AWS Vs. Azure Vs. Google Cloud: 5 Cloud Spending Trends

Read where cloud-decision makers are placing their public cloud bets regarding spending and adoption of Amazon Web Services, Google Cloud and Microsoft Azure, according to Flexera’s new 2022 State of the Cloud Report.

Cloud Adoption And Spending Trends Around AWS, Azure And Google Cloud

As Amazon Web Services, Microsoft Azure and Google Cloud continue to battle for public cloud supremacy, a new report is shining light on where enterprises and SMBs are placing their bets on this year regarding the world’s three largest cloud providers.

Flexera’s new 2022 State of the Cloud report includes over 750 respondents made up of mostly directors and managers in the Unites States, providing great insight on where these cloud decision makers are placing their cloud bets.

“Cloud adoption was already expanding for several years—and has been accelerated by the pandemic—but as a post-pandemic world begins to take shape, new trends in cloud usage are coming into focus,” said Flexera in its new report.

Seattle-based AWS is the market share leader in the public cloud, followed by Redmond, Wash.-based Microsoft and Mountain View, Calif.-based Google. However, according to Flexera’s new 2022 State of the Cloud report, Azure is gaining ground on AWS, while Google is currently being experimented by many for potential future plans.

AWS, Microsoft and Google are each spending billions annually on building and equipping new data centers to meet the skyrocketing demand for their cloud services. IT research firm Gartner predicts that public cloud services revenue will increase 22 percent globally in 2022 year over year, due to broad acceleration of cloud adoption.

Approximately 46 percent of Flexera survey respondents are from organizations containing 5,001 to more than 10,000 employees, while 33 percent are from businesses with 1,001 to 5,000 employees, and 21 percent are from companies with 1,000 employees or less.

CRN specifically highlights the key findings in Flexera’s new cloud report around AWS, Google Cloud Platform (GCP) and Microsoft Azure as it regards to cloud spending, adoption and the cloud provider discounts users are leveraging. Here are five key cloud trends AWS, Azure and GCP customers, investors and channel partners should know.

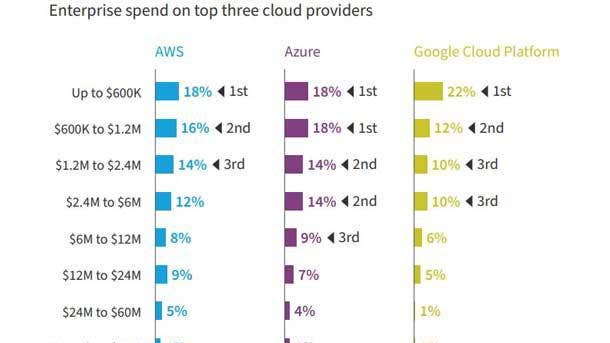

Enterprise Spending On AWS, Azure, GCP

Implementing cloud-first policies and investing in cloud migration are top of mind for senior IT leaders, particularly in the enterprise. As a result, enterprises are rapidly increasing public cloud spending and workload volumes.

According to Flexera’s report, AWS holds a slight lead among enterprises spending over $12 million annually.

Approximately 18 percent of enterprises spend $12 million or more annually on AWS. By comparison, 15 percent spend $12 million or more annually on Azure. Approximately 7 percent of enterprises reported spending $12 million or more annually on Google Cloud Platform.

Looking at other figures, 53 percent of enterprise Azure customers spend at least $1.2 million annually, compared with 52 percent for AWS, and 33 percent for GCP.

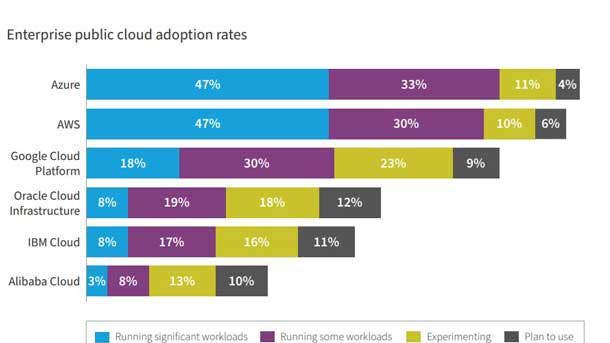

Public Cloud Provider Adoption Rates: All Organizations

The Flexera 2022 State of the Cloud Report survey looked into the public clouds that organizations are leveraging.

