The Biggest News Stories Of The Past 10 Years

Take a look back with CRN over the last 10 years to revisit the stories and headlines that had the biggest impact on the channel.

As part of CRN’s year-long celebration of our 40th anniversary, we are looking back at our coverage from the past to revisit the stories and headlines that had the biggest impact on the channel in each of the last 10 years.

You’ll see some familiar companies, such as Microsoft, Dell, HP (and, later, Hewlett Packard Enterprise), as well as some recognizable themes.

Security concerns topped the list back in 2014 and then again in three other years, for example, while Dell’s $65 billion acquisition of EMC kept readers captivated in 2015 and 2016, a deal that laid the groundwork for the impending Broadcom-VMware deal that so many are watching closely now.

News about Hewlett Packard Enterprise topped the list twice, both before and after it was spun out from the original Hewlett Packard.

And of course, all eyes were on the pandemic and the wave of channel-fueled digital transformation it spurred in 2020 (For a look at the biggest stories of this year, check out our piece on the 10 Biggest News Stories of 2022).

For a walk down memory lane, keep reading to take a look back at some of the biggest news stories of the past decade, many of which are still reverberating in the channel today.

Steve Ballmer

2012: Ballmer Vs. Apple

A few months before we all knew how bumpy the launch of Windows 8 would be (with some fans lauding its security enhancements and touchscreen capabilities while critics maligned its blocky user interface and the fact that those same touchscreen elements made it harder to navigate with a keyboard and mouse), Microsoft unveiled a major salvo against long-time rival Apple in the form of the Surface tablet. Then-CEO Steve Ballmer sat down for an interview with CRN to discuss the company’s plans to launch two devices: Surface for Windows RT, a consumer tablet running Windows 8 on ARM microprocessors, and Surface for Windows 8 Pro, an Intel Core-based tablet that ran a version of Windows 8 operating system designed for business professionals.

The Surface tablet was seen as a direct competitor to Apple’s juggernaut iPad line, challenging it with new features such as the ability to work with a detachable keyboard. Unfortunately for solution providers eager to take a bite out of Apple by selling the new devices to customers, Microsoft chose to launch the Surface family via direct sales and through retailers, leaving the channel without an invitation to the party. And then, even when Microsoft did expand sales to the channel, it did so with restraint, launching a program that limited sales to a select group of Microsoft distributors and reseller partners.

By 2013, it became clear that Microsoft had miscalculated the demand for the Surface tablet line. The company by then had slashed the price and taken a $900 million “inventory adjustment” charge related to Surface in the fourth quarter of its fiscal 2013.

But Surface survived and eventually thrived. A decade after it’s launch, the Surface line represents a nearly $7 billion business for Microsoft.

From our original 2012 coverage:

Exclusive: Microsoft's Ballmer Throws Down Gauntlet Against Apple

With Windows 8 on the way, Microsoft unveiled the Surface in June, a tablet that would be built much like Apple‘s, integrating its own hardware and software. In one of his first interviews after the announcement, CRN met with Steve Ballmer to talk about Microsoft gunning for Apple’s share of the mobility market. “We are trying to make absolutely clear we are not going to leave any space uncovered to Apple,” Ballmer told CRN.

The big question was whether or not partners would be able to sell Surface, which has only been available in Microsoft’s retail stores and online at its website. “If a partner says, ’Hey look I want to sell some of these things. I want to put them in solutions,‘ they can order some off Microsoft.com and sell them,” said Ballmer. “There is nothing that gets in the way of that. But, we have not set up what I would call industrial distribution as sort of a first element. We may get there.” We haven’t gotten there quite yet. Surface is now available at Best Buy and Staples, but its availability for channel distribution remains a mystery.

2013: HP's Comeback

In 2012, HP was ranked as the second most important story of the year under the title Hey, Didn't You Used To Be Hewlett-Packard? A channel giant for decades, the company suffered through its catastrophic acquisitions of Compaq and Autonomy, and saw many top channel executives depart.

The former leaders of HP were also major sources of frustration for partners. Robert Faletra, the former CEO of The Channel Company, wrote in a May 2013 column that “when it‘s not clear what the CEO wants in its channel, as was the case during the Carly Fiorina and (Leo) Apotheker stewardships, the organization vacillates and is incapable of making the right decisions.”

Faletra said Meg Whitman, who was named CEO of HP in 2011, was changing that perception.

“In the end, it‘s her attitude that is most important,” he wrote. “It’s what I think partners should feel very good about because the signal is this is the direction she wants to go and believes it is necessary. That attitude from a CEO is the fastest way to change an organization and that is certainly happening. So long as Whitman remains consistent and doesn‘t vacillate over time, the HP channel is only going to become better and more lucrative.”

