The 18 Biggest News Stories Of 2018

From microprocessor vulnerabilities to billion-dollar acquisitions, from data privacy scandals to top executive resignations, CRN takes a look at the news stories that captured our attention in 2018.

2018: Semiconductor Flaws, Hybrid Computing, Tariffs, Acquisitions And AI

See the latest entry: The 10 Biggest News Stories of 2022

Compiling a list of the biggest news stories in the IT industry is always a challenge simply because there is always so much to choose from. And 2018 is no different.

The industry had its share of major acquisitions, botched software rollouts and semiconductor vulnerabilities in 2018. Leading IT companies wrestled with activist investors as they tried to go public, get acquired or just manage their business.

Some found themselves in the spotlight because of a failure to manage data or a failure to manage people. Others found themselves facing governmental challenges, from anti-trust scrutiny to global tariff wars.

And always there was the march of new technologies, from artificial intelligence to hybrid computing, that kept the IT industry in a constant state of evolution.

Which events made our list of the biggest news stories in 2018? Take a look and see if you agree with our choices.

18. HPE Offers Groundbreaking GreenLake Flexible Consumption Model

Hewlett Packard Enterprise upended the IT channel in 2018 when it debuted its GreenLake Flex Capacity offering that brought the pay-per-use model of cloud computing to partners selling HPE infrastructure.

HPE said the GreenLake compensation model, an alternative to public cloud, provided partners with rebate incentives much greater than traditional capex deals. The goal was to provide partners with a significant margin boost as they adopted a pay-per-use consumption model.

GreenLake is also designed to eliminate overprovisioning where customers buy more on-premise compute, storage or networking capacity than they need. It speeds up IT provisioning, provides detailed consumption information for customers and gives partners the option to provide a service as a capital or operating expense.

17. Google Employees Stage Global Walkout Over Allegations Of Sexual Harassment, Inequality

Google found itself in the center of the #MeToo movement when on Nov. 1 employees staged a worldwide walkout to protest what they see as a workplace culture that fosters sexual harassment and discrimination.

The demonstration was fallout from a New York Times investigative story a week earlier that detailed years of sexual harassment and abuse allegations, multimillion-dollar severance packages for accused executives and a lack of transparency over the cases.

The article detailed how in 2014 Google gave a $90 million exit package to Andy Rubin, creator of the Android mobile operating system, after an employee accused him of sexual misconduct and Google concluded the claim was credible.

16. Facebook Becomes The IT Industry Face Of Bad Data Practices

Facebook was in the news in 2018 – a lot – and generally not in a favorable light. Over the course of the year the social media giant came under fire a number of times for its business practices and its seeming inability to protect users' data. By year's end, for many, Facebook had become Exhibit A for what can go wrong when millions of users trust their personal data to an all-powerful IT company.

Facebook found itself in the midst of a firestorm in March when published reports said that Cambridge Analytica, a London-based political consulting firm, had harvested data from Facebook users and used the information to target those and their friends. Initial reports said data on 50 million users was used, a number later increased to 87 million. Reaction to the news of the incident was swift and angry. Compounding the problem was the slow response from Facebook and founder/CEO Mark Zuckerberg to address the incident.

Facebook's disclosure in September that a code vulnerability in its "View As" feature allowed attackers to potentially take over nearly 50 million user accounts only reinforced the view that Facebook was more concerned with its growth and bottom line than with protecting user data.

Through 2018, Facebook faced a stream of questions about how Russia used Facebook ads and social media accounts to influence the 2016 election – seemingly without Facebook being aware of what was happening. And in December documents surfaced that showed that Zuckerberg and other senior executives discussed strategies to cut off business customers' access to Facebook's user data unless they bought digital advertising.

