NetApp Faces ‘Current Economic Realities’ As Cloud Growth Stumbles

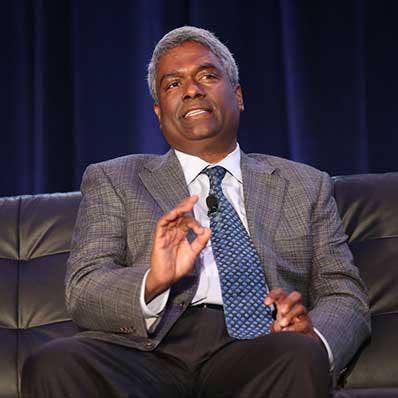

‘Public cloud ARR (annual recurring revenue) of $603 million fell short of our expectations. As our cloud partners discussed on their earnings calls, growth has slowed as customers look to optimize cloud spending. This macro-related optimization caused some slowing of growth in our cloud storage services as well,’ says NetApp CEO George Kurian in the company’s second fiscal quarter 2023 conference call.

Macroeconomic headwinds and concerns about a deceleration in cloud services revenue caused NetApp to lower its guidance for the coming quarter and the rest of the fiscal year, despite all-time highs for second quarter billings, revenue, gross profit dollars, operating income, and earnings per share.

NetApp CEO George Kurian, during his prepared remarks Tuesday to financial analysts during the company’s second fiscal quarter 2023 analyst conference call, said that the company delivered a good quarter in a dynamic environment.

“However, we are disappointed with the deceleration of growth in our cloud services,” Kurian said.

[Related: NetApp CEO George Kurian: Pure Storage Boss’ Comments Inaccurate]

On the macroeconomic front, NetApp saw changes in customer behavior impact the San Jose, Calif. company’s second fiscal quarter 2023, Kurian said.

“We saw increased budget scrutiny, requiring higher level approvals, which resulted in smaller deal sizes, longer selling cycles, and some deals moving out of the quarter,” he said. “In Q2, we felt this most acutely in the Americas hi-tech and service provider sectors. We see no change to our underlying opportunity and are confident in our position. However, current economic realities and unprecedented Fx (foreign exchange) headwinds are and will continue to impact IT spending, causing us to temper our revenue expectations for the second half.”

NetApp shares fell by about 10 percent in after-hours trading Tuesday to $64.

NetApp’s public cloud segment revenue during the second quarter increased 63 percent year-over-year to $142 million, while dollar-based net revenue retention rate remained healthy at 140 percent, Kurian said.

“However, public cloud ARR (annual recurring revenue) of $603 million fell short of our expectations,” he said. “As our cloud partners discussed on their earnings calls, growth has slowed as customers look to optimize cloud spending. This macro-related optimization caused some slowing of growth in our cloud storage services as well.”

At the same time, NetApp had a few customers with large project-based workloads like chip design that came to their natural conclusion, which resulted in capacity reductions in those environments, Kurian said.

“We expect these customers to kick off new projects early next calendar year,” he said. “As the number of cloud customers and their usage of our cloud services grows, the impact of this type of workload will be smoothed over a much broader customer base.”

In NetApp’s cloud operations portfolio, NetApp’s Spot cloud optimization business grew as customers looked to optimize their cloud spend, which Kurian said was a result of the same factors that led to a decrease in cloud storage services.

NetApp is taking actions to lower its operating expenses in response to its expected revenue slowing, Kurian said. This includes implementing a broad-based hiring freeze, reducing discretionary spending, and further optimizing its real estate footprint, he said.

“We are clearly aligned with our customers’ strategic priorities and remain confident in our long-term opportunity, despite the current external headwinds,” he said. “By focusing on what we can control, we will aggressively seek to maximize the near-term return on our product and services portfolio while leveraging our leadership position in all-flash, cloud storage, and cloud infrastructure optimization.”

For its second fiscal quarter 2023, which ended October 28, NetApp reported revenue of $1.66 billion, up 6 percent over the $1.57 billion the company reported for its second fiscal quarter 2022.

This includes product revenue of $837 million, up from $814 million; support revenue of $607 million, up from $598 million; professional and other services revenue of $77 million, up from $76 million; and public cloud segment net revenue of $142 million, up from $132 million.

In the revenue mix, NetApp’s hybrid cloud revenue grew 3 percent year-over-year, while its all-flash storage array business grew 2 percent year-over-year to an annualized revenue run rate of $3.1 billion. The company’s all-flash array penetration rate rose to 33 percent of the company’s installed base.

Americas commercial business accounted for 40 percent of NetApp’s business, while the U.S. public sector accounted for 14 percent.

Indirect sales accounted for 77 percent of NetApp’s revenue, down slightly from last year’s 79 percent.

Total revenue missed analyst expectations by $10 million, according to Seeking Alpha.

NetApp reported GAAP net income of $750 million or $3.46 per share, up significantly from last year’s $224 million or $1.00 per share. On a non-GAAP basis, NetApp reported $326 million or $1.48 per share, up from last year’s $269 million or $1.20 per share.

Non-GAAP earnings beat analyst expectations by 15 cents per share, according to Seeking Alpha.

Looking ahead, NetApp is expecting third fiscal quarter 2023 revenue of $1.525 billion, which would be down from the $1.61 billion the company reported for its third fiscal quarter 2022. The company is also expecting earnings per share in the range of $1.25 to $1.35, which compares to non-GAAP earnings last year of $1.44 per share.

NetApp is also reducing its full fiscal year by 1 to 2 points, with revenue expected to grow by 2 percent to 4 percent over fiscal 2022. Public cloud annual recurring revenue is expected to be about $700 million.