Under Whitman’s leadership, HP‘s innovation engine fired on all cylinders with projects such as Moonshot and Haven The company revamped its partner program with something that was simpler and more profitable, and its $120 billion balance sheet issues were also resolved. Whitman was later named No. 2 in CRN’s list of Most Influential Executives of 2013.

Two years later, Hewlett-Packard split into HP Inc. and Hewlett-Packard Enterprise. And in 2022, both companies remain vital in the channel community.

From our original 2013 coverage:

Remember where HP was at this time last year? We do. The company had just taken a whopping $8.8 billion charge over its disastrous Autonomy acquisition, and it was leaking high-profile channel executives too. But 2013 was a different story as a re-energized and refocused HP emerged. Under CEO Meg Whitman, the company got back on track with a full-court channel press and market share gains in key products categories like blade servers, PCs and printers. The second year of Whitman's five-year turnaround plan was a success on a number of fronts, and solution providers couldn‘t be happier.

2014: Security Breaches

As could probably be the case every year, cybersecurity was the biggest channel story of 2014. Target, Home Depot, eBay were three major retailers who were targeted by cybercriminals who stole millions of credit card information from customers.

“It doesn’t matter if it’s a small business or giant company, hackers try to target everybody,” said Gilson Marcos, a master technician at BostonPOS, a point-of-sale system provider, told CRN. “Even if it’s a small coffee shop, they need to think about security or they will suffer with a bad reputation once their customers look at their credit card statements and see unauthorized charges.”

It wasn’t just retail that was impacted by cybersecurity attacks. In November 2014, Sony Pictures was breached by hackers traced to North Korea, according to the FBI. The hack wrangled Sony’s systems and exposed a mountain of sensitive data, contracts and unreleased movies.

Solution providers with strong security practices and staff penetration testers said nation-state-funded targeted attacks like the Sony hack could infiltrate just about any organization, regardless of their security posture. However, partners said widespread access the hackers apparently had showed that Sony Pictures had a disregard for some basic security best practices.

Cybersecurity is still a major concern for companies both large and small. MSP executives on a panel at The Channel Company’s NextGen+ 2021 conference said they were pushing to increase their internal security standards and practices as cyberattacks targeting service providers continue to proliferate. And the companies that develop tools used by MSPs are expanding their software’s cybersecurity capabilities.

From our original 2014 coverage:

Security has been top of mind for customers and solution providers this year with a number of high profile breaches. Major retailers such as Target, eBay and Home Depot made headlines as they were hit by breaches that stole millions of customers' credit card data. Most recently, Sony revealed it had been hacked by a group calling itself the Guardians of Peace. The attacks put increased emphasis on PCI compliance, encryption and prompted a new level of security awareness across all industries.

2015: Dell Buying EMC for $67 Billion

In a year where John Chambers left his CEO position at Cisco, Microsoft launched Windows 10 and HP split into two companies, the top story still had to be the jaw-dropping announcement that Dell would be acquiring storage giant EMC for $67 billion, the largest technology acquisition in history.

Dell had gone private in 2013 in a $24.4B leveraged buyout. Long known as a major provider of personal PCs, the blockbuster acquisition of EMC expanded Dell’s offerings of servers and small- and midsize-business data centers to the largest data centers in the world and red-hot segments like enterprise hyper-converged infrastructure. The deal also included EMC’s other business units including VMware and RSA.

Solution providers were giddy with anticipation to see how Dell and EMC’s products and services would be knitted together and how partners can capitalize on what was perhaps the industry’s largest and most diverse portfolio.

The acquisition would create:

- The world’s largest storage vendor

- The world’s second-largest server vendor

- The world’s third-largest networking vendor

- One of the world’s largest software vendors

- The world’s premier provider of virtualization technology

- One of the world’s top cloud and cloud technology providers

- The leader in the big data and software development tool markets

The deal was finalized nearly a year later (see next slide) and in 2022 the rebranded Dell Technologies is a technology behemoth. The company spun out VMware in 2021. In 2022, semiconductor heavyweight Broadcom agreed to buy VMware in a $61 billion deal that will vault the chip maker into contention with global technology stalwarts.

From our original 2015 coverage:

On Oct. 12, Dell stunned the industry when it announced a deal to acquire storage technology giant EMC in the biggest information technology acquisition ever -- a move that many expect will reorder the IT industry‘s competitive landscape.

The acquisition won‘t be completed until sometime after May 2016. But the deal already has vendors such as Cisco, Hewlett Packard Enterprise and others recalibrating their strategies in anticipation of competing with Dell when it becomes a $90 billion powerhouse.

