AWS Bests Google, Microsoft In Being ‘Vertically Specialized,’ Says PTP Exec

‘The smallest of startup life sciences companies can spin up, with our help, their AWS account and have access to massive amounts of compute and GPU storage as a service,’ says PTP’s Ethan Simmons.

Life sciences cloud specialist Pinnacle Technology Partners (PTP) is confident it has picked the right cloud partner in Amazon Web Services to drive life sciences sales and innovation for customers.

“There are things that AWS is doing that the other cloud providers just aren’t getting as vertically specialized in compared to AWS,” said Ethan Simmons, managing partner at PTP. “An offering like Amazon Omics has been a great help to our customers to streamline the time that it takes to start doing research in the cloud. That’s really the conversation that we’re having: ‘How can we help you do your research faster?’”

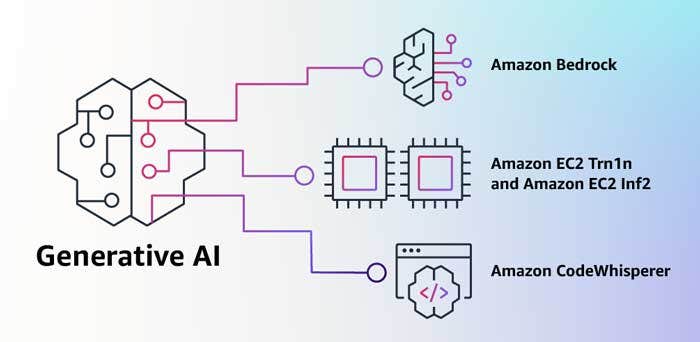

The Norwood, Mass.-based AWS Advanced Consulting partner is seeing new customer opportunities thanks to AWS innovation, including generative AI. PTP owns AWS’ Life Sciences and Managed Security Services competencies and partners closely with AWS and Cisco Systems.

[Related: The 10 Coolest New AWS Tools Of 2023 (So Far)]

AWS, Simmons said, is the top cloud company compared with Microsoft and Google when it comes to specializing and providing solutions in specific vertical markets such as health care and life sciences.

Companies Don’t Need To Spend ‘Millions’ On Computing, Nvidia

PTP and AWS are providing SMBs with scalability to take their business capabilities to the next level without needing to spend millions up front.

“They don’t have to go out and invest millions of dollars in computing and Nvidia infrastructure to have those capabilities,” he said. “The smallest of startup life sciences companies can spin up, with our help, their AWS account and have access to massive amounts of compute and GPU storage as a service.”

This month, PTP received new funding from venture capital firm 424 Capital with plans to enhance research and development in life sciences as well as seek potential acquisitions. “We’re looking to expand into new geographic areas [via acquisition], but from a capability standpoint, really adding on more capabilities around AI, machine learning and analytics,” said Simmons. “Our goal is to stay AWS-focused and life sciences-focused.”

In an interview with CRN, Simmons talks about why AWS has a leg up over Microsoft and Google when it comes to vertical expertise, why generative AI isn’t just “hype,” as well as PTP’s plans for the future.

Do you think AWS is the best cloud provider of life sciences technology and partner services in the market?

I do, and we work really closely with the Health AI team at AWS. One of their offers is the AWS Omics platform. [Amazon Omics helps life sciences organizations build at scale to store, query and analyze genomic, transcriptomic and other omics data.] So really a combination of compute and storage and, basically, a dedicated service offering from AWS specifically for genomics research.

There are things that AWS is doing that the other cloud providers just aren’t getting as vertically specialized in compared to AWS. So an offering like Amazon Omics has been a great help to our customers to streamline the time that it takes to start doing research in the cloud. That’s really the conversation that we’re having: ‘How can we help you do your research faster?’

Before, what we’d have to do is build it manually, but now it’s a service. If you go to the AWS console, click on Amazon Omics, it spins up the environment to start doing your research. Those are the types of things that have an impact on our customers.

Talk about AWS having such an in-depth vertical-specialized portfolio. What is it doing that other cloud companies can’t?

They are moving so much faster. Like there was a Generative AI Life Science release that AWS just did this week that I haven’t had a chance to look at.

There will continue to be releases like that which are specific, but AWS has really put a lot of time, research and resources behind specific life sciences applications that are geared toward these early stage life sciences companies that we just don’t see the other hyperscalers providing.

For us, working with those AWS teams is a huge competitive advantage from that standpoint. What we’re doing with Amazon Omics has been amazing for our customers.

What are you seeing in the market right now in life sciences around generative AI? What are some opportunities? Or is it just hype?

No, it’s definitely not hype. Most of our customers have been doing some type of AI and ML in their research for years now. So it’s not something that’s super new.

What we’re seeing, though, is the ability for these small companies to leverage the scale and flexibility of the AWS cloud to greatly accelerate their capability. So they don’t have to go out and invest millions of dollars in computing and Nvidia infrastructure to have those capabilities. The smallest of startup life sciences companies can spin up, with our help, their AWS account and have access to massive amounts of compute and GPU storage as a service. Then they just pay for it as they need it.

Those companies have an investment from their VCs [venture capitalists] that are backing them within a relatively short window of time, and also money, to prove out their research to move on to later stages—that’s what we’re helping those companies be smart about. So they’ve been able to leverage the power of the cloud to harness all this supercomputing power to run their workloads in their pipelines faster and their machine learning pipelines faster.

That’s where we’ve seen in life sciences the real power of the cloud. That’s been the driving factor. You can call it generative AI or ML.

Do you see consumer generative AI offerings like ChatGPT helping life sciences companies?

ChatGPT is very interesting and will help from a productivity standpoint. But these customers are doing scientific research and looking at how certain molecules dock with other molecules to create a therapy or to create a drug.

The more of those scenarios they can run in the cloud versus in the lab helps them do their research faster and unlock potential drugs faster. So that’s the benefit on our side, what we’re seeing in the space.

On the managed services side, our customers are constantly asking us to do more. They’re pushing us outside of our comfort zone a little bit. We use the term internally, ‘You’ll get comfortable being uncomfortable pretty often.’ We’re trying to be very smart in making sure we’re keeping the level of quality and consistency in place.

We can’t do everything that AWS offers. We can’t do everything that our customers want us to do. But we’ll go after the pieces that have the highest impact on our customers.

What is PTP going to do with your new funding from 424 Capital?

The people at 424 really believed in our thesis around early stage life sciences and how cloud adoption can help those businesses do their research faster, accelerate the pace of their research, and accelerate our growth at the same time. We just had our best month ever in January. We are firing on all cylinders.

From a new funding and growth standpoint, we’re seeing a ton of activity outside of the Boston, Cambridge area from a life sciences standpoint. So if you look at the Bay Area, San Diego, Austin, Seattle, New York, these other biotech hubs are growing quickly.

Our plan is to take that investment to organically grow into new geographies to grow the business, but also keep an eye out for the right acquisition targets. The strategy around acquisition would be to stay within life sciences.

We’re seeing a ton of activity outside of the Boston area from a life sciences standpoint. So we’re looking to expand into those new geographic areas, but from a capability standpoint really adding on more capabilities around AI, machine learning and analytics.

We’ll be strategic about where we build and where we buy. But definitely the whole AI conversation and adding those capabilities to extend the services that we’re already offering is critical. Also, a large part of our businesses is around managed services and managing those environments for our customers. So we would be looking for targets that would extend our managed services capabilities as well.

Our goal is to stay AWS-focused and life-sciences-focused. We will extend our offerings with our existing customer base and then also acquire new customers. We’re bullish on the space.