Programmable Solutions Group.

Intel spun off Mobileye, its advanced driver-assistance system and autonomous driving technologies business, through an initial public offering in 2021.

Then in October 2023, the chipmaker announced that it planned to spin off the Programmable Solutions Group, which ran Intel’s FPGA business, into a standalone company that it would eventually take public through an IPO by 2026. Before the IPO, the company said it would seek private investment for the FPGA business, which was given its original Altera name in February.

The semiconductor giant has remained a majority shareholder in Mobileye and the same is expected to be true for Altera when it goes public.

At the beginning of 2024, Intel announced that it had spun off a business around enterprise generative AI software it had developed with the Boston Consulting Group. The business, called Articul8, was turned into an independent company with investment firm DigitalBridge Ventures serving as the lead investor. The company also received investments from Intel itself as well as several venture capital firms, including Fin Capital and Mindset Ventures.

On top of these spin-offs, Intel sold minority stakes in its IMS Nanofabrication business to private equity firm Bain Capital and Taiwanese foundry giant TSMC in 2023. The business develops multi-beam masking tools that are required to develop advanced extreme ultraviolet lithography, also known as EUV, a technology key to advanced manufacturing nodes developed by Intel and TSMC.

In an October 2022 earnings call, Gelsinger said the Mobileye spin-off and the minority stake sales for its IMS Nanofabrication businesses added $4 billion to the company’s balance sheet.

Big Changes To Intel’s Accelerator Chip Road Maps

Last year, Intel made major changes to its road maps for accelerator chips, a nascent but important data center product segment where it hopes to mount a major challenge against Nvidia.

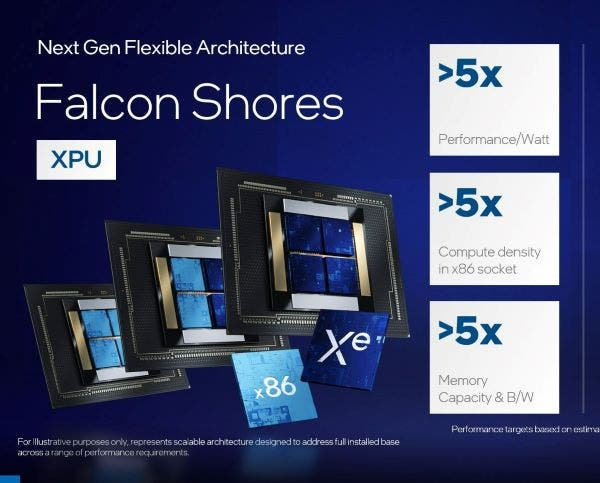

The biggest change, announced in May 2023, was the decision to converge the Max Series GPU and Gaudi AI chip road maps starting with a next-generation product code-named Falcon Shores. This means Falcon Shores will incorporate a new version of the company’s Xe GPU architecture along with updated technology originally developed for its Gaudi deep learning processors.

Originating from Intel’s $2 billion acquisition of Habana Labs in 2019, the Gaudi chips have been positioned by the company as competing products to Nvidia’s most powerful data center GPU for deep learning training and inference. The Max Series GPUs, on the other hand, have been advertised to target the “most challenging high-performance computing and AI workloads.”

As a result of the converged road maps, Falcon Shores will serve as a successor to both the first Intel Data Center GPU Max Series, which debuted in early 2023, and Gaudi 3, which is expected to launch later this year, when the converged chip design arrives in 2025.

The company also said in May 2023 that Falcon Shores would no longer include variants that combine GPU and CPU cores, a nascent design approach that rivals Nvidia and AMD have adopted starting with their recently launched Grace Hopper and Instinct MI300A chips, respectively. The company had previously said it was planning GPU-CPU designs on top of its GPU designs.

Two months before these changes were announced, Intel made other modifications to its data center GPU road maps. These changes included the cancellation of Rialto Bridge, which was supposed to serve as the successor to the first-generation Max Series GPU.

The company also said it was delaying Falcon Shores to 2025 from 2024.