But questions remain. Will Dell keep all parts of the EMC Federation, including VMware, RSA and other operating units? Or could Dell sell off some of its own businesses lines, such as SonicWall, Quest Software or Perot Systems, as some reports suggest?

2016: Dell Completes EMC Acquisition, Works To Integrate The Two Businesses And Their Channel Operations

A year after it was first announced, Dell’s blockbuster acquisition of storage giant EMC was completed in September 2016. The deal created Dell Technologies, a technology behemoth that included market-leading positions in PCs, servers, data centers, virtualization and cloud computing.

The move sent shockwaves throughout the channel. Dell and EMC’s partner programs ran parallel through the end of 2016, with a newly unified Dell EMC Partner Program launched the following year. That program was renamed the Dell Technologies Partner Program in 2019.

Dan Serpico, CEO of FusionStorm, a major solution provider that worked with both Dell and EMC, told CRN that the closing of the deal signaled that Dell will now be able to answer questions openly.

“The important thing is all the questions everyone has -- partners, employees, customers -- they all start to get settled,” Serpico said. “Everybody was in a holding pattern, and now the leadership can talk openly about the stuff they want to do. They have great ideas, and now the cover comes off, and to some degree it’s easier. Things start to happen, you get more information, more opportunity. I expect it to start to open up.”

But other solution providers understandably had major concerns about how a titanic acquisition such as this would impact their own businesses.

“I want to see what real decisions they’re going to make,” said Paul Neyman, president of Waypoint Solutions, a Houston-based Dell solution provider. “What’s the partner program going to look like? What’s deal registration going to look like? I’m cautiously optimistic, but it’s going to boil down to the compensation plans they put together because I’m more worried about infighting between teams than between partners. There are so many moving parts that it could get dicey. We’ve embraced EMC. We’ve started training, we’ve started engaging their field folks.”

From our original 2016 coverage:

Nearly a year after the deal was first announced, Dell completed its $65 billion acquisition of EMC on Sept. 7. The move created Dell Technologies, a privately held IT behemoth and channel powerhouse with designs on dominating markets from budget PCs to data center infrastructure and cloud computing.

Throughout the year the acquisition moved inexorably along through approvals by EMC shareholders in July and Chinese antitrust authorities in August. To help defray the cost of the acquisition, Dell took steps to sell off other businesses including Dell services and its software division that included such products such as Quest and SonicWall.

But now the real work begins as Dell integrates EMC’s operations – including its channel programs – with its own. Channel veteran John Byrne was named global channel chief of Dell EMC and in October the company rolled out key elements of the company‘s new channel program – including strict deal protection rules. But other program components, including its rebate structure, remained unsettled and in early December CFO Tom Sweet said partners may face disruption as integration of sales forces and channel programs proceed.

HPE CEO Antonio Neri

2017: The Transformation Of Hewlett Packard Enterprise And The Company's Leadership Change

The split of Hewlett-Packard was CRN’s second biggest story of 2015, with the creation of HP Inc. and Hewlett Packard Enterprise. Two years later, HPE was an IT software powerhouse, as the company transformed itself in an ever-evolving industry.

CEO Meg Whitman was at the forefront of this transformation. Ranked No. 2 on CRN’s Top 25 Influential Executives of 2017 list, Whitman led the charge of HPE’s rebirth by acquiring four companies – including hyper-converged leader SimpliVity and all-flash superstar Nimble. HPE also spun out its Enterprise Services business in a merger with CSC to form DXC Technology. DXC is among the top 10 biggest solution providers in the world, according to CRN’s Solution Provider 500 list. And finally, HPE bought cybersecurity vendor Niara to enhance the company‘s Aruba ClearPass network security portfolio for wired and wireless network infrastructure.

But perhaps the biggest move HPE made in 2017 was at the end of the year, when Whitman announced she would be stepping down as CEO of the company, with Antonio Neri named as her successor. And over the last four years, Neri has transformed the legacy infrastructure product provider into an on-premises cloud services powerhouse that is going head-to-head against Amazon Web Services, Microsoft Azure and Google Cloud.

From our original 2017 coverage:

Hewlett Packard Enterprise was created in 2015 from the split of the Hewlett-Packard Co. But the transformation was far from complete: In 2017 HPE, through key acquisitions, a major divestiture and a change in the company‘s top executive post, continued its efforts to remake itself in a fast-changing industry.

In February HPE acquired SimpliVity for $650 million, instantly boosting its competitive position in the red hot hyper-converged systems market against rivals Cisco, Dell EMC and Nutanix.

