Nutanix Earnings Preview: 5 Huge Things To Watch For

From its recent product portfolio refresh and Nutanix Clusters on Azure to net income losses, here are five important things to watch for during Nutanix’s second-quarter financial earnings report Wednesday.

Nutanix’s Second-Quarter Financial Earnings Wednesday

Fresh off a major product portfolio refresh, Nutanix is set to release its second-quarter 2022 financial earnings Wednesday, with expectations to reach upward of $410 million in revenue.

The San Jose, Calif.-based hyperconverged infrastructure software superstar is looking to become a dominant player in the hybrid cloud software space, with an upcoming release of Nutanix Clusters on Microsoft Azure hopefully being discussed during its upcoming earnings call with media and analysts.

Many questions remain about the future of the company as it strives to make a profit and become free-cash-flow break even by the second half of 2022.

In addition, Nutanix simplified its entire product portfolio last month from 15 products and brands into just five new offerings, while also enabling core-based pricing and metering.

“Many customers have gone to the public cloud and then they’ve realized, ‘Whoa, my cost is really getting out of control.’ And this is why multi-cloud, on-prem and hybrid cloud have really become such a huge use case and very attractive to them,” said Christian Alvarez, Nutanix’s senior vice president of worldwide channel sales, in a recent interview with CRN. “So by going towards a core-metered offering, from a billing and cost perspective, it really gives the customer more control of their investments.”

Nutanix’s second-quarter fiscal year 2022 financial earnings report is set to take place at 4:30 p.m. ET.

CRN breaks down five key areas to watch for in Nutanix’s earnings report.

Can Nutanix Stabilize Its Net Income Loss?

For years, Nutanix has been plagued with growing sales but consistently being in the red in terms of net income. It appears the more Nutanix sells, the greater the losses have been in recent years.

During Nutanix’s first fiscal quarter 2022, it reported a net income loss of $420 million. The company reported a net income loss of $265 million in first fiscal quarter 2021, meaning Nutanix’s net loss increased by $155 million during its most recent first fiscal quarter 2022.

For its entire fiscal year 2021—which ran from July 2020 to July 2021—Nutanix reported a total net loss of just over $1 billion, compared with a net loss of $873 million in fiscal year 2020.

However, Nutanix sales continue to increase double digits quarter after quarter.

For its first fiscal quarter 2022, Nutanix sales climbed 21 percent year over year to $378 million. In Nutanix’s fourth quarter fiscal year 2021, sales jumped nearly 20 percent year over year to $391 million.

“We are focused on disciplined and purposeful spending to help us reach our profitability goals,” said Nutanix CEO Rajiv Ramaswami during the company’s first-quarter earnings call in November. “Through it all, we continue to delight our customers, and they continue to love us.”

It will be interesting to see if Nutanix’s net income loss increased during its second quarter or if the company can better stabilize itself with help from Bain Capital’s $750 million in funding.

Update On Microsoft Azure Launch

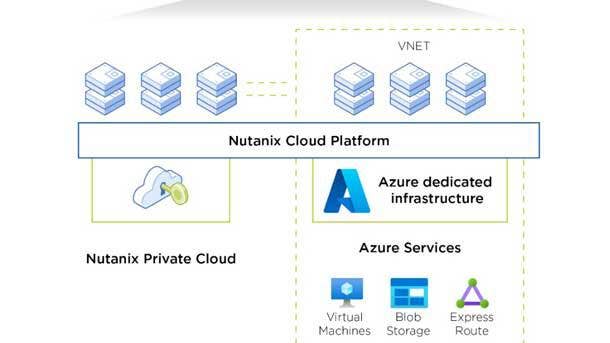

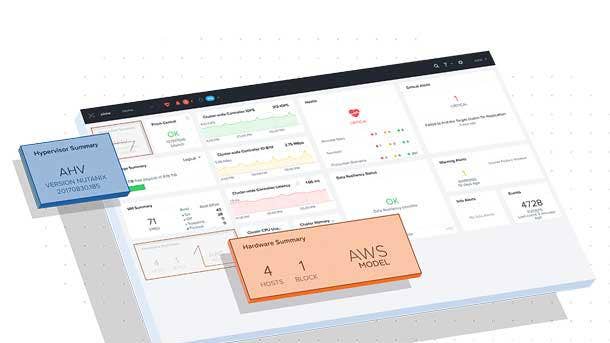

Nutanix has been collaborating with Microsoft Azure for over six months on creating hybrid cloud offerings that help blend the boundaries between cloud and on-premises. With a high level of customer interest for Nutanix Clusters on Microsoft Azure, many channel partners are awaiting the green light for general availability.

In September 2021, Nutanix said the offering was in limited preview with the two companies working together to eliminate the traditional silos between data center and cloud so customers can realize the benefits of their on-premises and Azure environments with a unified management plane and seamless mobility across clouds. For workloads running on Nutanix Clusters on Azure, customers will be able to access Azure services.

“We are at the starting early stages with Azure,” said Ramaswami in November. “I think we’ve got great potential here with lots of customer interest. … Our base platform is available on AWS, soon to be Azure.”

