The 15 Biggest News Stories Of 2015

2015: Acquisitions, Consolidations And Splits

We started compiling a list of the 10 biggest news stories in 2015, but keeping it to 10 was proving to be a challenge. Throw in the fact this is 2015, and the 10 biggest news stories quickly became the biggest 15.

So what made the list? Dell struck a deal to buy EMC, while Comcast dropped its bid to buy Time-Warner. Hewlett-Packard and CSC each split into two companies while Symantec was trying to split in two. And Cisco began operating under new management.

A wave of consolidation, meanwhile, swept the channel as solution providers merged to achieve scale and gain expertise, and channel leaders continued to evolve into strategic service suppliers. On the technology side the promise of the Internet of Things market continued to grow while questions grew about the future of OpenStack.

What else? Take a look and see which news stories made the list, counting down to the biggest news story of the year. And to take a bigger look at the year that was in the channel, check out CRN's 2015 Tech Year In Review.

15. VMware, Carahsoft Pay $75.5 Million To Settle Government Overcharging Lawsuit

VMware and channel partner Carahsoft in June agreed to pay $75.5 million to settle a civil lawsuit alleging they overcharged the federal government for VMware products and services over a six-year period. A former VMware executive brought the suit on behalf of the U.S. General Services Administration, the federal government's purchasing arm.

VMware and Carahsoft were alleged to have given private sector customers better pricing and discounts than it offered government customers. Between 2007 and 2013, they were alleged to have provided "inaccurate pricing, inaccurate disclosures and incomplete information" to the GSA. The result was that government agencies bought more server virtualization software than they needed.

It hasn't been a great year for VMware's government business. In March, the U.S. department canceled VMware's proposed five-year, $1.6 billion enterprise licensing agreement. But VMware and Carasoft haven't given up, reportedly winning a new $40 million U.S. Army contract in August.

14. Comcast Drops $45.2 Billion Bid To Acquire Time-Warner

It was to be a megadeal that would have created a cable and telecommunications powerhouse. But in April, after it became increasingly clear that U.S. regulators would oppose Comcast's $45.2 billion bid to acquire Time-Warner, Comcast decided to walk away from the planned acquisition it had announced in February 2014.

Little more than a month later, Comcast rival Charter Communications revealed its own deal to buy Time-Warner -- for $56 billion. At the same time Charter said it would buy Bright House Networks for $10.4 billion. If both deals (still pending at publication time) go through, Charter will become the second-largest U.S. cable provider.

13. OpenStack: Hot Or Not?

In 2014, a wave of startup companies focused on delivering products and services based on the OpenStack Infrastructure-as-a-Service standards. They attracted a lot of attention -- and financing -- but by mid-2015, many were gone.

The consolidation actually began in late 2014 with Cisco's acquisition of Metacloud in September and EMC's buyout of Cloudscaling in October. The trend continued this year with Cisco's June 3 deal to buy Piston Cloud and IBM's deal the same day to acquire Blue Box.

But it was the sudden shuttering in April of Nebula, perhaps the hottest company in the OpenStack arena, that really jolted the industry. Nebula's demise sparked an immediate debate: Is OpenStack a viable technology for the cloud computing industry?

OpenStack lives, however. Mirantis, which calls itself the "pure play" OpenStack company, raised $100 million in venture funding in August. Hewlett-Packard released its HP OpenStack 2.0 in October. And startups like Platform9, SwiftStack and PLUMgrid are developing products for OpenStack environments.

12. Venture Capital Flows To Big Data, Security Startups

In an echo of the dot.com days, venture capital firms seemed especially eager to give money to IT startups this year. In CRN's monthly "Follow the Money" roundup of funding announcements, some 15 startups closed funding rounds of $100 million or more, with announcements in the $50 million to $100 million range downright routine. Some of the funding announcements put the startups' market capitalizations at more than $1 billion -- what's become known as "unicorn" valuations.