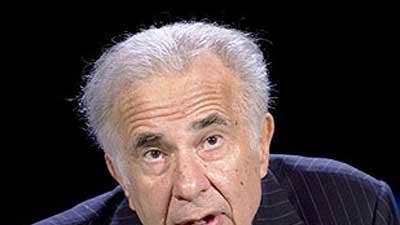

15. IT Companies Battle, Accommodate Activist Investors

Throughout the year activist investors, and uber investor Carl Icahn (pictured) in particular, played significant roles as some of the IT industry's biggest companies tried to execute deals and manage their businesses. Could the heightened level of activist investor activity be a portent of things to come?

Icahn's influence was most evident earlier in the year in the battle for control of Xerox. Icahn opposed a plan for Fujifilm Holdings to acquire a majority stake in the storied printer and copier maker. Icahn ultimately won when Xerox's CEO and some of its board members resigned to avoid a proxy fight. The Fujifilm deal was canceled.

Icahn also led the opposition to Dell Technologies' plan to go public using its VMware tracking stock. But Icahn lost this battle when CEO Michael Dell raised the offer for the stock and Icahn called a potential proxy fight "unwinnable." A majority of stockholders ultimately approved the deal setting the stage for Dell to once again become a public company.

Icahn also owns sizeable stakes in VMware and Conduent.

But in other cases, IT companies avoided pitched battles by coming to an accommodation with activist investors. Symantec, for example, reached an agreement with Starboard Value, naming three Starboard-proposed candidates to its board of directors (Starboard had demanded five).

14. Apple, Google And Facebook Come Under Increased Government Scrutiny

Throughout 2018 Apple, Google and Facebook seemed to find themselves in the crosshairs of politicians and government regulators – both in the U.S. and abroad – and their business practices under scrutiny.

Through 2018, Facebook faced a stream of questions about the Cambridge Analytica scandal (see No. 16) and the social media giant's seemingly cavalier attitude toward user data. Also under scrutiny was the company's business practices that allowed Russia to use Facebook ads and social media accounts to influence the 2016 election – seemingly without Facebook being aware of what was happening. A lasting image of 2018 will be CEO Mark Zuckerberg, looking very out-of-place in a suit and tie, undergoing intense questioning and intense criticism before U.S. congressional committees in Washington, D.C.

Apple and Google, meanwhile, both found themselves in costly disputes with the European Commission in 2018. In July the EC slapped Google with a record $5.05 billion fine for allegedly abusing its power in the mobile phone market with its Android software and ordered the company to change its business practices. Apple, meanwhile, made several tax and interest payments to Ireland totaling 14.3 billion euro (about $16.19 billion), following a European Union ruling in 2016 that Apple had received unfair tax incentives from the Irish government.

In October, reports surfaced that regulators in the U.S. Department of Justice's Antitrust Division could follow the EC's lead and investigate Google for possible anti-trust violations relating to the company's Android business practices.

And in testimony before the House Judiciary Committee on Dec. 12, Google CEO Sundar Pichai found himself responding to questions on a range of topics from Google's data collection business practices, to alleged bias in Google search results, to the company's plans to develop search technology for the Chinese market. At one point, Pichai had to explain why searching for "idiot" turned up photos of President Donald Trump.

13. Embarrassing Glitches Plague Microsoft's Rollout Of Windows 10 Update

In early October, Microsoft debuted a new release of the Windows 10 operating system, also known as "version 1809," touting its new clipboard history capability, a dark mode for Microsoft applications, a new screenshot utility, search previews in the start menu, Edge browser updates and other new functionality.

But it quickly became clear that 1809 had some serious problems as reports began hitting Microsoft's user forum and social media sites of users losing documents and files, including photos and music, when the Windows 10 update was installed. There were also reports that the new release created compatibility problems with a number of Intel display audio drivers.

On Oct. 8 Microsoft hit the pause button and temporarily halted the deployment of the Windows 10 update while it investigated the reports and tried to figure out what was happening.

On Nov. 13, more than a month later, Microsoft said it had resolved the issues and resumed the Windows 10 update rollout. But it's a good guess that users took a little longer this time to install the new software.