In April, after nearly a year of preparations, HPE spun off its Enterprise Services business, which was then merged with CSC to form DXC Technology, a new systems integration and services leader.

Also in April HPE bought Nimble Storage, a developer of leading-edge flash storage systems, for $1.09 billion. And in February, between the SimpliVity and Nimble deals, HPE bought Niara, a startup developer of security analytics and network forensics technology, in a move to boost HPE‘s Aruba ClearPass network security portfolio.

But the biggest move was yet to come. On Nov. 21 Meg Whitman, who began serving as CEO of HP in 2011 and held that post at HPE after the split, announced that she would step down as of Feb. 1, 2018. Taking over the top job is Antonio Neri, who was promoted from executive vice president to president in June.

2018: Spectre/Meltdown Chip Vulnerabilities

One of the biggest security-related stories in the past decade involved the Meltdown and Spectre processor vulnerabilities, which were first discovered in early 2018. Intel initially refuted a report that its chips contained a massive security flaw, stressing that the exploit did not have the potential to corrupt, modify or delete data.

But the vulnerabilities were very well.

Meltdown was a hardware vulnerability affecting laptops, desktop computers and internet servers using Intel x86 microprocessors. The flaw was said to allow unauthorized access to user data, including passwords and cached files.

Spectre, the less serious of the two security flaws, was a bug affecting smartphones, tablets, and computer chips from several vendors, including Intel, Advanced Micro Devices Inc. (AMD) and ARM. Spectre let hackers manipulate applications into leaking sensitive information. Researchers that discovered the vulnerabilities on the chips said at the time that between Meltdown and Spectre, nearly every modern computer and mobile device was impacted.

Solution providers were on alert from the moment the flaws were disclosed. “The channel should be very worried,” Alton Kizziah, vice president of global managed services for Kudelski Security, told CRN at the time. “Ignore it at your own peril. I don‘t see how anybody would be able to not pay attention to this.”

A day after the vulnerabilities were discovered, an Intel executive said the chip giant was moving forward with a “comprehensive” threat mitigation plan that included operating system and firmware updates that would be made available.

In May 2022, a new variant of the flaws was discovered by Intel.

In the end, one takeaway from Spectre/Meltdown was “the need for all vendors to build strong teams with top-notch technical, support and communications specifically focused on partners,” said CRN’s own Steven Burke. “The vendors that make those investments are sure to be rewarded with high customer satisfaction scores in good times or bad times. Those that don‘t are destined for their own meltdown.”

From our original 2018 coverage:

When the first reports of the processor vulnerabilities that quickly became known as Spectre and Meltdown surfaced on Jan. 3, Intel called the reports inaccurate, downplaying their severity and – initially – even disputing whether they constituted “flaws.”

But Spectre and Meltdown soon became a serious crisis for Intel, other chipmakers like AMD, and for the IT industry as a whole. The side channel analysis vulnerabilities were believed to affect generations of microprocessors used in millions of servers, desktop and laptop computers, mobile phones and other devices.

2019: MSPs At Risk

The big revelation from 2019 was that it’s not only vendors that are at risk of attacks. In fact, MSPs themselves could be vulnerable to hackers too. A slew of attacks on solution providers that year revealed just how bad things could get.

Wipro, the giant India-based solution provider, acknowledged in April of that year that employee accounts had been compromised in a phishing campaign. Wipro‘s systems were then used to launch attacks against at least a dozen of the company’s IT outsourcing customers. Wipro said it was able to detect and respond to the threat and limit the damage, but the incident highlighted the potential danger, according to CRN reporting at the time. In February, hackers exploited ConnectWise partners who had not patched an integration tool with a rival MSP platform, using it to install ransomware on end users‘ machines. Then, in the Wipro incident, the attackers were believed to have used ConnectWise Control on the hacked systems to connect to Wipro client systems, which were then used to obtain deeper access into Wipro customer networks.

ConnectWise Chief Product Officer Jeff Bishop told CRN at the time that the Wipro breach appeared to be a “legitimate use” of the ConnectWise Control remote support and remote access tool.

Bishop said his understanding of the Wipro breach is that the Control product wasn‘t hacked or accessed improperly. Instead, Bishop said the hackers were supposedly authenticating through a legitimate instance of the remote control machine.

In August of that year, 22 Texas towns and counties suffered a devastating ransomware attack that was orchestrated using an on-premises ConnectWise MSP remote access tool as an entry point. The owner of TSM Consulting, an MSP that provided products and services to those towns and counties, told CRN that he stood by his work.

Since the revelations about ConnectWise Control’s vulnerability, ConnectWise has taken a more proactive approach to security.

