Michael Dell’s 2021 Economic Outlook And Top 6 Tech Drivers

Dell Technologies CEO Michael Dell talks to CRN about his 2021 economic outlook, VMware integration ahead and the six major technology sales drivers next year.

Michael Dell On 2021 Outlook, VMware And Message To Partners

Dell Technologies founder, Chairman and CEO Michael Dell is bullish about his US$92 billion company’s future heading into 2021 alongside Dell’s innovation road map around six major technology drivers that he said will fuel sales next year.

“What we’re seeing broadly is organizations are looking at their capabilities and infrastructure and realizing that the digital future that they might have imagined three or five years from now is actually here today,” said Dell in an interview with CRN. “There’s an acceleration going on. A lot of people are calling it ‘The Great Acceleration.’”

The legendary IT leader who founded Dell in 1984 in his college dorm room said 2021 will be a “rebound” year for some technology investments as organizations around the globe rethink their IT strategies.

“Many businesses have realized that technology was the only thing that allowed them to keep up and running,” said Dell. “What you’re also seeing in this economy is that the CEOs and the business line executives have realized that technology is the most important enabler for their business.”

Dell talks to CRN about a variety of topics from Dell’s new global channel chief and VMware integration ahead, to his 2021 economic outlook and the major technology drivers that will fuel growth next year.

What’s your economic outlook for 2021?

What you’re likely to see in 2021 is a rebound in some of the tech investments that might not have happened in the first part of this year. What we’re seeing broadly is organizations are looking at their capabilities and infrastructure and realizing that the digital future that they might have imagined three or five years from now is actually here today. There’s an acceleration going on. A lot of people are calling it ‘The Great Acceleration.’

You can look back on 2020 and say, ‘Whoa, there were economic difficulties, horrible tragedy and loss of life.’ But it’s amazing how much was able to be continued because of technology, and organizations are realizing that. Next year, I think there will be some pretty strong economic rebounds as businesses and organizations are building back.

What will be some of the major tech sales drivers in 2021, and how is Dell positioned to win?

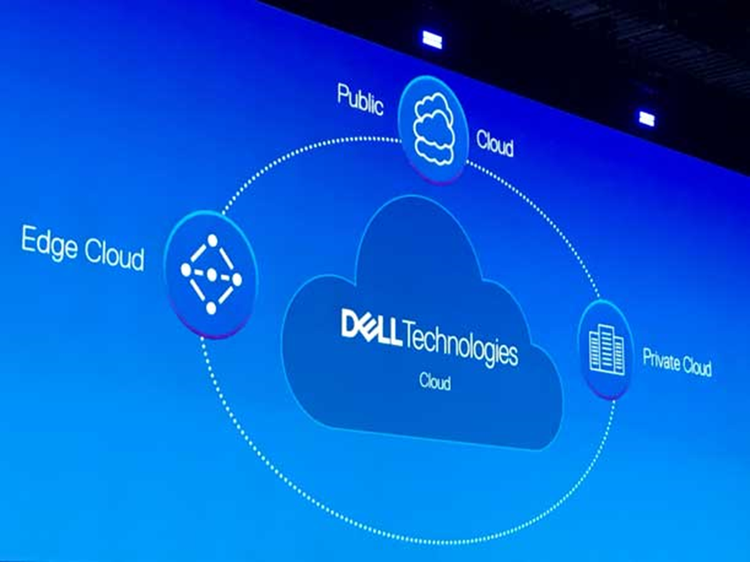

We see about six key themes. Multi-cloud is certainly a major theme that all organizations are dealing with right now. Another one is edge, there’s going to be tremendous growth—it’s already starting—at the edge, which is essentially the build-out of things and objects becoming intelligent and connected. Closely related to that is a continual build-out of our next-generation networks, specifically 5G and software-defined networks. All of those create an enormous amount of data, which creates a challenge in terms of how do you bring value from that data and manage all that data, which is enabled by artificial intelligence and machine learning. Then, of course, we have to secure it all where security is the last major tech driver.

Those are the six we see. We are certainly building our business around those. When you join us for VMworld and Dell Technologies World coming up in a few weeks, you’ll hear a lot more about each of those.

Can you talk about Dell potentially spinning off its 81 percent stake in VMware next year?

So this is different from selling VMware—we are not selling VMware, by the way. Some people are a little confused about that. Look, we believe that this spin-off that we’re considering could benefit both the Dell Technologies and the VMware stockholders . It simplifies the capital structures, it enhances strategic flexibility and gives both companies more flexibility, while we continue with the mutually beneficial strategic and commercial partnership that we’ve had for many, many years that has worked extremely well and it continues to . Yes, our core business is healthy. It’s got runway to continue to generate growth for years to come regardless of what structure we use, but this is certainly another example of our focus on creating value for the benefit of all of our shareholders. It doesn’t in any way change our strategy with VMware. We’ll continue with the mutually beneficial strategic and commercial partnerships that we’ve had.

Look, customers have benefited tremendously from those, partners have loved that. When we look at the data, we see that our partners who sell our three main lines of business—server, storage and client—generate 12 times as much revenue as those who sell two lines of business. And 45 times as much as those who sell only one. The real bonus is if you sell VMware and the three [lines of business], it’s 138 times more compared to partners that only sell one. So it’s a pretty simple test. You want to be selling VMware and all three of those [lines of business] together. That’s why our partners are delivering great value and great solutions.