12. AT&T Completes Time Warner Acquisition – Or Has It?

AT&T struck a deal in 2016 to acquire entertainment powerhouse Time Warner for $85.4 billion, the latest effort by communications carriers to expand into content production. The deal seemed on track to be completed by late 2017 when the U.S. Justice Department announced in November that it would oppose the acquisition on antitrust grounds.

The outcome of the case was widely seen as possibly setting a precedent for the telecom industry from an antitrust perspective.

The case went to trial in March and, after several months of deliberations, U.S. District Court Judge Richard Leon ruled on June 12 that the acquisition could proceed without any restrictions or conditions. And just days later AT&T completed the acquisition.

But in an unexpected move, the U.S. Justice Department announced July 12 that it would appeal Judge Leon's ruling. Now the case will drag on in court into 2019 and maybe beyond and AT&T has to be wondering if it will be forced to undo an $85 billion acquisition.

11. The Fight For Control Of Xerox

On Jan. 31, Xerox announced a deal under which Fujifilm Holdings would acquire a majority stake in the storied printer and copier manufacturer. Executives at the two companies trumpeted the move, saying it would create an $18 billion industry player in the competitive printer market.

But the deal didn't sit well with activist investor Carl Icahn and Darwin Deason, the latter among Xerox's largest shareholders, who filed suit to stop the plan. That triggered a months-long battle in court, on Xerox's board and in the public domain about the company's future.

At times the battle's twists and turns boarded on the absurd: In early May CEO Jeff Jacobson and a number of Xerox board members resigned to avoid a proxy fight, only to return three days later, only to leave – this time for good – one week later.

In the end Xerox's newly reconstituted board killed the Fujifilm Holdings deal. That led to angry denunciations from Fujifilm, vows to compete against Xerox in the U.S. market, and a $1 billion lawsuit seeking damages for alleged breach of contract.

10. Apple Loses Its Shine

Apple is often seen as something of an IT industry golden child: Leading in innovation, serving an almost-fanatical customer base, and always enjoying robust sales growth. The company, in fact, reached a pinnacle of sorts on Oct. 3 when it became the first U.S. publicly traded company with a market capitalization of $1 trillion. But Apple, nevertheless, had a bumpy year in 2018.

Apple acknowledged it had deliberately slowed the performance of older iPhones to help preserve the life of their batteries – and had been doing so throughout 2017 without telling anyone. As 2018 dawned, Apple came under heavy criticism for not disclosing what became known as "throttling," seen by some as a way to push customers to upgrade their iPhones more quickly. CEO Tim Cook defended Apple's use of throttling, but admitted that Apple had erred in not being more transparent about the practice. The controversy is seen as having tarnished Apple's reputation with its customers.

In November the U.S. Supreme Court heard arguments in a case in which consumers charge that Apple's requirements that iOS applications be sold only through its AppStore constituted a monopoly that violates U.S. anti-trust laws. Supreme Court justices seemed receptive to the argument.

In September Apple introduced the iPhone Xs, Xs Max and XR to much fanfare. But as the year went on, reports surfaced that sales of the latest iPhones weren't meeting expectations and Apple had slashed production of the three devices – a problem given that iPhone sales account for more than 80 percent of Apple's annual revenue. In November Apple annoyed Wall Street analysts when the company said it would no longer disclose unit sales data for its iPhone, iPad and Mac products.

Through the year Apple scrambled to respond to consumer complaints – and even lawsuits – about alleged product defects including problems with Mac laptop keyboards and display screens.

And as the year drew to a close, Apple found itself caught up in the escalating U.S.-China trade war. While iPhones manufactured in China weren't included in the initial rounds of tariffs the Trump Administration slapped on Chinese-made goods, President Donald Trump said in November that he was considering levying a 10 percent tariff on iPhones and other Apple products.

9. China Tariffs Put A Damper On Economic Outlook For IT Vendors, Solution Providers

Most IT vendors and solution providers will remember 2018 as the economic boom year. But the escalating tit-for-tat tariff war between the U.S. and China began to hit some companies where it hurts most – the bottom line – and created economic uncertainty for the IT industry for the latter part of 2018 and for the coming new year.

