Microsoft’s Swenson: Poor Economy Could ‘Cause A Shift’ Toward Marketplace

“The marketplace will eventually enable a much richer, peer-to-peer type of conversation through the customer-decision journey in this digital space,” Jake Swenson said.

As tech giants reexamine their spending in a worsening economy, Microsoft appears to be going forward with investments in its online commercial marketplace, promising more features to entice other software vendors and services-led partners.

But Microsoft Marketplace could be more than just a transaction engine, Jake Swenson, Microsoft’s vice president of commercial marketplace, told CRN in an interview. More integration between the marketplace and Microsoft’s partner portal could mean better data sharing among partners, Microsoft sellers and customers in the future.

“The Marketplace will eventually enable a much richer, peer-to-peer type of conversation through the customer-decision journey in this digital space,” Swenson (pictured) said. “None of us are quite there yet. … My aspiration and my belief is that Marketplace as a community is really what the interesting use case looks like for that in the long run.”

[RELATED: Partners Weigh Investments In Online Vendor Marketplaces]

What Is Microsoft Marketplace?

The Redmond, Wash.-based tech giant has expanded access to its ISV Success program – moving into public preview the function of its partner program meant for unfamiliar independent software vendors – and published some statistics related to selling on its Marketplace.

Some services partners are starting to test out the opportunity from online marketplaces, which have been receiving major investments from vendors including Microsoft, Amazon Web Services, Google Cloud and Cisco, and distributors such as Ingram Micro and Pax8.

But service partner listings on online marketplaces isn’t a ubiquitous practice just yet. And for some partners who are participating in marketplaces, the revenue made off marketplaces isn’t exactly replacing more traditional practices for finding leads and closing deals.

“For certain partners, there’s definitely a good opportunity to get exposure that they might not get otherwise and to reach an audience that they might not reach otherwise,” Gabriel Romero, chief marketing officer and head of alliances for Denver-based AllCloud, an Amazon Web Services and Salesforce partner, recently told CRN. “For us, we’re still in the early days of putting our solutions out on a marketplace. We’re figuring out the best way to engage with customers on marketplaces to make sure that we’re giving them something that they can easily find and that they can easily use.”

Mark Wyllie, CEO of Boca Raton, Fla.-based IBM partner Flagship Solutions Group, told CRN in a recent interview that he plans to add to his company’s marketing spend on marketplaces next year.

“Marketplaces, we really haven’t done much in that area,” he said. “They’re going to be a factor, but they’re still not a significant factor. … If I started seeing an uptick in customers really buying through a marketplace (I would invest more). I just haven’t seen that.”

This week, Microsoft also announced an upcoming multi-party private offers function in its Marketplace, which should appeal to system integrators, resellers and distributors, Swenson said.

“Functions like what we call multi-party private offers – that we will be bringing to market early next year – make Marketplace relevant for the services partners,” he said. “Now your SIs [systems integrators] or your resellers or your distis [distributors] have an opportunity to say, ‘Look, I’ve got an ISV offer. I have a Microsoft customer. I have my services or my value-add to the equation that can be packaged and transacted in this way that’s convenient for the customer and that has positive economic terms for everybody involved.’”

Here’s what else Swenson had to say.

What do you want partners to know about Microsoft’s marketplace investments?

The fundamental goal is to dramatically simplify how B2B [business-to-business] technology is bought and sold. Make it much more of a digital experience and make it much more of an empowering experience for customers.

And in doing so, really create a unique opportunity for ISVs [independent software vendors] and for partners that work with Microsoft to really tap into Microsoft both to build with us and to sell with us so that they can grow. … Marketplace has kind of been in the discourse for a while, but why is it so important right now? … The reality is that we are entering volatile economic times.

And in those times, we’ve got companies that are cutting budgets, people that are worried about their jobs and companies that are finding a need to find a path to growth.

And the reality is for many of the partners we work with, especially the ISVs, the products and the technologies that they’re delivering, are the very things that could help a company, a customer of ours, a shared customer of ours, weather an economic recession.

They produce things that help drive growth, that help cut costs, that help manage risk. But the challenge is, the refrain that you’ll hear from customers is, ‘Oh, yeah, I really need this. But I don’t have the budget right now.’

So with Marketplace, there’s a bit of a silver lining. The budget actually does exist.

What does marketplace have to do with cloud budgets?

Budgets are being slashed – yet the cloud budgets are growing. … Cloud migrations need to continue in order to help IT professionals manage costs and risk in their own environments.

And further to that, the subscription-based economics and the impact on cash flow makes it easier for our customers to watch their cash flow through a downturn. And it’s a time where cash is crucial.

And so those budgets are increasing. And customers who are now needing to do more with less once want to make that budget work harder for them.

And so they can spend that budget in the Marketplace on a bunch of different things. They can spend that budget on apps and infra[structure] on top of their investment in Azure. Or they can spend it on third-party applications that extend Azure or extend our productivity [suite] or extend our collaboration clouds. Extend any part of the Microsoft Cloud.