After successful co-engineered products like VxRail, what’s the next wave of VMware and Dell integration?

Our strategy has worked really well. We’re seeing substantial growth rates and continuing adoption of VxRail. I think because it’s the easy button to hybrid cloud. As I talk to customers, that’s certainly the overwhelming theme—they want hybrid cloud and multi-cloud. What we’ve also done is we put VMware Cloud Foundation (VCF) in VxRail and of course that makes it super easy for customers to have consistent operations and infrastructure no matter where they decide to run their workloads. All of that has been very well received by customers. Clearly, Dell Technologies continues to be the industry leader in HCI [hyperconverged infrastructure] no matter how you count it.

We’re going to continue to enhance [VMware integration] with new edge offerings and new footprints as customers require a wide range of solutions from rugged edge solutions to scaling up their core data centers and beyond.

With many companies going to the public cloud when the COVID-19 pandemic started, can you talk about on-premises versus public cloud in terms of workloads?

I think what happened during the crisis was that organizations went the fast route with everything they were doing because they didn’t really have any other good options. So when it came to work-from-home, it was like, ‘OK, take your PC, stick it under your arm and go to your house.’ There wasn’t a lot of preparation or planning or thought.

I had one customer who told me they had a pilot program for two years and they had all kinds of reasons why they couldn’t do it. And then over the period of about 10 days, they had 20,000 people working from home. The simple answer was because they had to. They had no choice.

So when it came to expanding infrastructure capability, the fastest way was what customers often went for—in many cases that was public cloud. But, as customers go back and look at that capability, they kind of say, ‘Well, how do I optimize this? And how do I make all of these things work efficiently together? I still have some on-premises infrastructure and I want to seamlessly move workloads around. And at the same time, as I now get the bills coming in for all of these things, I understand certain workloads are going to be more efficient on-premises. Certain workloads might be more efficient in the public cloud, and I want those to all work together smoothly. That’s where we’re seeing VMware Cloud Foundation and the whole multi-cloud approach that we’re taking really resonate.

Do you still find that 85 percent of workloads are more cost-effective on-premises versus the public cloud?

I think it’s going to vary by workload and by industry. If you look at banks, lots of banks repeat the kind of statistics you just mentioned.

What R&D investments is Dell putting into Dell Technologies Cloud or Dell Tech On Demand?

On Demand and consumption is certainly a key focus for us. Obviously in an environment like this, an offering like Dell Technologies On Demand makes it possible for customers to more efficiently deal with their resources. Let me give you a sense of the growth in this. So our deferred revenues at the end of the last quarter were $28.8 billion, up 14 percent year over year. That was driven by subscriptions, software licenses, maintenance and as-a-service. So we’re definitely seeing a big uptick in those.

You’ll hear more about this at VMworld and Dell Technologies World, but we’re in the process of moving the vast majority of our offerings to consumption and as-a-service.

When you say move everything to as a service, do you mean PCs as a Service, VDI as a Service, data center infrastructure, etc?

Yes, that’s the direction we are heading. That’s doesn’t mean we are going to force customers into buying it that way, but for customers who want On Demand and consumption as a service, we’re going to roll that across all of our offerings.

[For example] at VMware, the SaaS and subscription revenue was up 44 percent year over year. And there was triple-digit growth on VMware Cloud on AWS, which is based on VMware Cloud Foundation. We’re seeing great traction there. Our overall Dell Financial Services originations in the second quarter were up 31 percent year over year. As another part of this, we rolled out our Payment Flexibility Program, which has been super well received by our channel partners.

What are you seeing in terms of trends for Dell PCs and laptops? How can partners drive sales there?

There’s definitely been strong demand for work-from-home and learn-from-home solutions, particularly from government and education industries. In education, there’s a lot of new requirements for customers. In the early stages of the pandemic, there was a do-it-fast approach.

As time has gone on, organizations have said, ‘All right, now we want to do it right. If we’re going to have people working remotely on a more permanent basis, what are the capabilities they need in terms of a complete workstation, larger displays, docking stations, security—effectively everything you would have in a traditional office environment but at home?’ So there are lots of opportunities for channel partners to help customers as they build out those do-it-right environments.

Can you talk about Dell Technologies’ new channel chief, Rola Dagher?

Rola has 20 years of successfully leading channel go-to-market organizations and building partner capabilities, driving results, removing complexity and delivering simplicity. During that time, she’s built tremendous partner relationships both at Cisco as the president of their business in Canada, where she was instrumental in driving the growth and expansion of the channel. Also previously here at Dell. All through that time she had a great track record of results. Having worked with her in the past, I know she’s passionate, she has a winning spirit and attitude, she has a great strategic mind and brings great insights to the business. She’s a value-based leader. We are thrilled to have Rola back on the Dell team.

What’s your call to arms for channel partners as 2021 approaches?

Many businesses have realized that technology was the only thing that allowed them to keep up and running. I think there are tremendous opportunities for our channel partners to engage with us around the big solutions areas: multi-cloud, edge, the explosion in data and data management, the modernization of networking and the build-out of 5G, AI and machine learning, security—all areas we have fantastic solutions and capabilities in, but we need our partners’ help.

What you’re also seeing in this economy is that the CEOs and the business line executives have realized that technology is the most important enabler for their business. So that’s a great time to be in front of customers, to help understand what their challenges and requirements are, and how we can transform together.