5 Big HPE Bets Driving Shareholder Value: CEO Antonio Neri

With artificial intelligence driving the next big wave of IT investment and innovation, Hewlett Packard Enterprise is poised to introduce ‘new breakthrough innovation this year’ to capitalize on the growing market opportunity, HPE CEO Antonio Neri said in remarks at the company’s annual stockholder’s meeting.

Accelerating Shareholder Value

Hewlett Packard Enterprise President and CEO Antonio Neri Wednesday said HPE’s “evolution” into an edge-to-cloud platform company “fueled by a software- and services-rich portfolio” is delivering strong financial results that will accelerate shareholder value for “years to come.”

HPE performed “remarkably well” in Fiscal Year 2022 despite the “economic, geopolitical and supply challenges,” said Neri in remarks at the company’s annual stockholder’s meeting. “Hewlett Packard Enterprise is executing a winning strategy,” he said.

With the HPE portfolio focused on “high-growth, high gross-margin,” HPE reported “record non-GAAP diluted net earnings” per share of $2.02 on a 5 percent increase in sales in constant currency in Fiscal Year 2022 to $28.5 billion, said Neri.

HPE generated free cash flow in Fiscal Year 2022 of $1.8 billion, the second-highest free cash flow in the company’s history, three times the level of Fiscal Year 2020.

Over the last five years HPE has returned nearly $10 billion to shareholders through dividends and share repurchases, said Neri.

“Our winning edge-to-cloud strategy, differentiated portfolio and outstanding execution have delivered continued momentum into Fiscal Year 2023,” said Neri.

In the first quarter of Fiscal 2023 ended Jan. 31, HPE reported non-GAAP diluted net earnings of 63 cents per share, a new quarterly record, on a 19 percent increase in sales in constant currency to $7.8 billion. That was HPE’s highest first-quarter sales since 2016.

Here are Neri’s comments on five big bets driving shareholder value.

AI: A Generational Shift That Favors HPE

The AI market is rapidly accelerating and represents a generational technology shift similar to web, mobile and cloud. It will drive the next wave of investment in innovation and value creation in the IT market and the global economy. We see the demand shifting dramatically with new business models emerging.

HPE is the market leader in supercomputing innovation with decades of experience that accelerate our competitive advantage to capitalize on the AI market opportunity while offering a sustainable solution to our customers.

In the last year we announced Frontier, the world’s first exascale supercomputer. Built by HPE for the Department of Energy Oak Ridge National Laboratory, Frontier helps conduct advanced modeling and simulation, high-performance data analytics and AI at scale.

Our leadership in exascale computing positions allows us to play an essential role in powering AI at scale. As organizations increasingly build and deliver AI models, our leading supercomputer technology and expertise will be very critical to enabling AI model adoption.

For example, most of the large models in development today including generic large language models like ChatGPT demand supercomputing to meet their training needs. [AI] model developers are seeking these powerful supercomputer solutions as a cloud service and they need the scale, cost-efficiency and reliability that HPE provides.

In addition, organizations are looking for a robust set of software tools to simplify the mass production of custom AI models. This is an exciting and growing market for us. We look forward to introducing new breakthrough innovation this year to capture these market opportunities.

A $230 Billion Market Opportunity By Capitalizing On Edge, Hybrid Cloud And AI Megatrends

As we innovate, we focus on capitalizing on industry megatrends around edge, hybrid cloud and AI that have emerged to shape customer needs and consumption habits for enterprise technology.

Looking at markets that underpin our edge-to-cloud strategy we see our total addressable market opportunity growing 1.5 times from about $150 billion today to more than $230 billion by 2025. This is driven by market growth and expansion of our portfolio.

The growth of data at the edge represents a significant opportunity. Our intelligent edge portfolio is a major differentiator for HPE. Through HPE GreenLake we connect and power distributed cloud infrastructure and experiences for our customers. We anticipate capturing a large portion of this market as we expand into new market segments including Secure Access Service Edge with Axis Security and the planned expansion of our HPE Aruba data center switching portfolio.

Cloud is our largest market opportunity. According to [global management consulting company] Bain [& Company], approximately 70 percent of customers will operate in a hybrid multi-cloud model in the next three years.