So the budget is there. And so one of the reasons why Marketplace is so crucial right now is it represents the place for one source of cloud that’s still available, and for partners that cloud budget could very well be a growth lifeline through this volatility. … It is clear to me that we haven’t quite crossed the chasm with Marketplace adoption in the market all up.

And so it could very well be a set of circumstances like this that cause the shift toward much more of a seamless and digitally led manner of purchasing. … Many of the larger enterprises will make annual consumption commitments against their cloud spend as a means of controlling – then you get both. You have both the ability to somewhat predict, but then be able to consume flexibly against it.

And so they’ve made those cloud consumption commitments. The Marketplace uniquely enables them to apply those commitments to both Microsoft and third-party applications. And Amazon does this, too.

But that dynamic could be very well the thing that accelerates marketwide adoption through economic times like these.

Can Marketplace benefit Microsoft and partners by acting as a repository for partner specialities and abilities?

The Marketplace will eventually enable a much richer, peer-to-peer type of conversation through the customer-decision journey in this digital space.

None of us are quite there yet. … My aspiration and my belief is that Marketplace as a community is really what the interesting use case looks like for that in the long run.

Because then you’re creating a richness of fidelity of interaction between the actors and the people. You’ve got customers who are trying to solve problems. You have their peers who solved that problem before. And you have the partners and the vendors and everybody else in the ecosystem who supply the factors of production to help bring that together for another customer.

That isn’t the way they operate. They [marketplaces] are today much more about transactions than they are about discovery and consideration. But it’s definitely my belief that widening the role of Marketplace to be more of a tool for discovery and consideration, it’s worth exploring and it’s certainly something that’s on our minds. … First for me is setting up the right business model and the right set of digital experiences for both customer and partner to make this just intrinsically easier and more valuable.

That is substantial value right there because B2B buying and selling has lots of friction in it. And I want to take out all that friction.

Then, yeah, ostensibly, if all of this is being conducted through this digital channel, then you get data and a signature that allows you to even further enrich that experience to … position the right product to the right person at the right time so that the customer has a convenient experience and so that the partner has effective customer acquisition. It makes our sales and marketing more effective. … We have to be very careful about that, though. You have to be very careful about the privacy of that data. We have to be very careful about how that data is used. And that’s why a little bit of my first priority is to make the experience in economics just fundamentally better for ecosystem growth. And then the data is almost like the turbocharger. The exhaust of this engine can then be used to make the engine more effective.

Will we see more integration between Marketplace and the Microsoft partner portal?

We do agree that widening the aperture of communication – and I think the key word is engagement – between customers and then among customers and partners is the vision.

For now, it’s still the traditional means of dealmaking. But Marketplace affords a set of economic accelerators that are valuable.

One is that the customer can purchase a third-party application without having to onboard them as a vendor and pay for it on their Microsoft EA [Enterprise Agreement licensing option].

So the name of the game there is simplifying procurement, simplifying selling, taking some of the traditional hurdles out of the transacting process in addition to – for offers that are qualified – being able to use those to apply against their consumption commitments.

So it is largely about convenience and simplicity and dealmaking and transacting right now. Because if you look on the flip side, for the ISV, some of our ISVs have seen their sales cycle times reduced by 50 percent because they’re not having to onboard as a vendor.

They’re carried into the market with terms in front of the customer. All they have to do is make the offer, and they’re able to stand on top of and leverage Microsoft’s commerce capabilities in order to be able to be the last mile.

Do partners often come to Microsoft with their own transaction engine?

Like with anything that’s new, people are at different points in their journey with it. Many of the partners we work with already have either a very mature direct or channel go-to-market.

And so for them, they need to figure out how Marketplace fits in. For some of them, marketplace is yet another channel.

For some of them, they have worked to bring about a better integration of their co-sell motion with Marketplace. So those emerged.

We do have Marketplace applications for channel partners. And this is something we’re still at work on. But for partners who do sell through the channel, they want to be able to bring their channel partner into the deal, into the Marketplace-assisted deal.

Functions like what we call multi-party private offers – that we will be bringing to market early next year – make Marketplace relevant for the services partners. … Now your SIs [system integrators] or your resellers or your distis [distributors] have an opportunity to say, ‘Look I’ve got an ISV offer. I have a Microsoft customer. I have my services or my value-add to the equation that can be packaged and transacted in this way that’s convenient for the customer and that has positive economic terms for everybody involved.’ … We have a margin-sharing capability in the Marketplace now.

But the margin-sharing capability allows the ISV to share margin with the channel partner and then transact it on the channel partner’s paper to the customer.

The application that we see a lot of demand for that we’ll be releasing next year is the ISV and the channel, the ISV and the partner, can package an offer, transact it on Microsoft’s paper and take advantage of the consumption commitment benefit.

What challenges are you overcoming to grow the popularity of Marketplace?

For some partners, this is, ‘I have very-well established direct and channel go-to-market strategies. What is this thing? Is it real? How do I make the most of this? How does this fit in with the rest?’

