Pure Storage CEO On Why The Firm Was ‘Well Positioned’ Before COVID-19 Hit And What’s Next

Charles Giancarlo told CRN the company is doing well financially in large part to its focus on software and on its Pure-as-a-Service subscription service, and said Dell's new PowerStore means big opportunities for Pure Storage to get into Dell accounts.

Riding A Wave Of Software, Services For Storage Growth

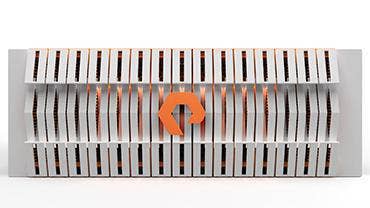

Pure Storage continues to grow its storage business with a focus on the company's software and especially its Pure-as-a-Service subscription service. However, CEO Charles Giancarlo also makes it clear that hardware, whether sold by Pure Storage or in an Amazon Web Services cloud, is important for storage, given that that software and services need someplace to run.

The Mountain View, Calif.-based all-flash storage pioneer this week released its first fiscal quarter 2021 financials, reporting a year-over-year 12-percent growth in total revenue, a 37-percent growth in subscription services revenue, and a big drop in its expected net loss. After the financial report was released, Giancarlo talked to CRN about the results and about what can be expected from Pure Storage for the rest of 2020. He also outlined some of what to expect at the virtual Pure Accelerate conference in early June, and offered Pure's take on Dell Technologies' new PowerStore midrange storage line.

What's the key takeaway from Pure Storage's first fiscal quarter 2021 results?

We had a really strong Q1 results. The company executed very well. Great physical [product] supply chain and subscription services supply chain. Really strong enterprise growth overall. We think that we were well positioned when the [COVID-19] crisis hit in terms of having a product that's simple and fast to install and easy to manage on a remote basis. We're seeing good take-up on both existing and new products. So overall, it was a really good quarter.

Where is Pure Storage seeing the better revenue growth: hardware or software?

We're seeing it across the board, actually. Our subscription growth was up 37 percent [year-over-year]. So we continue seeing really strong growth in our subscription services. But product growth has been good as well.

I see that for the first fiscal quarter of 2021, Pure Storage reported both GAAP and non-GAAP net losses. When can we expect to see those turn to net profits?

It's our Q1. And in our Q1, typically we have more expenses and lower sales. And so Q1 is nearly always a loss for us just from a seasonality standpoint. So that's not a surprise. [The analysts will say] it's a much lower loss than was expected, and a much lower loss than ever before. So that bodes well. What was shown is actually very positive. We're profitable for the year. Wait, who knows, this year anything can happen. But for the last three years, we've been profitable for the year even though Q1's a loss.

How important is hardware for Pure Storage in an age where people are looking to do more with software and with operating expenses instead of capital expenses?

Let me start from a customer point of view first. Eventually, everything boils down to hardware. What I mean by that, even our Cloud Block Store [which lets the company's storage operating system run natively in AWS], which is 100-percent software, sits on Amazon hardware. What we think is important is the customer experience. And the customer wants a cloud-like experience, meaning they don't want to worry about upgrades, they don't have to worry about hardware, but they want all the services and they want those services to be highly automated and able to be done just with resource calls.

What our strategy has been, and it's proven to be very successful, is, we're able to provide that to our customers whether it's on their own premises or in the cloud on one of the hyperscalers. If it's on their own premises, yes, we ship hardware, but that hardware now is fully automated and operates in many ways a cloud-orchestrated services. And we do it in the cloud as well.

Hardware is important because somewhere the software operates on hardware, but we make it invisible to the customer. And that's what they care about.

How does that compare to what Pure Storage's competitors are doing?

We've really been providing a cloud-like experience regardless of whether it's on-prem or in the cloud. And not only that, but bringing along a unified subscription. We're the only vendor, with our Pure-as-a-Service model, that has one subscription regardless of where you place your data and the technology underneath that makes the data look the same to the application regardless of whether it's on-prem or in the cloud, all managed under one umbrella management system called Pure1. So we've really unified on-prem and in the cloud. No other vendor has done that.

At least one vendor, NetApp with its Data Fabric, might disagree that no other vendor has done that.

They're separate products. They have separate contracts. And it's not the same software operating in both environments.

May finally saw Dell Technologies release its new PowerStore line of storage aimed at replacing a number of its incompatible storage lines. What is your take on what Dell Technologies is doing, including their talk about bringing storage closer to the cloud?

Honestly, we look at it as a great opportunity. Every time they do a disruptive upgrade, and now they're doing it to four of their midmarket products, every time they do a disruptive upgrade, they give us an open invitation to go into that account. We've had seven years and seven generations of product, all non-disruptive [in terms of upgrading], and Dell's PowerStore is a version 1.0 product. That's something that just opens doors for us, honestly.

What are some things Pure Storage is looking at for the rest of 2020 in terms of product and services focuses?

We do have our virtual Pure Accelerate conference coming up early June. And we would very much encourage you to partake in that.

We have just come out with Purity 3.0 for our FlashBlade product. It's putting on some very important features such as file and object replication, Kerberos [network authentication], and NFS 4.1. So that opens up new opportunities. FlashArray//c continues to do very well for us, so we're very excited about that. And finally, the uptake and the degree of interest in our Pure-as-a-Service model has really gone through the roof. It's really a model that's fit for the time. And the reason is, it's a pay-as-you-go model, it's a pay-only-for-what-you-use model. So for companies that are worried about capital and cash right now, it fits. And more importantly, because it's a unified subscription, both on-prem and in the cloud, it means customers can satisfy their urgent needs today on prem, but if they're worried about making a commitment, when they think they may be going to the cloud in a year or two or even sooner, our unified subscription doesn't matter. They can have it all on-prem today and all in the cloud tomorrow. It's all the same price. We don't charge [customers] twice for the same data.

Those are things that Pure Storage has in the market now. What are some of the new things Pure will introduce in early June at the virtual Pure Accelerate conference?

Because of the number of things that COVID has taken the oxygen out of the room on over the last four or five months, we are going to go into great detail on some of the things that we have just released. But there'll also be a few surprises coming out in the next couple of weeks.

Any hints?

Sorry, Joe. I can't do it.

Pure Storage really hasn't done a lot of acquisitions. Do you have an acquisition strategy?

We do. It's very active. We have acquired two companies just over the last two years, StorReduce and Compuverde. You'll be hearing more certainly about Compuverde in early June.

There's the hint I was looking for. Have you done much in terms of integration yet?

Again, I'm going to have to ask you to wait a couple of weeks.