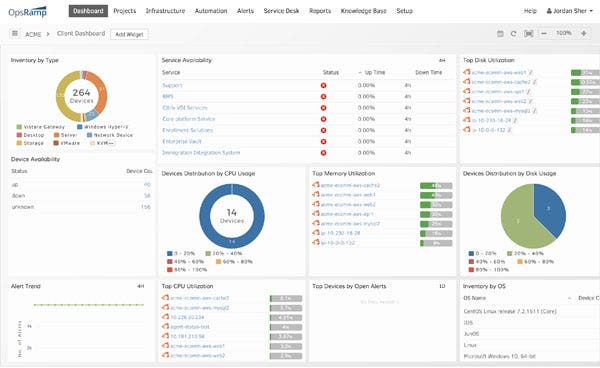

We anticipate the market for private cloud will grow double digits through modernization, automation and workload repatriation. Acquisitions like OpsRamp will enable us to enter fast-growing market segments like hybrid cloud management.

Our own organic investments are strengthening our HPE GreenLake platform offerings. Today those offerings span more than 70 hybrid cloud services and continue to grow.

HPE GreenLake Momentum: Total Contract Value Hits $10 Billion

Since beginning our as-a-service transformation in 2019, we have steadily increased the business coming through our HPE GreenLake hybrid cloud platform.

HPE GreenLake provides a foundation for customers to drive a sustainable data-first, digital transformation with one unified, intuitive hybrid cloud operating experience. It continues to attract new customers and new business, which enhances our performance across the entire HPE portfolio.

The relevance of our HPE GreenLake platform combined with our discipline and execution has propelled both our ARR [annualized revenue run rate] and total contract value. Over the last two years, we have more than doubled our as-a-service total contract value, reaching nearly $10 billion through Fiscal Year 2022.

This is an impressive set of results and momentum. With more than 65,000 customers, the HPE GreenLake platform manages more than 2 million devices and more than 1 exabyte of data for customers and partners around the globe.

We continue to invest in developing new technologies and differentiating the platform. Just yesterday we announced new storage services: HPE GreenLake for Block Storage and HPE GreenLake for File Storage. The new services leverage HPE Alletra storage to simplify data life-cycle management with intuitive cloud operations to store, manage and protect customer data wherever it resides. These services also accelerate our focus on areas of high growth with high gross margins.

OpsRamp: A New $39 Billion Market Opportunity

Two weeks ago, we announced an agreement to acquire OpsRamp. The OpsRamp hybrid digital operations management solutions will advance our hybrid cloud leadership and help customers navigate the complexity of multivendor and multi-cloud IT environments.

With integration of OpsRamp technology into our HPE GreenLake platform, we will enter a $39 billion IT operations market.

We anticipate the market for private cloud will grow double digits through modernization, automation and workload repatriation. Acquisitions like OpsRamp will enable us to enter fast-growing market segments like hybrid cloud management.

Early in March we acquired cloud security provider Axis Security, which will help fortify network security and strengthen our Secure Access Service Edge solutions while continuing to expand our addressable market.

In February, we announced our agreement to purchase Athonet, which bolsters our private networking capabilities to help enterprises and telecommunications companies accelerate 5G deployments. The combination of Athonet, Axis Security and our world-class HPE Aruba intelligent edge capabilities give HPE one of the most comprehensive, connected edge portfolios in the market.

Environmental, Social and Governance Driving New Growth Opportunities

I am incredibly proud of how we continue to advance the way people live and work through our ESG strategy that is directly aligned to our business strategy and spans our entire value chain.

We are committed to becoming a net-zero company. Last year we accelerated our target date by 10 years to 2040 and set near-term science-based targets.

Our transition to an as-a-service company goes hand in hand with our sustainability agenda. Our greatest opportunity to make a positive impact on the planet is by enabling our customers to transform sustainably through efficient technology and cloud consumption models like HPE GreenLake.

We also help customers accelerate their sustainability goals through the asset life-cycle management services and circular economy solutions offers through HPE Financial Services. For our shareholders these offerings are a great source of profitability that expand our earnings.

It is important that we integrate our ESG agenda with our business agenda. So as I think about customers driving sustainable digital transformation it is important that we build that sustainability into our technology. It is not how we build it, but how we consume it, how we operate that. So more and more we see customer demand increasing. We know the European market is probably in the forefront of that.

We won more than $1 billion last year because of our sustainability and differentiated solutions. At the same time, we also need to understand the implications in the communities we operate. But ESG considerations go hand in hand with our transformation journey. That is why it is perfectly aligned to our strategy because everything we do is to deliver everything as a service.

When we move into an as-a-service model that technology that gets deployed has a longer life for many of our customers. In many ways we are managing a fleet of assets that stays in the market for longer. It is actually better for the planet to use that technology longer than recycle it.