In addition, Intel said it was cancelling Lancaster Sound, which was supposed to serve as the successor to Intel’s first-generation Flex Series GPU that debuted in 2022, to focus on a next-generation product code-named Melville Sound. The Flex Series GPUs are designed to accelerate video transcoding, cloud gaming, virtual desktop infrastructure and AI inference workloads.

The cancellation of Rialto Bridge and Lancaster Sound represented Intel’s decision to release data center GPUs every two years instead of its original plan for a one-year cadence.

At the time of the announcement, Intel executive Jeff McVeigh said the company decided to move to a two-year cadence of new data center GPUs to match customer expectations and allow more time for ecosystems to build around the products.

“We have simplified our road map with the goal of doing fewer things better and are rapidly rolling out products to our customers,” he said.

Software And Services Strategy Expansion

Several months after Pat Gelsinger came on board as Intel’s CEO in 2021, he told CRN for a cover story that the company was adopting a “software-first” approach that aims to make it the silicon platform of choice when it comes to running a vast array of applications.

This approach would include increased engagements with independent software vendors as well as an expansion of Intel’s commercial software and services products, he said at the time.

“One of the things that I’ve learned in my 11-year ‘vacation’ [at VMware and EMC] is delivering silicon that isn’t supported by software is a bug,” Gelsinger said in 2021. “We have to deliver the software capabilities, and then we have to empower it, accelerate it, make it more secure with hardware underneath it. And to me, this is the big bit flip that I need to drive at Intel.”

While Intel had started to sell software and services before Gelsinger re-joined the company, this activity significantly increased under his leadership.

Intel’s commercial software and services efforts under Gelsinger include:

- The company’s 2022 acquisition of Granulate, which provides cloud and data center workload optimization software.

- The 2023 launch of Intel Developer Cloud, which lets developers test and deploy AI and high-performance computing workloads with its latest CPUs, GPUs and accelerator chips.

- The 2023 launch of Intel Trust Authority, a cloud-based attestation service that verifies whether confidential computing enclaves enabled by Xeon processors are properly handling sensitive data in data centers.

- The 2024 launch of its Edge Platform, which is designed to let businesses “develop, deploy, run, secure and manage edge and AI applications at scale with cloud-like simplicity.”

AI PC Strategy

In a bid to revitalize the PC market, Intel CEO Pat Gelsinger announced last September the semiconductor giant’s plan to “usher in the age of the AI PC” with major AI and graphics updates to client processors that debuted at the end of 2023.

This new wave of processors started with the first generation of Core Ultra chips, which come with a CPU, GPU and, for the first time in an Intel CPU, a neural processing unit.

Like its rivals, Intel sees the CPU, GPU and NPU as complementary accelerators for AI workloads with different requirements: the CPU is ideal for low-latency AI workloads that require a quick response, the GPU is best for AI-accelerated content creation workloads with high-throughput needs, and the NPU is a low-power accelerator designed to run and offload sustained AI workloads from the CPU and GPU to reduce battery use.

Intel and other tech giants believe the AI PC category represents a significant opportunity in the industry because they see a growing need to compute AI workloads using a PC’s local processor as opposed to relying on the cloud. The expected benefits include improves personalization, latency, privacy and security as well as reduced costs, as CRN reported for AI PC Week.

The chipmaker launched the Core Ultra processors, code-named Meteor Lake, last December and said they will go into more than 230 laptop designs from Dell Technologies, HP Inc., Lenovo along with an additional 30-plus OEMs.

At CES 2024 in January, the company revealed that it plans to release the successor to Meteor Lake, Lunar Lake, later this year. The chipmaker also said it also plans to release its first desktop processor series with an NPU, code-named Arrow Lake, in 2024.

Ahead of Core Ultra launch last December, the company said it expects to ship processors for 100 million AI PCs by 2025. To boost demand, it launched what it called the “industry’s first” AI PC Acceleration Program, which was created to provide engineering, design and marketing resources to more than 100 independent software vendors working on AI features for PCs.