Big data startups pulled in some of the biggest hauls, including Domo ($200 million in Series D funding in April) and Palantir Technologies (a stunning $450 million private equity round in July). Security startups were also hot, including Tanium ($52 million in March and $120 million more in September), Zscaler ($125 million in August and September) and CrowdStrike (a $100 million Series C round in July).

Also hot on the VC financing front were next-generation storage technology builders like Infinidat ($150 million in April) and Tintri ($125 million in August), converged infrastructure vendors led by SimpliVity ($175 million in March), and cloud software developers such as Zuora ($115 million in March) and FinancialForce ($110 million in March).

11. Elliott Management Flexes Its Investor Muscle

Has any financial investment company had such an impact on the IT industry? In 2015, several prominent IT companies, including EMC and Citrix, found themselves wrestling with demands for change from Elliott Management Group, a New York hedge fund company and activist investor.

Other companies have wrangled with Elliott Management before: BMC went private in 2013 under pressure from the investor while Juniper Networks implemented a $160 million cost-cutting plan last year largely in response to pressure from Elliott.

In June, Elliott executive Jesse Cohn disclosed that the investor owned 7.1 percent of Citrix and was demanding a series of changes, including overhauling the vendor's channel operations, cutting operating costs, ditching underperforming product lines, possibly selling off online services and increasing share repurchases. In July, longtime President and CEO Mark Templeton announced his retirement plans. After months of pressure, Citrix announced in November a plan to spin off its GoTo online services and cut as many as 1,000 jobs -- about 10 percent of its workforce.

Elliott, meanwhile, continued to push storage system giant EMC to break up its five-company federation, including selling off its stake in VMware. EMC's battle with Elliott was somewhat muted this year since the investor gained two seats on EMC's board in November. But one has to wonder if Elliot's unrelenting pressure was a factor in its decision to sell out to Dell in a $67 billion deal.

10. Amazon Web Services: Bigger And Growing Even Faster Than You Thought

In the years since its launch, Amazon Web Services has become a major player, if not the dominant vendor, in the growing cloud services market. But just how big it was and how fast it was growing was a mystery because Amazon did not break out AWS' financial numbers.

Until this year, that is. In April, Amazon stunned the industry when it disclosed in its Q1 financial report that AWS generated $1.57 billion in revenue in the quarter, up 49 percent year over year, and $265 million in profits.

For the first three quarters of the year, AWS recorded revenue of nearly $5.5 billion, and Amazon CEO Jeff Bezos, at the Re:Invent conference, said AWS was on track for $7.3 billion in sales for the year -- up 81 percent year over year. Even more impressive is its nearly 20 percent operating margin. And the cloud giant has more than 1 million business customers.

9. The Symantec Saga

Few IT vendors seemed to generate as many headlines in 2015 than did Symantec as the company underwent a seemingly never-ending restructuring and struggled to set a course toward growth and profitability.

The headlines, of course, extend back into 2014 when the company fired CEO Steve Bennett in May and appointed Michael Brown as CEO to lead efforts to turn around the struggling company. That included a plan unveiled in October for Symantec to spin off Veritas, the storage management products company acquired in 2005 in a marriage that observers generally agree never worked.

But the travails continued through 2015, including declining revenue and profits, layoffs and executive defections. Finally, on Aug. 11, the company announced a deal to sell Veritas to a private equity firm for $8 billion in a move that would finally free the security vendor to pursue its own course. A short time later the company launched a new channel program and executives declared the company had its "security swagger" back.

But the good news was short-lived. Several key channel managers suddenly exited the company, including Adrian Jones, the respected executive vice president and general manager of global sales and operations. Two banks pulled funding for the Veritas deal, putting the sale in jeopardy. As the year drew to a close, angry shareholders were demanding results and solution providers were questioning the company's commitment to the channel.

8. Microsoft Launches Windows 10

Microsoft CEO Satya Nadella unveiled Windows 10, the next generation of the company's flagship operating system, in January. In July, after months of preparation, planning and training by the vendor's thousands of channel partners, the software was released.

