The 10 Biggest Microsoft Stories Of 2015

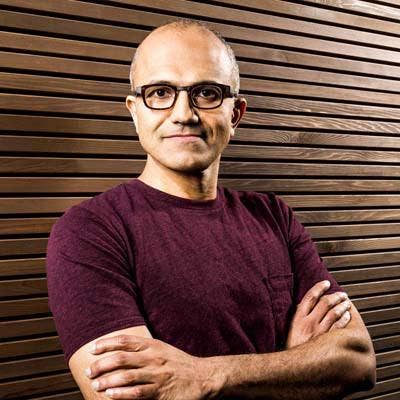

The Nadella Era In Full Swing

Microsoft is the world's largest software vendor, and every one of its many billion-dollar businesses generates its fair share of attention over the course of a typical year. 2015 was no exception, as Microsoft launched Windows 10 -- arguably the most important product release in its 40-year history -- and also made big splashes in emerging businesses like computer hardware and cloud computing.

Microsoft, under Nadella, has sought to form friendlier relationships with other industry vendors. At the same time, Microsoft is boldly going after other PC makers' stronghold by developing its own Surface laptop to go along with the Surface tablet.

As Microsoft transitions more of its business to the cloud, and becomes more familiar with the financial aspects of navigating this difficult transition, it's beefing up existing products and services with new features, while rolling out new ones like the HoloLens wearable computer. This is Nadella's Microsoft now, and he's doing things differently than they've been done in the past.

Following are CRN's picks for the top 10 Microsoft stories of 2015.

10. Microsoft Turns Some Google Apps Partners Into Allies

For years, Microsoft and Google have been waging an ideological proxy war through channel partners, with solution providers on both sides promoting their respective cloud productivity software suites as the best tools for getting work done.

This year in the Google channel, some partners -- upset with shrinking margins -- began questioning whether it makes financial sense to continue to partner exclusively with the vendor. And in an encouraging development for Microsoft, some of these Google partners have decided to start selling Office 365 along with Google For Work.

Cumulus Global, a longtime Google For Work reseller, is one such partner. "It's clear from a market perspective that Microsoft has or is close to closing the gap" in the cloud productivity software space, founder and CEO Allen Falcon told CRN in August.

This trend is obviously great news for Microsoft, which now claims 60 million monthly active users for Office 365, and recently added a premium SKU with advanced analytics and security features.

9. The 'New' Microsoft Is Friends With Pretty Much Everyone

Ever since Satya Nadella took over as CEO, Microsoft has seemingly been on a quest to reshape itself as a kindly, middle-aged company that just wants to be friends with every other technology vendor -- except Google, of course.

The most surprising example came in November, when Microsoft unveiled a partnership with longtime rival Red Hat, which enables the open source vendor's enterprise focused version of Linux to run on the Azure cloud for the first time ever. Given that former Microsoft CEO Steve Ballmer once described Linux as a "cancer," this was a big deal.

Microsoft also doubled down on its existing partnerships with cloud rival Salesforce.com and hyper-converged startup Nutanix. And there was even a holiday television ad that showed Microsoft and Apple retail store employees singing and hugging together on a New York sidewalk. Aww!

Microsoft's new partnership philosophy goes against decades of previous practice, and while the software giant still has fierce competition with other vendors, the tenor of these battles under Nadella's leadership doesn't seem to be nearly as intense.

8. Microsoft Says Surface Tablet Channel Strategy Will Work Fine For Surface Book

Microsoft's channel strategy for Surface tablets has always been a thorny issue for some partners. But a lot has changed since the first Surface hit the market in 2013: After starting out with a mostly direct sales model, Microsoft now has around 1,000 partners selling Surface tablets.

For the recently unveiled Surface Book -- which is Microsoft's first-ever notebook PC -- the software giant thinks its existing Surface channel go-to-market strategy will work just fine. "We don't see any reason our current channel model doesn't work fantastically for Surface Book," Microsoft Surface General Manager Brian Hall told CRN in October.

However, Dell and Hewlett-Packard partners were up in arms in September after the vendors signed up to resell Surface tablets, a move that potentially puts them in competition with the channel. HP and Dell representatives have insisted this won't be the case, but this issue could be rekindled if the Surface Book ends up being a big hit in the marketplace.

7. Channel Consolidation Involving Large Microsoft Partners

Two of Microsoft's oldest and biggest software licensing partners -- En Pointe Technologies, No. 42 on CRN's 2014 Solution Provider 500 list, and Compucom, No. 23 on the list -- entered 2015 looking for buyers, and they were both snapped up in March by other Microsoft licensing partners.

SoftwareONE, No. 14 on the CRN 2015 Solution Provider 500, bought CompuCom's software licensing business, and PCM, No. 29 on the CRN Solution Provider 500, acquired En Pointe. PCM also acquired Acrodex, No. 92 on the 2015 SP 500, in October, and has made a number of other power moves this year.

Some Microsoft partners attributed the uptick in M&A to changes the software giant has made to its channel incentive structure as it focused more on cloud computing.

Even Insight Enterprises -- No. 13 on the Solution Provider 500 list and one of Microsoft's closest partners -- has been impacted by the changes. Microsoft’s partner program changes reduced gross profit for Insight’s North America software business by $11 million to $14 million in its fiscal 2014, the company said in January.