U.S. tariffs on some goods manufactured in China went into effect in September and IT vendors such as Cisco Systems and Juniper Networks raised prices on some of their products. Cisco increased prices on nearly 3,000 specific products, some by 10 percent, in response to the Trump Administration tariffs while solution providers said Juniper Networks was adding a 3.5 percent charge on products that contained parts made in China.

In October, Dell Technologies CEO Michael Dell said his company was "making adjustments" in preparation for China tariffs—including the possibility of raising prices on Dell products.

In September, Apple warned that the Trump Administration's proposed tariffs on $200 billion worth of imports from China would raise the cost of doing business in the U.S., increase the price of products for consumers and provide a boost to foreign competitors. But that didn't dissuade Trump, in an interview in November, from proposing to slap tariffs of as much as 10 percent on Apple iPhones made in China.

8. IBM Strikes $34 Billion Deal To Acquire Red Hat

IBM and Red Hat stunned the IT industry on Oct. 28 when they announced a deal for IBM to acquire the open-source software developer for $34 billion in a move that IBM said would make it the No. 1 vendor of hybrid, multi-cloud computing software.

Some observers viewed the acquisition as a bold move, noting the two companies' complementary product lines, and a natural outgrowth of a strategic alliance the two announced in May. Others saw it as a desperate Hail Mary pass by IBM, which has struggled in recent years to reinvent itself. The companies expect to close the acquisition in 2019.

The IBM-Red Hat deal was just one of a number of blockbuster acquisitions in 2018, some with the potential to change the IT industry landscape. Semiconductor maker Broadcom announced a deal in July to acquire data center software vendor CA Technology for $18.9 billion, a deal that was completed in November. And in October Microsoft wrapped up one of its biggest acquisitions when it bought source code repository GitHub for $7.5 billion.

The channel community seemed to be especially active on the mergers and acquisitions front in 2018. Major companies such as Accenture and Cognizant continued buying up companies with technology, services and expertise as they sought to expand into new areas. French IT services giant Atos struck a $3.57 billion deal to buy Syntel in a move that expands its presence in North America. And European systems integrator giant Computacenter agreed to buy fast growing FusionStorm.

7. Artificial Intelligence Everywhere

As with the Internet in the mid-1990s and cloud computing a decade ago, IT vendors of all types moved swiftly in 2018 to jump on the artificial intelligence bandwagon. Throughout the year IT companies announced the addition of AI capabilities to their existing products, acquired AI technology startups or even redefined themselves as "AI companies."

Technology sectors such as business analytics and Internet of Things seemed to be the most transformed by the AI wave. Developers of business intelligence software, for example, added AI technology to their products to boost their predictive analysis and self-service capabilities.

But even many comparatively routine product announcements in 2018 included the addition of AI to make existing products smarter. Case-in-point was Aruba Network's Aruba 510 Series WiFi product announcement in November that included the addition of AI-based autonomous tuning to optimize the system's performance and efficiency.

Venture fund companies were eager to provide AI startups with financing. Statup Paperspace raised $13 million in October to continue developing its AI-fueled GPU provisioning platform. Startup YotaScale received $8 million in November to market its AI-injected cloud management automation system.

But it was on the acquisition front where much of the AI activity was in 2018 with major vendors eager to acquire young AI tech developers. Microsoft led the way with its AI startup acquisition spree including Xoxoco, Bonsai and Lobe. Apple bought Silk Labs, a developer of artificially intelligent software for connected devices, while Intel acquired deep-learning software developer Vertex.Ai and Google bought AI-powered chatbot startup Onward.

6. AWS Vs. Everyone Else In Battles Over Pentagon Cloud Service Contracts

In February Rean Cloud, a systems integrator and Premier Amazon Web Services partner, announced that it had been awarded a five-year, $950-million contract to implement a custom cloud system for the U.S. Department of Defense.

