AI Face-Off: Cisco Vs. Juniper Networks And Aruba Networks

Solution providers, decide: Here’s how Aruba Networks, Cisco Systems, and Juniper Networks stack up in the AI department.

The Battle Is On

Artificial intelligence (AI) has been a buzzword in the IT industry for some time now, but a global pandemic prompting a massive shift in favor of working from home and demand simplifying complicated IT environments has a way of accelerating emerging trends into the mainstream.

Changing business needs due in part to COVID-19 is driving adoption of AI and advancements in the technology are making it increasingly accessible to more businesses. In fact, by 2025, a whopping 50 percent of enterprises will have devised AI orchestration platforms to operationalize AI, up from fewer than 10 percent in 2020, according to the Global AI Adoption Index 2021, a report conducted by Morning Consult on behalf of IBM.

[RELATED: Artificial Intelligence Week 2021]

To meet the growing demand, some of the biggest networking giants in the market have taken it upon themselves recently to up their AI games and inject the technology deeply into more of their offerings.

When it comes to AI, here’s how Aruba Networks, Cisco Systems, and Juniper Networks stack up and what the company’s CEOs have to say about their approach to AI.

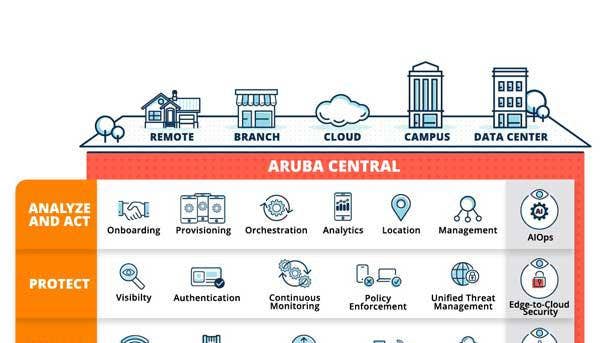

Aruba ESP

Introduced in 2020, the breakthrough Aruba Edge Services Platform (ESP) is an intelligent edge to cloud central nervous system of sorts that can analyze data across edge, wired and wireless networks, identify any issues or abnormalities and self-optimize with its AI capabilities. In addition, Aruba ESP can also find and secure unknown devices on the network.

Aruba has been very consistently updating the one-year-old platform. In April, the company announced an expansion of the Aruba ESP multivendor security partner ecosystem and also integrated in SD-WAN technology from Silver Peak, which Aruba acquired in 2020. In June, Aruba ESP was bolstered with more AI and security to power IoT operations.

Specifically, Aruba Central, the company’s flagship network management and analytics platform which sits inside Aruba ESP, got a boost with an integration of Aruba’s AI Insights solution for IT operators, which offers closed-loop remediation, meaning problems are surfaced and can be set to adjust or fix itself before end users are impacted and without any manual effort from channel partners or IT.

Cisco DNA Center

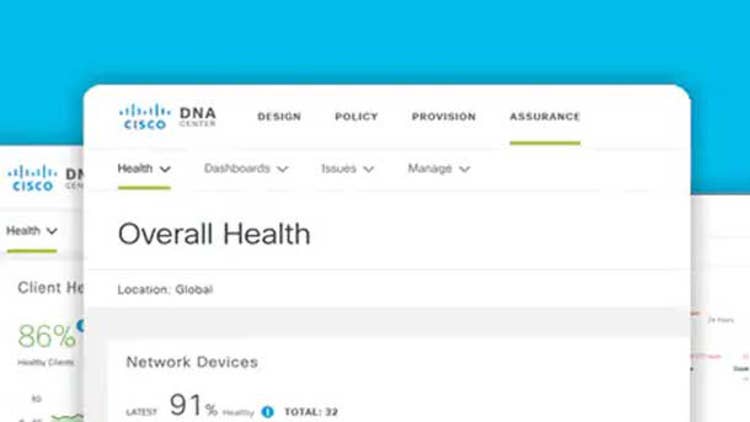

Cisco’s answer to AI can be found within its network management dashboard, Cisco Digital Network Architecture (DNA) Center.

The San Jose, Calif.-based tech giant in 2020 strengthened DNA Center with a new feature: AI Endpoint Analytics, which is letting DNA Center identify previously unknown endpoints at scale and then drawing from various contextual sources and AI. This allows the endpoints to be segmented, grouped appropriately, and have policies applied.