It's true that Microsoft doesn't dominate the industry the way it did 20 years ago, and the proliferation of smartphones and tablet computers that don't run Windows means that a new edition of the operating system isn't quite the Earth-shaking event it used to be.

But most desktop and laptop computers still run Windows, and this was the first release since the much-maligned Windows 8 -- meaning there were millions of computers running Windows 7 (released in 2009) and even Windows XP out there to be upgraded. It's the first Windows release to support PCs, tablets, smartphones and other devices with a single version. And there remains a huge ecosystem of solution providers, PC makers, application developers and others whose business remains Windows-focused.

Windows 10 wasn't without controversy, however. Some partners complained that Microsoft's surprise announcement of a free Windows 10 upgrade for some customers hurt their upgrade sales prospects. There were reports later in the year that Microsoft was aggressively pushing Windows 10 through Windows Update onto PCs with older releases. And in the end, Windows 10 failed to boost PC sales as some partners had hoped.

7. Internet of Things Drives Acquisitions, Channel Preparations

The Internet of Things was probably the most hyped technology of the year, with market forecasts reaching $19 trillion. Right now, real spending on IoT technology is a fraction of that. But in 2015, the potential of IoT was a major driver of industry and channel developments, including acquisitions, vendor spending on product development, and channel partner preparation.

In March, for example, IBM said it would spend $3 billion over four years developing a portfolio of cloud services and software aimed at IoT. In June, Intel struck a deal to acquire custom-design semiconductor manufacturer Altera for $16.7 billion, widely seen as a move to bolster its IoT business, and in November the chipmaker unleashed new hardware and software products tied to its IoT reference architecture platform.

In September, Microsoft began selling an Azure IoT suite, and one month later, Verizon unveiled its IoT platform and strategy. Also in October, Amazon Web Services capped off its Invent conference by unveiling an expansive IoT platform for systems integrators.

The preparations extended to the channel. Cisco offered channel partners an Internet of Everything playbook for partners building IoT vertical industry practices. Zones created a worldwide IoT practice that provides both horizontal IoT systems and IoT solutions for vertical industries. Aeris Communications launched a partner program that brings IoT network connectivity services to the channel using a recurring revenue model.

6. Federal Office Of Personnel Management Hit With Massive Security Breach

There has been a series of headline-grabbing IT security breaches in the past several years from retailers such as Target and Home Depot, to health-care providers such as Premera BlueCross BlueShield and Anthem, and IT vendors (including Kaspersky Lab, which develops security software).

In June came news that the federal government's Office of Personnel Management had been hit by two cyberattacks that exposed the records of more than 21.5 million federal workers and contractors. Investigators suspect that hackers in China were responsible.

The exposed information included sensitive background information, including Social Security numbers, residency and educational history, employment history, information about immediate family and other personal and business acquaintances, health, criminal and financial history, and more. Some 1.1 million individuals also had their fingerprint information exposed.

5. Channel Consolidation Gives Rise To Strategic Service Providers

Mergers and acquisitions in the channel have been on the rise. In 2015, M&A activity accelerated, sometimes simply to create a bigger company, but often to gain expertise in new technologies, industries and business practices with the goal of becoming a strategic service provider.

Perhaps no other acquisition epitomized the trend more than Accenture's September agreement to acquire Cloud Sherpas, one of the pioneering "born-in-the-cloud" solution providers, giving Accenture one of the largest Salesforce.com and Google application consulting businesses.

The need for size and market presence drove some acquisitions: The February merger of Accuvant and Fishnet created a $1.5 billion security solution provider, for example, while Compugen's acquisition of Metafore in September created a $530 million channel powerhouse. Other acquisitions brought expertise in new areas: Perficient's $12 million buy of digital marketing agency Enlighten, for example, and HCL's $46 million acquisition of PowerObjects and its Microsoft Dynamics CRM practice.