From our original 2019 coverage:

In mid-August 22 towns in Texas were hit with a coordinated ransomware attack, seizing control of the local governments’ IT systems and blocking access to important data. Investigations concluded that the hackers had used an on-premises version of ConnectWise Control, used by managed service provider TSM Consulting, as the vehicle for the attack.

Managed Service Providers are a fast-growing segment of the channel, offering customers a new way to outsource IT management chores and reduce costs. But a series of security breach incidents this year like the Texas one put the spotlight on a potential downside to the rise of MSPs: Cyber criminals are targeting MSPs and exploiting the tools they use to manage customer IT systems as vehicles to attack their customers.

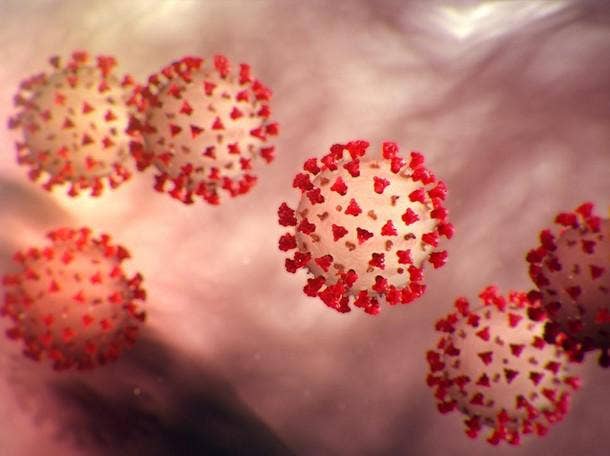

2020: The Pandemic

2020 will always be known as the year the world shut down as the COVID-19 pandemic began to take control of all decision-making on a personal and business level.

As the shock of the novel respiratory virus cascaded across the globe, the IT industry came to the rescue to make sure employees and students, families and individuals could still function in the face of fear, lockdowns and other public health measures.

The IT industry thrived during the initial year of the pandemic, delivering robust cloud services, PCs and data center capabilities at a staggering pace to help everyone connect. Conferences and events of all kinds were canceled but companies found a way to deliver almost the same experience virtually.

Of course, as demand skyrocketed for tech, supply chain disruptions arose and continue to plague the industry to this day. But many companies have been successful in coming up with creative solutions to address those challenges.

From our original 2020 coverage:

The year 2020 has been like no other.

The year got off to a promising start with the booming economy generating strong demand for IT products and services.

But then the COVID-19 pandemic struck, followed by a shuttered economy, a recession and a new work-from-home reality for millions of workers. And then an already unsettled nation found itself in the midst of widespread protests against racial injustice after the death of George Floyd, a Black man, while being held down by a Minneapolis police officer.

2021: MSP Security Woes

MSPs were targets in prior years. But 2021 was the year that target got markedly bigger. It all came via the massive SolarWinds hacking campaign, which Microsoft said was orchestrated by the Russian foreign intelligence service and targeted more than 140 IT resellers and managed service providers in just a few short months.

But the SolarWinds hack was only the tip of the iceberg for the MSP industry. IT service management vendor Kaseya suffered its own cyberattack via its VSA remote monitoring and management software, which affected nearly 40 of the company’s on-premises MSP customers, according to CEO Fred Voccola. The perpetrator? Ransomware operator REvil, based in Russia.

The U.S. Department of Justice, along with the Federal Bureau of Investigation, later in the year announced the arrest of one suspect and the indictment of another. The agencies also announced the recovery of $6.1 million in alleged illicit ransom payments.

Accenture was also hit by hackers using LockBit ransomware. Accenture confirmed the attack on Aug. 11, although it reportedly spotted the attack as early as July 30. Accenture said the incident had no impact on the company, maintaining it had successfully identified and contained the attack and isolated the affected servers.

The attackers reportedly demanded a $50 million ransom and in a Dark Web posting, said: “If you’re interested in buying some databases, reach us.” The hackers also reportedly went after Accenture customers using credentials accessed during the cyberattack.

MSPs have done their best to fight back, focusing more on security than ever before.

From our original 2021 coverage:

In late October, Microsoft warned that the Russian foreign intelligence service responsible for the massive SolarWinds hack, which came to light at the close of 2020, had targeted more than 140 IT resellers and managed service providers since May and had compromised as many as 14 in a new surveillance effort. The Russian agency looked to exploit any direct access that solution providers have to their customers’ IT systems.

The warning was just the latest in a growing wave of cybersecurity and ransomware attacks this year that have targeted MSPs and solution providers – and what has been the biggest news story of 2021 for the channel.