Cisco has since been juicing up its platform to compete against its competitors and in June, added even more to DNA Center in the form of AIOps and machine learning (ML) for network operations.

Cisco DNA Center gives businesses and channel partners the ability to do more advanced network segmentation, automation, and provides more visibility, which will be especially critical for IoT environments and customers that need to run “smarter” operations in the new tech normal, partners told CRN last summer.

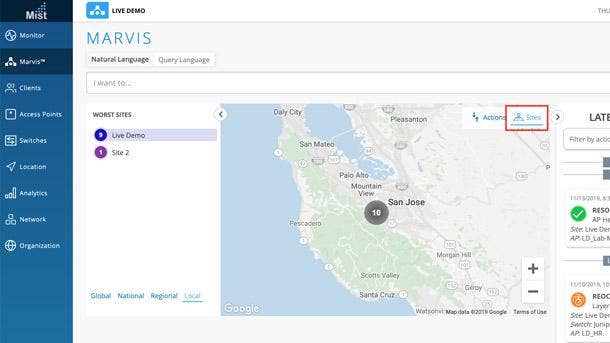

Juniper Mist

In 2019, Juniper Networks bought Mist Systems for $405 million for its groundbreaking AI-driven wireless platform. The company’s founders at the time said that the Mist platform makes Wi-Fi more “predictable, reliable and measurable.”

Since then, the once-data center networking leader has been making its mark on the cloud-managed segment of the wireless networking market with its AI chops as it works to integrate Mist technology into every aspect of its portfolio. In fact, Juniper Networks found itself in the Leaders quadrant of Gartner’s Magic Quadrant for Wired, Wireless LAN 2020 report thanks to its acquisition of Mist, which the company has used to inject AI into its wired switching and WLAN products.

Sunnyvale, Calif.-based Juniper in 2019 folded its EX switch line for campus and branch environments into the Mist cloud to pull in more intelligence and target more enterprise business. At the same time, Juniper Mist is expanding its platform with a new cloud subscription service called Mist Wired Assurance Service. The new service brings Juniper’s Junos switch line into the Mist microservices cloud and AI engine, which can simplify IT operations, the company said.

Juniper last summer introduced its new WAN Assurance Service and a virtual network assistant (VNA) conversational interface powered by Marvis, Mist’s VNA technology. The enhancements make up the fourth generation of Juniper’s AI-Driven Enterprise strategy, which revolves around automating and optimizing IT management and end user satisfaction, the company told CRN at the time.

Aruba Duking It Out

Aruba founder and President Keerti Melkote in November told CRN that rival Cisco lacks the artificial intelligence muscle to compete against Aruba’s Edge Services Platform.

“They don’t have the AI and security capabilities that we believe is fundamental to this ESP vision,” he said. “Automation is at the heart of it. And automation with AI is the bet we made on ESP. That piece Cisco simply does not have: neither in Meraki or DNA.”

Aruba’s cloud-native AI and security capabilities built into its unified edge to cloud ESP platform is in sharp contrast to Cisco’s multi-product edge to cloud offering, said Melkote.

In Juniper’s Own Words

In speaking about Mist compared to the competition, Juniper’s CEO, Rami Rahim said that Mist is in a league of its own.

“Mist was built from the beginning with a microservices cloud architecture. And that means that the speed of innovation is second to none. It means that the volume of data, down to the individual client, application, or session, has been optimized from the beginning. The proof is in the pudding -- fast deployment, fewest trouble tickets, [and the] fastest time to resolution. We are, I think, honestly miles ahead of the competition that we’re seeing it with the share that we’re taking in the market right now. I honestly believe that our competitors would need to start from scratch in order to build the kind of differentiation and deliver the result that we’re delivering every day in the market,” Rahim told CRN in April.

Cisco’s Take

Cisco, for its part, told CRN that AI is going to be one of the most disruptive technologies and a big area of investment for the company.

“I think AIOps and APM is a very significant play for us today and into the future, and you are going to see us invest heavily there. I think for many of our partners, as our customers continue to evolve how they develop applications, they are going to need these modern capabilities to operate and run these applications, optimize these applications, and bringing all these pieces together to help our customers do that, I think, is a very big opportunity for our partners,” Robbins said.