Private equity companies snapped up fast-growing solution and service providers: Millstein & Co. acquired DLT Solutions, New State Capital Partners bought a majority stake in NWN, and GTCR acquired Park Place Technologies. And in a sometimes-controversial trend, distributors bought solution providers, potentially putting them in competition with resellers.

4. CSC Divides Into Companies Focused On Commercial, Federal Government Businesses

Computer Sciences Corp. has been undergoing significant restructuring and transformation for several years and there's been no shortage of speculation that the company, No. 5 on the CRN 2015 Solution Provider 500, would be acquired by another systems integrator, bought by a private equity company, or broken up.

So it came as no huge surprise when the company announced May 19 a plan to split into two publicly held companies, one focused on the company's $8.1 billion commercial business and the other on its U.S. federal government business. The split officially took place at the end of November with the public sector business merging with SRA to create a $5.5 billion company.

Now, with the split complete, industry observers will be watching to see if the two new companies will be more focused and successful than the CSC of old.

3. Cisco Systems Under New Management

While a retirement announcement from Cisco CEO John Chambers had been rumored -- even expected -- for some time, it still took many by surprise when he announced May 4 that he would relinquish the top post after 20 years. Even more surprising was the announcement that Chuck Robbins, a 17-year Cisco veteran who ran the company's global sales and partner team, would become the networking giant's new CEO.

The repercussions from the news began even before Robbins officially took over July 26. Most prominent have been the changes in Cisco's management ranks, starting with the departures of President and Chief Operating Officer Gary Moore and Rob Lloyd, president of development and sales, each of whom had been seen as Chambers' possible successor. Others heading for the door included Chief Technology Officer Padmasree Warrior and global channel chief Bruce Klein.

There have been strategic changes at Cisco as well, including a greater focus on IT security and the closing of the company's Invicta storage business. The company's growing emphasis on cloud computing and security can be seen in recent acquisitions of Piston Cloud Computing, OpenDNS and Tropo.

2. Hewlett-Packard Splits Into Two Companies

Hewlett-Packard officially divided into two Fortune 50 companies as of Nov. 1, one focused on enterprise computing (Hewlett Packard Enterprise) and one on personal systems and printers (HP Inc.). The split completed a plan first revealed in October 2014 and on which company executives had worked for more than a year to execute.

But will it work? For its final quarter before the split Hewlett-Packard reported a 9 percent sales decline year over year -- including a 9 percent drop in enterprise services and a 14 percent plunge in PC and printer sales. Just weeks after the split, HP Inc. CEO Don Weisler said the new company was experiencing weaker-than-expected results in its cash cow printer business.

Just one month after the split, however, Hewlett Packard Enterprise CEO Meg Whitman unveiled its groundbreaking Synergy "composable" infrastructure technology -- a glimpse of the innovator the company used to be -- and could be again.

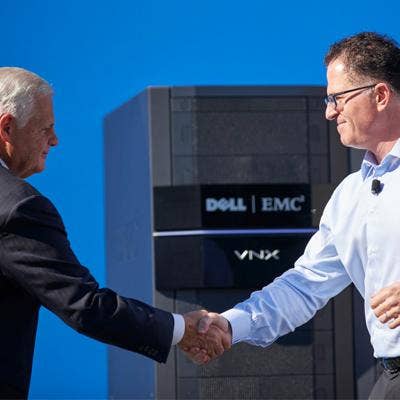

1. Dell Buying EMC for $67 Billion

On Oct. 12, Dell stunned the industry when it announced a deal to acquire storage technology giant EMC in the biggest information technology acquisition ever -- a move that many expect will reorder the IT industry's competitive landscape.

The acquisition won't be completed until sometime after May 2016. But the deal already has vendors such as Cisco, Hewlett Packard Enterprise and others recalibrating their strategies in anticipation of competing with Dell when it becomes a $90 billion powerhouse.

But questions remain. Will Dell keep all parts of the EMC Federation, including VMware, RSA and other operating units? Or could Dell sell off some of its own businesses lines, such as SonicWall, Quest Software or Perot Systems, as some reports suggest?