For each public cloud provider, survey respondents specified on whether they’re running significant workloads in that cloud; running some workloads; experimenting, plan to use it or had no plans to use it.

AWS, Azure and Google Cloud Platform are the top three public cloud providers in North America. But for the first time, Flexera said Azure has closed the gap with AWS, while other cloud providers have not shown much growth year over year.

Azure has a 77 percent adoption rate, followed by AWS at 76 percent, then GCP at 48 percent.

Compared to last year’s Flexera 2021 State of the Cloud report, AWS had the highest adoption rate at 77 percent, followed by Azure at 73 percent, then GCP at 47 percent.

Azure Cloud Adoption Surpasses AWS In The Enterprise

Azure has passed AWS for breadth of adoption among enterprises, according to Flexera’s 2022 report.

Additionally, Google Cloud Platform has the highest percentage for experimentation and plan to use out of the big three, which could drive more adoption in the future.

For each public cloud provider, survey respondents specified on whether they’re running significant workloads in that cloud; running some workloads; experimenting, plan to use it or had no plans to use it.

Enterprises running some or significant workloads on Azure hit 80 percent. Comparatively, enterprises running some or significant workloads on AWS reached 77 percent. For GCP, enterprises running some or significant workloads was 48 percent.

Compared to last year’s Flexera 2021 State of the Cloud Report, AWS had the highest adoption rate in the enterprise at 79 percent, followed by Azure at 76 percent, then GCP at 49 percent.

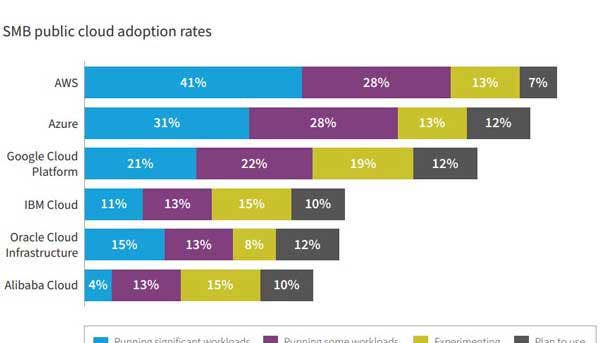

AWS Still Dominant With SMBs

Among small- and medium-sized businesses (SMBs), AWS continues to be the clear leader as of 2022.

For each public cloud provider, survey respondents specified whether they’re running significant workloads in that cloud; running some workloads; experimenting, planning to use it or have no plans to use it.

SMBs running significant or some workloads on AWS reached 69 percent, compared to 59 percent on Azure, and 43 percent on GCP.

Compared to last year’s Flexera 2021 State of the Cloud Report, AWS also has the highest adoption rate in the SMB market at 72 percent, followed by Azure at 48 percent, then GCP at 39 percent.

For 2022, SMB respondents with future projects—indicated by the combination of the clouds they’re experimenting with and planning to use—say they are most interested in Google Cloud Platform at 31 percent, followed by Azure at 25 percent.

Saving With Cloud Provider Discounts

One big strategy with cloud providers and buyers is that organizations can leverage public cloud discount options for additional cost savings.

Cloud provider pricing structures can be complex, but cloud provider discounts can identify opportunities to reduce costs. According to Flexera’s report, some organizations aren’t taking advantage of all the available discounts.

Breaking down the top AWS discounts being used, 36 percent of AWS users take advantage of reserved instances, 32 percent leverage AWS’ Enterprise Discount Program (EDP), and 31 percent use savings plans.

The top Azure discounts being leveraged by respondents include 37 percent using the Azure enterprise agreement (EA) discount, 32 percent using Azure reservice instances, and 26 percent using the Azure Hybrid Benefit.

Approximately 26 percent of Google Cloud users leverage the company’s committed use discounts, while 10 percent use the Ad Hoc negotiated discounts, according to the survey.