6. Microsoft Challenges PC Makers With Surface Book Laptop

Microsoft shocked the IT industry in October by unveiling Surface Book, a 13.5-inch notebook PC that starts at $1,499. Partners said Microsoft's first stab at a real notebook PC shows the software giant isn't just dabbling in high-end PC hardware.

PC makers Dell and HP said they welcomed the competition because it would bring more attention to the high-end PC space. But Apple CEO Tim Cook wasn't impressed, describing Surface Book as "a product that tries too hard to do too much" in skirting the line between notebook and tablet.

Some solution providers said Microsoft's entry to the space will force PC makers to raise the quality of their own laptops or risk losing customers. Other solution providers believe Microsoft has a real chance to shift the balance of power in the high-end laptop space away from Apple's MacBook line.

5. Microsoft Unveils HoloLens Wearable Computer

Microsoft had a surprise up its sleeve at the Windows 10 consumer launch in January, unveiling HoloLens, a wearable computer and augmented reality platform that represents several years of hard-core R&D.

The software giant allowed reporters to test out HoloLens at the event, and again at its Build conference in April. Most reviews contained a common theme: This is truly groundbreaking and the kind of stuff we'd like to see Microsoft doing more of in the future.

But Microsoft isn't rushing HoloLens to market: CEO Satya Nadella said in September that the product would be a "five-year project" and that an initial software development kit wouldn't be available until next year. Even that estimate was a change of course for Microsoft, which has, in the past, rushed products to market only to see them flop because they weren't ready.

4. Microsoft Unveils Windows Server 2016, Switches To Per-Core Licensing

Microsoft is adding new networking, security and virtualization features to Windows Server 2016, but all this good stuff will only be available in the most expensive Datacenter edition. But the biggest change coming with Windows Server 2016, slated for launch sometime next summer, has to do with licensing.

Microsoft is switching from a per-processor licensing model to one based on the number of cores a customer's server processors contain. Microsoft isn't alone in doing this, as many other enterprise software vendors have moved to per-core licensing to account for the rising core density in today's processors.

However, the change means some customers will have to upgrade from the cheaper Standard edition if they want to keep running the same virtualized environments they've got in place today. And while Microsoft has been promising to simplify its notoriously complex licensing, partners said moves like this will require customers to spend time figuring out if they've bought enough licenses.

3. Office 365 Usage Continues To Climb

It has been another strong year for Microsoft's Office 365 business. CEO Satya Nadella said in October that Microsoft now has more than 18 million consumer Office 365 subscribers, and more than 60 million commercial customers, including Kraft, General Electric and Louis Vuitton.

Microsoft has been fueling this growth by getting small businesses onboard; Nadella said Microsoft has been adding 50,000 new customers in this segment for each of the past 19 months.

Now Microsoft is upping the ante with a new premium version of Office 365, called E5 and priced at $35 per month for each user, which adds security, analytics and voice features to the mix. It's expected to hit the market next month.

At the same time, Microsoft is ditching the existing E4 version of Office 365, which costs $22 per user per month. So customers are either going to have to pay more and go with the E5 SKU or dial it back and go with the E3 SKU, which costs $20 per user monthly. Obviously, Microsoft is hoping that customers that already feel like Office 365 is a great deal will accept paying more for the higher-end SKU.

2. Microsoft's Azure Business Booms

Microsoft's cloud unit, which includes Azure, Windows Server and database services, saw sales jump 8 percent year over year in its October quarter. The most important piece is Azure, and Microsoft CEO Satya Nadella said revenue and compute usage on its public cloud had more than doubled year over year during the quarter. He has said previously that Microsoft is on course to hit a $20 billion annualized run rate from cloud in 2018.

Azure is still seen as the No. 2 public cloud behind Amazon Web Services, but Microsoft has been making headway with vendor partnerships. Hewlett Packard Enterprise anointed Azure a "preferred" public cloud partner in November, a couple of weeks after Red Hat and Microsoft unveiled a landmark Azure partnership.

Azure still has its share of service interruptions and outages, but many partners believe Microsoft is on track to become the preferred cloud for enterprises that still aren't sure they can trust their data in the AWS cloud.

1. Windows 10 Hits The Market, Sees Mixed Sales Results

Given the negative market reaction to Windows 8, Microsoft's Windows 10 release was hugely important and closely watched. Would Microsoft put aside its pride (and business goals) and give customers an operating system that was actually best for users?

The early numbers on Windows 10 sales were good, though not as glowing as Microsoft suggested when it revealed that Windows 10 was downloaded more than 14 million times in the first 24 hours it was available. There are also signs that enterprise customers that skipped Windows 8 have a more positive impression of Windows 10.

However, Windows 10's market share has been dipping slightly for each of the past three months, according to research firm NetMarketShare's November report. This suggests that people aren't taking Microsoft up on its free Windows 10 upgrade offer as much as it would have hoped.

Meanwhile, the jury is still out on whether enterprises will fuel the kind of massive Windows 10 upgrade cycle that Microsoft would love to see. Windows 10 fixes most of the things that people couldn't stand about Windows 8, but with declining PC sales in the shift to mobile computing, it's fair to wonder if even a perfect version of Windows will have that much of an impact.