But the Pentagon pulled back on the deal in March after Oracle lodged a protest arguing that the contract unfairly benefited AWS. The issue became a year-long tug-of-war between AWS and its competitors, including Oracle, Microsoft and Dell Technologies, over the future of DoD cloud computing contracts.

The consortium of vendors argue that such contracts should be broken up into multiple projects to avoid vendor lock-in. In October IBM joined Oracle in formally protesting the contract saying the decision to go with a single provider would be a liability for the military.

The Pentagon, however, says it prefered to award such contracts to single cloud providers, including a massive multi-billion-dollar cloud migration project known as Joint Enterprise Defense Infrastructure or JEDI.

In May Amazon Web Services CEO Andy Jassy pledged an aggressive bid for JEDI and dismissed the complaints from competitors as worries among "old guard" IT suppliers of losing business.

The DoD delayed the deadline for submitting JEDI bids several times and by year's end no final decision on a contract award had been announced. The issue became even murkier in October when two U.S. congressmen took steps to challenge the JEDI contract process saying military officials violated ethical obligations because of their ties to a specific contractor – an apparent reference to Amazon.

The Government Accountability Office dismissed Oracle's protest of the JEDI bidding plans in November and IBM's protest in December. On Dec. 10, Oracle filed a lawsuit against the federal government in the case.

5. Industry Hit By Intel CPU Shortage

Supplies of Intel CPU chips became tight in the second half of 2018 leading to delays in shipments of products that use the processors – everything from servers and PCs to peripheral devices – to solution providers, distributors and customers.

The first hint of problems came in July when interim Intel CEO Bob Swan said the company's biggest challenge in the second half of the year would be meeting demand for 14-nanometer CPUs, including Core client and Xeon server processors.

By early September solution providers were reporting delays in shipping products to their customers and, in some cases, faced increased costs for those products. "It's causing pain and apprehensiveness," one solution provider executive told CRN. Global market intelligence firm TrendForce said the chip shortage would strain OEMs' ability to ship laptop computers in the second half of the year and lowered its forecast for 2018 global notebook shipments by 0.2 percent.

Intel blamed the shortage on greater-than-expected demand for the latest generation of its 14nm processors, which also require additional factory and assembly test capacity. The need to devote more resources to meeting demand could also impact Intel's efforts to begin manufacturing its next-generation 10nm processors.

On Sept. 28, Swan issued a statement saying chip supplies were "undoubtedly tight." And during the company's third-quarter earnings call on Oct. 25 the acting CEO said CPU chips, especially entry-level CPUs and Internet of Things chips, would remain constrained at least through the end of the year.

4. Industry Leaders Catch The Hybrid-Cloud Wave

At Amazon's re:Invent conference in November, Amazon Web Services – the giant of cloud computing – stunned attendees when it unveiled AWS Outposts, a line of (gasp!) on-premise compute and storage systems designed to work with AWS services, including Amazon Elastic Compute Cloud and Amazon Elastic Block Store, in a hybrid-cloud architecture.

The announcement also highlighted the increasingly important role VMware is playing in hybrid-cloud computing. VMware helped bridge the cloud and on-premise worlds with its VMware Cloud on AWS (announced in 2016 and shipped last year). At re:Invent it debuted VMware Cloud on AWS Outposts and VMware Cloud Foundation for EC2, a move that served to solidify its position in hybrid cloud.

Earlier in November Cisco stepped up its hybrid-, multi-cloud offensive by teaming with AWS to offer Cisco Hybrid Solution for Kubernetes on AWS. Cisco made a big move into hybrid cloud with a strategic alliance with Google in October 2017 that extended Cisco's networking and security technology to Google's public cloud offering.

And IBM said its blockbuster $34 billion deal to acquire Red Hat was primarily focused on making IBM a leader in the hybrid computing software arena.

3. Intel CEO Krzanich Resigns Over Violation Of Company Conduct Policy

The news broke early on the morning of June 21 when Intel announced that CEO Brian Krzanich (pictured) had resigned after the company learned that he had had a consensual relationship with an Intel employee in violation of the chipmaker's non-fraternization policy.

