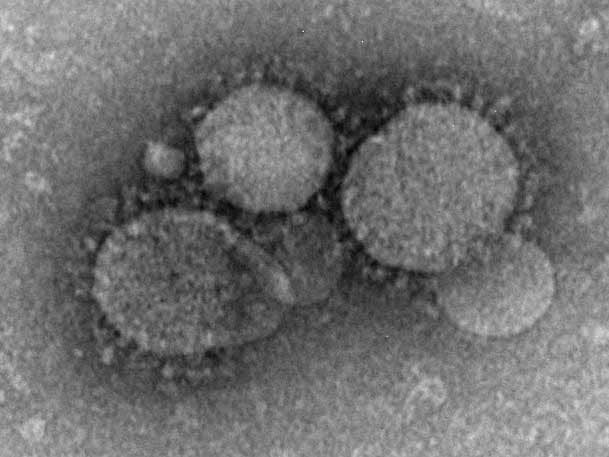

6 Ways The Tech Industry Is Confronting The Coronavirus Pandemic

The coronavirus pandemic has hit the IT industry hard with supply chain disruptions, plunging stock prices and forecasts of reduced IT spending.

The IT industry, with its broad exposure to international markets, sophistication in prognosticating economic risk, and scientific bent of its highly educated workforce, was quick to recognize and react to the threat of coronavirus – well before the disease that originated in the Wuhan region of China officially became a global pandemic.

As much of the U.S. and the world failed to appreciate the severity of the looming crisis, technology giants began preparing for the worst-case scenarios. Those companies were among the first to start cancelling major events and, especially due to their exposure to markets and OEM suppliers in Asia, planning to mitigate supply chain and workforce disruptions.

But the reality the world is now grappling with is unprecedented—nobody has a playbook. As Silicon Valley companies look to protect the physical health of their employees and the financial health of their businesses, as well as those of their vast networks of ecosystem partners, they also have a major role to play in supplying customers with technologies that allow them to do the same.

Cancelling Conferences

The tech industry thrives on massive public events that bring together, often in extremely close confines, large international crowds.

It’s hard to overstate the importance of conferences in nurturing the development and health of IT ecosystems. Whether sponsored by companies, foundations or trade groups, those gatherings provide meaningful opportunities for resellers and services providers to coordinate with their vendor partners, engage new customers, and learn from each other.

But the IT industry was quick to make a big sacrifice to protect the health of those attendees.

Mobile World Congress 2020, set for Barcelona, was cancelled in early February. Then IBM made some waves when it pulled out of RSA less than two weeks before the industry’s premier security conference kicked off in San Francisco.

RSA went forward in the final week of February, but it was essentially the last big conference the industry saw.

Within a few weeks, every major technology vendor, from HPE to Google to Oracle to VMware, were cancelling, postponing or converting to online formats previously scheduled events.

For many people, even those not directly involved in the industry, the spate of conference cancellations was the first signal that business would not return to normal anytime soon.

Mitigating Supply Chain Snags

For hardware vendors especially, a deadly viral outbreak originating in China, and the shut down of manufacturers and distribution channels from that country, presented particularly pressing challenges to the continuity of their businesses long before coronavirus was detected on American shores.

Component shortages and disrupted supply chains have forced the largest IT systems manufacturers to respond with creative tactics to protect their top lines.

Tech giants like Oracle have been adjusting procedures for how they manage inventory while reallocating resources and working with international suppliers as they come back on online to keep fulfilling orders as best they can.

But it’s been an uphill battle because of the mushrooming scope of the pandemic.

“We had good demand but we couldn’t fulfill it,” Hewlett Packard Enterprise CEO Antonio Neri said in a conference call with investors at the start of the month.

Bracing For Decreased IT Spending

It’s inevitable that enterprises across nearly all major vertical industries are going to drastically cut IT spending in the coming quarters and year as revenue shortfalls limit their ability to refresh systems and fund digital transformation initiatives.

IDC just cut its IT spending forecast for 2020, expecting to see a “significant slowdown” in hardware along with software and services spending as the coronavirus pandemic continues to spread across the globe.

