The 10 Biggest Data Center Stories Of 2015

The New Data Center

The pace of change in the data center quickened in 2015, with the industry's biggest players jumping headlong into the converged and hyper-converged infrastructure market while managing sweeping changes to their businesses.

Hewlett-Packard, the industry's No. 1 server-maker, officially split into two business units late in the year. Dell, another server powerhouse, unveiled plans to acquire data storage giant EMC for a whopping $67 billion.

And the market itself saw server revenue jump year over year in each of the first three quarters, according to Gartner, reversing the declines the market was experiencing just a couple of years ago.

Here, CRN looks back at some of the biggest data center news of the year. If you missed it, be sure to take a look back at the rest of the best of 2015 with CRN.

10. Cisco Raises Bar On Certifications

Today's data center puts new demands on IT vendors and their partners, and Cisco said in November that it was prepared to make its partners step up. The San Jose, Calif.-based company has created a new framework and standards for all Cisco-certified individuals, and they'll now be assessed not only on a specific domain, but also on advanced skill sets that encapsulate emerging technologies across the IT industry. Starting in July, all individuals seeking to be Cisco-certified -- including all seeking the Cisco Certified Internetwork Expert (CCIE) and Cisco Certified Design Expert (CCDE) certifications -- will need to understand interrelated technologies and how they impact business outcomes. Topics such as the Internet of Things (IoT), cloud, business transformation and network programmability will influence all certifications.

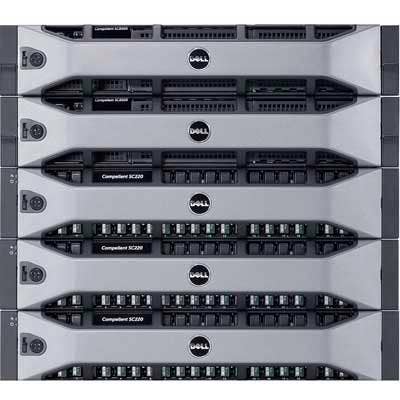

9 . Dell Makes New Enterprise Play With Compellent

Dell used its annual Dell World conference in October to make its case as a big-time player in the enterprise data center market. The Round Rock, Texas, company said it would adding a new top-of-the-line model to its Compellent-based SC family of arrays and refresh its line of hyper-converged appliances based on the Nutanix software stack. It also introduced its new SC9000 storage server, which can scale to 3 PB of raw capacity and beyond.

8. Sever Sales Continue To Climb

According to research firm Gartner, server revenue grew in each of the first three quarters of the year. In the third quarter, the most recent for which data is available, server revenue topped $12.5 billion, a 7.5 percent increase over the same period a year ago. HP, with $3.7 billion, and Dell, $2.4 billion, accounted for about half of that revenue, Gartner said.

7. APC Enters The Managed Services Market

In May, APC by Schneider Electric said it would launch a managed services channel offering backed up by new software services aimed at driving recurring revenue for partners. The driver of those managed services is APC's PowerChute software for UPS management, safe system shutdown and energy management that comes with every UPS shipped to the channel. Most customers can no longer take on the responsibility of managing data center power, and APC's effort is designed to provide peace of mind to customers while driving recurring revenue for partners.

6. Dell, Microsoft Team On Cloud-In-A-Box

Dell rolled out a hybrid cloud solution co-engineered with VMware rival Microsoft that provides customers a flexible Azure-in-a-box-based cloud solution starting at $9,000 a month. The new system, which was introduced at Dell World by Dell founder and CEO Michael Dell and Microsoft CEO Satya Nadella, puts into sharp focus the open systems technology high wire that Dell will have to walk in the wake of its pending $67 billion acquisition of EMC.

5. HP Splits

Hewlett-Packard in early November finalized its split into two independent companies, Hewlett Packard Enterprise and HP Inc., and partners felt encouraged that Hewlett Packard Enterprise would drive growth in the data center market. Partners praised HPE's channel focus, as well as its strengthening solutions, certifications and training. Partners also said they expect HPE to be more agile than competitors just as changes in the data center market make that even more important. The stand-alone company will be more able to quickly address eroding infrastructure margins and help partners focus on customers' business objectives and efficiency, especially in areas such as hybrid infrastructure.

4. Dell Launches Business Unit To Focus On Data Centers

Dell in August said its prowess in hyper-scale environments would help catapult a new business unit into the market for custom, scalable, flexible data center solutions among customers that don't quite require hyper-scale. The new server unit is called Datacenter Scalable Solutions, or DSS. It takes the repeatable processes and designs developed by Dell's eight-year-old Data Center Solutions (DCS) hyper-scale business, and uses that well-oiled strategy to address a growing market with a "semi-custom" solution for businesses that aren't quite a fit for hyper-scale. Dell started the DSS business in "stealth mode" last year, and said it has already had 200 customer engagements when DSS was officially rolled out. Dell said it expected to double that total by the end of this year.

3. EMC Buys Virtustream

In July, EMC officially stepped into the cloud provider market, closing its $1.2 billion cash acquisition of Bethesda, Md.-based cloud software and Infrastructure-as-a-Service firm Virtustream. What seemed at the time like a warning shot across Amazon Web Services' bow has since become a significant game piece in the proposed acquisition of EMC by Dell. EMC and VMware said they'd run Virtustream as a 50-50 joint venture, but that agreement was more recently said to be scrapped. Investors seeking to squeeze value out of the Dell acquisition have urged EMC and VMware to spin off Virtustream, and there were indications that it could actually happen.

2. HPE Launches 'Composable' Synergy Architecture

Calling it "as revolutionary a product as we have introduced probably in the last decade," Hewlett Packard Enterprise CEO Meg Whitman introduced the company's new "composable" Synergy architecture early this month. The architecture, designed to overtake converged infrastructure offerings from the likes of Nutanix and Cisco, was in development at HP for years. It is essentially a set of open APIs that bring software intelligence to deploying workloads based on the business demands of the application. Hence the term "composable" infrastructure.

1. Hyper-Converged Market Gets Hyper

The hyper-converged infrastructure market accelerated to a breakneck pace in 2015 with the industry's large vendors jumping into the action and partnering up with market-leading startups SimpliVity and Nutanix. In May, EMC released white box-based VxRack, its first foray into the hyper-converged infrastructure market. SimpliVity and Nutanix, flush with venture funding, took the fight to their much larger competitors, including Amazon Web Services and VMware, which Nutanix singled out in a public war of words, noting the lack of market success of EVO:RAIL.

The red-hot startups inked deals with major vendors, including Dell and Lenovo. Lenovo, too, assumed an aggressive posture, telling CRN over the summer that the company intends to slash its way to bigger market share. "We're going to drive down our cost structure to be the lowest-cost provider in the market vs. Dell, vs. HP, vs. Cisco," said Brian Hamel, Lenovo vice president and general manager, North American Enterprise Business Group. The hyper-converged market is top-of-mind for the channel, and late in the year, Cisco partners went so far as to urge the networking giant to acquire startup Springpath.