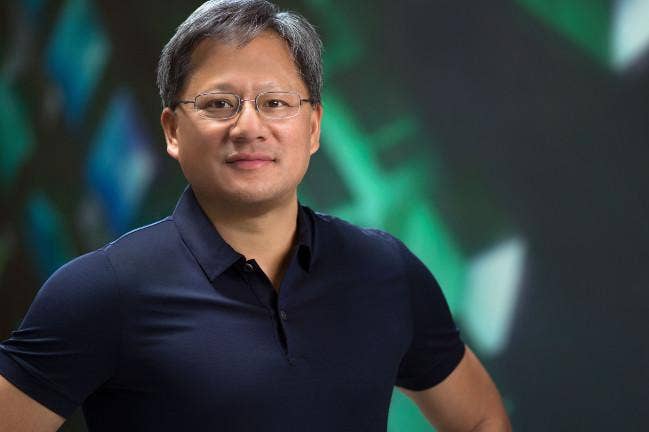

Nvidia CEO Jensen Huang: Our Future Is About ‘Data Center-Scale Computing’

Huang says the company’s investments, from Mellanox Technologies to its line of DGX systems, are in service of turning Nvidia into a ‘data-center scale company.’ ‘All of that technology was inspired by the idea that you have to think about the data center all in one holistic way,’ he says on the company’s second-quarter earnings call.

Nvidia CEO Jensen Huang said the company’s future success lies not in its ability to optimize performance at the chip level but to push things forward with “data center-scale computing.”

Huang, the company’s co-founder, made the comments Wednesday as the Santa Clara, Calif.-based company reported that its data center revenue eclipsed gaming sales for the first time in the company’s history, thanks in part to its acquisition of Mellanox Technologies that gave Nvidia a critical component of modern data centers: high-speed interconnects.

[Related: Nvidia Expands Partner Program With New Incentives, Training]

“Going forward, you optimize at the data center scale. The reason why I know this for a fact is because if you’re a software engineer, you would be sitting at home right now and you will write a piece of software that runs on the entire data center in the cloud,” Huang said during Nvidia’s earnings call for the second quarter of its fiscal 2021 year. “He has no idea what’s underneath it, nor do you care. And so what you really want is to make sure that that data center is as high throughput as possible.”

Huang pointed to Nvidia’s future as a “data center-scale company” in response to an analyst’s question about the importance of process technology given Intel's recent struggles with its own 7-nanometer process. Nvidia’s new A100 data center GPU, launched in May, uses chip foundry TSMC’s 7nm process, but Huang said the reaction to Intel’s has been off base.

“Process technology is a lot more complex than a number. I think people have simplified it down to an almost a ridiculous level,” he said.

While Nvidia’s engineering work on process technology is important, according to Huang, architecture is just as, if not more important.

“There‘s a vast difference between our architecture and the second best architecture and the rest of the architectures. The difference is incredible,” he said. “We are easily twice the energy efficiency, all the time, irrespective of the number in the transistor side. And so it must be more complicated than that.”

But even then, the chip that the architecture powers is just one part of the equation, which is why Huang believes innovation in computer chips alone cannot drive new advancements in performance. It needs to happen in the communication between the chips, which is why Nvidia developed the NVLink GPU-to-GPU interconnect and why it acquired Mellanox for system-level interconnects. It also needs to happen at the system level, which is why the company created its line of DGX deep learning systems.

“All of that technology was inspired by the idea that you have to think about the data center all in one holistic way,” Huang said.

While Huang did not address speculation about Nvidia potentially acquiring Arm, he made clear why he values the British chip designer in response to an analyst. Huang said Nvidia has been a long-term partner of Arm, which provides silicon designs for several products, from automotive applications to the system-on-chip that powers the Nintendo Switch game console. The company has also made a major investment in enabling Arm-based servers for GPU acceleration.

“We work with the Arm team very closely. They’re really, really great guys,” Huang said. “And one of the special [things] about the Arm architecture is that it’s incredibly energy efficient. And because it’s energy efficient, it has the headroom to scale into very high-performance levels over time”

Nvidia’s second-quarter revenue was $3.76 billion, a 50 percent year-over-year increase over the same period last year and beating Wall Street’s expectations by $210 million. The company’s new earnings, on the other hand, was $2.18 per share, above Wall Street’s analyst estimate by 21 cents.

The company’s stock price was down about 1.6 percent in after-hours trading Wednesday.

Out of the company’s five market segments, Nvidia’s data center revenue grew the fastest, increasing 167 percent year-over-year to $1.75 billion. Mellanox accounted for more than 30 percent of the data center segment — and 14 percent of total revenue — while the new A100 GPU made up less than a quarter, which CFO Colette Kress said shows there’s a lot more room for growth.

Gaming revenue was $1.65 billion, up 26 percent from the same period last year. OEM was also up, 32 percent, growing to $146 million. The professional visualization and automotive segments were down — 30 percent to $203 million and 47 percent to $111 million, respectively — which Nvidia attributed to the economic impacts of the coronavirus pandemic on industries like automotive, manufacturing and media.

The company said it expects third-quarter revenue to be $4.4 billion, plus or minus 2 percent, which would mark a roughly 13 percent increase from the same period last year. Kress said gaming GPU sales are expected to increase more than 25 percent from the second quarter while data center revenue is estimated to be up only by the low- to mid-single digits.