The market research firm now forecasts only 1 percent growth in IT spending in 2020, compared to its original expectation in January of 5 percent growth year-over-year, adding that its spending forecast is likely to keep notching downward.

Finding Opportunity In Crisis

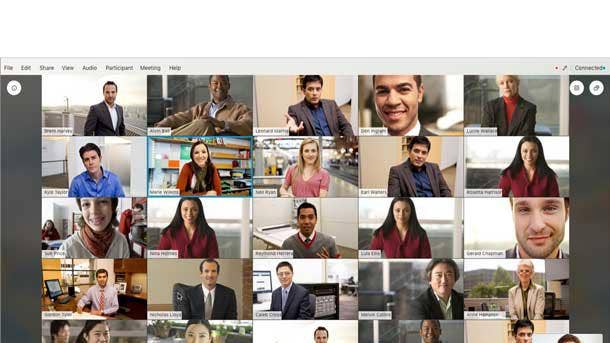

Zoom Video Communications made its initial public offering in April at $62 a share. By March 5, as the world was staring down the coronavirus pandemic, the stock climbed to a high of $125. Even in the disastrous week-and-a-half that followed, Zoom shares only fell to $107, with no decline caused by Monday’s record-setting sell-off.

While most companies are anticipating significant declines in revenue because of the disease’s impact on customer spending, virtual conferencing solutions like those offered by Zoom, and other communications and collaboration technologies, are increasingly in demand with so many employees forced to work from home.

That’s not always evident in a stock price, as Unified Communications-as-a-Service providers like LogMeIn, RingCentral and Vonage can attest to after a punishing week on Wall Street for nearly every corporation in America. But those companies are likely to have a moment in the midst of the global outbreak.

In every crisis there’s opportunity, and some technology providers will almost certainly see a major surge in adoption as their customers increasingly look to implement remote workplaces.

Collaboration was already red hot before the current coronavirus crisis—among the fastest growing segments of the SaaS market, according to a recent Synergy Research study.

UCaaS and collaboration products can cushion the economic blow for diversified technology vendors like Google, Microsoft and Cisco, as well as fuel growth in younger companies like Zoom and Slack.

Transforming Workforce Behavior

Tech professionals are known to jet around the world at a frantic pace, mingling in office visits, conferences and seminars.

But when coronavirus started to spread beyond China, among the first measures the largest tech companies implemented to protect employees were travel restrictions, dramatically altering how business is done in an industry still largely fueled by interpersonal relationships.

Limiting air travel wasn’t enough, and before long, companies like Google started advising employees whose roles allowed to work remotely and stay out of offices.

Reducing face-to-face interactions is just one challenge the corporate world is trying to figure out. It’s clear that all businesses now must find ways to change the behavior of their workforces without cramping the effectiveness of their sales teams, hampering collaboration between engineering and product developers, and preventing executives from driving important deals.

In this new reality the tech industry, known for its innovation and willingness to disrupt norms, will take the lead in developing creative solutions to keep workers and partners productive while protecting them and the larger society from unnecessary risk.

Helping Out

Tech companies know they can play a larger role in helping millions impacted by the coronavirus pandemic transition to a new way of working and living that halts transmission of the disease.

“As we navigate this global pandemic, the future of work is changing,” said VMware CEO Pat Gelsinger in a blog post about what he described as a “black swan” event.

As such, VMware is offering free trials of its Workspace ONE and new SD-WAN Work @Home offering while extending free trials of Horizon and VMware Cloud on AWS, Gelsinger said.

Many more IT vendors and service providers are rushing to the aid of businesses, armed with remote collaboration and security tools to enable an offsite work staff.

In addition to providing technical solutions, industry giants are contributing cash to aid the fight against the virus, and relief efforts.

VMware parent Dell Technologies has donated millions of dollars to upgrade IT infrastructure in China hospitals and fund front-line organizations.

“We must protect each other and especially our most vulnerable – our elderly and those with underlying conditions,” Dell CEO and founder Michael Dell said in a blog post.

Salesforce is doing its part by donating $1 million to UCSF’s COVID-19 Respond Fund and $500 thousand to the CDC Foundation’s Emergency Response Fund, while matching employee donations to other aid organizations, CEO Marc Benioff announced.