In addition to Nutanix Clusters on Azure, organizations will be able to use Azure Arc for Kubernetes to manage their Kubernetes containers running on Nutanix as well as in Azure-native environments.

On Wednesday, Ramaswami will hopefully provide a time frame for when Nutanix Clusters on Azure will become generally available in 2022.

Nutanix’s New Portfolio Launch

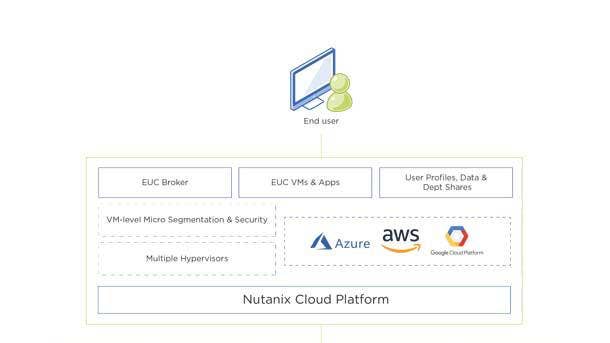

Last month, Nutanix completely revamped its entire portfolio— simplifying 15 products and brands into just five new offerings.

The new simplified portfolio brings together Nutanix’s product capabilities across on-premises and public clouds to deliver consistent infrastructure, data services, management and operations for applications in virtual machines and containers.

“Nutanix has been at war with complexity and obsessed with simplicity,” said Alvarez in his interview with CRN.

“We’ve put some of the brightest men and women together with a single mission: to streamline and simplify our offerings in our portfolio. After a considerable amount of work and time, with tons of anticipation, I couldn’t be more thrilled to announce to the world the availability of our new and exciting streamlined portfolio, with simplified packaging, metering and pricing,” Alvarez told CRN. “The company has built an enterprise-ready, unified cloud platform on HCI solutions as the core foundation.”

Nutanix has aligned its new portfolio to customer requirements in the multi-cloud and hybrid cloud world.

The new portfolio includes Nutanix Cloud Infrastructure, Nutanix Cloud Manager, Nutanix Unified Storage, Nutanix Database Service and the new Nutanix End User Computing Solutions.

Keep an eye out to see how Nutanix executives respond to financial analysts on the earnings call regarding what the new simplified portfolio means its channel partners and 20,700 customers.

New Core-Base Pricing Model Competitive Advantage

In addition to launching its new product portfolio, Nutanix said it is changing the way it sells its software by enabling core-based pricing and metering.

“We’re going to a core-based pricing model and metering. This has been a big-time demand by our customers and partners,” said Nutanix’s Alvarez. “The pricing and the metering is really going to give our customers now the ability to pay per core. And that’s going to give them a lot more flexibility and control around their cost structure.”

Nutanix has simplified packaging, metering and pricing to allow partners to offer better hybrid cloud solutions to customers without the complexity.

“Many customers have gone to the public cloud and then they’ve realized, ‘Whoa, my cost is really getting out of control.’ And this is why multi-cloud, on-prem and hybrid cloud have really become such a huge use case and very attractive to them,” said Alvarez. “So by going towards a core-metered offering, from a billing and cost perspective, it really gives the customer more control of their investments.”

Channel partners, investors and customers should listen to what Nutanix says about its new way of selling in terms of competitive advantages and potentially helping grow its customer base.

Will Nutanix Hit Wall Street Estimate Of $408 Million?

Wall Street analysts predict that Nutanix will report total sales of $408 million for its second fiscal quarter 2022, according to Zacks Consensus Estimate, with earnings of 68 cents per share.

Nutanix generated sales of $346 million in its second-quarter 2021, meaning Wall Street is expecting 18 percent year-over-year sales growth.

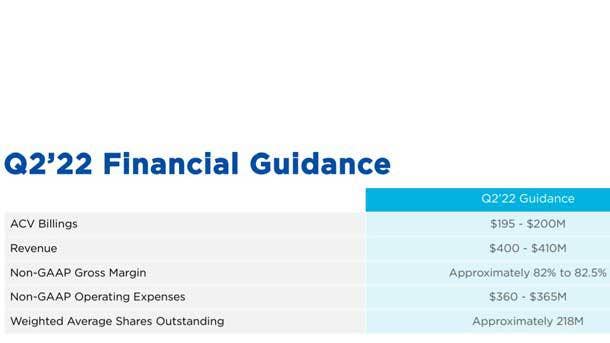

Nutanix has provided a revenue guidance for its second-quarter 2022 of between $400 million and $410 million.

One key metric to watch is Nutanix’s annual contact value (ACV) billings, which is on fire, hitting a record-breaking $183 million in its first-quarter 2022, up 33 percent year over year. The company is projecting another record quarter for ACV billings with upward of $200 million for its second quarter.

Nutanix’s ACV run rate stands at $1.59 billion, up 23 percent year over year.

“We continued to execute towards our targets of free cash flow break-even in the second half of calendar 2022 and a 25 percent-plus ACV billings CAGR through fiscal 2025,” said Ramaswami in November. “Our subscription business model positions us to continue to deliver strong growth with the opportunity for substantial sales and marketing expense leverage as renewals become a larger portion of our business.”