It was a difficult turn of events for Intel, which has been transforming itself from its PC-centric roots to focus on new areas such as data center systems and artificial intelligence. It also came just weeks before the company's 50th anniversary.

The company named Chief Financial Officer Robert Swan to be interim CEO and has been conducting a search for a new CEO since. While rumors surfaced throughout the year about one candidate or another, including a pair of Qualcomm executives, by year's end the chipmaker had yet to name a permanent replacement.

Krzanich had been with Intel since 1982, starting as an engineer and eventually being named chief operating officer in 2012 and Intel's sixth CEO in May 2013. On Nov. 7 CDK Global, a developer of software used by auto dealerships, announced that it had hired Krzanich as its new president and CEO.

2. Dell To Go Public Again In VMware Tracking Stock Deal

Reports circulated in January that Dell Technologies, taken private by founder and CEO Michael Dell (pictured) in 2013, was considering a plan to go public again through a "reverse merger" plan that would leverage its tracking stock for virtualization technology developer VMware, of which Dell Technologies was a majority owner following its 2016 acquisition of EMC. The plan was seen as a way to help Dell mitigate its high debt load.

While company executives acknowledged it was considering a number of options for going public, it wasn't until July 2 that Dell Technologies struck a deal to take the company public through a complex share swap plan with its VMware tracking stock. Dell offered to pay $21.7 billion in cash and stock to buy back the tracking stock, a way to take the company public without a traditional IPO.

But the plan ran into opposition, primarily from activist investor Cark Ichan, one of VMware's largest shareholders. Other leading shareholders, including Jericho Capital, also expressed opposition to the plan, saying it could undermine VMware's own growth strategy.

In early November Dell increased its offer to $23.9 billion, a move that appeared to win over shareholders. Icahn backed off his opposition, calling a proxy fight "unwinnable," and withdrew a lawsuit he had filed against the company.

On. Dec. 11, shareholders approved the VMware tracking stock plan, with more than 61 percent of shareholders approving the deal, and Dell Technologies made ready to once again become a public company on Dec. 28.

1. Spectre and Meltdown Chip Vulnerabilities Disrupt IT industry

When the first reports of the processor vulnerabilities that quickly became known as Spectre and Meltdown surfaced on Jan. 3, Intel called the reports inaccurate, downplaying their severity and – initially – even disputing whether they constituted "flaws."

But Spectre and Meltdown soon became a serious crisis for Intel, other chipmakers like AMD, and for the IT industry as a whole. The side channel analysis vulnerabilities were believed to affect generations of microprocessors used in millions of servers, desktop and laptop computers, mobile phones and other devices.

Within days Intel launched a "comprehensive" threat mitigation plan that included operating system and firmware updates to correct the vulnerabilities. Intel CEO Brian Krzanich began his Jan. 8 keynote at CES 2018 by declaring that "Security is the number one job for Intel."

The rest of the IT industry issued warnings to customers and went into fix-it mode. Almost immediately Apple said Spectre and Meltdown could impact Mac and iOS devices and was developing mitigation technology. Dell conducted performance tests across its entire product portfolio to assess the risk. Cisco investigated dozens of routers, switches and servers to determine the extent of the problem. And major software developers, including Microsoft, Google, Red Hat and Pivotal, rolled out patches and firmware updates: On Jan. 17 Oracle issued 237 security patches to close the vulnerabilities in the vendor's products.

There were stumbles along the way: A bug in a firmware update issued by Intel forced vendors like VMware and to retract faulty patches. But ultimately the fixes were made. Intel has since taken steps to prevent a similar incident, including launching a bug bounty program and creating a new cross-company security group to make product security as high a priority as performance.

Intel continued to develop hardware fixes for Spectre, Meltdown and other vulnerabilities throughout the year. In August it detailed plans for hardware-level protections against the vulnerabilities in its upcoming Core Whiskey Lake client CPUs and Xeon Cascade Lake processors.