And so some of it is just education and integration and helping those companies adopt. For others that have the benefit of only launching their businesses when this is already a productive market channel – we run into partners who are Marketplace-first in their go-to-market. Very easy for them to adopt. And they can use it as a competitive advantage.

So yes, there are challenges in the technology of it. But the fundamental obstacle right now is we’re just at the left side of the chasm. This is a go-to-market set of channels and tactics that people have started using productively, have observed that it reduces sales cycle times, have observed that it yields more cost-effective acquisition and lower CAC [customer acquisition cost], customers who have done it once and realize, ‘Yeah, this is easy.’

We’re at the inflection point of where I believe that this will start to accelerate. … 2023 is really the year that Marketplace goes mainstream. Marketplace did about [$]8 billion in global billed sales in 2022. That will scale to [$]50 billion by 2025.

Do partners understand investing in Marketplace once they try it?

We run into this all the time. First-time customers are like, ‘I don’t know about this. Do people really buy this way? Do people really transact seven- and eight-figure deals this way?’ They realize they can. Then they want to do it again.

Partners – ‘Do customers really buy this way? Am I giving up any control? No, I’m not really. This is just making it easier for my customer. And, oh, by the way, I’m unlocking budget that I hadn’t had access to in the past. Yeah. I want to do this.’

And that has to happen only so many times for it to start to take off. … marketplaces all – not just ours – look more like a vending machine than a marketplace right now.

If you know exactly what you want, yeah, you can definitely get it. But to really become a marketplace, it requires a richness of engagement that has not been available really in the B2B space before.

Maybe there’s been rich engagement, but it’s every seller trying to manage the engagement on their own terms. ‘Come talk to me and to my salesperson. I’m going to try to skew your RFP [request for proposal] so that it works for me.’ … And as a customer, you are trying to navigate these disparate interactions with different people, all of whom are vying for your same dollar.

And if we can change the way that’s done in a way that’s more empowering to the customer – because we already know that B2B customer, they do 60 to 70 percent of their journey before they even talk to the first person.

So if we can make that 60 to 70 percent a much richer experience that is infused with much more social proof and expert content in a digital experience that is truly helpful, and then when they’re ready to buy, ready to engage, they can raise their hand in a way that’s consistent and visible to everybody in the ecosystem.

It’s empowering customers, and then it’ll end up becoming efficient for partners because – rather than spending so much money at the top of the funnel just trying to find somebody who’s in market – there will be a community where the people who are in market are saying so.

Is more education needed on how to make a SKU [stock keeping unit] for Marketplace?

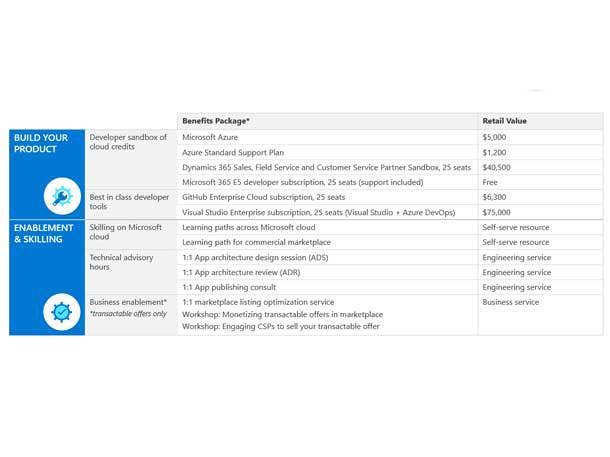

Yeah. And that’s the crux of the ISV Success program, which we’re taking into public preview. … One of the things that has been true about Microsoft in the past is a small partner might look and say, ‘Well, where do I even start?’ It’s this huge company. Where’s the front door? And for those types of partners, the ISV Success program is the front door.

This is the way for them to unlock benefits. Build with benefits. Go-to-market benefits. And have a very clear path to what it is to get on Marketplace and start selling.

So yes, it’s been working for some of the larger partners who have those established person-to-person relationships within Microsoft. But this is a way for us to help bring something that works at scale so that smaller partners can be part of this. … We’re putting partners in a common marketplace with a common customer base and trying to level the playing field and create an environment where truly the best product should win.

If you take this all the way to the extreme, if the products are being supported by word of mouth, they’re being supported by things like ratings and reviews, they’re being supported by what’s actually going to market, then this is a huge playing field leveler.

And this actually informs some of what we’re doing from a DNI [diversity and inclusion] perspective. We’ve got programs that we were working on to help partners who are owned by underrepresented members of the tech community to be able to self-attest and to show and demonstrate that this is a diverse partner in the Marketplace.

This is important because more and more of our customers have supplier diversity pledges. And so to help them, you look at this from a digital experience. If you have somewhere to go where you can say, ‘Look, I very clearly see that what I’m buying aligns to my supplier diversity pledge’ because we’ve helped the partners make that visible. … That’s live. … We have many more than 1,000 self-attested partners in our Marketplace right now.

And this opens up opportunities to look at other dimensions as well around sustainability, for example.