Aruba Networks Founder Keerti Melkote On AI, Wi-Fi 6, And Why Edge Computing Is A 'Promising Buzzword’

Evolving Aruba

Keerti Melkote, Aruba's founder and president, said that Hewlett Packard Enterprise will be investing $4 billion over four years in technology and HPE-owned Aruba is a core part of that plan. In fact, HPE's investments will be around connectivity and security.

But that's not the only thing Melkote has on his mind right now. At Aruba Atmosphere 2019, Melkote talked to CRN about using artificial intelligence to evolve networking technology, the emerging areas of opportunity for Aruba and HPE partners, and why even though edge computing is still a buzzword today, it has a lot of promise.

What follows are excerpts from the conversation.

How will AI help Aruba evolve its networking technology?

I think at the highest level, businesses are adopting technology in a different way than they did in the past. It was fundamentally about productivity, giving [employees] compute and tools to be productive on the network, like email or ERP systems, but today technology is at the forefront of the customer experience. [Technology] is directly tied to revenue, so now we are in the line of fire, so to speak. You can't have any downtime.

I think investments in it are going to start to shift from a traditional productivity mentality to a much more proactive and aggressive [mentality]—I want to implement technology and that's my business. So, to IT people, it's about how to react to that change and change is not an easy thing. That's because most of the processes that IT people use today are manual, so AI's role is to automate a lot of those manual processes so they can scale to the needs of the business. Frankly, we are at the stage now where the technology has emerged enough so that AI can be used to predict failure and identify new behaviors and new patterns in the business that [IT] can take advantage of that didn’t exist before.

Why is edge computing such a big opportunity for partners?

Edge computing is still a buzzword, but it’s a very promising buzzword in that any customer experience that matters today is happening at the edge. It's that moment of interaction between what you want to sell and what the customer wants to buy, and if there is any latency it's a bad experience for the customer. You don’t want to have to send bits to the cloud and then come back, so making that whole experience happen in real time requires you to do a lot of processing at the edge. For the partner, the opportunity is to be able to build and deliver a richer infrastructure at the edge. In the edge world, it's all about IoT, and you're going to see billions of devices get connected. Getting them connected and secured is job No. 1.

If you talk to a lot of partners, many felt disenfranchised by the cloud movement because it felt like they didn't have the opportunity to sell the way they used to sell and renew what they used to sell and refresh, so it felt like the revenue just went away. With edge, it comes back.

Where is Aruba making investments in AI and machine learning?

We started our AI journey almost three years ago when we acquired Rasa Networks, which is now our product called NetInsight. What you'll see now happen is that all the AI intelligence we built around user experience and assessment will find its way into products like Aruba Central. The goal is really to monitor and measure user experience.

The second AI investment was when we acquired a company called Niara, which focuses on security, and today that product is called Introspect, which is about using behavior analytics to deliver early detection of security threats and that is again being very helpful to us.

The third was our acquisition of Cape Networks, which provides user experience insights by doing synthetic tests that actually have sensors that run tests and run predictive analytics of what the breaking points of your system are and provide recommendations on how to tune the network. Those are three areas where we have placed bets—user experience, network management and security. To us, AIOps will continue to be an important dimension of the evolution of the product line.

How is Aruba's mobile-first, cloud-first approach helping the company differentiate itself?

Mobile-first is something we have had for a long time and, frankly, after the acquisition by HPE, we kept that mantra in the market because it speaks of truth of most networks. In most networks, the traffic is on wireless, not wired. Talking about mobile first recognizes the reality of the world we live in, it resonates with customers because they recognize that, and it also pivots the architectural conversation from being: ‘How do I bolt on wireless?’ to ‘How do I create a mobile-first architecture to which a wired network can be connected?’ That architectural differentiation is foundationally different from anyone else in the market. We are the only ones driving a mobile-first, cloud-first vision and architecture compared to any of our direct competitors, and partners see that very clearly. That has really helped propel the growth we've had.

Where are the opportunities around Wi-Fi 6 for the channel?

I think the most exciting part is two opportunities I see—one in just refresh. There's a lot of customers that have invested in Wi-Fi that has aged, so there's a refresh opportunity with [802.11ax] Wi-Fi 6, the next new standard on the block. As customers go through the refresh, it's an opportunity to boost capacity in their networks, but also our Wi-Fi 6 access points have IoT capabilities like Zigbee and BLE built in, which means [partners] can sell more around the access point and not just the Wi-Fi access aspect. For example, Zigbee allows you to unlock doors in hotel rooms when you present your key card, so that presents an integration opportunity for partners to sell a completely new solution in addition to Wi-Fi. Wi-Fi 6 will drive a need for more bandwidth, so that means the switch that connects that access point is another opportunity for refresh.

How has Aruba brought in some of its core products, like ClearPass, into the HPE stack?

In some ways, HPE acquired Aruba and in other ways, Aruba acquired HPE networking. The switching portfolio originally came from HPE networking and we integrated it into ClearPass and Airwave.

The Aruba team is all still here—we are driving the bus along with the HPE networking team, so it helps us create a unified portfolio, but we also kept true to the vision and culture of the company, which is what I think customers value the most. Our partner programs and enablement has been consistent as well. The fact that we are all still here four years later is a testament to that. Ninety-three percent of my business worldwide goes through the channel, and Aruba has always been partner-first. Thankfully, HPE is as well, so culturally, it's been a very good fit. HPE had a more data center- and compute-centric partner base and Aruba had a more networking and security [partner base], but that is the opportunity—to have partners sell the fuller solution.

How has bringing Vishal Lall over from HPE to chief operating officer of the Aruba intelligent edge business unit helped Aruba grow?

[Lall] and I have collaborated on the idea of the intelligent edge and edge compute, and we've had many conversations around that. Fundamentally, as Aruba continues to be the strategic bet for HPE at the edge, we need to scale the business. For me personally, running operations as well as innovating with products and meeting customers at scale is a big challenge and I just needed to scale the executive team's bandwidth. We needed more people that are the right cultural fit and the right vision for where we need to go. Because [Lall and I] have had so many exchanges, I felt very comfortable bringing him on as my chief operating officer.

How are you trying to drive sales through the partner program?

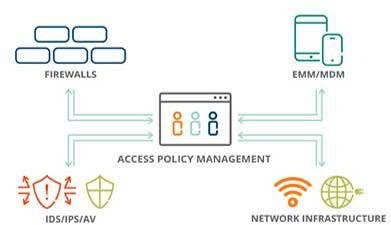

I think at this point I would say the new opportunities are really around products like ClearPass Device Insight, which we are really enabling. There are four key sales plays that we talk to partners about. One is our traditional unified access play across wired and wireless; the second is around SD-WAN, which are both in the overlay networking context; and then the two others are in the core and data center. Core networking is a new entry for us, so it’s a different selling motion. We have begun to enable our partners in those areas to monetize those four key growth opportunities.

What's coming down the pike that partners should be on the lookout for?

We want to go deeper with the partners we have, especially those that have invested in us and have earned competencies with us, but also we do want more partners selling in the midmarket and enterprise space. Also, partners [should know] that the culture of Aruba is still the culture that it's always been, that they can trust us to continue to innovate and grow in the market with them and continue to make sure the program economics are really good so partners can continue to grow their businesses.